Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help ! 3. You are interested in building a portfolio of two stocks Yes2Future Inc. and Finance1 Inc. Your analysts have provided a

can someone help !

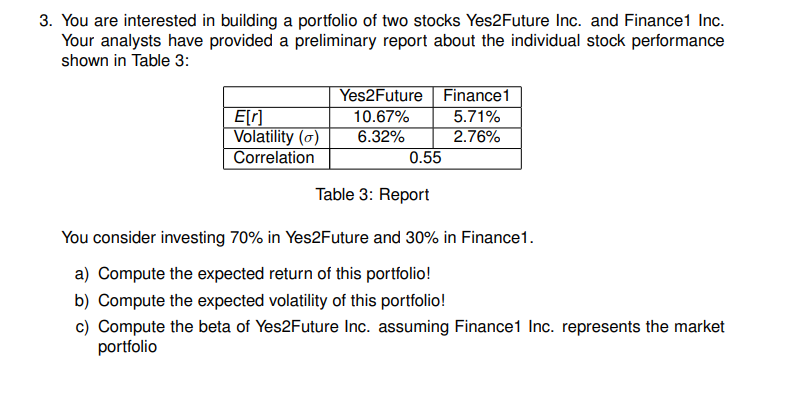

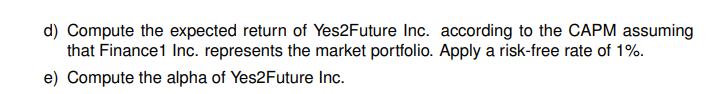

3. You are interested in building a portfolio of two stocks Yes2Future Inc. and Finance1 Inc. Your analysts have provided a preliminary report about the individual stock performance shown in Table 3: E[r] Volatility (0) Correlation Yes2Future 10.67% 6.32% 0.55 Finance1 5.71% 2.76% Table 3: Report You consider investing 70% in Yes2Future and 30% in Finance 1. a) Compute the expected return of this portfolio! b) Compute the expected volatility of this portfolio! c) Compute the beta of Yes2Future Inc. assuming Finance1 Inc. represents the market portfolio d) Compute the expected return of Yes2Future Inc. according to the CAPM assuming that Finance1 Inc. represents the market portfolio. Apply a risk-free rate of 1%. e) Compute the alpha of Yes2Future IncStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started