Can someone help me fill in this question using the provided materials? I only need #2 and the second part of the last one

Can someone help me fill in this question using the provided materials? I only need #2 and the second part of the last one

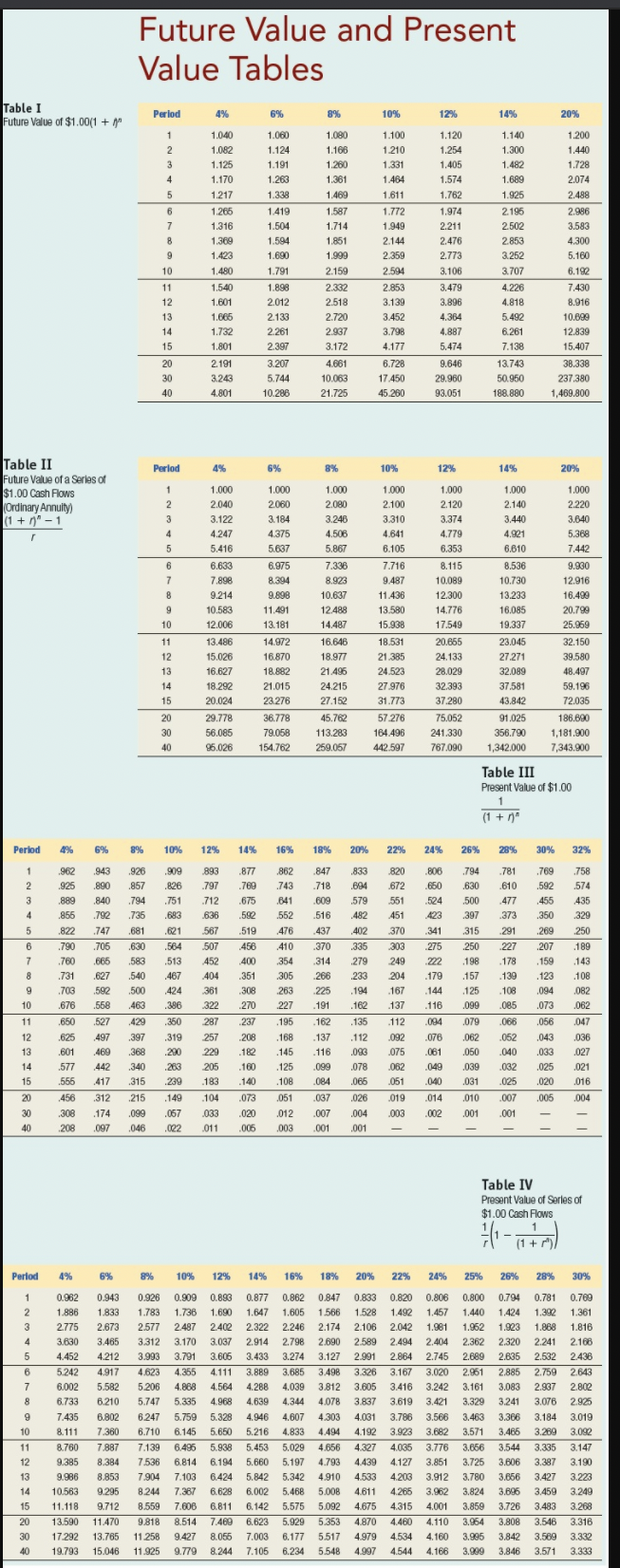

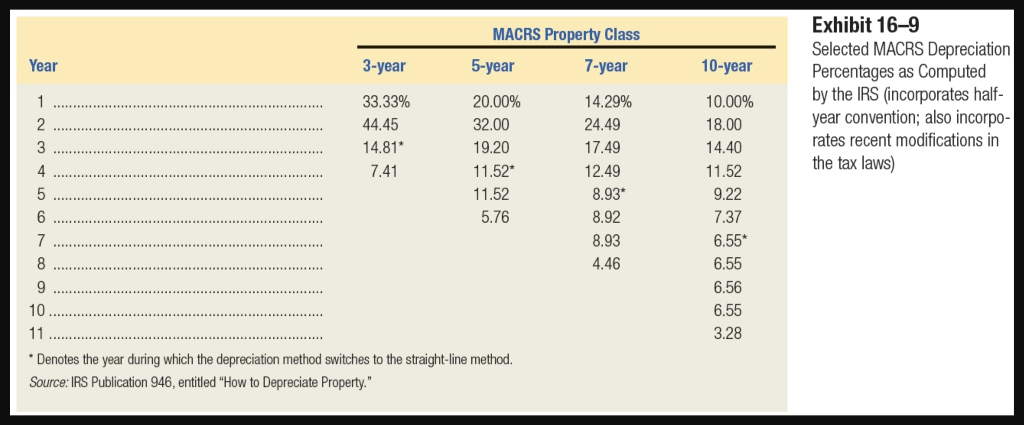

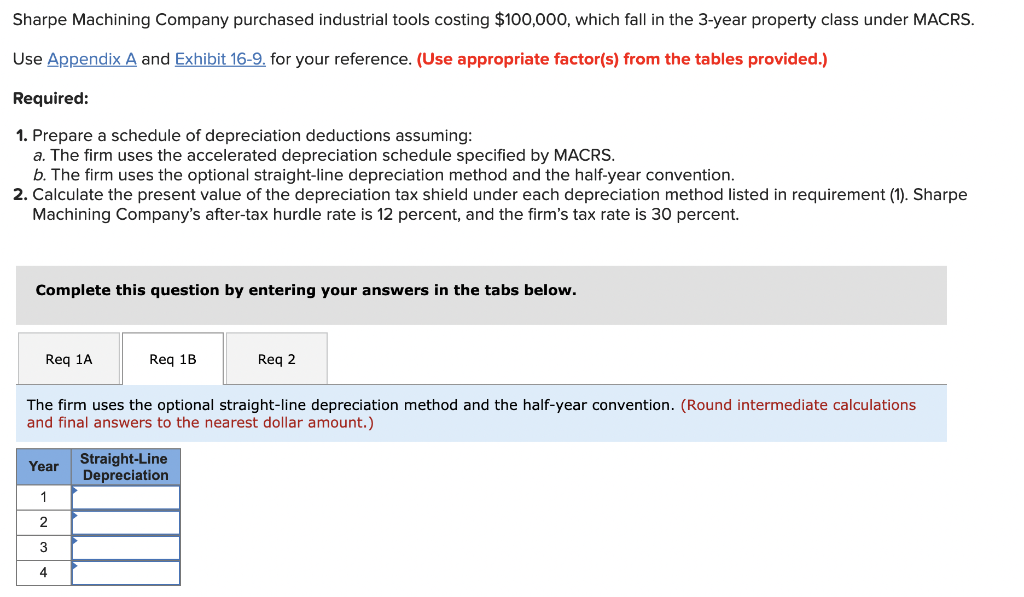

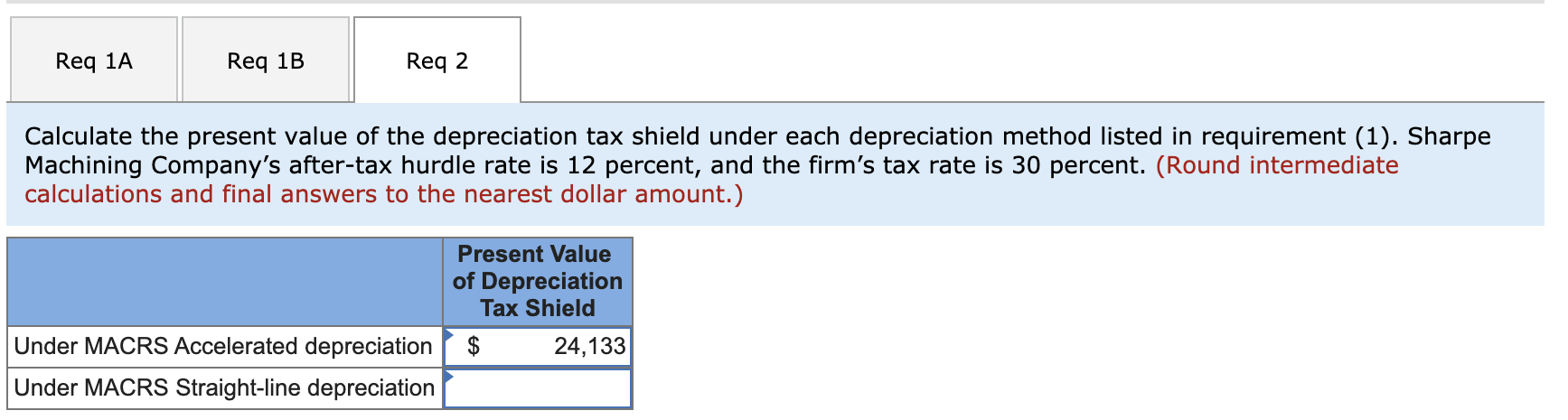

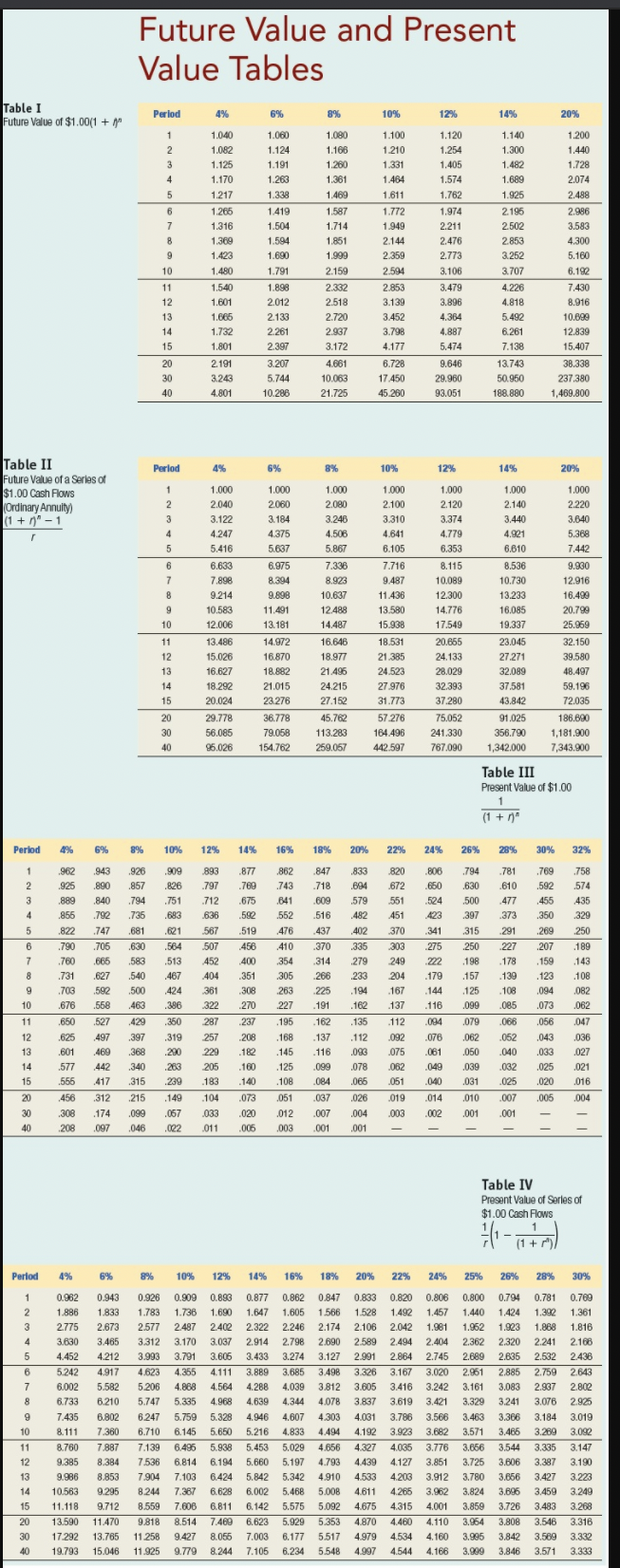

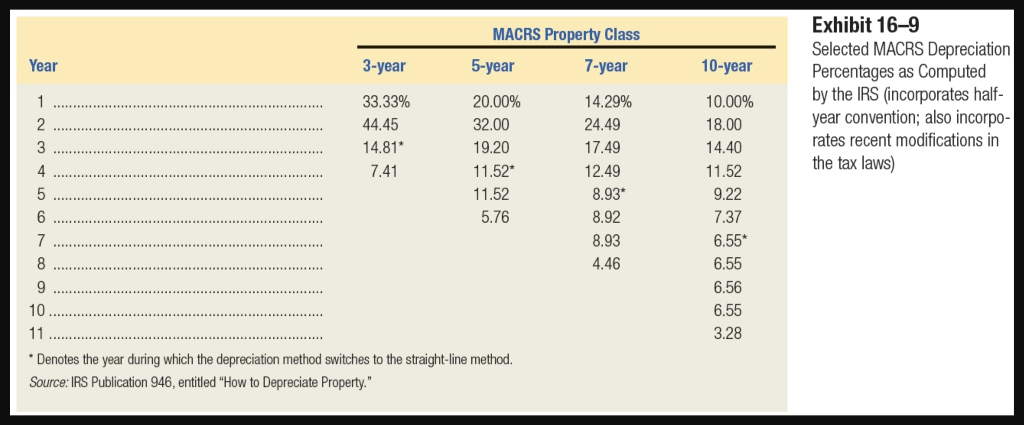

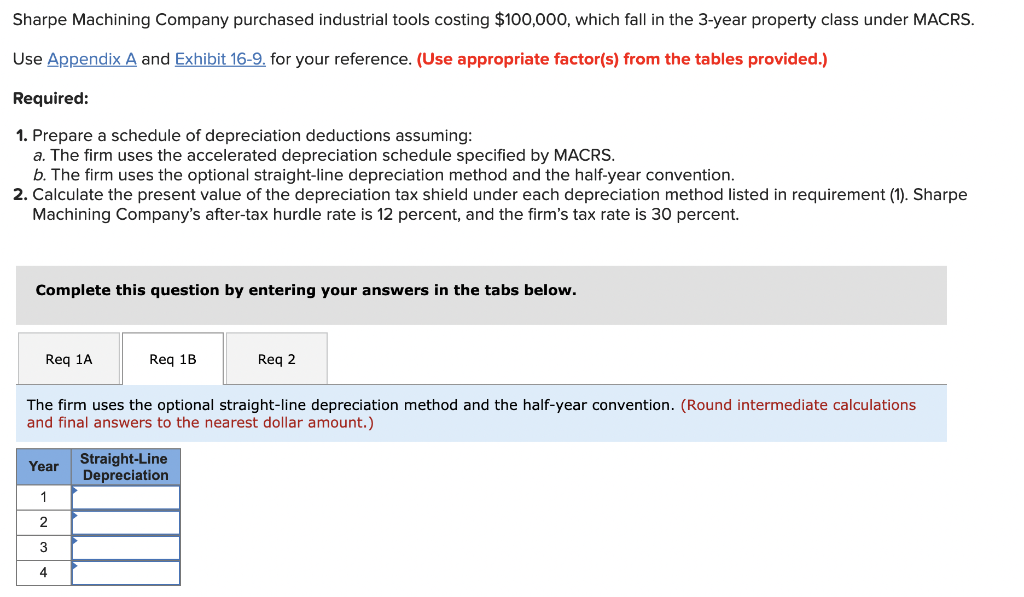

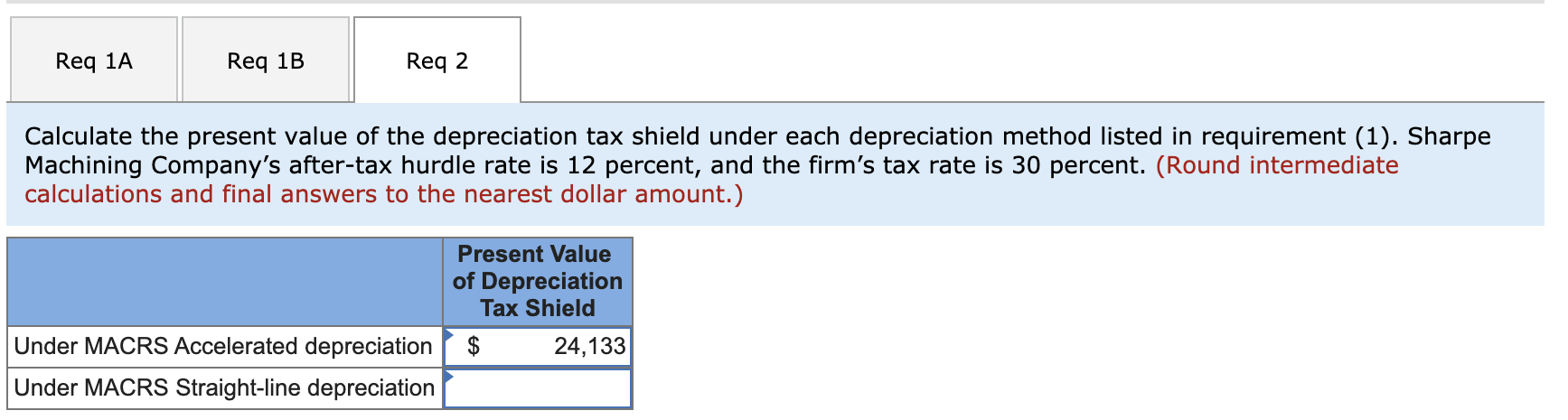

Sharpe Machining Company purchased industrial tools costing $100,000, which fall in the 3-year property class under MACRS. Use Appendix A and Exhibit 16-9. for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a schedule of depreciation deductions assuming: a. The firm uses the accelerated depreciation schedule specified by MACRS. b. The firm uses the optional straight-line depreciation method and the half-year convention. 2. Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 12 percent, and the firm's tax rate is 30 percent. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 The firm uses the optional straight-line depreciation method and the half-year convention. (Round intermediate calculations and final answers to the nearest dollar amount.) Year Straight-Line Depreciation 1 2 3 4 Req 1A Req 1B Req 2 Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 12 percent, and the firm's tax rate is 30 percent. (Round intermediate calculations and final answers to the nearest dollar amount.) Present Value of Depreciation Tax Shield $ 24,133 Under MACRS Accelerated depreciation Under MACRS Straight-line depreciation Future Value and Present Value Tables Table 1 Future Value of $1.00(1 + 1" $ Period 4% 6% % 10% 12% 14% 20% 1 2 3 4 5 8% 1.080 1.166 1.280 1.361 1.469 1.587 1.714 1.851 1.999 2.159 1.040 1.082 1.125 1.170 1.217 1.265 1.316 wa 1.369 1.423 1.480 1.540 1.00 1.601 . 