Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone explain how we get the answers for these? You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer

can someone explain how we get the answers for these?

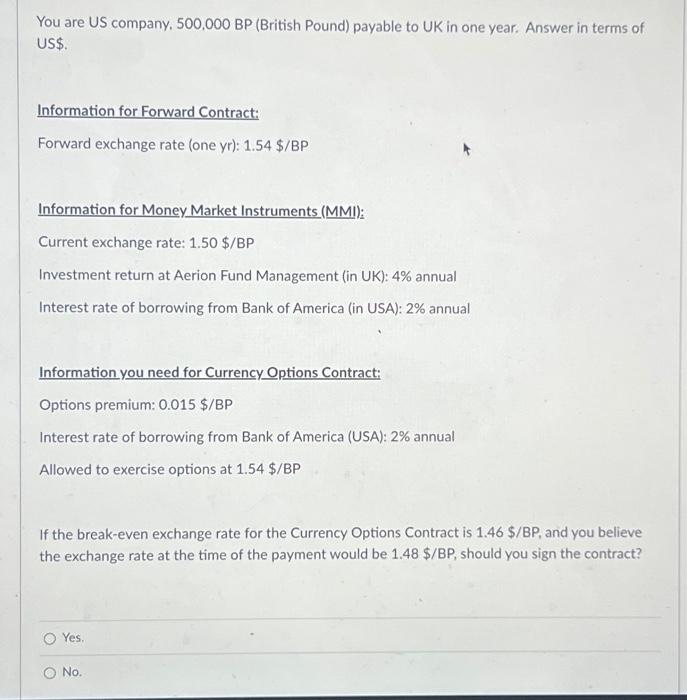

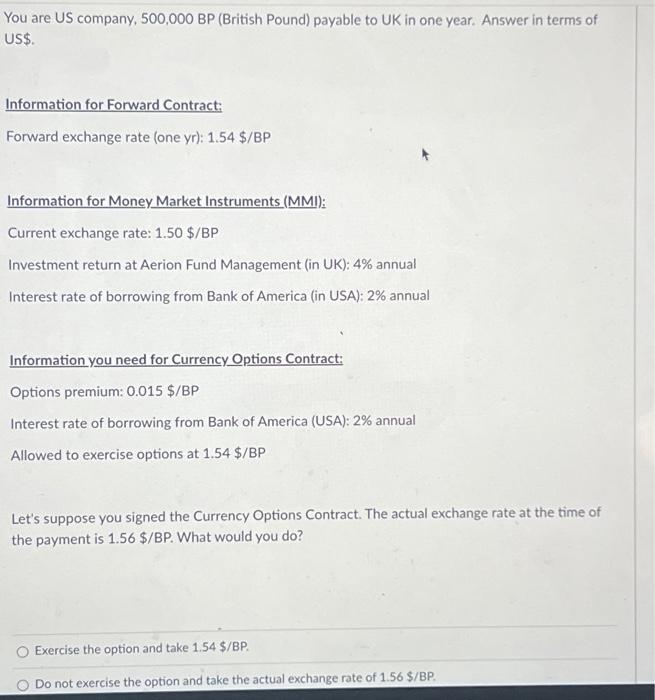

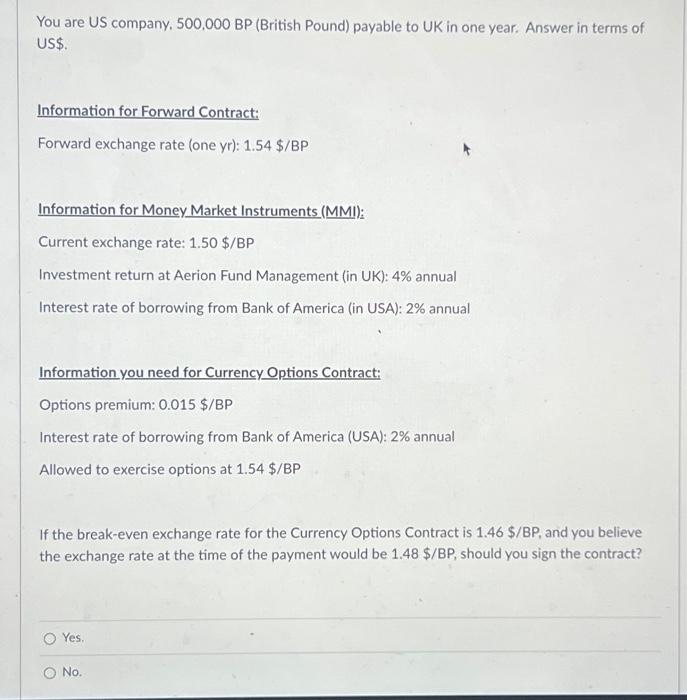

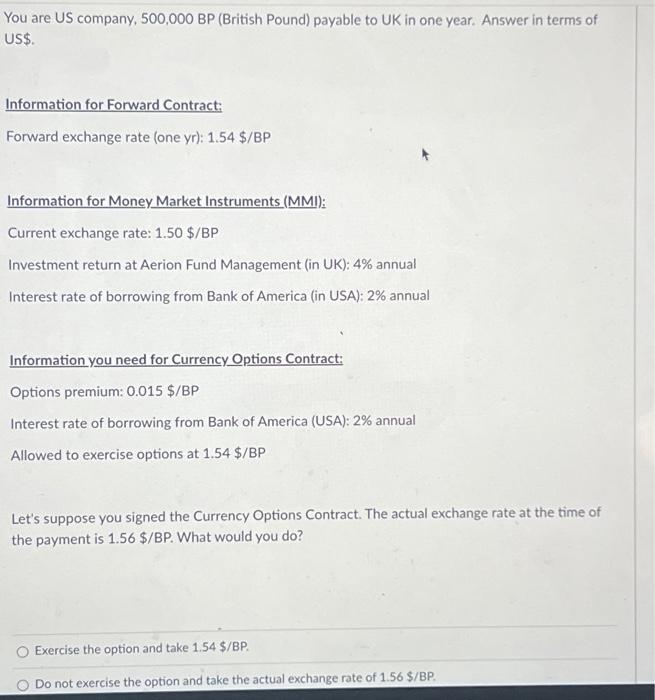

You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US\$. Information for Forward Contract: Forward exchange rate (one yr): 1.54$/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50 \$/BP Investment return at Aerion Fund Management (in UK): 4% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015$/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54$/BP If the break-even exchange rate for the Currency Options Contract is 1.46$/BP, and you believe the exchange rate at the time of the payment would be 1.48$/BP, should you sign the contract? Yes. No. You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US\$. Information for Forward Contract: Forward exchange rate (one yr): 1.54$/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50$/BP Investment return at Aerion Fund Management (in UK): 4% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015$/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54$/BP Let's suppose you signed the Currency Options Contract. The actual exchange rate at the time of the payment is 1.56$/BP. What would you do? Exercise the option and take 1.54$/BP. Do not exercise the option and take the actual exchange rate of 1.56$/BP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started