Can someone find the solutions using a calculator please? Excel is okay for the first problem!

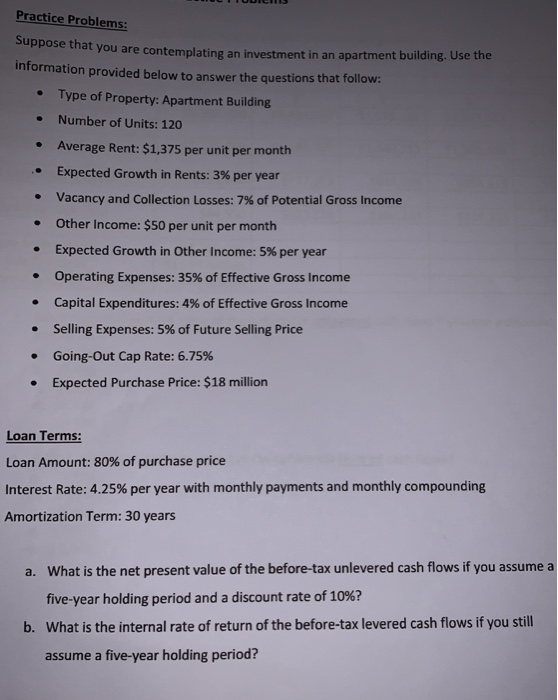

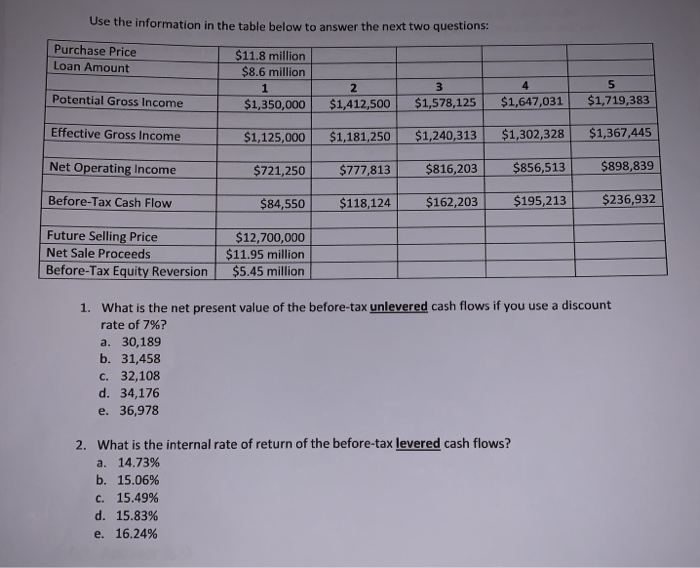

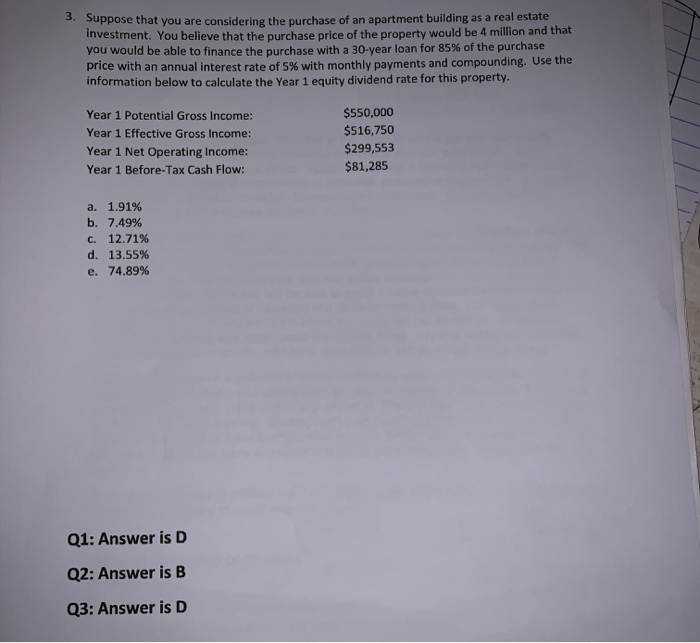

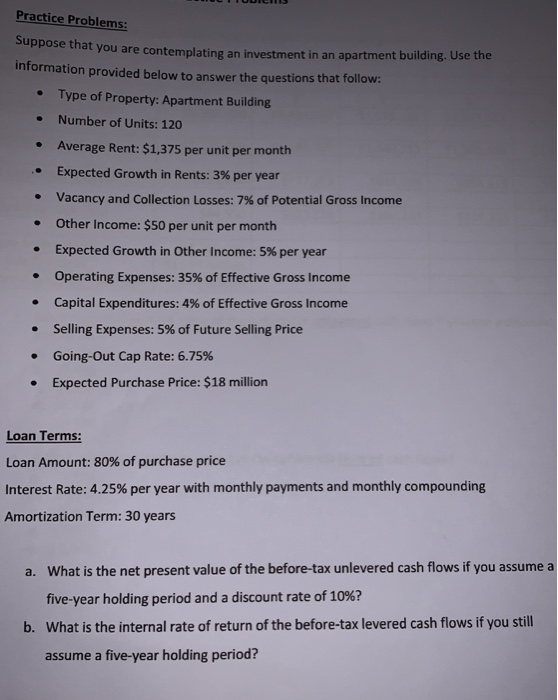

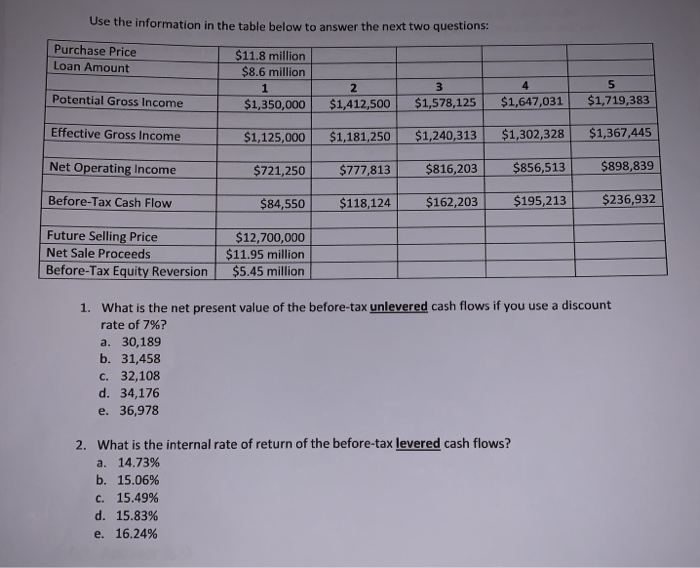

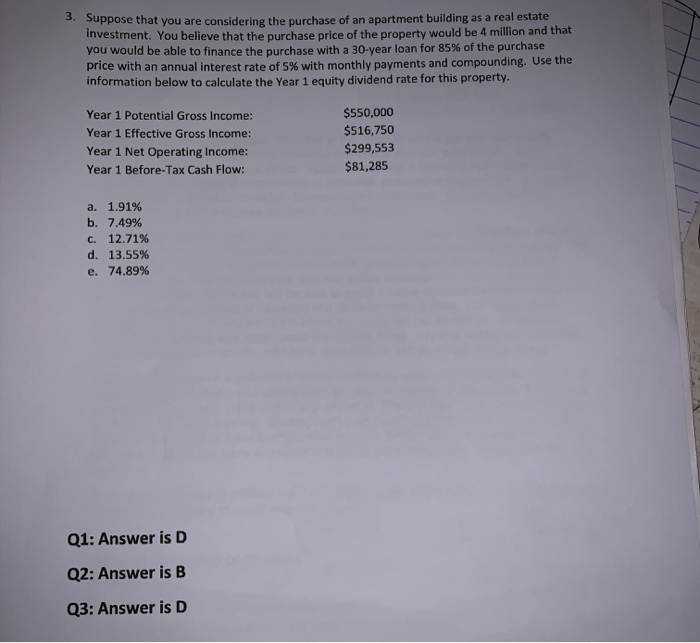

Practice Problems: that you are contemplating an investment in an apartment building. Use the Information provided below to answer the questions that follow: Type of Property: Apartment Building Number of Units: 120 Average Rent: $1,375 per unit per month .. Expected Growth in Rents: 3% per year Vacancy and Collection Losses: 7% of Potential Gross Income Other Income: $50 per unit per month Expected Growth in Other Income: 5% per year Operating Expenses: 35% of Effective Gross Income Capital Expenditures: 4% of Effective Gross Income Selling Expenses: 5% of Future Selling Price Going-Out Cap Rate: 6.75% Expected Purchase Price: $18 million Loan Terms: Loan Amount: 80% of purchase price Interest Rate: 4.25% per year with monthly payments and monthly compounding Amortization Term: 30 years a. What is the net present value of the before-tax unlevered cash flows if you assume a five-year holding period and a discount rate of 10%? b. What is the internal rate of return of the before-tax levered cash flows if you still assume a five-year holding period? Use the information in the table below to answer the next two questions: Purchase Price Loan Amount $11.8 million $8.6 million Potential Gross Income $1,350,000 $1,412,500 $1,578,125 $1,647,031 $1,719,383 Effective Gross Income $1,125,000 $1,181,250 $1,240,313 $1,302,328 $1,367,445 Net Operating Income $721,250 $777,813 $816,203 $856,513 $898,839 Before-Tax Cash Flow $84,550 $118,124 $162,203_ $195,213 $236,932 Future Selling Price Net Sale Proceeds Before-Tax Equity Reversion $12,700,000 $11.95 million $5.45 million 1. What is the net present value of the before-tax unlevered cash flows if you use a discount rate of 7%? a. 30,189 b. 31,458 c. 32,108 d. 34,176 e. 36,978 2. What is the internal rate of return of the before-tax levered cash flows? a. 14.73% b. 15.06% c. 15.49% d. 15.83% e. 16.24% 3. Suppose that you are considering the purchase of an apartment building as a real estate investment. You believe that the purchase price of the property would be 4 million and that you would be able to finance the purchase with a 30-year loan for 85% of the purchase price with an annual interest rate of 5% with monthly payments and compounding. Use the information below to calculate the Year 1 equity dividend rate for this property, Year 1 Potential Gross Income: Year 1 Effective Gross Income: Year 1 Net Operating Income: Year 1 Before-Tax Cash Flow: $550,000 $516,750 $299,553 $81,285 a. 1.91% b. 7.49% C. 12.71% d. 13.55% e. 74.89% Q1: Answer is D Q2: Answer is B Q3: Answer is D Practice Problems: that you are contemplating an investment in an apartment building. Use the Information provided below to answer the questions that follow: Type of Property: Apartment Building Number of Units: 120 Average Rent: $1,375 per unit per month .. Expected Growth in Rents: 3% per year Vacancy and Collection Losses: 7% of Potential Gross Income Other Income: $50 per unit per month Expected Growth in Other Income: 5% per year Operating Expenses: 35% of Effective Gross Income Capital Expenditures: 4% of Effective Gross Income Selling Expenses: 5% of Future Selling Price Going-Out Cap Rate: 6.75% Expected Purchase Price: $18 million Loan Terms: Loan Amount: 80% of purchase price Interest Rate: 4.25% per year with monthly