1.665 1.732 1.801 2.191 3.243 4.801 6 7 8 1.060 1.124 1.191 1.263 1.338 1.419 1.41 1.504 1.594 1.690 1.791 1.898 2012 so 2.133 2.261 2.397 3.207 5.744 10.288 9 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 24 3.106 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.359 2.594 2.853 3.139 3.452 3.798 4.177 6.728 17 450 45.280 1.140 1.300 1.482 1.689 1.925 2. 195 2.502 so 2.853 3.252 3.707 4.220 4.226 4.818 5.492 6.261 7.138 13.743 50.950 188.880 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 38.338 237.380 1,469.800 10 ******* 11 12 13 14 15 2.332 2.518 2.720 2.937 3.172 3.479 3.896 4.364 4.887 5.474 9.646 29.960 93.051 20 30 40 4.661 10.063 21.725 Period 4% 6% 8% 10% 12% 14% 20% Table II Future Value of a Series of $1.00 Cash Flows (Ordinary Annuity) (1 + "-1 r 1 2 3 4 5 1.000 2.220 3.640 5.368 7.442 8.900 6 7 8 9 1.000 2.040 3.122 4.247 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 29.778 56.085 95.026 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.898 11.491 13.181 14.972 16.870 18.882 21.015 23 276 36.778 79.058 154.762 1.000 2.080 3.246 4.506 5.867 7.336 8.923 10.637 12488 14.487 16.646 18.977 21.496 24.215 27.152 45.782 113.283 259.057 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.436 13.500 15.938 18.531 21.385 24.523 27 976 31.773 57.276 164.496 442.597 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 12.000 14.776 17.549 20.865 24.133 COUCO 28.029 32.393 37.280 75,052 241.330 767.090 1.000 2.140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 37581 43.842 91.025 356.790 1,342.000 10 11 12 13 14 15 12.916 16.490 ww 20.799 BE 25.969 32.150 39.580 48.497 04 59.196 72.035 186.690 1,181.900 7,343.900 20 30 40 Table III Present Value of $1.00 1 (1 + 1" Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 943 820 877 .769 .847 .718 833 .694 .794 .630 672 1 2 3 4 5 .962 928 889 .855 822 893 .797 .712 .636 567 .675 .609 .579 482 .890 .840 .792 .747 .705 .665 .627 500 397 .592 519 .516 437 .909 .826 .751 .683 .621 .564 .513 .467 424 .386 .769 .592 455 .350 269 .207 .456 .370 6 7 .781 .610 .477 .373 291 .227 .178 .139 . 108 .085 551 451 370 303 249 204 167 .137 .806 .650 .524 423 .341 275 .222 .179 .144 .116 .094 400 314 .926 .857 .794 .735 .681 .630 .583 .540 .500 .463 .429 .397 .368 .340 .315 215 .099 ,046 315 .250 198 157 .125 .099 . 159 .123 8 9 862 .743 141 , 552 476 410 354 305 .263 227 .195 .168 .145 .125 . 108 051 351 308 270 592 .790 .760 .731 .703 .676 .650 .625 .601 .577 555 ,456 TE .558 ,094 2 .073 10 .758 .574 435 329 250 .189 .143 .108 ,082 .062 .047 .036 00 .027 .021 .016 ,004 11 350 .079 -507 452 404 361 322 287 257 229 205 .183 104 033 .006 266 225 . .191 .162 .137 .116 099 .084 .527 497 .469 442 417 402 .335 .279 .233 .194 .162 .135 .112 .096 .078 .065 026 .004 .001 .056 .043 237 208 182 .160 .140 12 13 14 45 15 062 ,050 319 .290 .263 239 ,033 .112 .092 .075 .062 .051 .019 .076 .061 .049 .040 052 .040 .032 039 .031 ,025 .020 .025 .007 20 .312 .037 .010 ,005 .073 020 .014 .002 .149 .067 .022 ,012 003 ,001 30 40 .001 308 200 174 .097 007 .001 011 005 ,003 Table IV Present Value of Series of $1.00 Cash Flows 16-17) (1 + r) Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% 26% 28% 30% 1 0.877 1.647 2.322 2.914 3.433 2 3 4 5 6 2 7 8 9 10 10 11 0.962 1.886 2.775 3.630 4.452 4.452 5242 5.242 6.002 0.002 6.733 7.435 0. 8.111 8.760 9.385 9.986 10.563 11.118 13.590 17.292 19.793 0.943 1.833 2.673 3.465 4.212 4042 4.917 5.582 6.210 Bona 6.802 ody 7.360 7.887 8.384 8.853 9.295 9.712 11.470 13.765 15.046 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 B247 6.247 0.241 6.710 7.139 7536 7.904 00 8.244 8.559 9.818 11258 11.925 0.909 1.736 2.487 3.170 3.791 4.355 ARD 4.868 