Can someone help me do 20X3 Financial Statement Project. Need Adjustments worksheet, Income statement, Statement of comprehensive income ,Statement of owners' equity, Balance sheet, Statement of cash flows

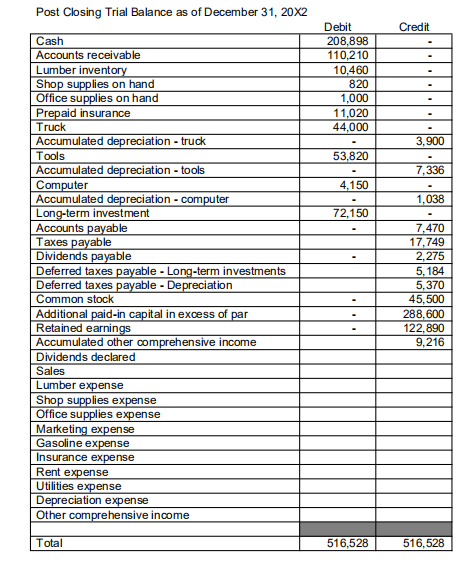

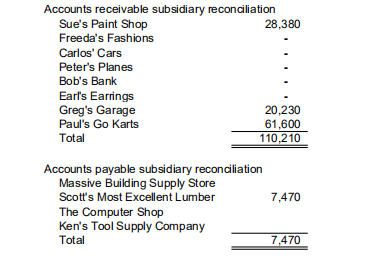

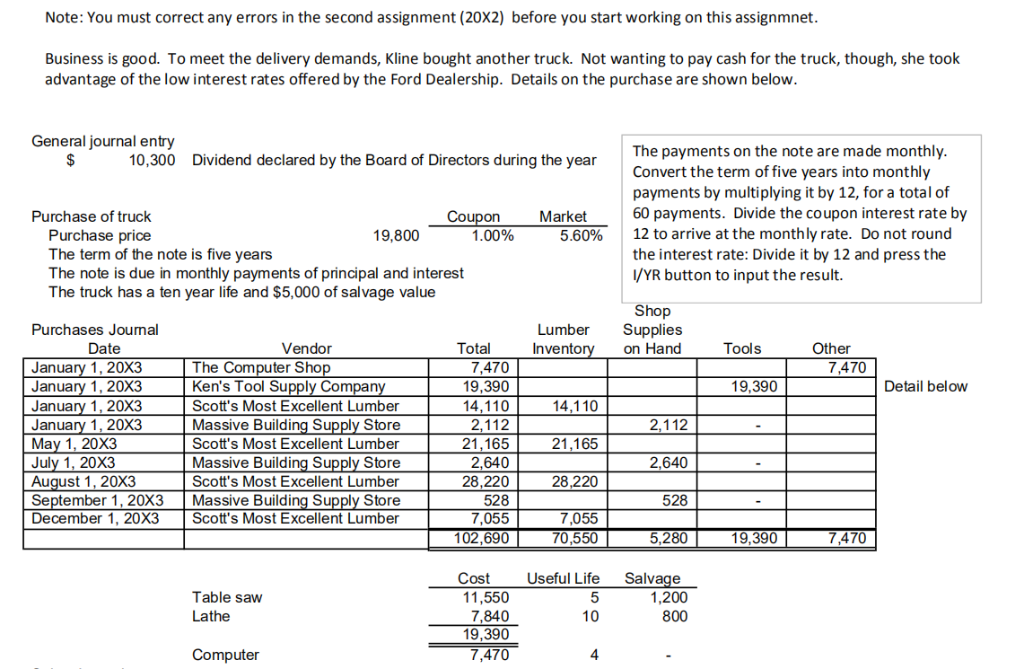

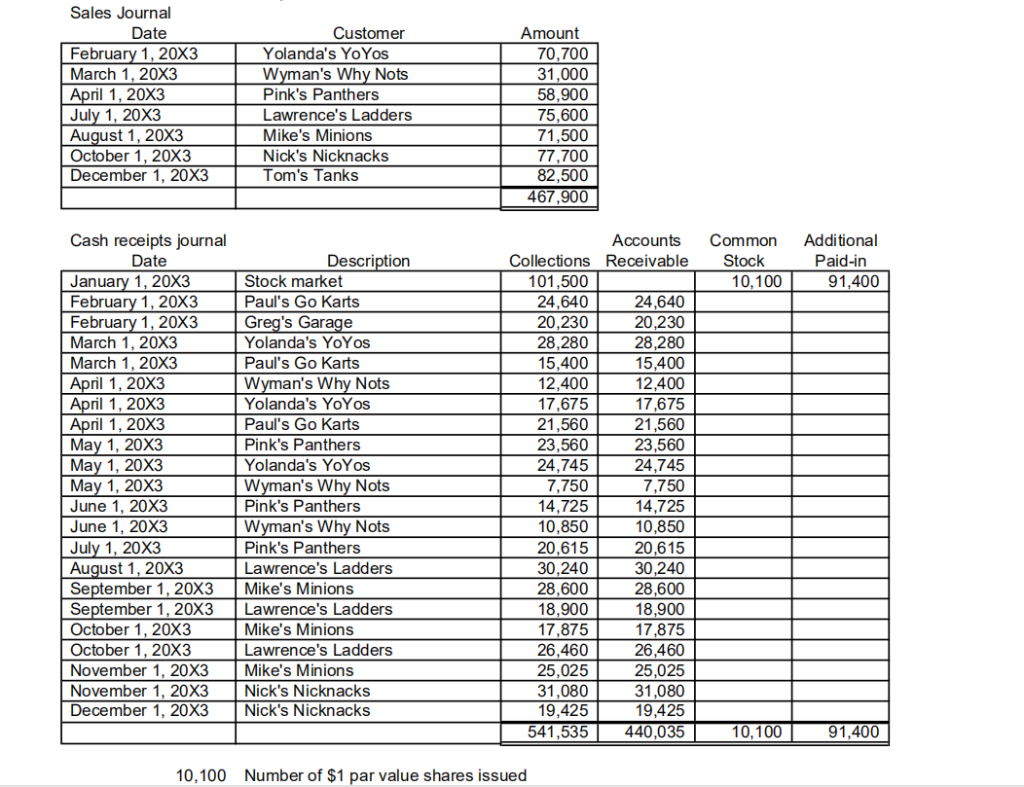

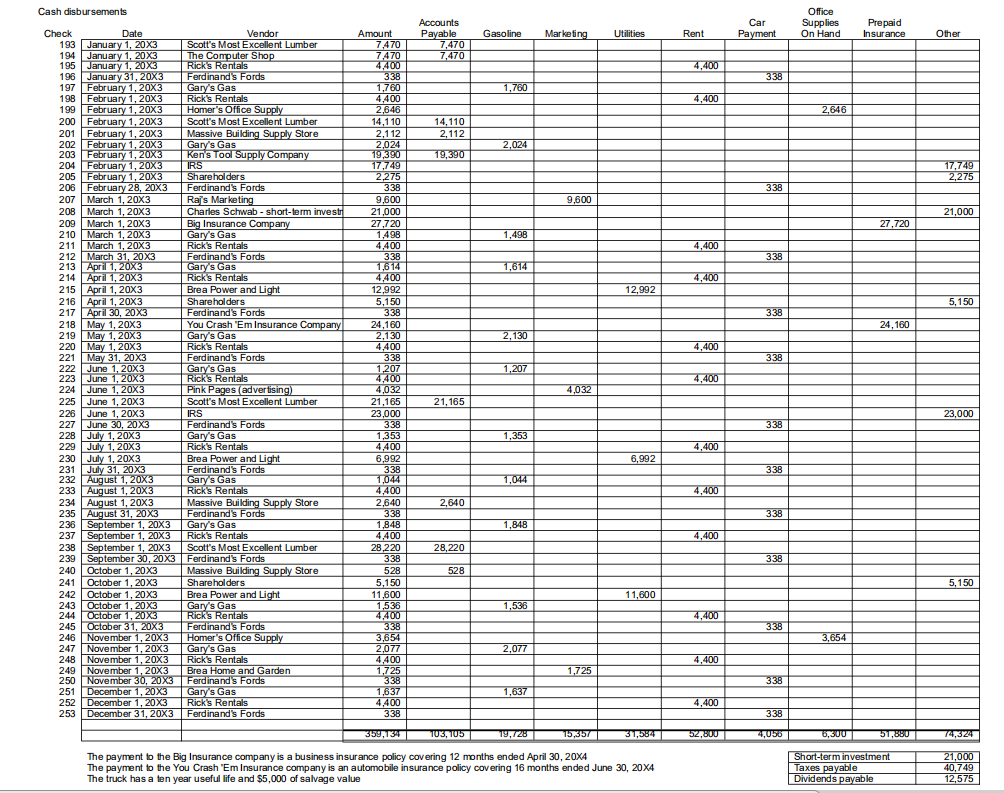

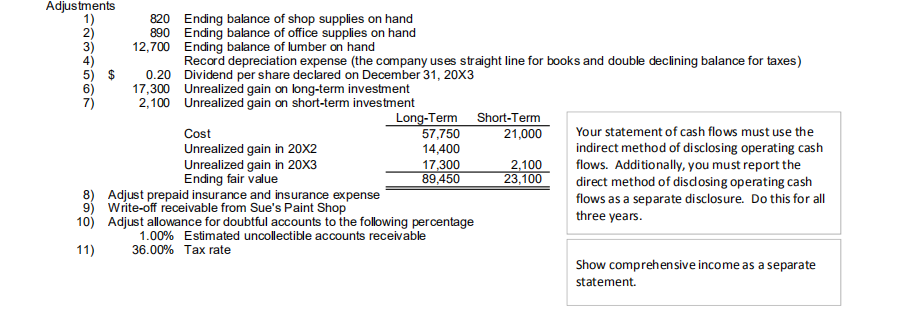

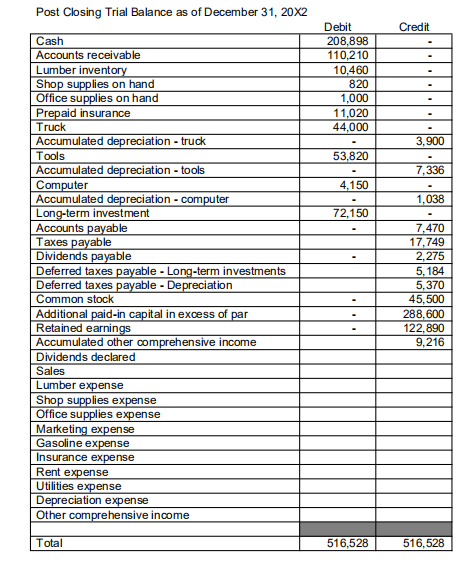

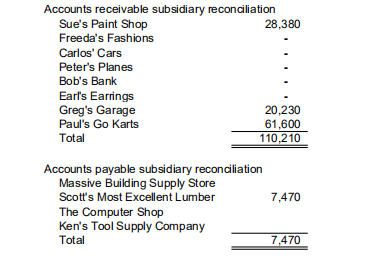

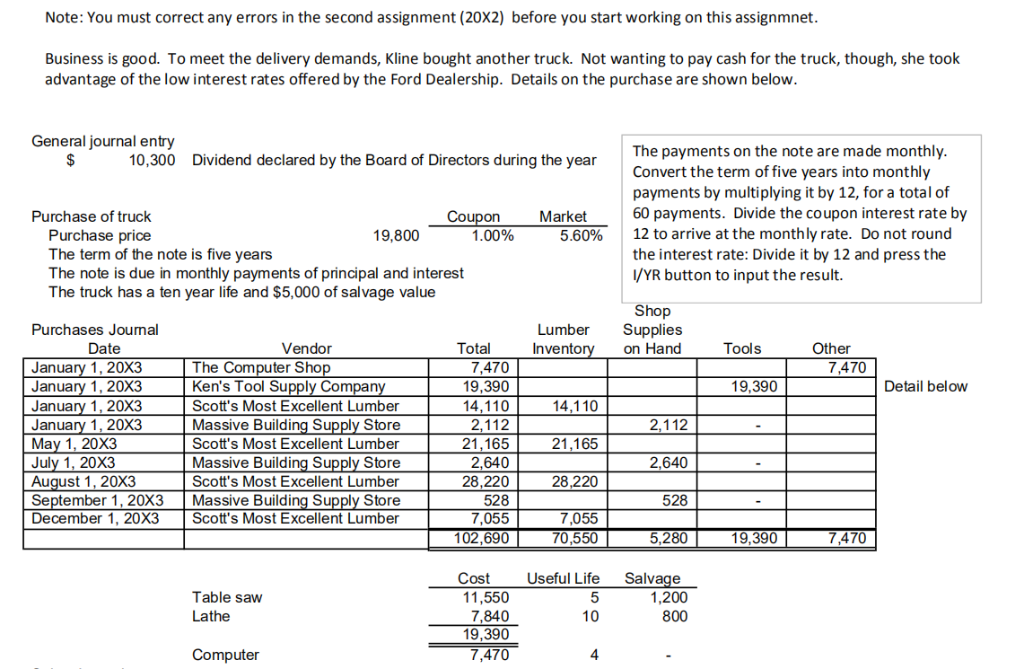

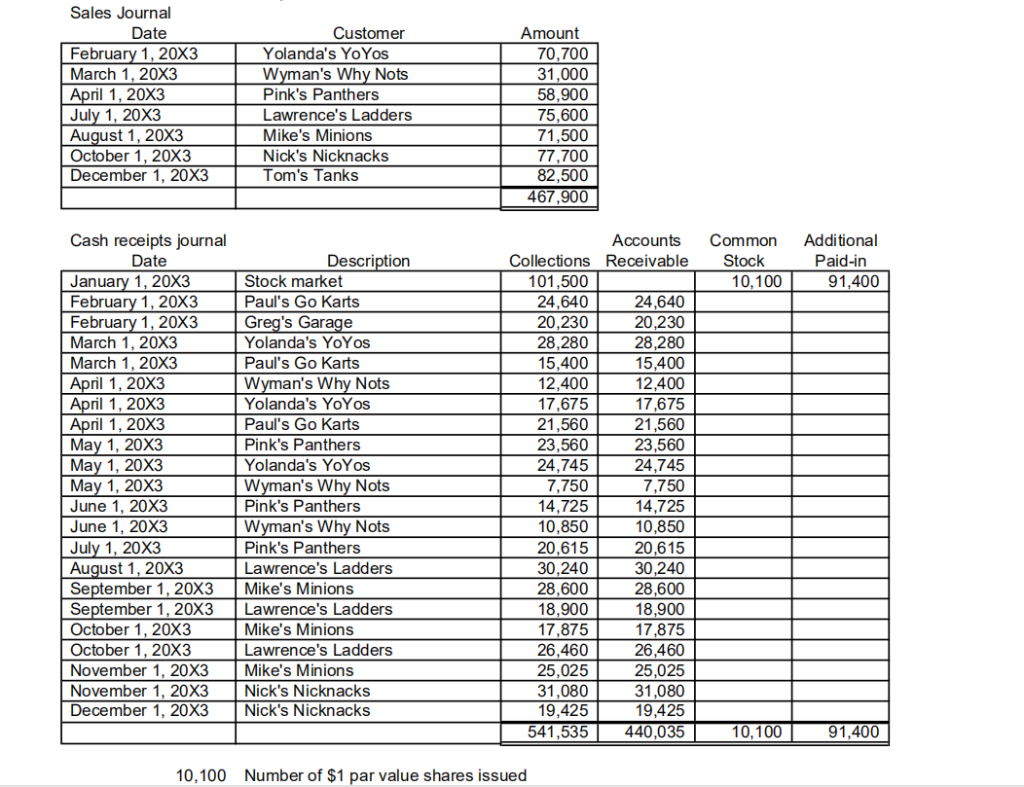

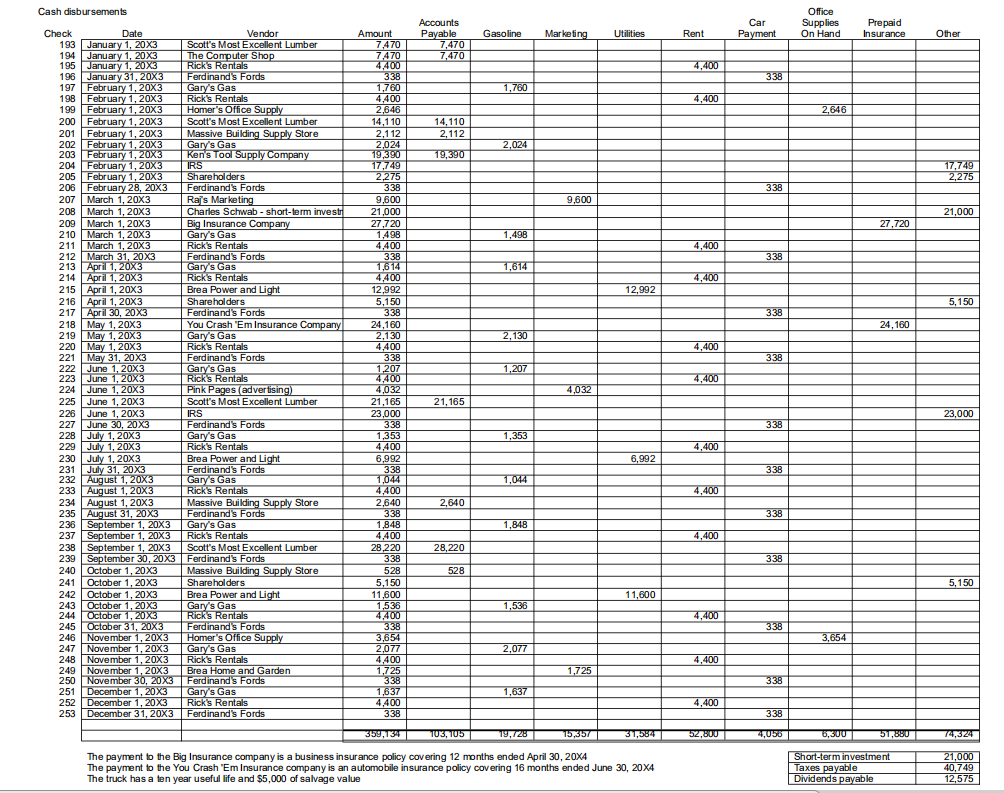

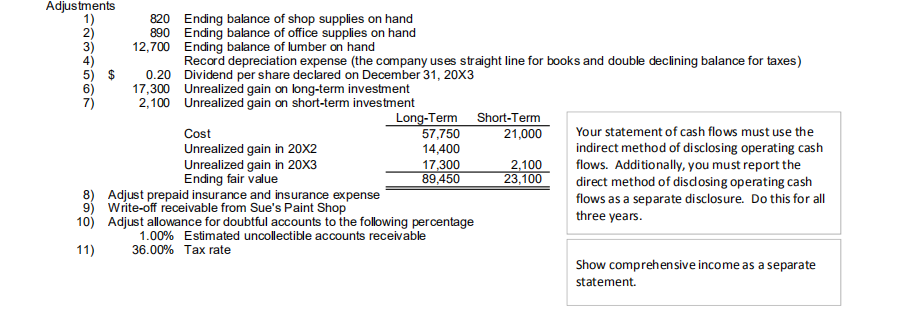

Post Closing Trial Balance as of December 31, 20X2 Credit Debit 208.898 110.210 10,460 820 1,000 11.020 44,000 3,900 53,820 7,336 4,150 . 72,150 1,038 Cash Accounts receivable Lumber inventory Shop supplies on hand Office supplies on hand Prepaid insurance Truck Accumulated depreciation - truck Tools Accumulated depreciation - tools Computer Accumulated depreciation - computer Long-term investment Accounts payable Taxes payable Dividends payable Deferred taxes payable - Long-term investments Deferred taxes payable - Depreciation Common stock Additional paid-in capital in excess of par Retained earnings Accumulated other comprehensive income Dividends declared Sales Lumber expense Shop supplies expense Office supplies expense Marketing