Answered step by step

Verified Expert Solution

Question

1 Approved Answer

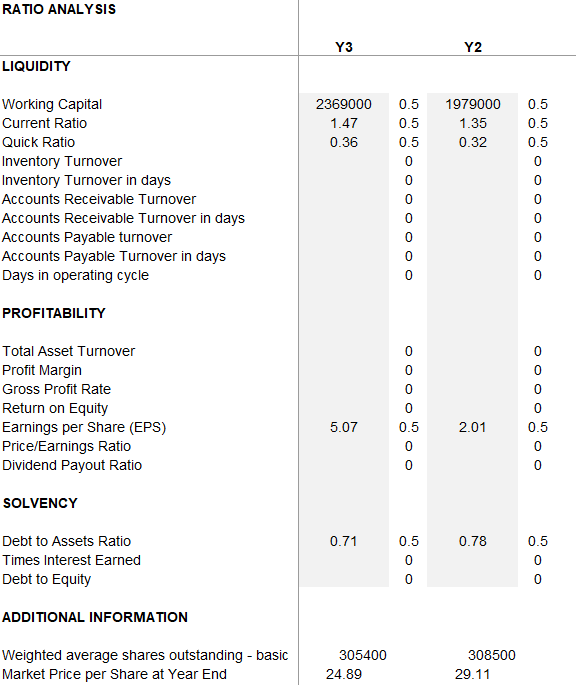

Can someone help me with the ratio analysis with the balance, income statement and cash flow data that I provided. I only need help on

Can someone help me with the ratio analysis with the balance, income statement and cash flow data that I provided. I only need help on the empty blanks on the ratio analysis. If you can provide the steps on the answers as well.