5335 5.335 5.759 6.145 6.496 6.814 7.103 7.387 7.606 8.514 9.427 9.779 0.893 1.690 2.402 3.037 3.606 A1 4.111 4.564 4.968 5999 0.020 5.650 www 5.938 6.194 6.424 6.628 we 6.811 7.469 1.40 8.055 8.244 0.862 1.605 2.246 2.798 3.274 3.685 2 BOE 4.039 A 314 4.344 4.607 4.833 9.000 5.029 5.197 5.342 5.46P 5.575 5.929 6.177 6.234 3.889 4.288 4.639 4940 4.946 8.219 5.216 5.453 5.660 0.044 5.842 6.002 6.142 6.623 7.003 7.105 0.847 1.566 2.174 2.690 3.127 2.400 3.498 3.812 4.078 4.303 1203 4.494 4.656 4.793 4.910 5.008 5.092 5.353 5.517 5.548 0.833 1.528 2.106 2.589 2.991 3.326 2005 3.605 3.837 403 4.031 4.192 4.327 4327 4.439 4.533 7.000 4.611 4.675 4.870 om 4.979 4.997 0.820 0.806 1.492 1.457 2.042 1.981 2.494 2.404 2.864 2.745 200 3.167 3.020 3416 3.416 3.242 3.619 3.421 3.121 3.160 3.786 3.566 Wace 3.923 3.682 4.050 4.035 3.776 4.127 4.121 3.851 4.203 3.912 4.265 3.962 4.315 4.001 4.460 4.110 4534 4.160 4544 4.168 0.800 1.440 1.962 2.362 2.689 2051 2.961 3.161 3.329 3.463 0.400 som 3.571 3 3.000 3.725 3.780 3,824 3.859 3.964 3.995 3.999 0.794 1.424 1.923 2.320 2.635 2005 2.885 2002 3.083 22 3.241 3.366 3.466 3544 3.544 3.606 3.656 . 3,696 3.726 3.808 3.842 3.846 0.781 1.392 1.868 2.241 2.532 2750 2.759 2007 2.937 3.076 3182 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.546 3.589 3.571 0.789 1.361 1.816 2.168 2438 2.438 2010 2.643 2.802 2.925 3.019 2000 3.092 wa 3.147 3.14 3.190 3.225 3.223 3.249 3.268 3.316 3.332 3.333 12 13 14 15 20 30 40 MACRS Property Class 5-year 7-year Year 3-year 10-year 1 2 33.33% 44.45 14.81" 7.41 Exhibit 169 Selected MACRS Depreciation Percentages as Computed by the IRS (incorporates half- year convention; also incorpo- rates recent modifications in the tax laws) 20.00% 32.00 19.20 11.52* 11.52 5.76 3 14.29% 24.49 17.49 12.49 8.93* 4 8.92 10.00% 18.00 14.40 11.52 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 7 8.93 4.46 8 9 