expense Gasoline expense Insurance expense Rent expense Utilities expense Depreciation expense Other comprehensive income 7,470 17,749 2,275 5,184 5.370 45,500 288,600 122,890 9,216 - - Total 516,528 516,528 Accounts receivable subsidiary reconciliation Sue's Paint Shop 28,380 Freeda's Fashions Carlos' Cars Peter's Planes Bob's Bank Earl's Earrings Greg's Garage 20,230 Paul's Go Karts 61,600 Total 110,210 Accounts payable subsidiary reconciliation Massive Building Supply Store Scott's Most Excellent Lumber The Computer Shop Ken's Tool Supply Company Total 7,470 7,470 Note: You must correct any errors in the second assignment (20X2) before you start working on this assignmnet. Business is good. To meet the delivery demands, Kline bought another truck. Not wanting to pay cash for the truck, though, she took advantage of the low interest rates offered by the Ford Dealership. Details on the purchase are shown below. General journal entry $ 10,300 Dividend declared by the Board of Directors during the year Market 5.60% Purchase of truck Coupon Purchase price 19,800 1.00% The term of the note is five years The note is due in monthly payments of principal and interest The truck has a ten year life and $5,000 of salvage value The payments on the note are made monthly. Convert the term of five years into monthly payments by multiplying it by 12, for a total of 60 payments. Divide the coupon interest rate by 12 to arrive at the monthly