Can someone help me please?

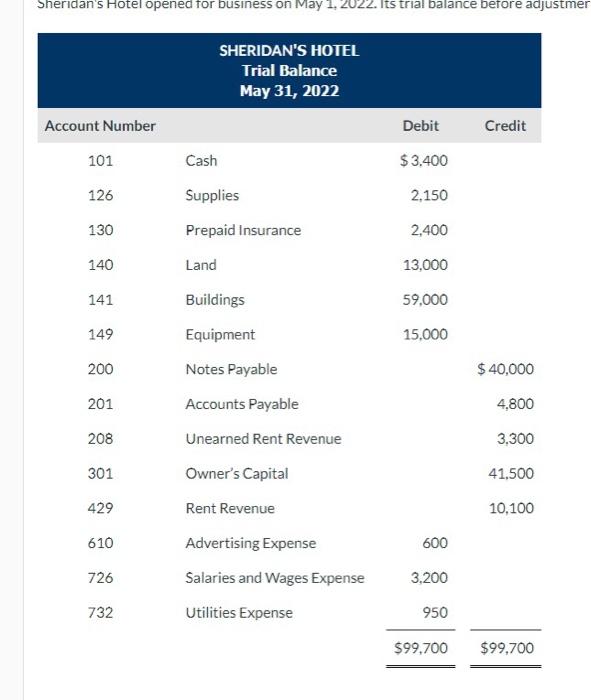

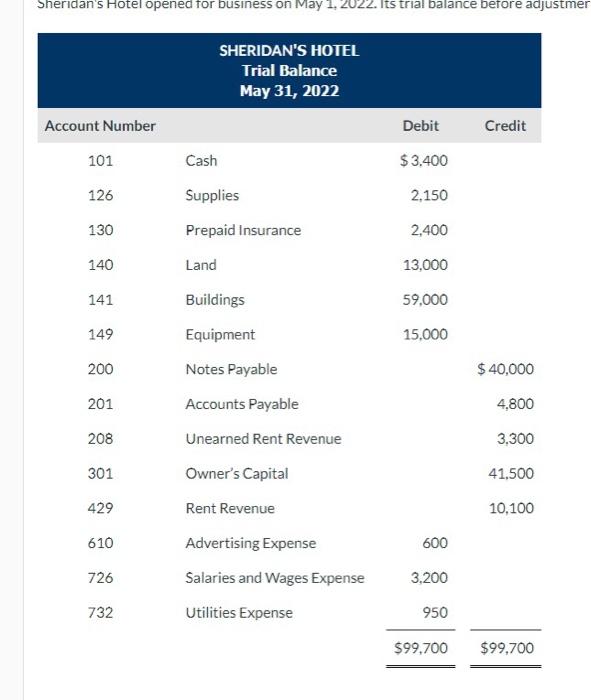

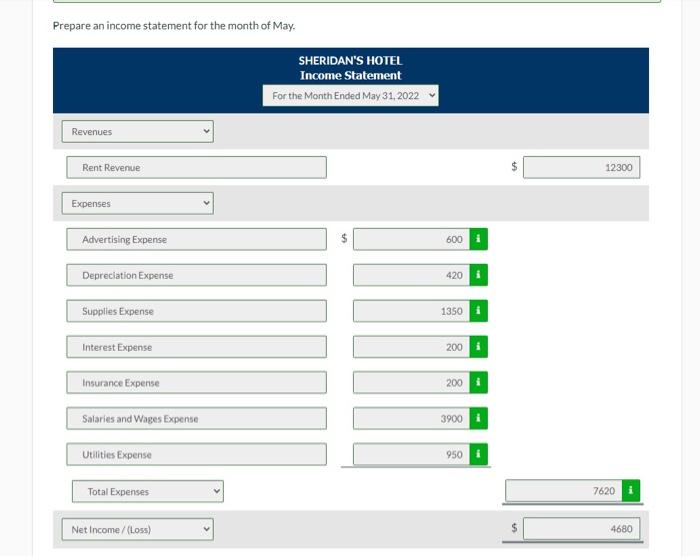

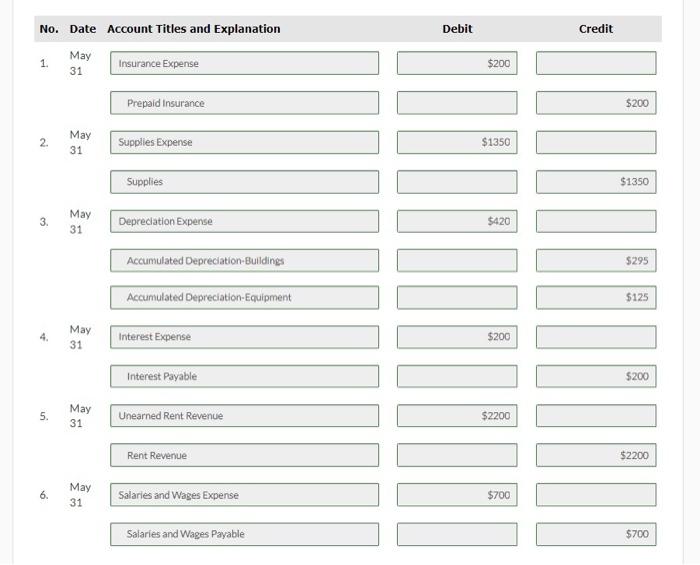

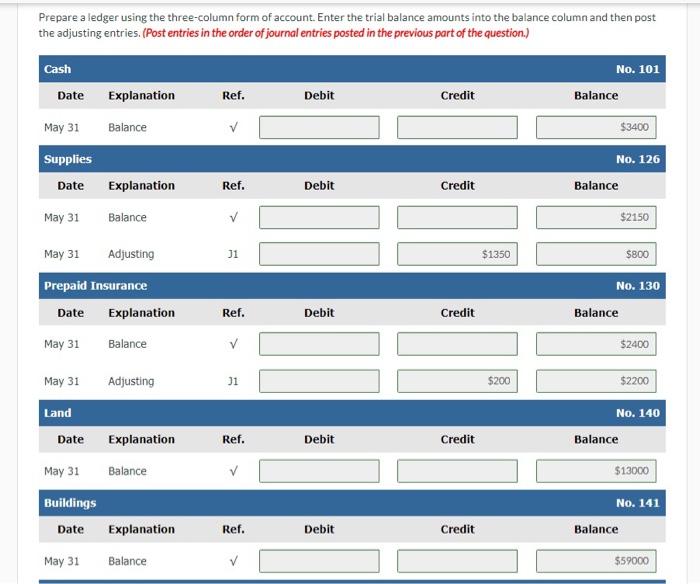

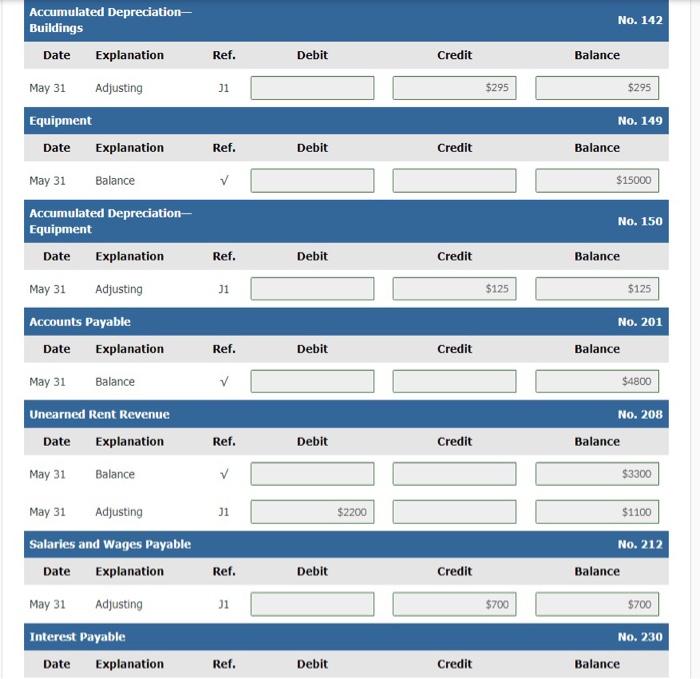

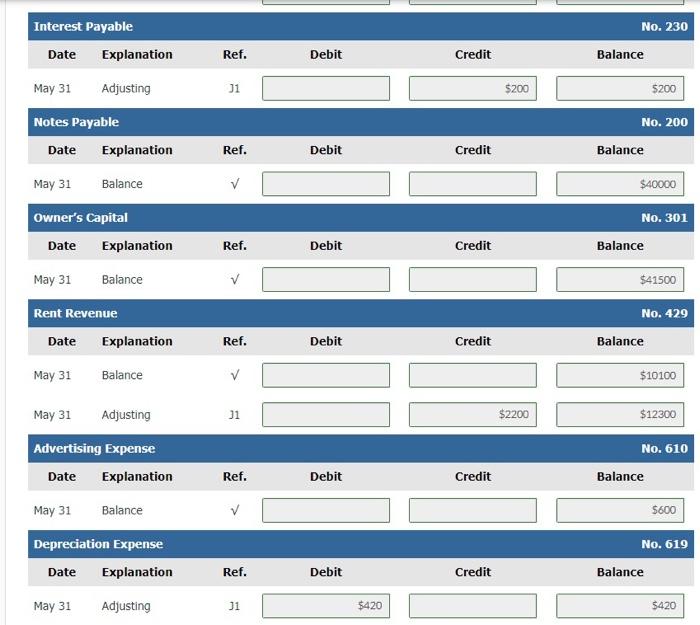

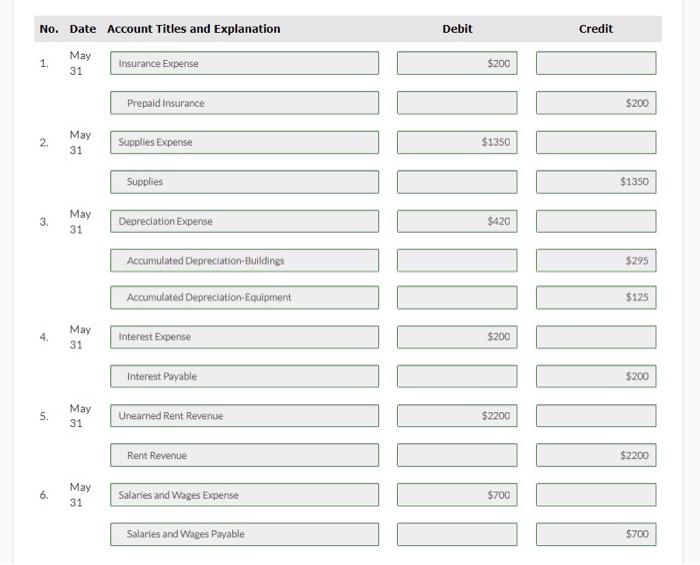

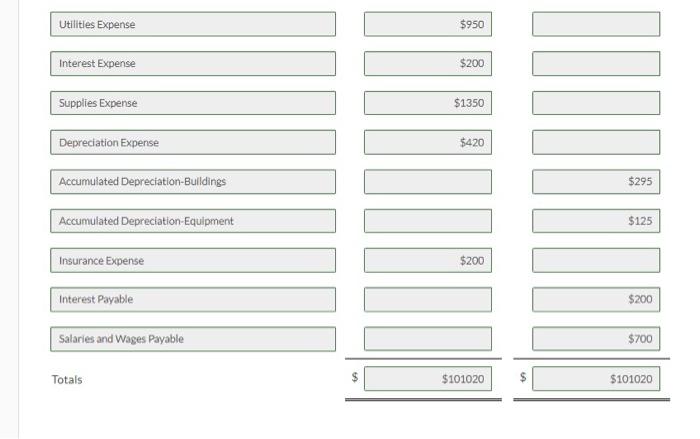

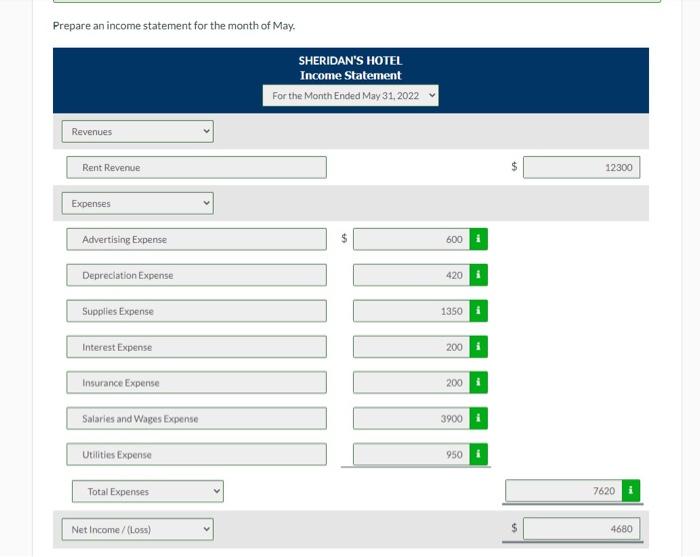

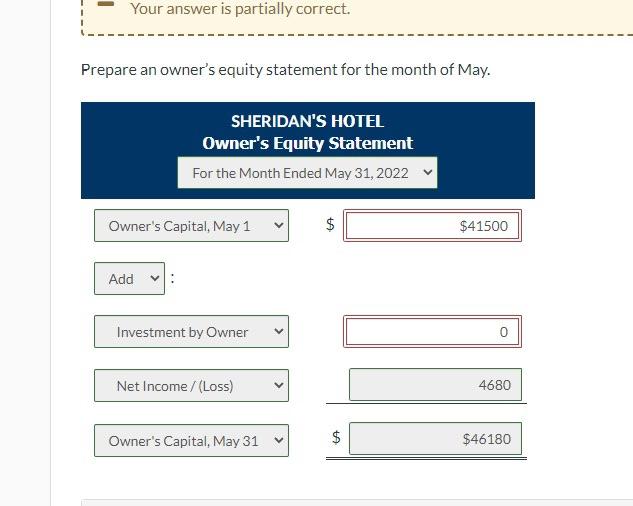

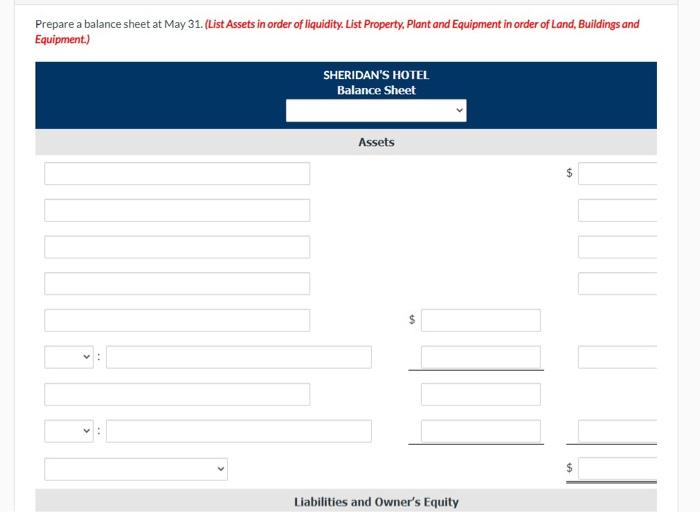

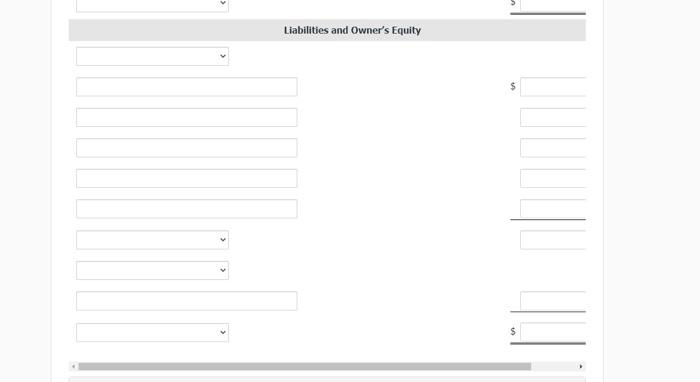

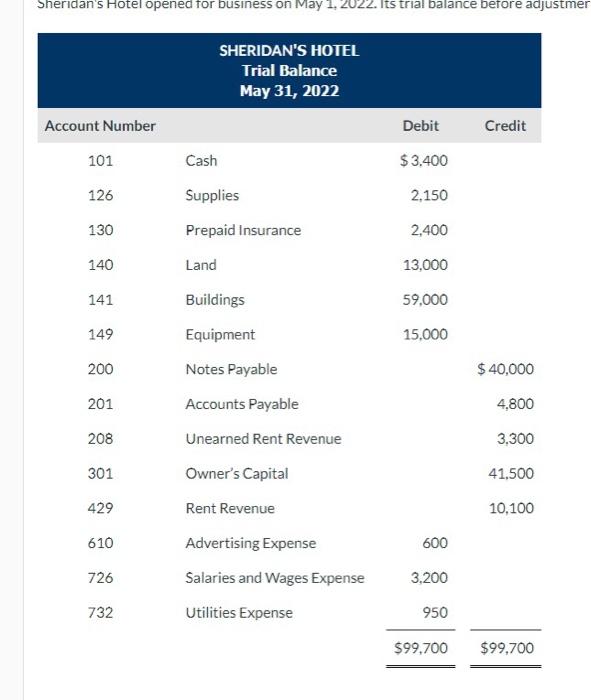

Sheridan's Hotel opened for business on May 1, 2022. Its trial balance before adjustmer SHERIDAN'S HOTEL Trial Balance May 31, 2022 Account Number Debit Credit 101 $3,400 126 2,150 130 2,400 140 13,000 141 59,000 149 15,000 200 201 208 301 429 610 726 732 Cash Supplies Prepaid Insurance Land Buildings Equipment Notes Payable Accounts Payable Unearned Rent Revenue Owner's Capital Rent Revenue Advertising