10 11 * Denotes the year during which the depreciation method switches to the straight-line method. Source: IRS Publication 946, entitled "How to Depreciate Property." Sharpe Machining Company purchased industrial tools costing $100,000, which fall in the 3-year property class under MACRS. Use Appendix A and Exhibit 16-9. for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a schedule of depreciation deductions assuming: a. The firm uses the accelerated depreciation schedule specified by MACRS. b. The firm uses the optional straight-line depreciation method and the half-year convention. 2. Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 12 percent, and the firm's tax rate is 30 percent. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 The firm uses the optional straight-line depreciation method and the half-year convention. (Round intermediate calculations and final answers to the nearest dollar amount.) Year Straight-Line Depreciation 1 2 3 4 Req 1A Req 1B Req 2 Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 12 percent, and the firm's tax rate is 30 percent. (Round intermediate calculations and final answers to the nearest dollar amount.) Present Value of Depreciation Tax Shield $ 24,133 Under MACRS Accelerated depreciation Under MACRS Straight-line depreciation Future Value and Present Value Tables Table 1 Future Value of $1.00(1 + 1" $ Period 4% 6% % 10% 12% 14% 20% 1 2 3 4 5 8% 1.080 1.166 1.280 1.361 1.469 1.587 1.714 1.851 1.999 2.159 1.040 1.082 1.125 1.170 1.217 1.265 1.316 wa 1.369 1.423 1.480 1.540 1.00 1.601 . 1.665 1.732 1.801 2.191 3.243 4.801 6 7 8 1.060 1.124 1.191 1.263 1.338 1.419 1.41 1.504 1.594 1.690 1.791 1.898 2012 so 2.133 2.261 2.397 3.207 5.744 10.288 9 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 24 3.106 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.359 2.594 2.853 3.139 3.452 3.798 4.177 6.728 17 450 45.280 1.140 1.300 1.482 1.689 1.925 2. 