Can someone help me calculate the ration analysis for Amazon from 2008 -2011? Attached are the information within those three years. Thank you in advance.

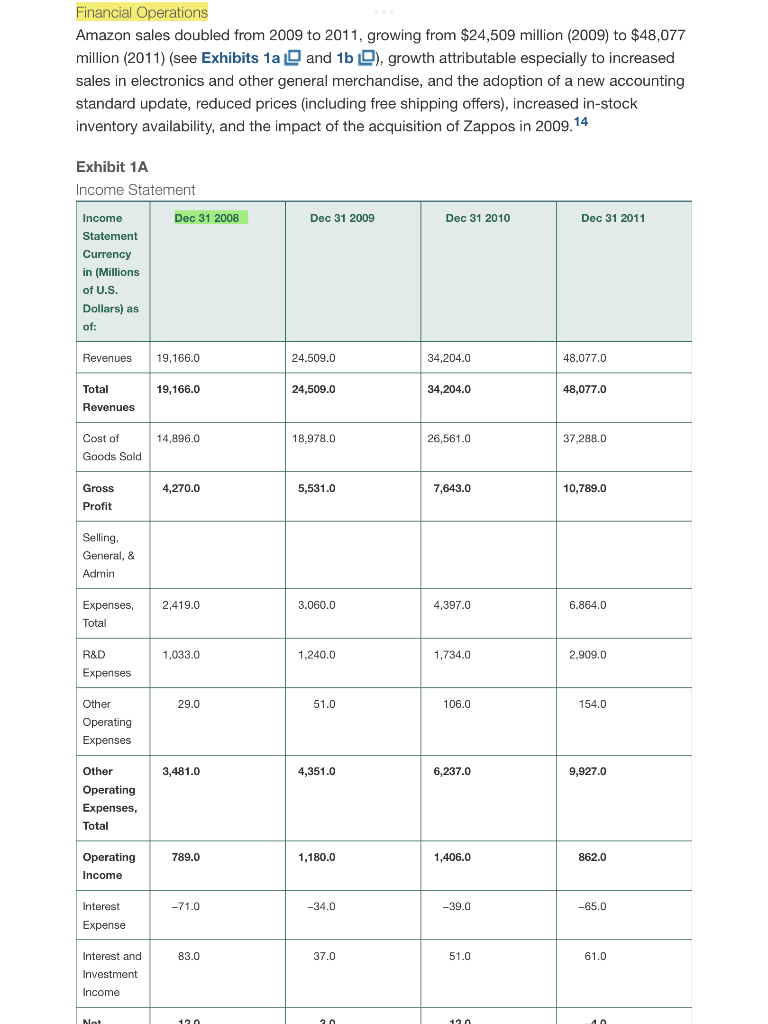

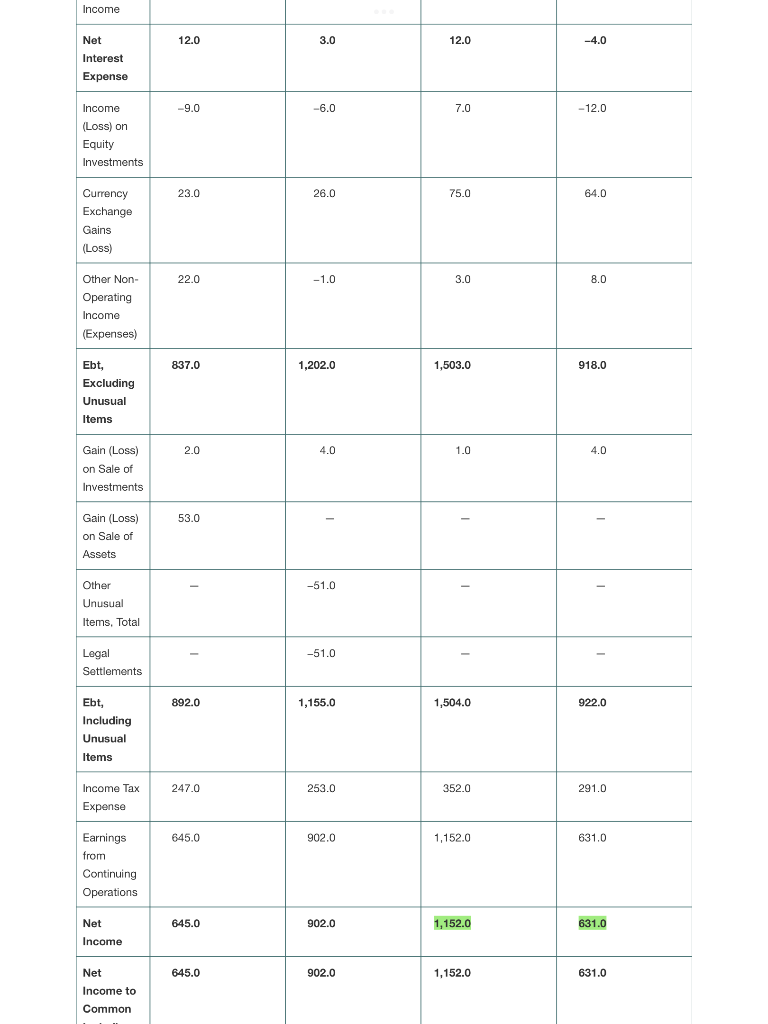

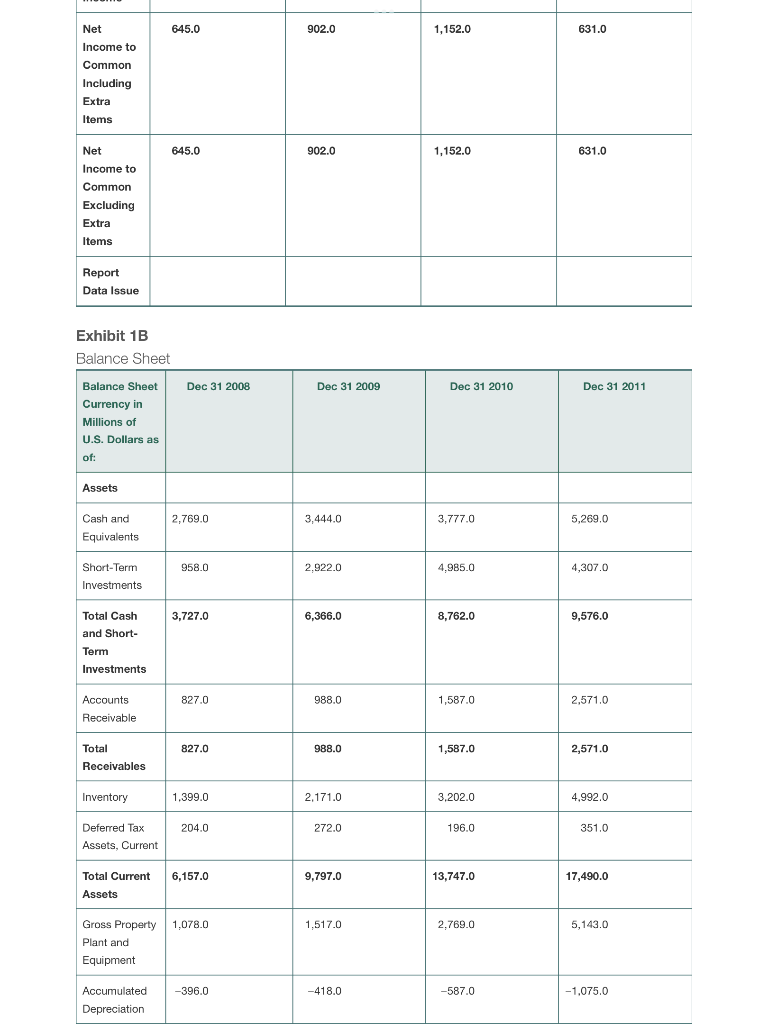

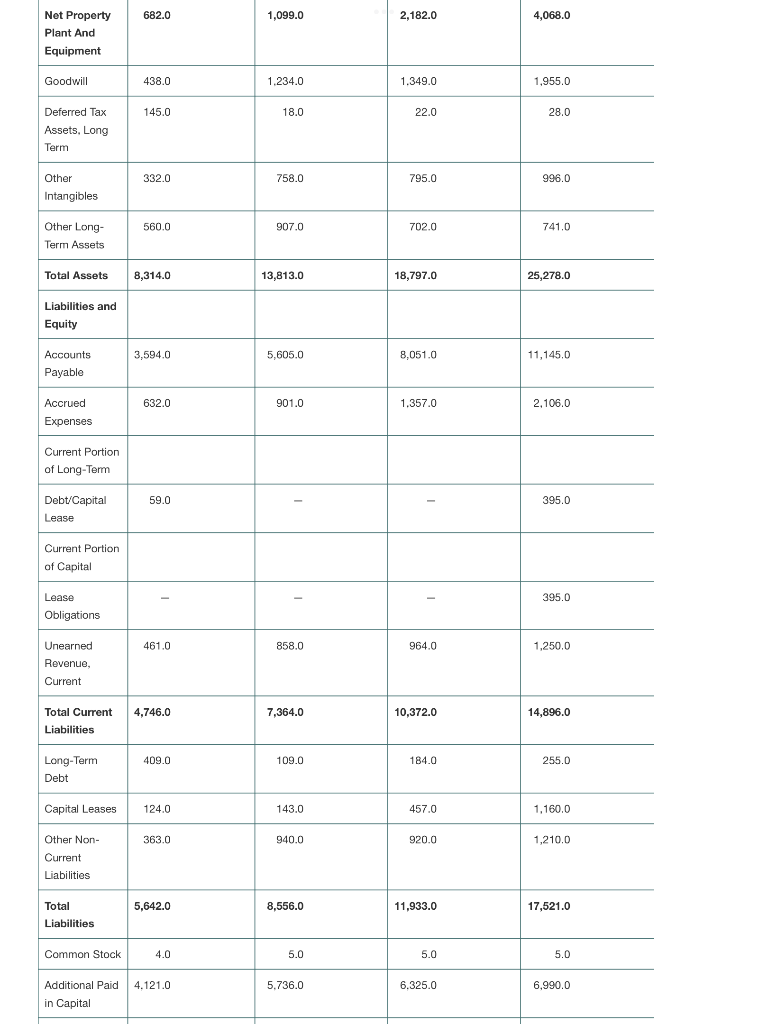

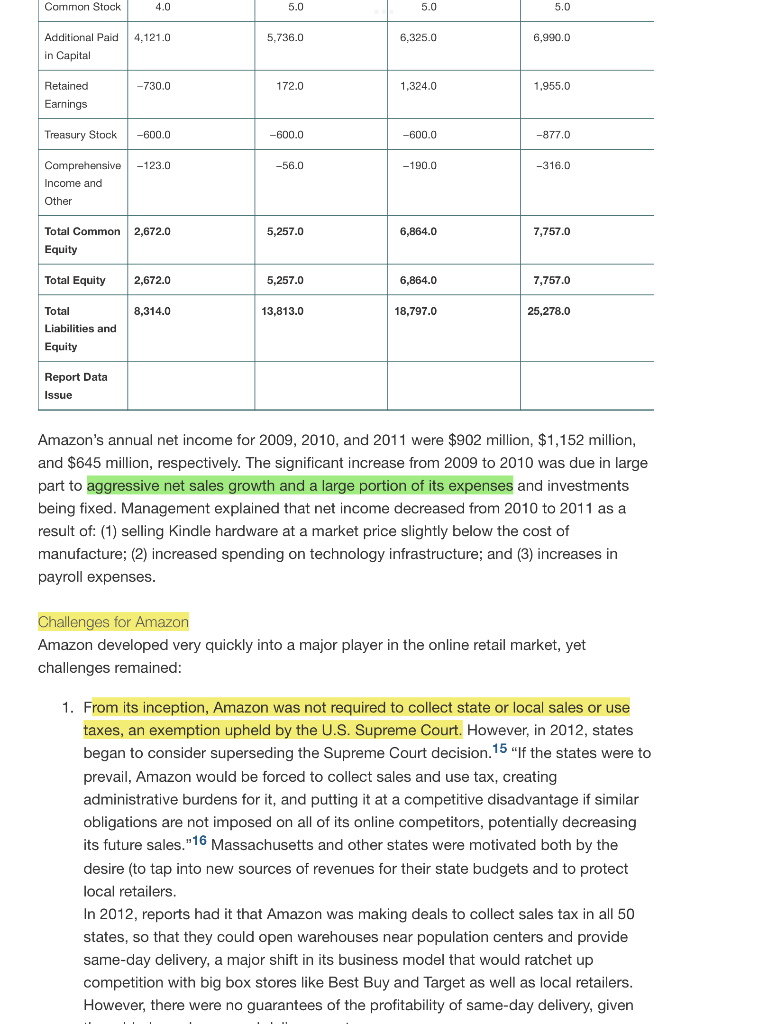

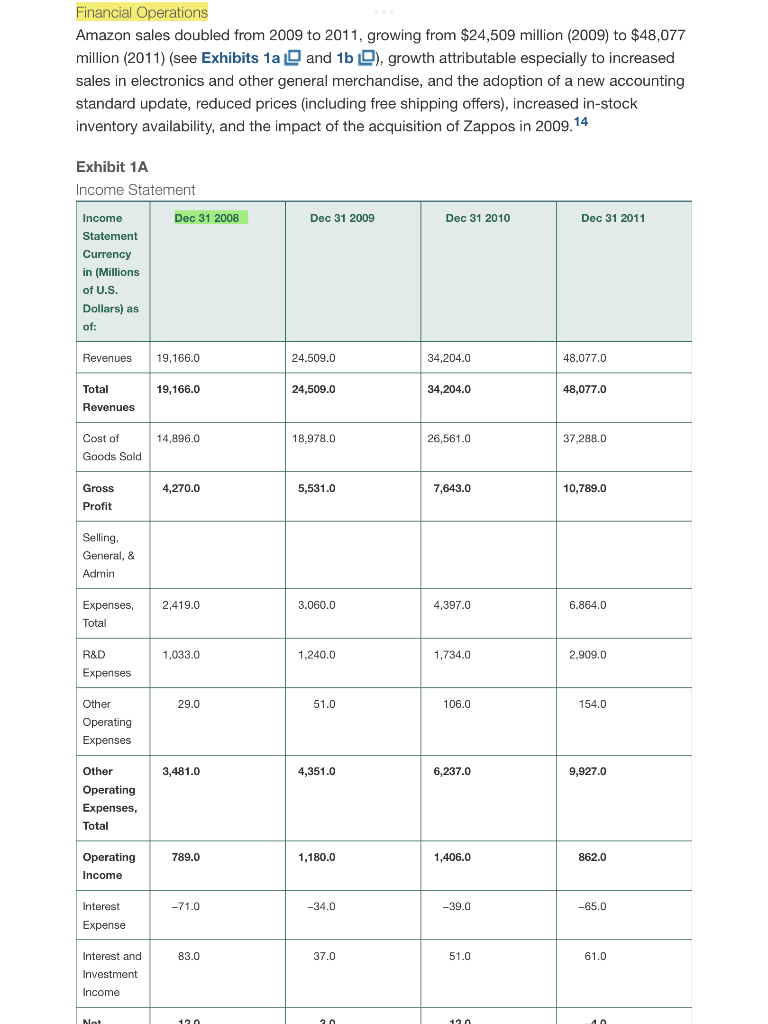

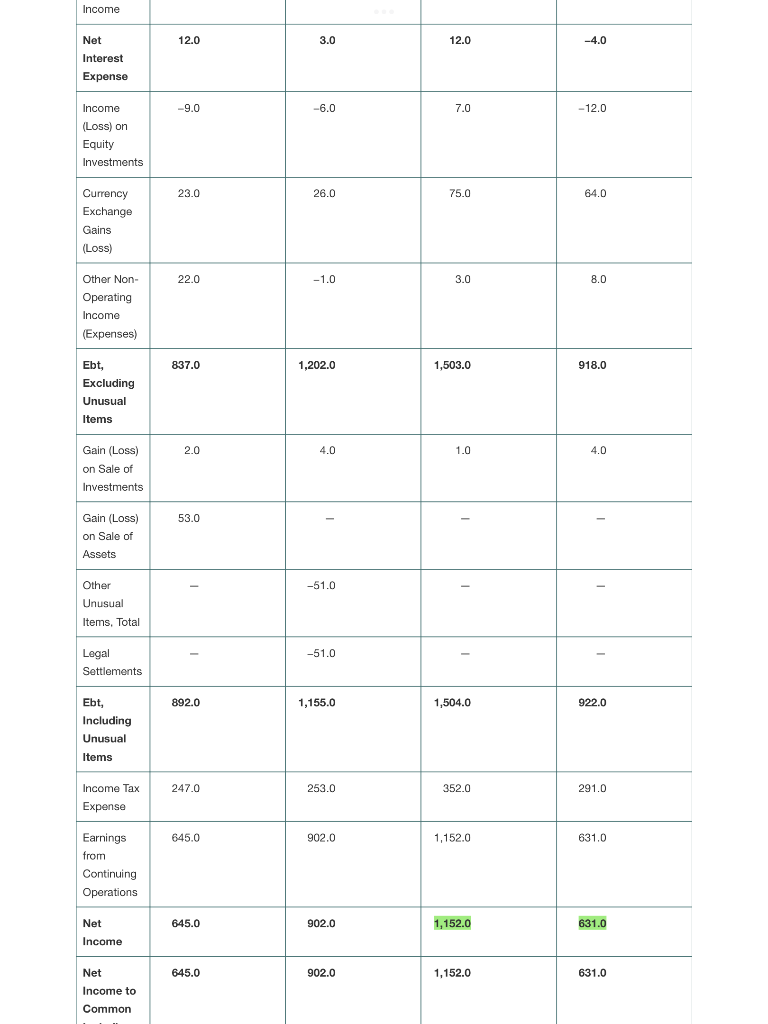

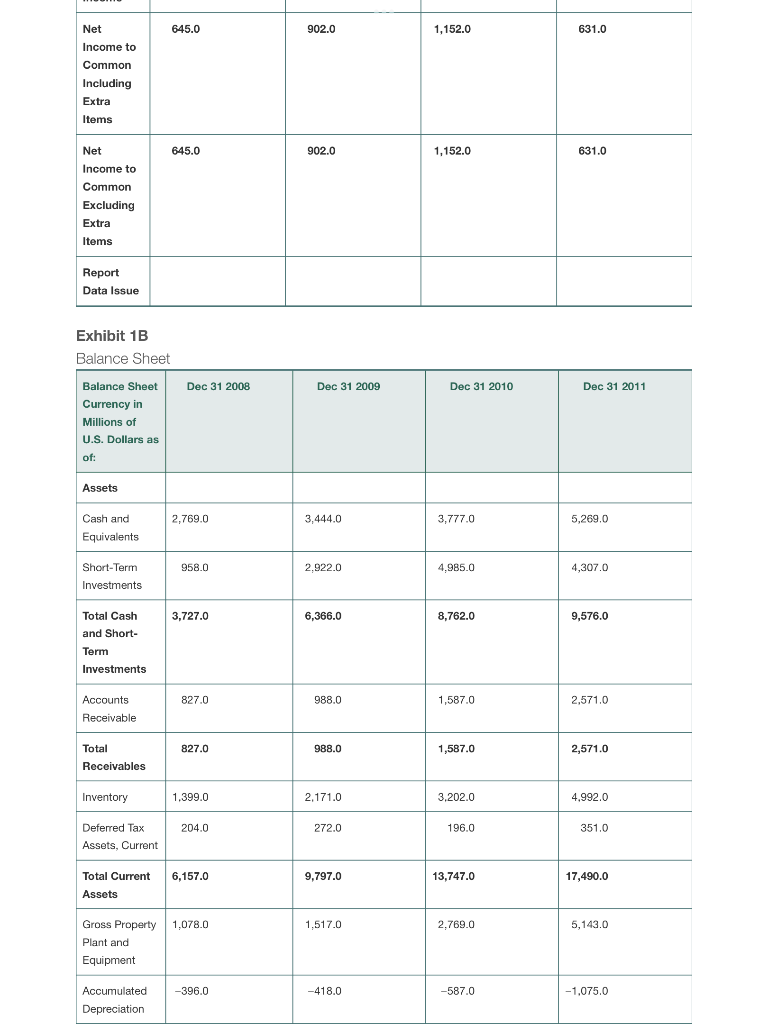

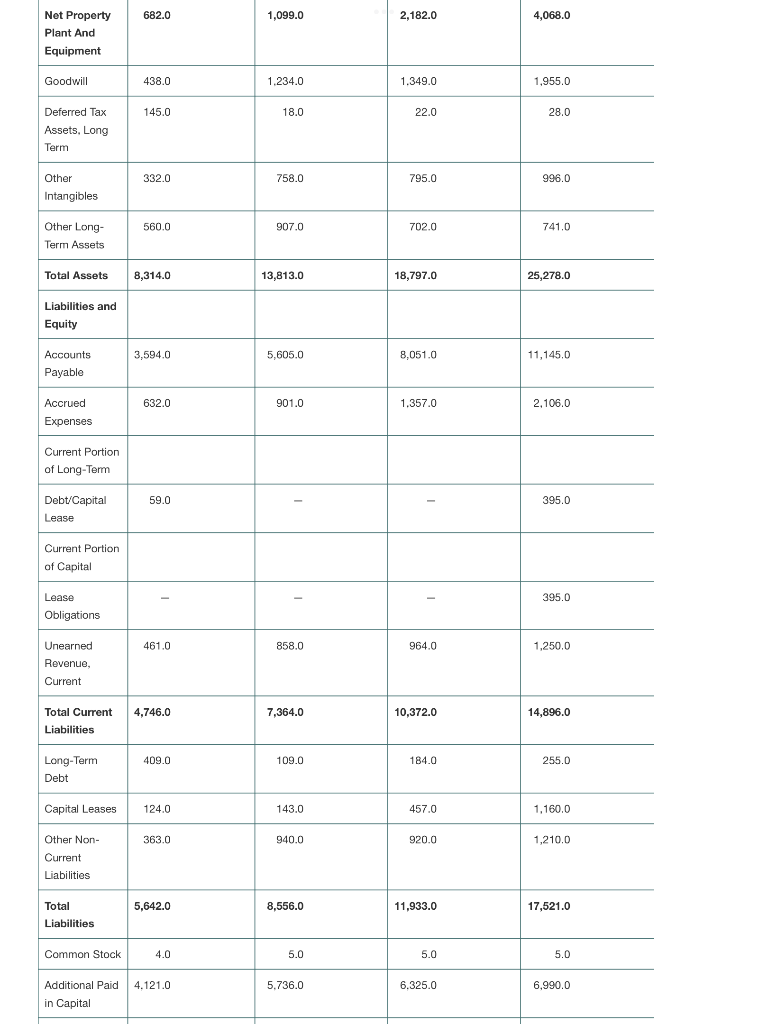

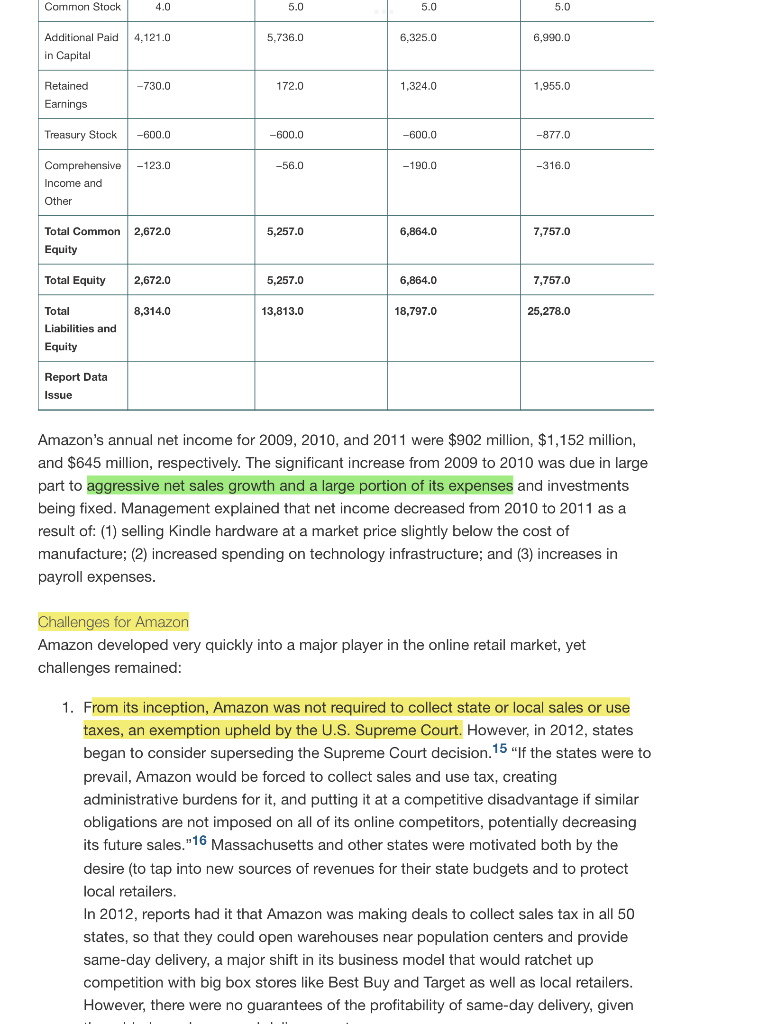

Financial Operations Amazon sales doubled from 2009 to 2011, growing from $24,509 million (2009) to $48,077 million (2011) (see Exhibits 1a and 