Expense Salaries and Wages Expense Utilities Expense 600 3,200 950 $99,700 $ 40,000 4,800 3,300 41,500 10,100 $99,700 Prepare an income statement for the month of May. Revenues Rent Revenue Expenses Advertising Expense Depreciation Expense Supplies Expense Interest Expense Insurance Expense Salaries and Wages Expense Utilities Expense Total Expenses Net Income /(Loss) SHERIDAN'S HOTEL Income Statement For the Month Ended May 31, 2022 SA 600 420 1350 200 i 200 i 3900 i 950 $ 12300 7620 i 4680 No. Date Account Titles and Explanation 1. May 31 Insurance Expense Prepaid Insurance 2. 3. 4. 5. 6. May 31 May 31 May 31 May 31 May 31 Supplies Expense Supplies Depreciation Expense Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Interest Expense Interest Payable Unearned Rent Revenue Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Debit $200 $1350 $420 $200 $2200 $700 Credit $200 $1350 $295 $125 $200 $2200 $700 Prepare a ledger using the three-column form of account. Enter the trial balance amounts into the balance column and then post the adjusting entries. (Post entries in the order of journal entries posted in the previous part of the question.) Cash No. 101 Explanation Ref. Debit Credit Balance Balance $3400 No. 126 Explanation Ref. Debit Credit Balance May 31 Balance $2150 May 31 Adjusting 31 $800 Prepaid Insurance No. 130 Date Ref. Debit $2400 31 $2200 No. 140 Ref. Debit $13000 No. 141 Ref. Debit $59000 Date May 31 Supplies Date May 31 May 31 Land Date May 31 Buildings Date May 31 Explanation Balance Adjusting Explanation Balance Explanation Balance Credit Credit Credit $1350 $200 Balance Balance Balance Accumulated Depreciation- Buildings Date Explanation May 31 Adjusting Equipment Date Explanation May 31 Balance Accumulated Depreciation- Equipment Date Explanation Adjusting May 31 Accounts Payable Date Explanation May 31 Balance Unearned Rent Revenue Date Explanation May 31 Balance May 31 Adjusting Salaries and Wages Payable Date Explanation Adjusting May 31 Interest Payable Date Explanation Ref. 31 