payments and monthly compounding Amortization Term: 30 years a. What is the net present value of the before-tax unlevered cash flows if you assume a five-year holding period and a discount rate of 10%? b. What is the internal rate of return of the before-tax levered cash flows if you still assume a five-year holding period? Use the information in the table below to answer the next two questions: Purchase Price Loan Amount $11.8 million $8.6 million Potential Gross Income $1,350,000 $1,412,500 $1,578,125 $1,647,031 $1,719,383 Effective Gross Income $1,125,000 $1,181,250 $1,240,313 $1,302,328 $1,367,445 Net Operating Income $721,250 $777,813 $816,203 $856,513 $898,839 Before-Tax Cash Flow $84,550 $118,124 $162,203_ $195,213 $236,932 Future Selling Price Net Sale Proceeds Before-Tax Equity Reversion $12,700,000 $11.95 million $5.45 million 1. What is the net present value of the before-tax unlevered cash flows if you use a discount rate of 7%? a. 30,189 b. 31,458 c. 32,108 d. 34,176 e. 36,978 2. What is the internal rate of return of the before-tax levered cash flows? a. 14.73% b. 15.06% c. 15.49% d. 15.83% e. 16.24% 3. Suppose that you are considering the purchase of an apartment building as a real estate investment. You believe that the purchase price of the property would be 4 million and that you would be able to finance the purchase with a 30-year loan for 85% of the purchase price with an annual interest rate of 5% with monthly payments and compounding. Use the information below to calculate the Year 1 equity dividend rate for this property, Year 1 Potential Gross Income: Year 1 Effective Gross Income: Year 1 Net Operating Income: Year 1 Before-Tax Cash Flow: $550,000 $516,750 $299,553 $81,285 a. 1.91% b. 7.49% C. 12.71% d. 13.55% e. 74.89% Q1: Answer is D Q2: Answer is B Q3: Answer is D