rate. Do not round the interest rate: Divide it by 12 and press the 1/YR button to input the result. Lumber Inventory Shop Supplies on Hand Tools Other 7,470 19,390 Detail below 14,1101 Purchases Journal Date January 1, 20X3 January 1, 20X3 January 1, 20X3 January 1, 20X3 May 1, 20X3 July 1, 20X3 August 1, 20X3 September 1, 20X3 December 1, 20X3 2,112 Vendor The Computer Shop Ken's Tool Supply Company Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Total 7,470 19,390 14,110 2,112 21,165 2,640 28,220 528 7,055 102,690 21,165 2,640 28,220 528 7,055 70,550 5,280 19,390 7,470 Table saw Lathe Cost 11,550 7,840 19,390 7,470 Useful Life Salvage 1,200 10800 Computer Sales Journal Date February 1, 20X3 March 1, 20X3 April 1, 20X3 July 1, 20X3 August 1, 20X3 October 1, 20X3 December 1, 20X3 Customer Yolanda's Yo Yos Wyman's Why Nots Pink's Panthers Lawrence's Ladders Mike's Minions Nick's Nicknacks Tom's Tanks Amount 70,700 31,000 58,900 75,600 71,500 77,700 82,500 467,900 Common Stock 10,100 Additional Paid-in 91,400 Cash receipts journal Date Description January 1, 20X3 Stock market February 1, 20X3 Paul's Go Karts February 1, 20X3 Greg's Garage March 1, 20X3 Yolanda's YoYos March 1, 20X3 Paul's Go Karts April 1, 20X3 Wyman's Why Nots April 1, 20X3 Yolanda's YoYos April 1, 20X3 Paul's Go Karts May 1, 20X3 Pink's Panthers May 1, 20X3 Yolanda's YoYos May 1, 20X3 Wyman's Why Nots June 1, 20X3 | Pink's Panthers June 1, 20X3 Wyman's Why Nots