Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me solve the PV using a finance calculator please 20. Suppose that you just turned 25, and you decide to contribute $100

can someone help me solve the PV using a finance calculator please

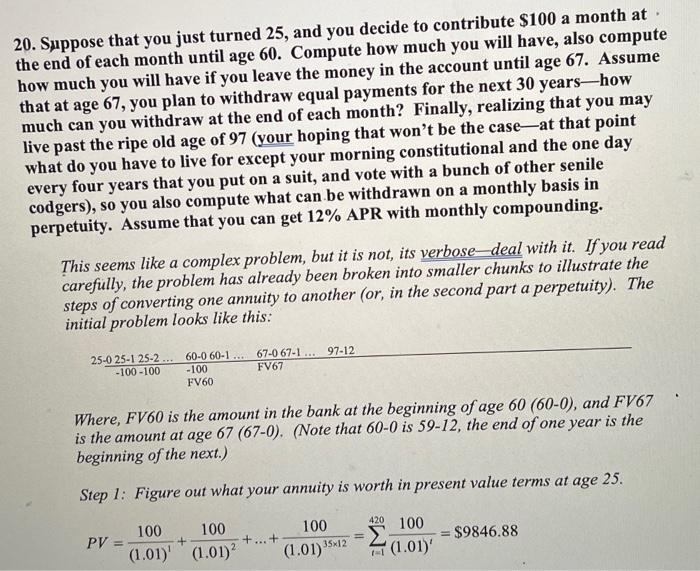

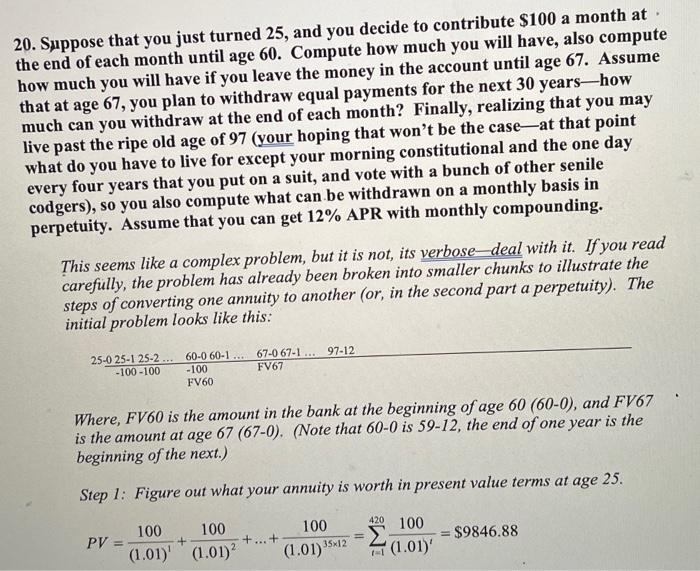

20. Suppose that you just turned 25, and you decide to contribute $100 a month at the end of each month until age 60. Compute how much you will have, also compute how much you will have if you leave the money in the account until age 67. Assume that at age 67, you plan to withdraw equal payments for the next 30 yearshow much can you withdraw at the end of each month? Finally, realizing that you may live past the ripe old age of 97 (your hoping that won't be the caseat that point what do you have to live for except your morning constitutional and the one day every four years that you put on a suit, and vote with a bunch of other senile codgers), so you also compute what can be withdrawn on a monthly basis in perpetuity. Assume that you can get 12% APR with monthly compounding. This seems like a complex problem, but it is not, its verbose deal with it. If you read carefully, the problem has already been broken into smaller chunks to illustrate the steps of converting one annuity to another (or, in the second part a perpetuity). The initial problem looks like this: 25-0 25-1 25-2... 60-060-1... 67-0 67-1 ... 97-12 -100 -100 -100 FV67 FV60 Where, FV60 is the amount in the bank at the beginning of age 60 (60-0), and FV67 is the amount at age 67 (67-0). (Note that 60-0 is 59-12, the end of one year is the beginning of the next.) Step 1: Figure out what your annuity is worth in present value terms at age 25. 420 100 100 100 PV = (1.01)' (1.01) $9846.88 + 100 + ... + 35x12 (1.01) (1.01)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started