Ref. Ref. J1 Ref. Ref. V 31 Ref. 31 Ref. Debit Debit Debit Debit Debit Debit Debit $2200 Credit Credit Credit Credit Credit Credit Credit $295 $125 $700 No. 142 $295 No. 149 $15000 No. 150 $125 No. 201 $4800 No. 208 $3300 $1100 No. 212 $700 No. 230 Balance Balance Balance Balance Balance Balance Balance Interest Payable Date Explanation Adjusting Explanation Balance May 31 Notes Payable Date May 31 Owner's Capital Date Explanation Balance Explanation May 31 Balance May 31 Adjusting Advertising Expense May 31 Rent Revenue Date Date Explanation May 31 Balance Depreciation Expense Date Explanation Adjusting May 31 Ref. J1 Ref. Ref. Ref. J1 Ref. Ref. J1 Debit Debit Debit Debit Debit Debit $420 Credit Credit Credit Credit Credit Credit $200 $2200 No. 230 $200 No. 200 $40000 No. 301 $41500 No. 429 $10100 $12300 No. 610 $600 No. 619 $420 Balance Balance Balance Balance Balance Balance Depreciation Expense Date Explanation Adjusting May 31 Supplies Expense Date Explanation Adjusting May 31 Interest Expense Date Explanation