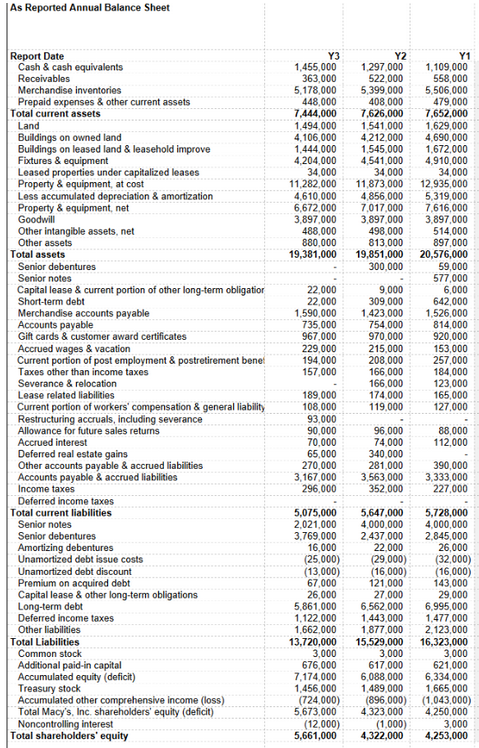

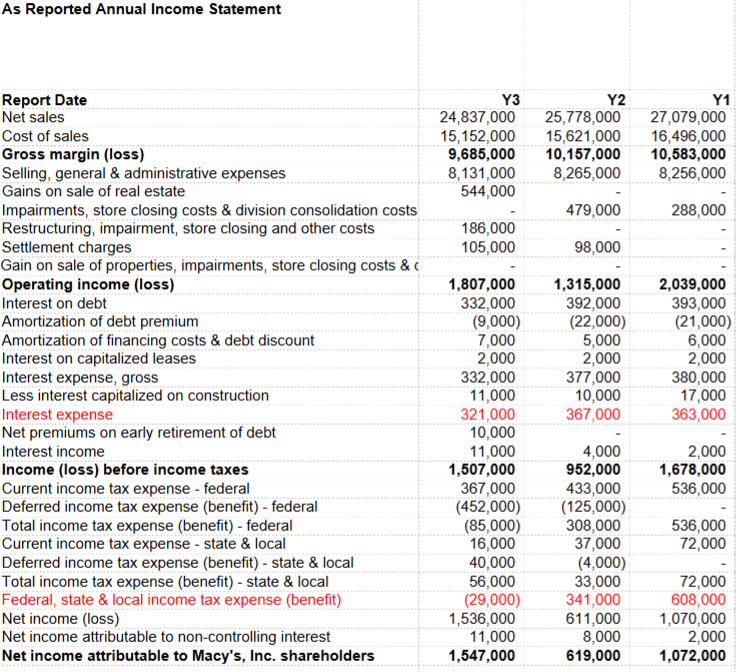

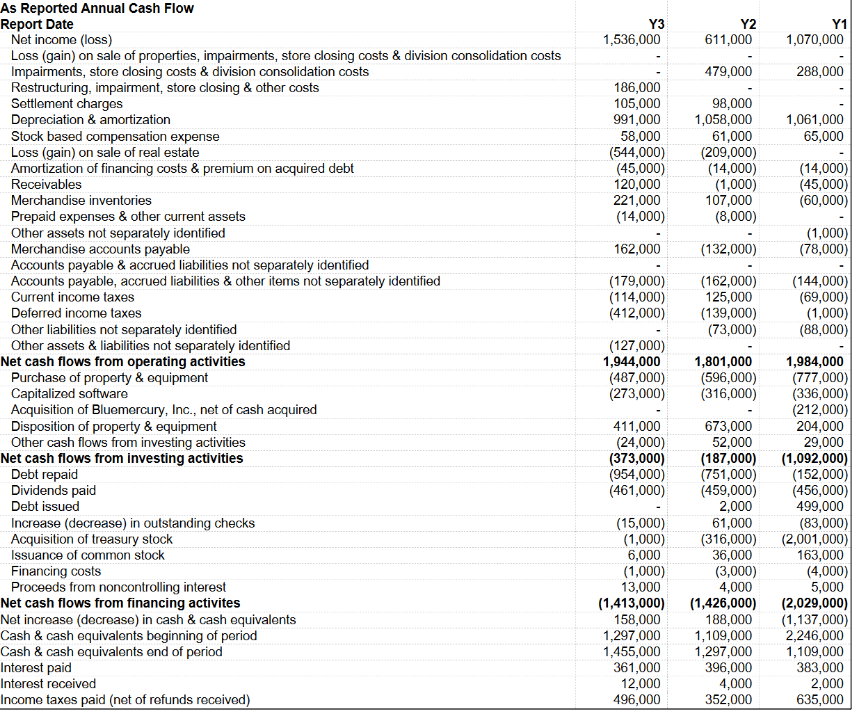

RATIO ANALYSIS Y3 Y2 LIQUIDITY 2369000 1.47 0.36 0.5 0.5 0.5 0 1979000 1.35 0.32 0.5 0.5 0.5 0 Working Capital Current Ratio Quick Ratio Inventory Turnover Inventory Turnover in days Accounts Receivable Turnover Accounts Receivable Turnover in days Accounts Payable turnover Accounts Payable Turnover in days Days in operating cycle PROFITABILITY Total Asset Turnover Profit Margin Gross Profit Rate Return on Equity Earnings per Share (EPS) Price/Earnings Ratio Dividend Payout Ratio OOOOOOO 0 0 0 0 0.5 0 0 5.07 0.5 2.01 SOLVENCY 0.71 0.78 0.5 Debt to Assets Ratio Times Interest Earned Debt to Equity 0.5 0 0 Oo ADDITIONAL INFORMATION Weighted average shares outstanding - basic Market Price per Share at Year End 305400 24.89 308500 29.11 As Reported Annual Balance Sheet Y3 1,455,000 363,000 5,178,000 448,000 7,444,000 1,494,000 4,106,000 1,444,000 4,204,000 34,000 11,282,000 4,610,000 6,672,000 3,897,000 488,000 880,000 19,381,000 Y2 1,297,000 522,000 5,399,000 408,000 7,626,000 1,541,000 4.212.000 1,545,000 4,541,000 34,000 11,873,000 4,856,000 7,017,000 3,897,000 498,000 813,000 19,851,000 300,000 Report Date Cash & cash equivalents Receivables Merchandise inventories Prepaid expenses & other current assets Total current assets Land Buildings on owned land Buildings on leased land & leasehold improve Fixtures & equipment Leased properties under capitalized leases Property & equipment, at cost Less accumulated depreciation & amortization Property & equipment, net Goodwill Other intangible assets, net Other assets Total assets Senior debentures Senior notes Capital lease & current portion of other long-term obligatior Short-term debt Merchandise accounts payable Accounts payable Gift cards & customer award certificates Accrued wages & vacation Current portion of post employment & postretirement benet Taxes other than income taxes Severance & relocation Lease related liabilities Current portion of workers' compensation & general liability Restructuring accruals, including severance Allowance for future sales returns Accrued interest Deferred real estate gains Other accounts payable & accrued liabilities Accounts payable & accrued liabilities Income taxes Deferred income taxes Total current liabilities Senior notes Senior debentures Amortizing debentures Unamortized debt issue costs Unamortized debt discount Premium on acquired debt Capital lease & other long-term obligations Long-term debt Deferred income taxes Other liabilities Total Liabilities Common stock Additional paid.in capital Accumulated equity (deficit) Treasury stock Accumulated other comprehensive income (loss) Total Macy's, Inc. shareholders' equity (deficit) Noncontrolling interest Total shareholders' equity Y1 1,109,000 558,000 5,506,000 479,000 7,652,000 1,629,000 4,690,000 1,672,000 4,910,000 34,000 12,935,000 5,319,000 7,616,000 3,897,000 514,000 897,000 20,576,000 59,000 577,000 6,000 642,000 1,526,000 814 000 920,000 153,000 257,000 184,000 123,000 165,000 127,000 22,000 22.000 1,590,000 735,000 967.000 229,000 194,000 157,000 9,000 309,000 1,423,000 754.000 970,000 215,000 208,000 166,000 166,000 174,000 119,000 189,000 108,000 93,000 90,000 70,000 65,000 270,000 3.167,000 296,000 88,000 112,000 96,000 74,000 340,000 281,000 3,563,000 352,000 390,000 3,333,000 227,000 5,075,000 2,021,000 3.769.000 16,000 (25.000) (13,000) 67,000 26,000 5,861,000 1.122.000 1,662,000 13,720,000 3,000 676,000 7,174,000 1.456,000 (724,000) 5,673,000 (12.000) 5,661,000 5,647,000 4,000,000 2.437,000 22.000 (29.000) (16,000) 121,000 27,000 6,562,000 1.443,000 1,877,000 15,529,000 3.000 617.000 6,088,000 1.489,000 (896,000) 4,323,000 (1,000) 4,322,000 5,728,000 4,000,000 2,845,000 26,000 (32,000) (16,000) 143,000 29,000 6.995,000 1,477,000 2,123,000 16,323,000 3,000 621,000 6,334,000 1,665,000 (1,043,000) 4,250,000 3,000 4,253,000 As Reported Annual Income Statement Y3 24,837,000 15,152,000 9,685,000 8,131,000 544,000 Y2 25,778,000 15,621,000 10,157,000 8,265,000 Y1 27,079,000 16,496,000 10,583,000 8,256,000 479,000 288,000 186,000 105,000 98,000 Report Date Net sales Cost of sales Gross margin (loss) Selling, general & administrative expenses Gains on sale of real estate Impairments, store closing costs & division consolidation costs Restructuring, impairment, store closing and other costs Settlement charges Gain on sale of properties, impairments, store closing costs & Operating income (loss) Interest on debt Amortization of debt premium Amortization of financing costs & debt discount Interest on capitalized leases Interest expense, gross Less interest capitalized on construction Interest expense Net premiums on early retirement of debt Interest income Income (loss) before income taxes Current income tax expense - federal Deferred income tax expense (benefit) - federal Total income tax expense (benefit) - federal Current income tax expense - state & local Deferred income tax expense (benefit) - state & local Total income tax expense (benefit) - state & local Federal, state & local income tax expense (benefit) Net income (loss) Net income attributable to non-controlling interest Net income attributable to Macy's, Inc. shareholders 1,315,000 392,000 (22,000) 5,000 2,000 377,000 10,000 367,000 2,039,000 393,000 (21,000) 6,000 2,000 380,000 17,000 363,000 1,807,000 332,000 (9,000) 7,000 2,000 332,000 11,000 321,000 10,000 11,000 1,507,000 367,000 (452,000) (85,000) 16,000 40,000 56,000 (29,000) 1,536,000 