1b ), growth attributable especially to increased sales in electronics and other general merchandise, and the adoption of a new accounting standard update, reduced prices (including free shipping offers), increased in-stock inventory availability, and the impact of the acquisition of Zappos in 2009.14 Evhihit 1 A Exhibit 1B Balance Sheet Amazon's annual net income for 2009,2010 , and 2011 were $902 million, $1,152 million, and $645 million, respectively. The significant increase from 2009 to 2010 was due in large part to aggressive net sales growth and a large portion of its expenses and investments being fixed. Management explained that net income decreased from 2010 to 2011 as a result of: (1) selling Kindle hardware at a market price slightly below the cost of manufacture; (2) increased spending on technology infrastructure; and (3) increases in payroll expenses. Challenges for Amazon Amazon developed very quickly into a major player in the online retail market, yet challenges remained: 1. From its inception, Amazon was not required to collect state or local sales or use taxes, an exemption upheld by the U.S. Supreme Court. However, in 2012, states began to consider superseding the Supreme Court decision. 15 "If the states were to prevail, Amazon would be forced to collect sales and use tax, creating administrative burdens for it, and putting it at a competitive disadvantage if similar obligations are not imposed on all of its online competitors, potentially decreasing its future sales."16 Massachusetts and other states were motivated both by the desire (to tap into new sources of revenues for their state budgets and to protect local retailers. In 2012, reports had it that Amazon was making deals to collect sales tax in all 50 states, so that they could open warehouses near population centers and provide same-day delivery, a major shift in its business model that would ratchet up competition with big box stores like Best Buy and Target as well as local retailers. However, there were no guarantees of the profitability of same-day delivery, given Financial Operations Amazon sales doubled from 2009 to 2011, growing