195 2.502 so 2.853 3.252 3.707 4.220 4.226 4.818 5.492 6.261 7.138 13.743 50.950 188.880 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 38.338 237.380 1,469.800 10 ******* 11 12 13 14 15 2.332 2.518 2.720 2.937 3.172 3.479 3.896 4.364 4.887 5.474 9.646 29.960 93.051 20 30 40 4.661 10.063 21.725 Period 4% 6% 8% 10% 12% 14% 20% Table II Future Value of a Series of $1.00 Cash Flows (Ordinary Annuity) (1 + "-1 r 1 2 3 4 5 1.000 2.220 3.640 5.368 7.442 8.900 6 7 8 9 1.000 2.040 3.122 4.247 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 29.778 56.085 95.026 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.898 11.491 13.181 14.972 16.870 18.882 21.015 23 276 36.778 79.058 154.762 1.000 2.080 3.246 4.506 5.867 7.336 8.923 10.637 12488 14.487 16.646 18.977 21.496 24.215 27.152 45.782 113.283 259.057 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.436 13.500 15.938 18.531 21.385 24.523 27 976 31.773 57.276 164.496 442.597 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 12.000 14.776 17.549 20.865 24.133 COUCO 28.029 32.393 37.280 75,052 241.330 767.090 1.000 2.140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 37581 43.842 91.025 356.790 1,342.000 10 11 12 13 14 15 12.916 16.490 ww 20.799 BE 25.969 32.150 39.580 48.497 04 59.196 72.035 186.690 1,181.900 7,343.900 20 30 40 Table III Present Value of $1.00 1 (1 + 1" Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 943 820 877 .769 .847 .718 833 .694 .794 .630 672 1 2 3 4 5 .962 928 889 .855 822 893 .797 .712 .636 567 .675 .609 .579 482 .890 .840 .792 .747 .705 .665 .627 500 397 .592 519 .516 437 .909 .826 .751 .683 .621 .564 .513 .467 424 .386 .769 .592 455 .350 269 .207 .456 .370 6 7 .781 .610 .477 .373 291 .227 .178 .139 . 108 .085 551 451 370 303 249 204 167 .137 .806 .650 .524 423 .341 275 .222 .179 .144 .116 .094 400 314 .926 .857 .794 .735 .681 .630 .583 .540 .500 .463 .429 .397 .368 .340 .315 215 .099 ,046 315 .250 198 157 .125 .099 . 