Can someone help me finish this?

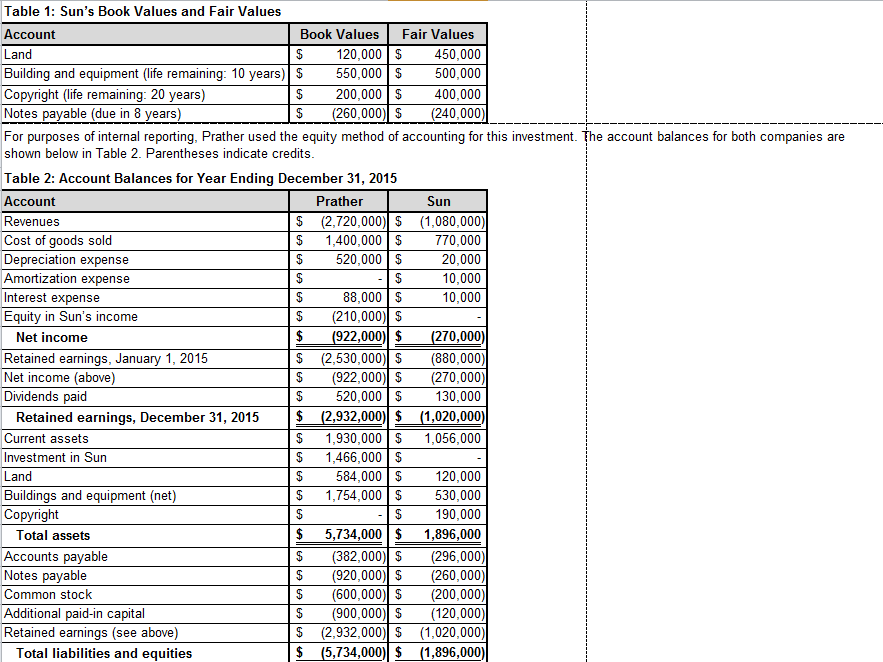

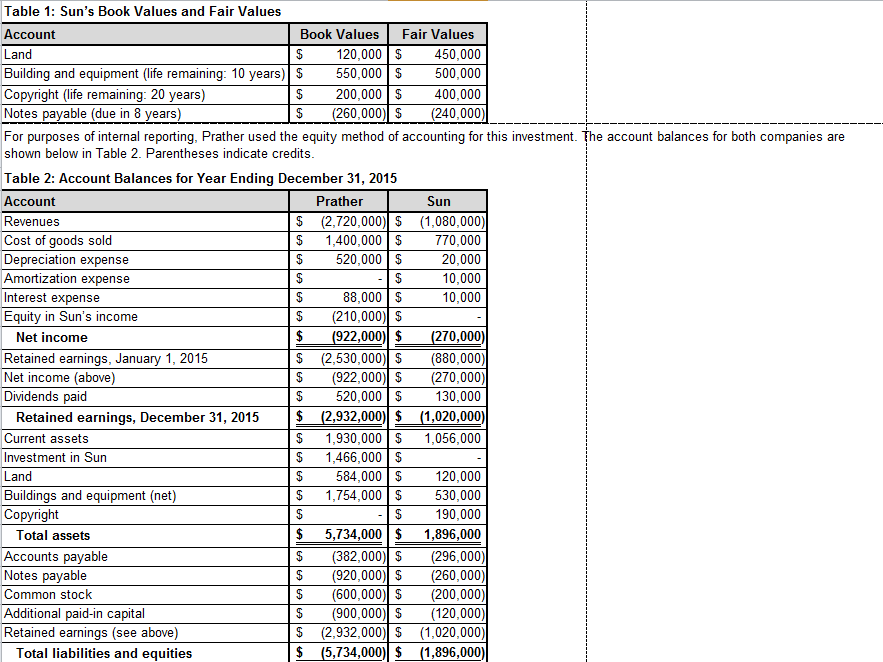

On January 1, 2015, the Prather Company purchased 80% of Sun Incorporateds outstanding common stock for $1,360,000 cash. On that date, Suns total fair value, including the noncontrolling interest, was assessed at $1,700,000, even though Suns book value was only $1,200,000. Additionally, Suns financial records indicated several items, shown below, with differences between book values and fair values.