11,000 1,547,000 2,000 1,678,000 536,000 4,000 952,000 433,000 (125,000) 308,000 37,000 (4,000) 33,000 341,000 611,000 8,000 619,000 536,000 72,000 72,000 608,000 1,070,000 2,000 1,072,000 Y2 Y3 1,536,000 611,000 Y1 1,070,000 479,000 288,000 1,061,000 65,000 186,000 105,000 991,000 58,000 (544,000) (45,000) 120,000 221,000 (14,000) 98,000 1,058,000 61,000 (209,000) (14,000) (1,000) 107,000 (8,000) (14,000) (45,000) (60,000) 162,000 (132,000) (1,000) (78,000) (179,000) (114,000) (412,000) (162,000) 125,000 (139,000) (73,000) (144,000) (69,000) (1,000) (88,000) As Reported Annual Cash Flow Report Date Net income (loss) Loss (gain) on sale of properties, impairments, store closing costs & division consolidation costs Impairments, store closing costs & division consolidation costs Restructuring, impairment, store closing & other costs Settlement charges Depreciation & amortization Stock based compensation expense Loss (gain) on sale of real estate Amortization of financing costs & premium on acquired debt Receivables Merchandise inventories Prepaid expenses & other current assets Other assets not separately identified Merchandise accounts payable Accounts payable & accrued liabilities not separately identified Accounts payable, accrued liabilities & other items not separately identified Current income taxes Deferred income taxes Other liabilities not separately identified Other assets & liabilities not separately identified Net cash flows from operating activities Purchase of property & equipment Capitalized software Acquisition of Bluemercury, Inc., net of cash acquired Disposition of property & equipment Other cash flows from investing activities Net cash flows from investing activities Debt repaid Dividends paid Debt issued Increase (decrease) in outstanding checks Acquisition of treasury stock Issuance of common stock Financing costs Proceeds from noncontrolling interest Net cash flows from financing activites Net increase (decrease) in cash & cash equivalents Cash & cash equivalents beginning of period Cash & cash equivalents end of period Interest paid Interest received Income taxes paid (net of refunds received) (127,000) 1,944,000 (487,000) (273,000) 1,801,000 (596,000) (316,000) 411,000 (24,000) (373,000) (954,000) (461,000) (15,000) (1,000) 6,000 (1,000) 13,000 (1,413,000) 158,000 1,297,000 1,455,000 361,000 12,000 496,000 673,000 52,000 (187,000) (751,000) (459,000) 2,000 61,000 (316,000) 36,000 (3,000) 4,000 (1,426,000) 188,000 1,109,000 1,297,000 396,000 4,000 352,000 1,984,000 (777,000) (336,000) (212,000) 204,000 29,000 (1,092,000) (152,000) (456,000) 499,000 (83,000) (2,001,000) 163,000 (4,000) 5,000 (2,029,000) (1,137,000) 2,246,000 1,109,000 383,000 2,000 635,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started