159 .123 8 9 862 .743 141 , 552 476 410 354 305 .263 227 .195 .168 .145 .125 . 108 051 351 308 270 592 .790 .760 .731 .703 .676 .650 .625 .601 .577 555 ,456 TE .558 ,094 2 .073 10 .758 .574 435 329 250 .189 .143 .108 ,082 .062 .047 .036 00 .027 .021 .016 ,004 11 350 .079 -507 452 404 361 322 287 257 229 205 .183 104 033 .006 266 225 . .191 .162 .137 .116 099 .084 .527 497 .469 442 417 402 .335 .279 .233 .194 .162 .135 .112 .096 .078 .065 026 .004 .001 .056 .043 237 208 182 .160 .140 12 13 14 45 15 062 ,050 319 .290 .263 239 ,033 .112 .092 .075 .062 .051 .019 .076 .061 .049 .040 052 .040 .032 039 .031 ,025 .020 .025 .007 20 .312 .037 .010 ,005 .073 020 .014 .002 .149 .067 .022 ,012 003 ,001 30 40 .001 308 200 174 .097 007 .001 011 005 ,003 Table IV Present Value of Series of $1.00 Cash Flows 16-17) (1 + r) Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 25% 26% 28% 30% 1 0.877 1.647 2.322 2.914 3.433 2 3 4 5 6 2 7 8 9 10 10 11 0.962 1.886 2.775 3.630 4.452 4.452 5242 5.242 6.002 0.002 6.733 7.435 0. 8.111 8.760 9.385 9.986 10.563 11.118 13.590 17.292 19.793 0.943 1.833 2.673 3.465 4.212 4042 4.917 5.582 6.210 Bona 6.802 ody 7.360 7.887 8.384 8.853 9.295 9.712 11.470 13.765 15.046 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 B247 6.247 0.241 6.710 7.139 7536 7.904 00 8.244 8.559 9.818 11258 11.925 0.909 1.736 2.487 3.170 3.791 4.355 ARD 4.868 5335 5.335 5.759 6.145 6.496 6.814 7.103 7.387 7.606 8.514 9.427 9.779 0.893 1.690 2.402 3.037 3.606 A1 4.111 4.564 4.968 5999 0.020 5.650 www 5.938 6.194 6.424 6.628 we 6.811 7.469 1.40 8.055 8.244 0.862 1.605 2.246 2.798 3.274 3.685 2 BOE 4.039 A 314 4.344 4.607 4.833 9.000 5.029 5.197 5.342 5.46P 5.575 5.929 6.177 6.234 3.889 4.288 4.639 4940 4.946 8.219 5.216 5.453 5.660 0.044 5.842 6.002 6.142 6.623 7.003 