Answered step by step

Verified Expert Solution

Question

1 Approved Answer

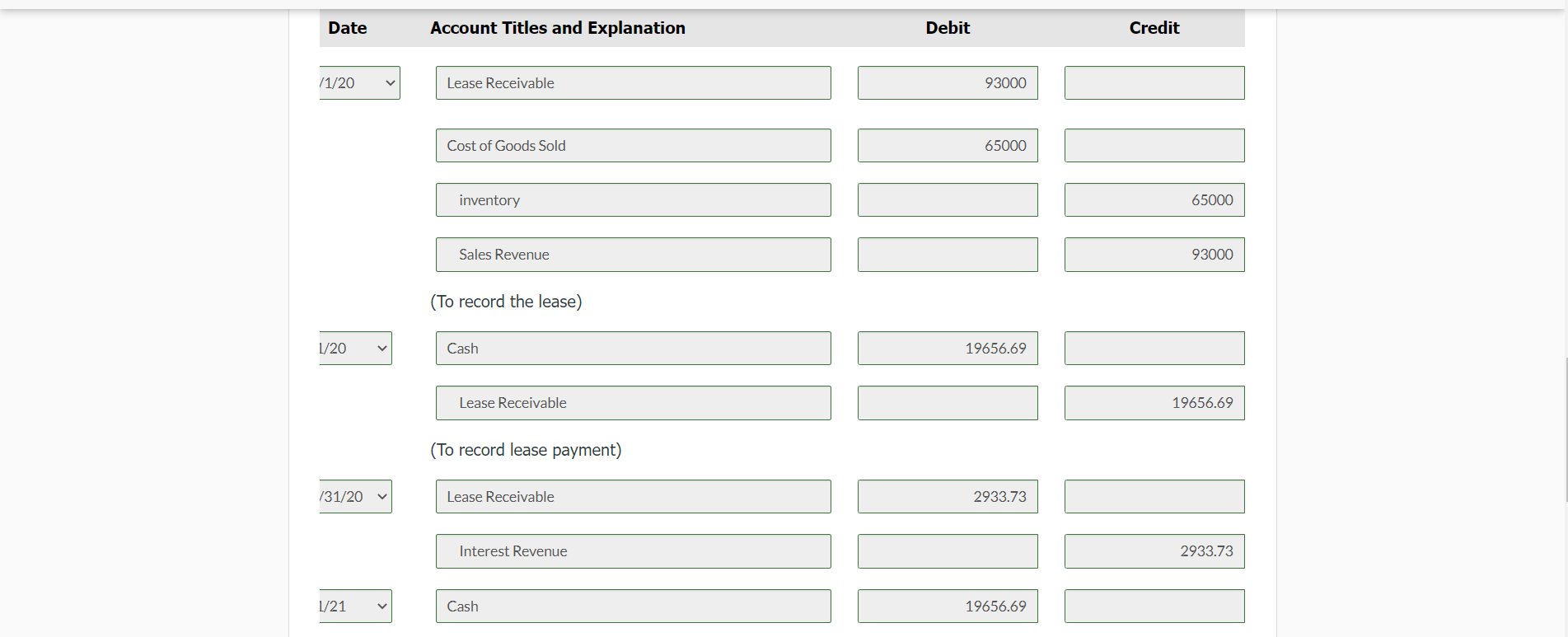

Can someone help me with the second to last entry that I did not get? also, if you have access to the last question, could

Can someone help me with the second to last entry that I did not get? also, if you have access to the last question, could you post the answers?

