Can someone help me solve the problem? There are multiple answers required based on the questions at the end of the problem description.

I attached also an example how to solve a similar problem. Please show me the steps of it, no excel!

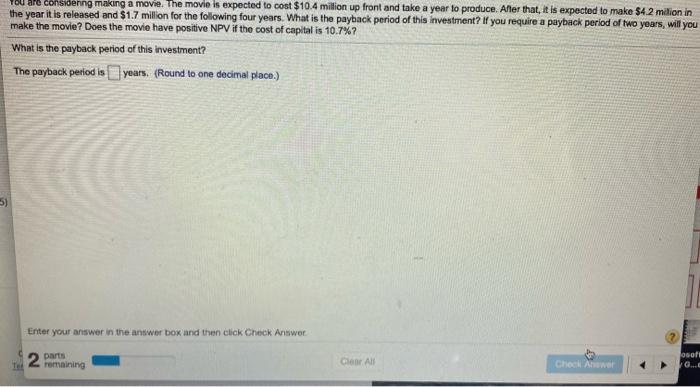

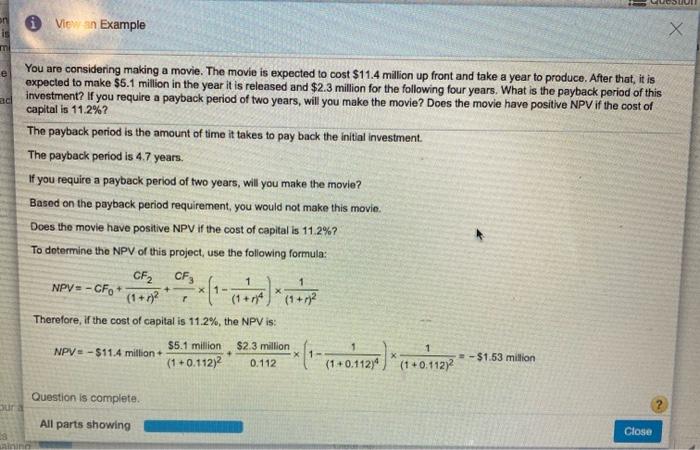

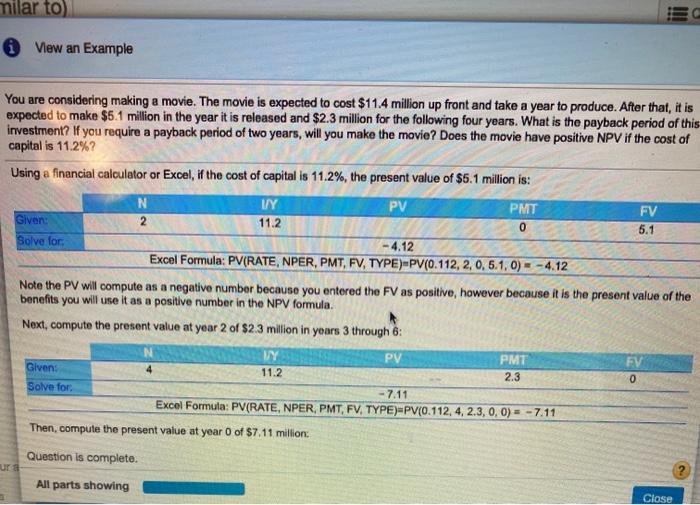

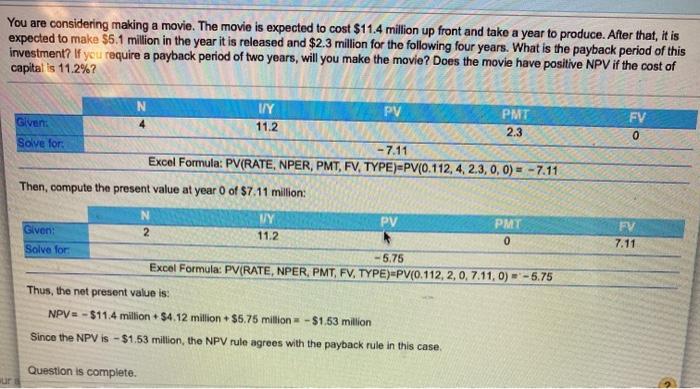

You are considering making a movie. The movie is expected to cost $10.4 million up front and take a year to produce. After that, it is expected to make $4.2 milion in the year it is released and $1.7 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.7%? What is the payback period of this investment? The payback period is years. {Round to one decimal place) 5) Enter your answer in the answer box and then click Check Answer osoft 2 parts remaining Con All Checker * View an Example on is m You are considering making a movie. The movie is expected to cost $11.4 million up front and take a year to produce. After that, it is expected to make $6.1 million in the year it is released and $2.3 million for the following four years. What is the payback period of this ad investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 11.2% The payback period is the amount of time it takes to pay back the initial investment The payback period is 47 years. If you require a payback period of two years, will you make the movie? Based on the payback period requirement, you would not make this movie. Does the movie have positive NPV if the cost of capital is 11.2%? To determine the NPV of this project, use the following formula: CF2 CF, NPV=- CFO + 1 1 + 1 - r (1 + r) Therefore, if the cost of capital is 11.2%, the NPV is: NPV = -511.4 million $5.1 million (1+0.112)2 $2.3 million 0.112 (1+0.112)*(1 +0.112)2 -$1.53 million Question is complete. Jura All parts showing Close minin milar to 0 View an Example 2 0 You are considering making a movie. The movie is expected to cost $11.4 million up front and take a year to produce. After that, it is expected to make $6.1 million in the year it is released and $2.3 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 11.2%? Using a financial calculator or Excel, if the cost of capital is 11.2%, the present value of $5.1 million is: N IY PV PMT FV Giver: 11.2 5.1 Solve for -4.12 Excel Formula: PV(RATE, NPER, PMT, FV, TYPE)-PV(0.112, 2, 0, 5.1,0) = -4.12 Note the PV will compute as a negative number because you entered the FV as positive, however because it is the present value of the benefits you will use it as a positive number in the NPV formula. Next, compute the present value at year 2 of $2.3 million in years 3 through 6: WY PV PMT Given: 11.2 2.3 Solve for -7.11 Excel Formula: PV(RATE, NPER, PMT, FV, TYPE)=PV(0.112, 4, 2.3, 0, 0) = -7.11 Then, compute the present value at year of $7.11 million Question is complete All parts showing Close 0 ur You are considering making a movie. The movie is expected to cost $11.4 million up front and take a year to produce. After that, it is expected to make $5.1 million in the year it is released and $2.3 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 11.2%? FV 0 I/Y pv PMT Given: 11.2 2.3 Solve for: -7.11 Excel Formula: PV(RATE, NPER, PMT, FV, TYPE)=P(0.112, 4, 2.3, 0, 0) = -7.11 Then, compute the present value at year 0 of $7.11 million: FV 7.11 N VY PV PMT Given: 2 11.2 0 Solve for -5.75 Excel Formula: PV(RATE, NPER, PMT, FV, TYPE)=PV(0.112, 2, 0, 7.11,0) = -5.75 Thus, the net present value is: NPV = - $11.4 million $4.12 million + $5.75 million - $1.53 million Since the NPV is - $1.53 million, the NPV rule agrees with the payback rule in this case, Question is complete. 2