July 1, 20X3 Pink's Panthers August 1, 20X3 Lawrence's Ladders September 1, 20X3 Mike's Minions September 1, 20X3 Lawrence's Ladders October 1, 20X3 Mike's Minions October 1, 20X3 Lawrence's Ladders November 1, 20X3 Mike's Minions November 1, 20X3 Nick's Nicknacks December 1, 20X3 Nick's Nicknacks Accounts Collections Receivable 101,500 24,640 24,640 20,230 20.230 28,280 28,280 15,400 15,400 12,400 12,400 17,675 17,675 21,560 21,560 23,560 23,560 24,745 24,745 7,750 7,750 14,725 | 14,725 10,850 10,850 20.615 20,615 30,240 30,240 28,600 28,600 18,900 18,900 17,875 17,875 26,460 26,460 25,025 25,025 31,080 31,080 19,425 19,425 541,535 440,035 10,100 91,400 10,100 Number of $1 par value shares issued annos Adjustments 820 Ending balance of shop supplies on hand 890 Ending balance of office supplies on hand 12,700 Ending balance of lumber on hand Record depreciation expense (the company uses straight line for books and double declining balance for taxes) 5) $ 0.20 Dividend per share declared on December 31, 20X3 17,300 Unrealized gain on long-term investment 2,100 Unrealized gain on short-term investment Long-Term Short-Term Cost 57,750 21,000 Your statement of cash flows must use the Unrealized gain in 20X2 14,400 indirect method of disclosing operating cash Unrealized gain in 20X3 17,300 2,100 flows. Additionally, you must report the Ending fair value 89,450 23.100 direct method of disclosing operating cash 8) Adjust prepaid insurance and insurance expense flows as a separate disclosure. Do this for all 9) Write-off receivable from Sue's Paint Shop 10) Adjust allowance for doubtful accounts to the following percentage three years. 