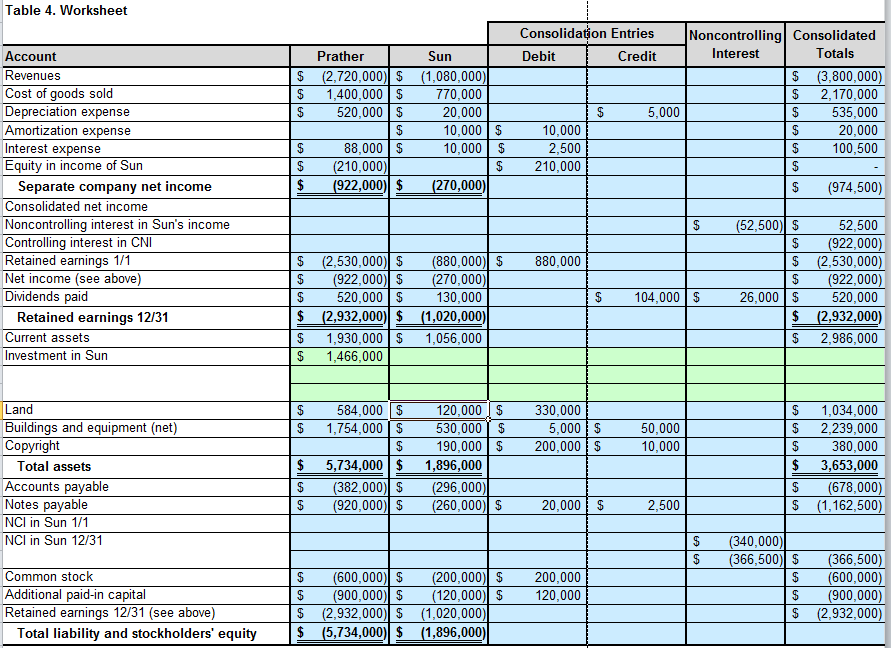

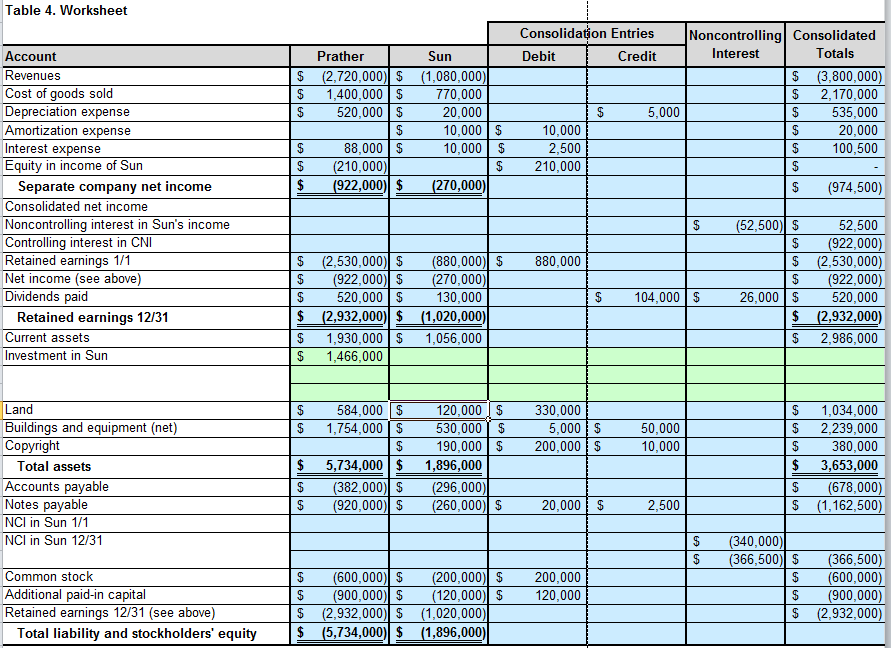

Table 1: Sun's Book Values and Fair Values Account Book Values Fair Values Land S 120.000 S 450.000 Building and equipment (life remaining: 10 years) 550,000 S 500,000 VIght (ife remaining: 20 260.000 240.000) Notes payable (due in 8 years For purposes of internal reporting, Prather used the equity method of accounting for this investment. The account balances for both companies are shown below n Table 2 Parentheses indicate credits Table 2: Account Balances for Year Ending December 31, 2015 Sun Account Prather Revenues S (2.720.000 S (1.080.000) S 1.400.000 S 770.000 Cost of goods sold S 520.000 S 20.000 Depreciation expense S S 10.000 Amortization expense S 88.000 S 10.000 nterest expense S 210.000 S Equity in Sun's income 92.000 20.000 Net income S (2.530.000 S 680.000) Retained earnings, January 1, 2015 S 922.000 S 270.000 Net income (above S 520.000 S 130.000 Dividends paid Retained earnings, December 31, 2015 (2,932,000) S (1,020,000) S 1.930.000 S 1.056000 Current assets S 1.466.000 S Investment in Sun Land S 584.000 S 120.000 S 1.154.000 S 530.000 Buildings and equipment (net) 3.34.000 1890.000 Total assets S (382,000) S (296,000) Accounts payable S 920.000 S 250.000 Notes payable S (600.000 S 200.000 Common stock S 900.000 S (120.000) Additional paid-in capital S (2.932.000 S (1.020.000) Retained earnings (see above) (5,734,000) S (1,896,000) Total liabilities and equities Table 1: Sun's Book Values and Fair Values Account Book Values Fair Values Land S 120.000 S 450.000 Building and equipment (life remaining: 10 years) 550,000 S 500,000 VIght (ife remaining: 20 260.000 240.000) Notes payable (due in 8 years For purposes of internal reporting, Prather used the equity method of accounting for this investment. The account balances for both companies are shown below n Table 2 Parentheses indicate credits Table 2: Account Balances for Year Ending December 31, 2015 Sun Account Prather Revenues S (2.720.000 S (1.080.000) S 1.400.000 S 770.000 Cost of goods sold S 520.000 S 20.000 Depreciation expense S S 10.000 Amortization expense S 88.000 S 10.000 nterest expense S 210.000 S Equity in Sun's income 92.000 20.000 Net income S (2.530.000 S 680.000) Retained earnings, January 1, 2015 S 922.000 S 270.000 Net income (above S 520.000 S 130.000 Dividends paid Retained earnings, December 31, 2015 (2,932,000) S (1,020,000) S 1.930.000 S 1.056000 Current assets S 1.466.000 S Investment in Sun Land S 584.000 S 120.000 S 1.154.000 S 530.000 Buildings and equipment (net) 3.34.000 1890.000 Total assets S (382,000) S (296,000) Accounts payable S 920.000 S 250.000 Notes payable S (600.000 S 200.000 Common stock S 900.000 S (120.000) Additional paid-in capital S (2.932.000 S (1.020.000) Retained earnings (see above) (5,734,000) S (1,896,000) Total liabilities and equities