Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me for this question ? QUESTION 1 MegaBot Company is going to purchase new equipment for RM75,000. The equipment has a depreciable

can someone help me for this question ?

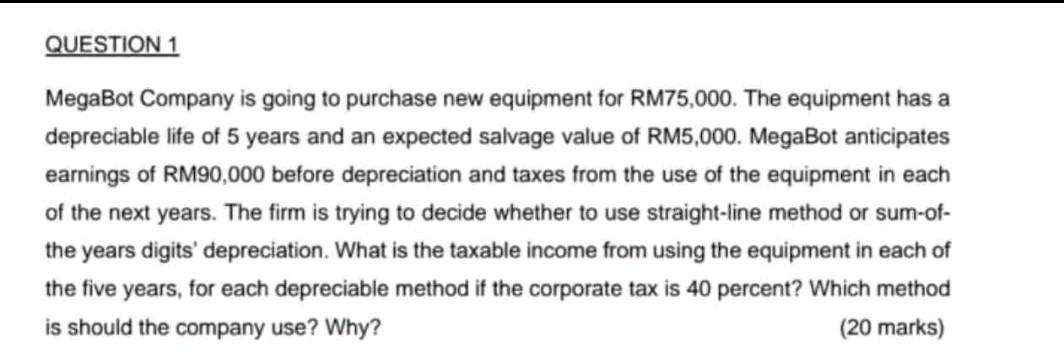

QUESTION 1 MegaBot Company is going to purchase new equipment for RM75,000. The equipment has a depreciable life of 5 years and an expected salvage value of RM5,000. MegaBot anticipates earnings of RM90,000 before depreciation and taxes from the use of the equipment in each of the next years. The firm is trying to decide whether to use straight-line method or sum-of- the years digits' depreciation. What is the taxable income from using the equipment in each of the five years, for each depreciable method if the corporate tax is 40 percent? Which method is should the company use? Why? (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started