1.00% Estimated uncollectible accounts receivable 11) 36.00% Tax rate Show comprehensive income as a separate statement. Post Closing Trial Balance as of December 31, 20X2 Credit Debit 208.898 110.210 10,460 820 1,000 11.020 44,000 3,900 53,820 7,336 4,150 . 72,150 1,038 Cash Accounts receivable Lumber inventory Shop supplies on hand Office supplies on hand Prepaid insurance Truck Accumulated depreciation - truck Tools Accumulated depreciation - tools Computer Accumulated depreciation - computer Long-term investment Accounts payable Taxes payable Dividends payable Deferred taxes payable - Long-term investments Deferred taxes payable - Depreciation Common stock Additional paid-in capital in excess of par Retained earnings Accumulated other comprehensive income Dividends declared Sales Lumber expense Shop supplies expense Office supplies expense Marketing expense Gasoline expense Insurance expense Rent expense Utilities expense Depreciation expense Other comprehensive income 7,470 17,749 2,275 5,184 5.370 45,500 288,600 122,890 9,216 - - Total 516,528 516,528 Accounts receivable subsidiary reconciliation Sue's Paint Shop 28,380 Freeda's Fashions Carlos' Cars Peter's Planes Bob's Bank Earl's Earrings Greg's Garage 20,230 Paul's Go