May 31 Adjusting Insurance Expense Date Explanation May 31 Adjusting Salaries and Wages Expense Date Explanation Balance Adjusting May 31 May 31 Utilities Expense Date May 31 Explanation Balance Ref. 31 Ref. 31 Ref. 31 Ref. 31 Ref. 31 Ref. Debit Debit Debit Debit Debit Debit $420 $1350 $200 $200 $700 Credit Credit Credit Credit Credit Credit No. 619 $420 No. 631 $1350 No. 718 $200 No. 722 $200 No. 726 $3200 $3900 No. 732 $950 Balance Balance Balance Balance Balance Balance No. Date Account Titles and Explanation 1. May 31 Insurance Expense Prepaid Insurance 2. 3. 4. 5. 6. May 31 May 31 May 31 May 31 May 31 Supplies Expense Supplies Depreciation Expense Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Interest Expense Interest Payable Unearned Rent Revenue Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Debit $200 $1350 $420 $200 $2200 $700 Credit $200 $1350 $295 $125 $200 $2200 $700 Utilities Expense Interest Expense Supplies Expense Depreciation Expense Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Insurance Expense Interest Payable Salaries and Wages Payable Totals $950 $200 $1350 $420 $200 $101020 $ IACOBU $295 $125 $200 $700 $101020 Prepare an income statement for the month of May. Revenues Rent Revenue Expenses Advertising Expense Depreciation Expense Supplies Expense Interest Expense Insurance Expense Salaries and Wages Expense Utilities Expense Total Expenses Net Income /(Loss) SHERIDAN'S HOTEL Income Statement For the Month Ended May 31, 2022 SA 600 420 1350 200 i 200 i 3900 i 950 $ 12300 7620 i 4680 Your answer is partially correct. Prepare an owner's equity statement for the month of May. SHERIDAN'S HOTEL Owner's Equity Statement For the Month Ended May 31, 2022 Owner's Capital, May 1 $ $41500 Add Investment by Owner Net Income /(Loss) Owner's Capital, May 31 LA $ +A 4680 $46180 Prepare a balance sheet at May 31. (List Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.) SHERIDAN'S HOTEL Balance Sheet Assets V: V: MA Liabilities and Owner's Equity $ Liabilities and Owner's Equity $ $