Can someone help me verify if these answers are correct

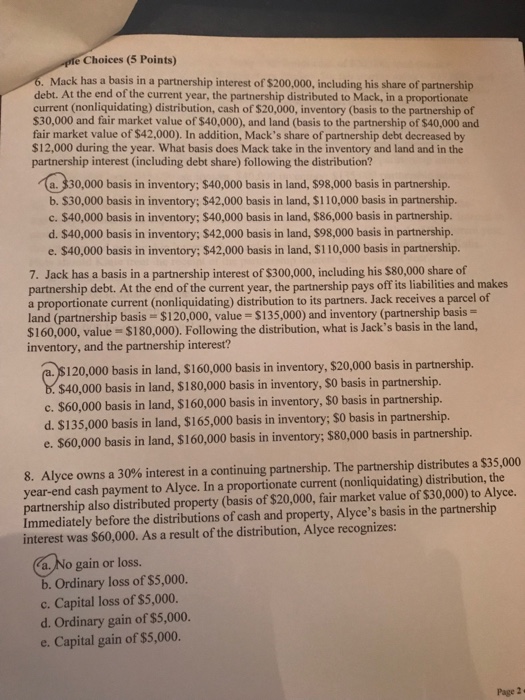

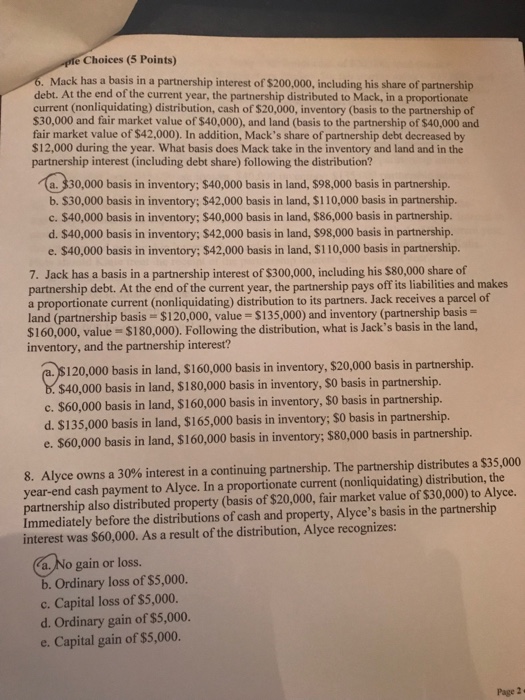

Choices (5 Points) Mack has a basis in a partnership interest of $200,000, including his share of partnership debt. At the end of the current year, the partnership distributed to Mack, in a proportionate current (nonliquidating) distribution, cash of $20,000, inventory (basis to the partnership of $30,000 and fair market value of $40,000), and land (basis to the partnership of $40,000 and fair market value of $42,000). In addition, Mack's share of partnership debt decreased by $12,000 during the year. What basis does Mack take in the inventory and land and in the partnership interest (including debt share) following the distribution? a.?30,000 basis in inventory; $40,000 basis in land, $98,000 basis in partnership. b. $30,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership. c. $40,000 basis in inventory; S40,000 basis in land, $86,000 basis in partnership. d. $40,000 basis in inventory; $42,000 basis in land, $98,000 basis in partnership. e. $40,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership. 7. Jack has a basis in a partnership interest of $300,000, including his $80,000 share of partnership debt. At the end of the current year, the partnership pays off its liabilities and makes a proportionate current (nonliquidating) distribution to its partners. Jack receives a parcel of land (partnership basis $120,000, value- $135,000) and inventory (partnership basis- S160,000, value $180,000). Following the distribution, what is Jack's basis in the land, inventory, and the partnership interest? 120,000 basis in land, $160,000 basis in inventory, $20,000 basis in partnership. S40,000 basis in land, $180,000 basis in inventory, S0 basis in partnership. c. $60,000 basis in land, $160,000 basis in inventory, $0 basis in partnership. d. $135,000 basis in land, $165,000 basis in inventory; $0 basis in partnership. e. $60,000 basis in land, $160,000 basis in inventory; $80,000 basis in partnership. 8. Alyce owns a 30% interest in a continuing partnership. The partnership distributes a S35.000 year-end cash payment to Alyce. In a proportionate current (nonliquidating) distribution, the partnership also distributed property (basis of $20,000, fair market value of $30,000) to Alyce Immediately before the distributions of cash and property, Alyce's basis in the partnership interest was $60,000. As a result of the distribution, Alyce recognizes: a No gain or loss. b. Ordinary loss of $5,000. c. Capital loss of $5,000. d. Ordinary gain of $5,000 e. Capital gain of $5,000 Page 2

Can someone help me verify if these answers are correct

Can someone help me verify if these answers are correct