7.105 0.847 1.566 2.174 2.690 3.127 2.400 3.498 3.812 4.078 4.303 1203 4.494 4.656 4.793 4.910 5.008 5.092 5.353 5.517 5.548 0.833 1.528 2.106 2.589 2.991 3.326 2005 3.605 3.837 403 4.031 4.192 4.327 4327 4.439 4.533 7.000 4.611 4.675 4.870 om 4.979 4.997 0.820 0.806 1.492 1.457 2.042 1.981 2.494 2.404 2.864 2.745 200 3.167 3.020 3416 3.416 3.242 3.619 3.421 3.121 3.160 3.786 3.566 Wace 3.923 3.682 4.050 4.035 3.776 4.127 4.121 3.851 4.203 3.912 4.265 3.962 4.315 4.001 4.460 4.110 4534 4.160 4544 4.168 0.800 1.440 1.962 2.362 2.689 2051 2.961 3.161 3.329 3.463 0.400 som 3.571 3 3.000 3.725 3.780 3,824 3.859 3.964 3.995 3.999 0.794 1.424 1.923 2.320 2.635 2005 2.885 2002 3.083 22 3.241 3.366 3.466 3544 3.544 3.606 3.656 . 3,696 3.726 3.808 3.842 3.846 0.781 1.392 1.868 2.241 2.532 2750 2.759 2007 2.937 3.076 3182 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.546 3.589 3.571 0.789 1.361 1.816 2.168 2438 2.438 2010 2.643 2.802 2.925 3.019 2000 3.092 wa 3.147 3.14 3.190 3.225 3.223 3.249 3.268 3.316 3.332 3.333 12 13 14 15 20 30 40 MACRS Property Class 5-year 7-year Year 3-year 10-year 1 2 33.33% 44.45 14.81" 7.41 Exhibit 169 Selected MACRS Depreciation Percentages as Computed by the IRS (incorporates half- year convention; also incorpo- rates recent modifications in the tax laws) 20.00% 32.00 19.20 11.52* 11.52 5.76 3 14.29% 24.49 17.49 12.49 8.93* 4 8.92 10.00% 18.00 14.40 11.52 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 7 8.93 4.46 8 9 10 11 * Denotes the year during which the depreciation method switches to the straight-line method. Source: IRS Publication 946, entitled "How to Depreciate Property

Can someone help me fill in this question using the provided materials? I only need #2 and the second part of the last one

Can someone help me fill in this question using the provided materials? I only need #2 and the second part of the last one