from $24,509 million (2009) to $48,077 million (2011) (see Exhibits 1a and 1b ), growth attributable especially to increased sales in electronics and other general merchandise, and the adoption of a new accounting standard update, reduced prices (including free shipping offers), increased in-stock inventory availability, and the impact of the acquisition of Zappos in 2009.14 Evhihit 1 A Exhibit 1B Balance Sheet Amazon's annual net income for 2009,2010 , and 2011 were $902 million, $1,152 million, and $645 million, respectively. The significant increase from 2009 to 2010 was due in large part to aggressive net sales growth and a large portion of its expenses and investments being fixed. Management explained that net income decreased from 2010 to 2011 as a result of: (1) selling Kindle hardware at a market price slightly below the cost of manufacture; (2) increased spending on technology infrastructure; and (3) increases in payroll expenses. Challenges for Amazon Amazon developed very quickly into a major player in the online retail market, yet challenges remained: 1. From its inception, Amazon was not required to collect state or local sales or use taxes, an exemption upheld by the U.S. Supreme Court. However, in 2012, states began to consider superseding the Supreme Court decision. 15 "If the states were to prevail, Amazon would be forced to collect sales and use tax, creating administrative burdens for it, and putting it at a competitive disadvantage if similar obligations are not imposed on all of its online competitors, potentially decreasing its future sales."16 Massachusetts and other states were motivated both by the desire (to tap into new sources of revenues for their state budgets and to protect local retailers. In 2012, reports had it that Amazon was making deals to collect sales tax in all 50 states, so that they could open warehouses near population centers and provide same-day delivery, a major shift in its business model that would ratchet up competition with big box stores like Best Buy and Target as well as local retailers. However, there were no guarantees of the profitability of same-day delivery, given