Karts 61,600 Total 110,210 Accounts payable subsidiary reconciliation Massive Building Supply Store Scott's Most Excellent Lumber The Computer Shop Ken's Tool Supply Company Total 7,470 7,470 Note: You must correct any errors in the second assignment (20X2) before you start working on this assignmnet. Business is good. To meet the delivery demands, Kline bought another truck. Not wanting to pay cash for the truck, though, she took advantage of the low interest rates offered by the Ford Dealership. Details on the purchase are shown below. General journal entry $ 10,300 Dividend declared by the Board of Directors during the year Market 5.60% Purchase of truck Coupon Purchase price 19,800 1.00% The term of the note is five years The note is due in monthly payments of principal and interest The truck has a ten year life and $5,000 of salvage value The payments on the note are made monthly. Convert the term of five years into monthly payments by multiplying it by 12, for a total of 60 payments. Divide the coupon interest rate by 12 to arrive at the monthly rate. Do not round the interest rate: Divide it by 12 and press the 1/YR button to input the result. Lumber Inventory Shop Supplies on Hand Tools Other 7,470 19,390 Detail below 14,1101 Purchases Journal Date January 1, 20X3 January 1, 20X3 January 1, 20X3 January 1, 20X3 May 1, 20X3 July 1, 20X3 August 1, 20X3 September 1, 20X3 December 1, 20X3 2,112 Vendor The Computer Shop Ken's