Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me locate what's missing in my answers? It's already answered it's just that it says it's not complete. Required Information P2-3 and

Can someone help me locate what's missing in my answers? It's already answered it's just that it says it's not complete.

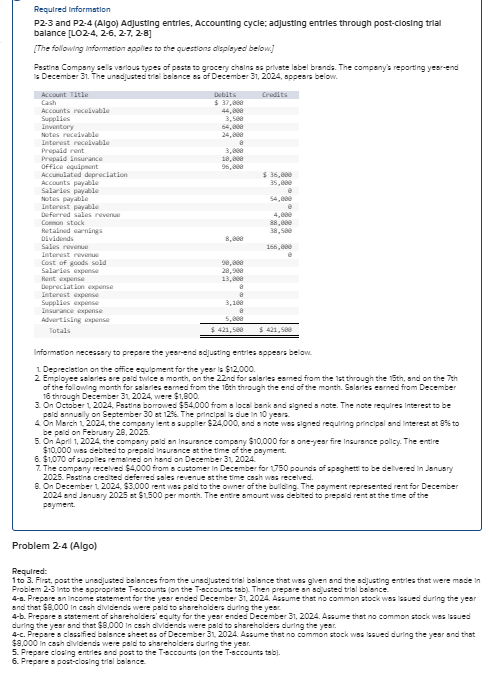

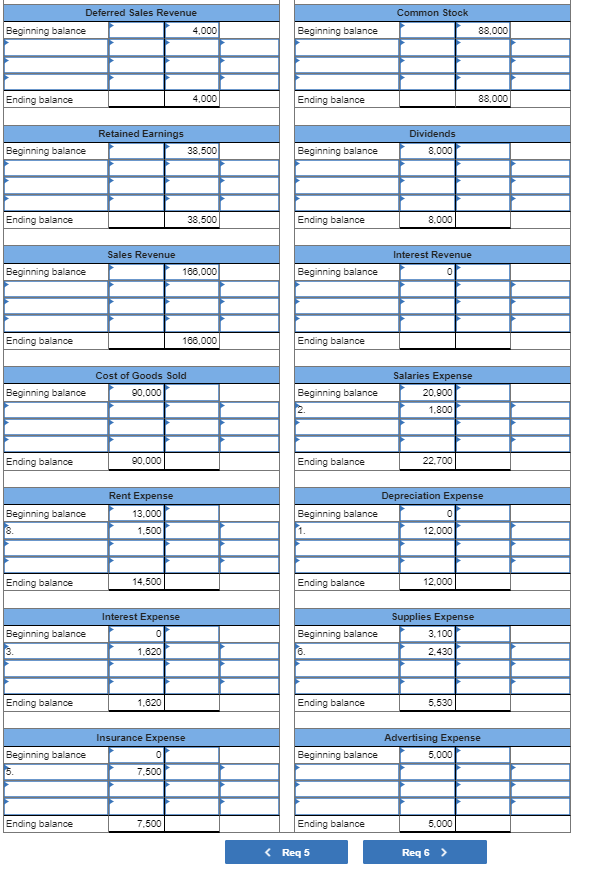

Required Information P2-3 and P2-4 (Algo) Ad]usting entries, Accounting cycle; adjusting entries through post-closing trlal balance [LO2-4, 2-6, 2-7, 2-8] [The following informetion applies to the questions dizplayed below.] Pasting Company sels varlous types of pasts to grocery chains as private label brendi. The compeny's reporting year-end is December 51 . The unedusted trial balance as of December 31,2024 , appes below. Information necessary to prepare the year-end adjusting entries appears be ow. 1. Depreciation on the office equlament for the year is $12,000. 2. Employee so iories are paid twice a month, on the 22 ind for salaries es red from the lat through the 15th, and on the 7th of the following month for salaries earned from the 16:h through the end of the month. Salaries esmed from December 16 through Decenber 31,2024 , were $1,800. 3. On October 2, 2024, Pastins borrowed \$54,000 from a local bank and signed a nate. The note requires interest to be paid annuely on September 30 at 12%. The principai is due in 10 yeara. 4. On March 2,2024 , the compony lent s supplier $24,000, snd o note wes signed requiring principal and interest st 9% to be peid on February 28,2025 . 5. On April 1, 2024, the compsny poid an insurance compsny $10,000 for a one-year fire insurance policy. The entire $10,000 was debted to prepsid insursnce at the time of the psyment. 6. $1,070 of supples remeined on hend on December 31,2024. 7. The compony recehed $4,000 from a customer in December for 150 pounds of speghett to be delvered in asnusy 2025. Pastins crecited deferred sales revenue at the time cash was recelved. 8. On December Z, 2024,$3,000 rent was peid to the owner of the bulling. The poyment represented rent for December 2024 and Janusy 2025 et $1.500 per month. The entre amount was debted to prepeid rent at the time of the poyment. Problem 2-4 (Algo) Required: 1 to 3 . Firat, post the unedjusted balances from the unadjusted trial balance that wes ghen and the adjusting entries that were made in Problem 2-3 into the sppropriste T-eccounte (on the T-gccounta tab). Then prepare an acluated trial bs ance. 4-a. Prepore an income statement for the yesr ended December 31, 2024. Azaume that no common atock, was lasued during the year and that $6,000in cesh dividend were paid to shareholders during the year 4-b. Prepare o statement of shareholders' equity for the year ended December 51,2024 . Assume that no common stock wes issued during the year and that $8,000 in cash dividends were paid to sharehalders during the year. 4-c. Prepere a clasalfied balgnce sheet as of December 31,2024 . Assume that no common stock was baed during the yesr snd that $9,000 in cash dividends were paid to sharehalders during the year. 5. Prepare cloaing entries and poat to the T-eccounts (on the T-sccourta tab). 6. Prepare a poat-cloaing trial bolance Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5 , post the closing entries to the T-accounts on this tab. Note: Select the number of the adjusting entry or "closing" in the column next to the amount. Req6>Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started