Tool Supply Company Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Massive Building Supply Store Scott's Most Excellent Lumber Total 7,470 19,390 14,110 2,112 21,165 2,640 28,220 528 7,055 102,690 21,165 2,640 28,220 528 7,055 70,550 5,280 19,390 7,470 Table saw Lathe Cost 11,550 7,840 19,390 7,470 Useful Life Salvage 1,200 10800 Computer Sales Journal Date February 1, 20X3 March 1, 20X3 April 1, 20X3 July 1, 20X3 August 1, 20X3 October 1, 20X3 December 1, 20X3 Customer Yolanda's Yo Yos Wyman's Why Nots Pink's Panthers Lawrence's Ladders Mike's Minions Nick's Nicknacks Tom's Tanks Amount 70,700 31,000 58,900 75,600 71,500 77,700 82,500 467,900 Common Stock 10,100 Additional Paid-in 91,400 Cash receipts journal Date Description January 1, 20X3 Stock market February 1, 20X3 Paul's Go Karts February 1, 20X3 Greg's Garage March 1, 20X3 Yolanda's YoYos March 1, 20X3 Paul's Go Karts April 1, 20X3 Wyman's Why Nots April 1, 20X3 Yolanda's YoYos April 1, 20X3 Paul's Go Karts May 1, 20X3 Pink's Panthers May 1, 20X3 Yolanda's YoYos May 1, 20X3 Wyman's Why Nots June 1, 20X3 | Pink's Panthers June 1, 20X3 Wyman's Why Nots July 1, 20X3 Pink's Panthers August 1, 20X3 Lawrence's Ladders September 1, 20X3 Mike's Minions September 1, 20X3 Lawrence's Ladders October 1, 20X3 Mike's Minions October 1, 20X3 Lawrence's Ladders November 1, 20X3 Mike's Minions November 1, 20X3 Nick's Nicknacks December 1, 20X3 Nick's Nicknacks Accounts Collections Receivable 101,500 24,640 24,640 20,230 20.230 28,280 28,280 15,400 15,400 12,400 12,400 17,675 17,675 21,560 21,560 23,560 23,560 24,745 24,745 7,750 7,750 14,725 | 14,725 10,850 10,850 20.615 20,615 30,240 30,240 28,600 28,600 18,900 18,900 17,875 17,875 26,460 26,460 25,025 25,025 31,080 31,080 19,425 19,425 541,535 440,035 10,100 91,400 10,100 Number of $1 par value shares issued annos Adjustments 820 Ending balance of shop supplies on hand 890 Ending balance of office supplies on hand 12,700 Ending balance of lumber on hand Record depreciation expense (the company uses straight line for books and double declining balance for taxes) 5) $ 0.20 Dividend per share declared on December 31, 20X3 17,300 Unrealized gain on long-term investment 2,100 Unrealized gain on short-term investment Long-Term Short-Term Cost 57,750 21,000 Your statement of cash flows must use the Unrealized gain in 20X2 14,400 indirect method of disclosing operating cash Unrealized gain in 20X3 17,300 2,100 flows. Additionally, you must report the Ending fair value 89,450 23.100 direct method of disclosing operating cash 8) Adjust prepaid insurance and insurance expense flows as a separate disclosure. Do this for all 9) Write-off receivable from Sue's Paint Shop 10) Adjust allowance for doubtful accounts to the following percentage three years. 1.00% Estimated uncollectible accounts receivable 11) 36.00% Tax rate Show comprehensive income as a separate statement