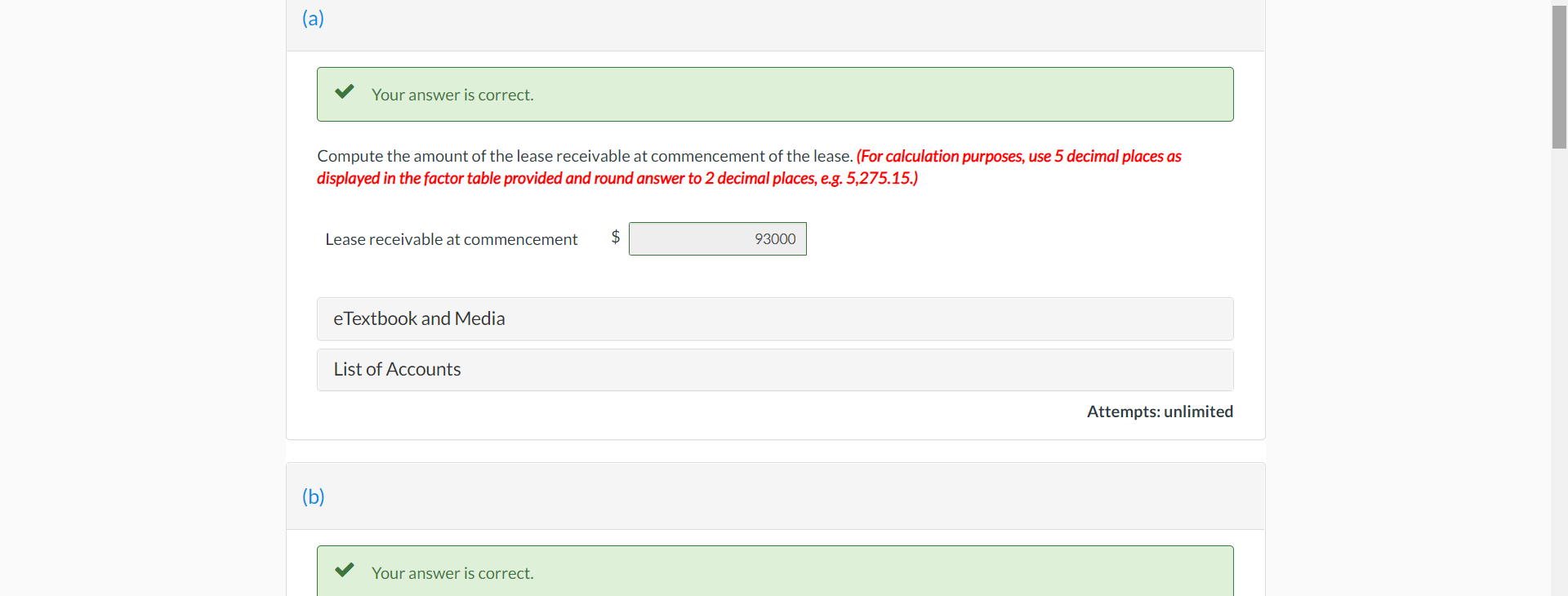

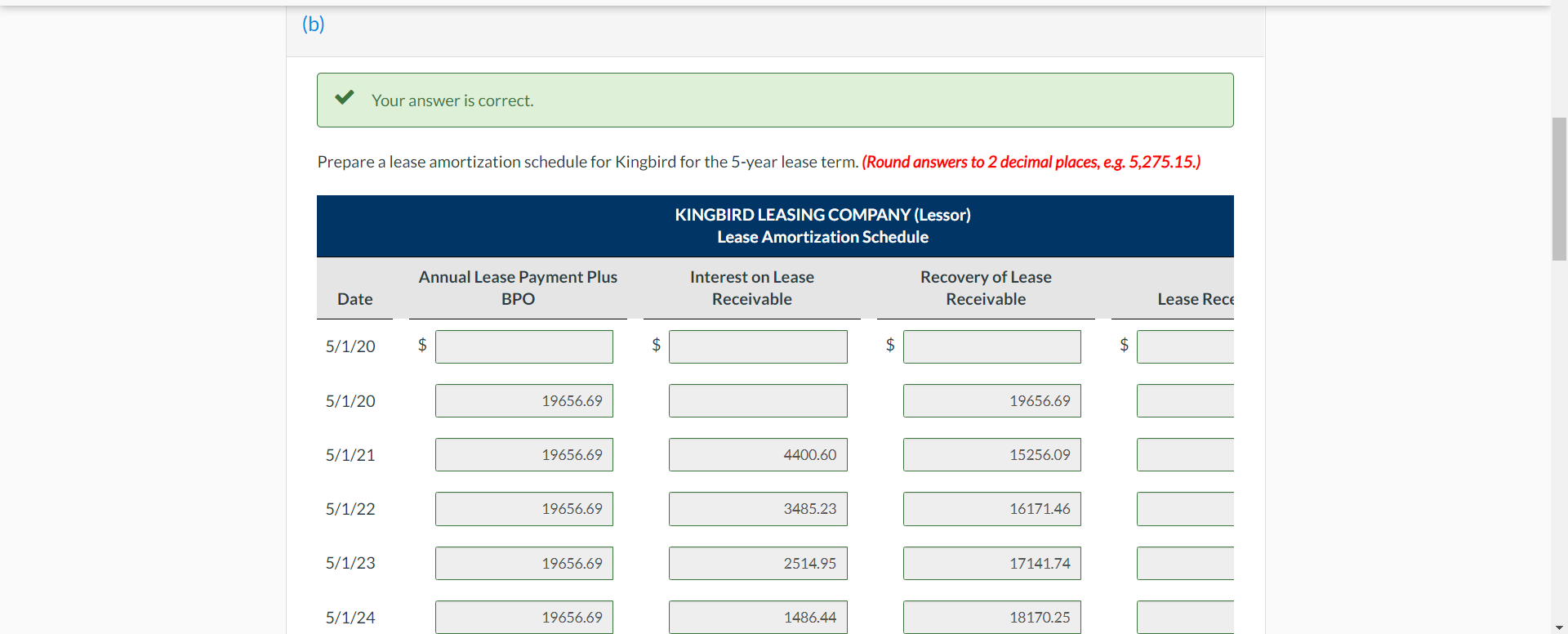

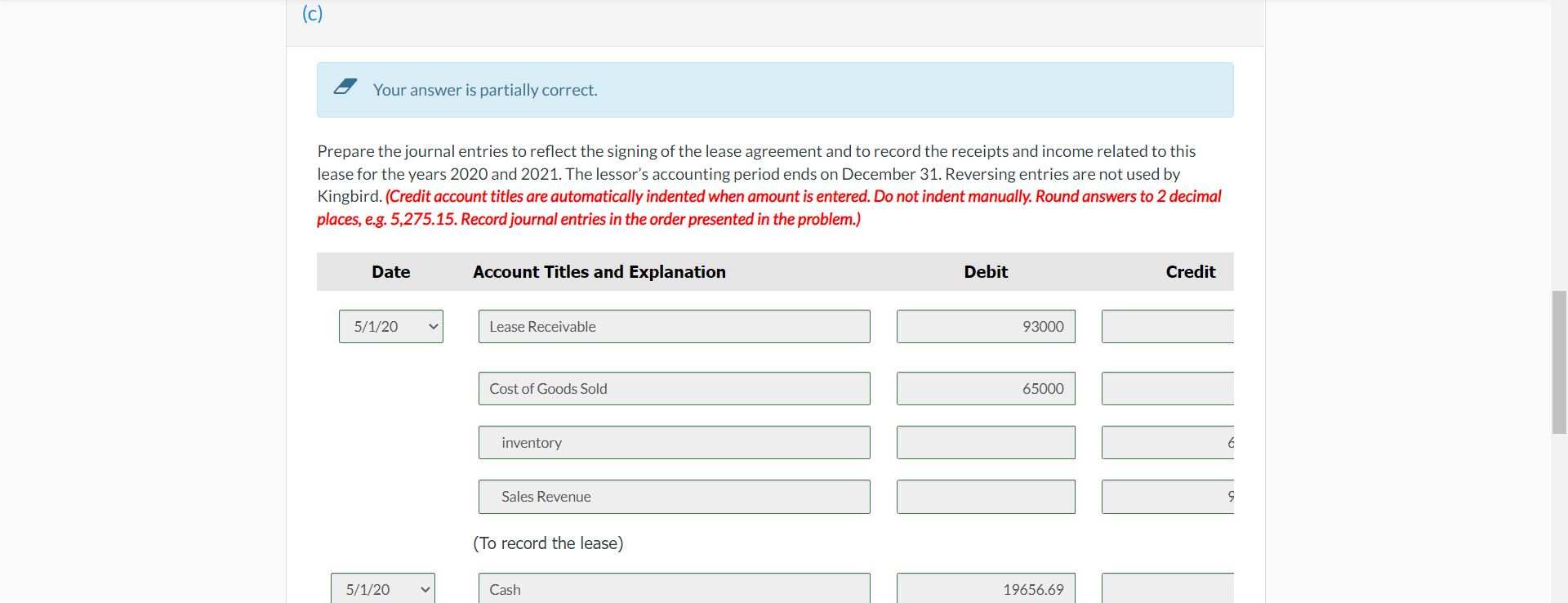

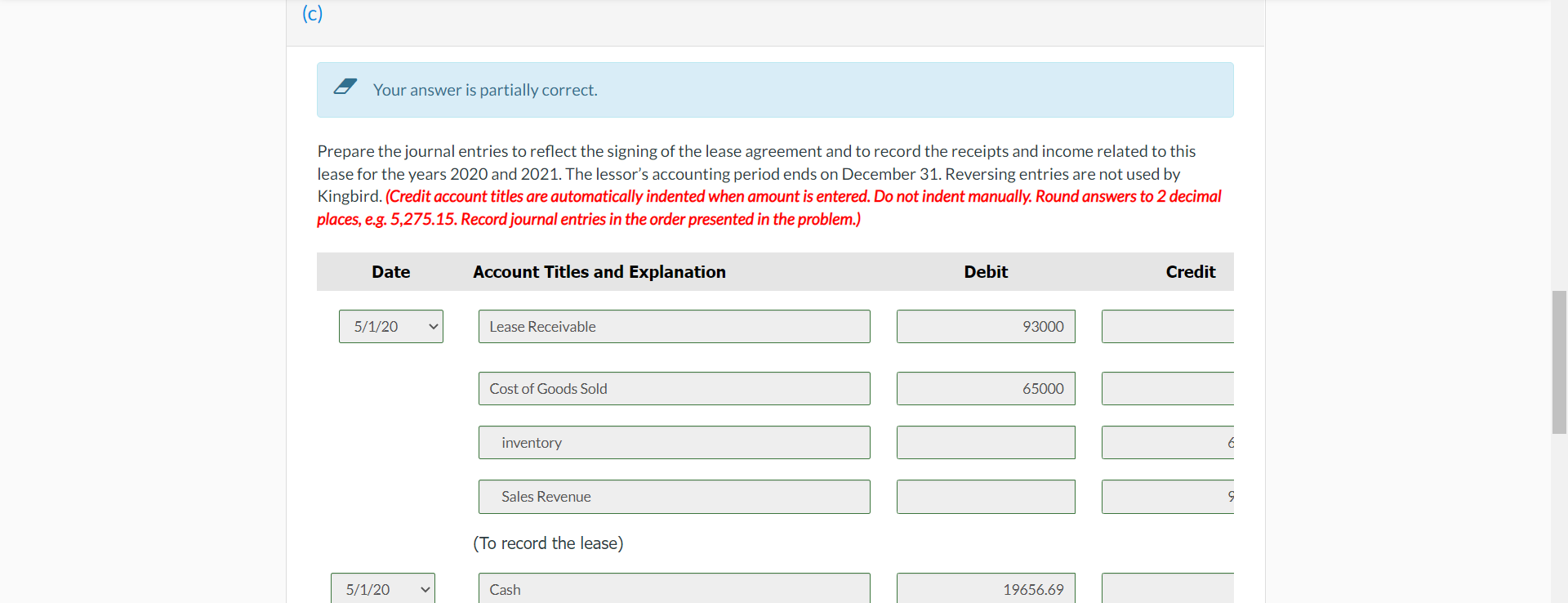

(a) Your answer is correct. Compute the amount of the lease receivable at commencement of the lease. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round answer to 2 decimal places, e.g. 5,275.15.) Lease receivable at commencement $ 93000 e Textbook and Media List of Accounts Attempts: unlimited (b) Your answer is correct. (b) Your answer is correct. Prepare a lease amortization schedule for Kingbird for the 5-year lease term. (Round answers to 2 decimal places, e.g. 5,275.15.) KINGBIRD LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus BPO Interest on Lease Receivable Recovery of Lease Receivable Date Lease Rece 5/1/20 $ $ $ $ 5/1/20 19656.69 19656.69 5/1/21 19656.69 4400.60 15256.09 5/1/22 19656.69 3485.23 16171.46 5/1/23 19656.69 2514.95 17141.74 5/1/24 19656.69 1486.44 18170.25 (c) Your answer is partially correct. Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2020 and 2021. The lessor's accounting period ends on December 31. Reversing entries are not used by Kingbird. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.15. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 5/1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 6 Sales Revenue S (To record the lease) 5/1/20 Cash 19656.69 (c) Your answer is partially correct. Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2020 and 2021. The lessor's accounting period ends on December 31. Reversing entries are not used by Kingbird. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.15. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 5/1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 6 Sales Revenue S (To record the lease) 5/1/20 Cash 19656.69 Date Account Titles and Explanation Debit Credit /1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 65000 .. Sales Revenue 93000 (To record the lease) 1/20 Cash 19656.69 Lease Receivable 19656.69 (To record lease payment) /31/20 Lease Receivable 2933.73 Interest Revenue 2933.73 1/21 Cash 19656.69 (a) Your answer is correct. Compute the amount of the lease receivable at commencement of the lease. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round answer to 2 decimal places, e.g. 5,275.15.) Lease receivable at commencement $ 93000 e Textbook and Media List of Accounts Attempts: unlimited (b) Your answer is correct. (b) Your answer is correct. Prepare a lease amortization schedule for Kingbird for the 5-year lease term. (Round answers to 2 decimal places, e.g. 5,275.15.) KINGBIRD LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus BPO Interest on Lease Receivable Recovery of Lease Receivable Date Lease Rece 5/1/20 $ $ $ $ 5/1/20 19656.69 19656.69 5/1/21 19656.69 4400.60 15256.09 5/1/22 19656.69 3485.23 16171.46 5/1/23 19656.69 2514.95 17141.74 5/1/24 19656.69 1486.44 18170.25 (c) Your answer is partially correct. Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2020 and 2021. The lessor's accounting period ends on December 31. Reversing entries are not used by Kingbird. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.15. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 5/1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 6 Sales Revenue S (To record the lease) 5/1/20 Cash 19656.69 (c) Your answer is partially correct. Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2020 and 2021. The lessor's accounting period ends on December 31. Reversing entries are not used by Kingbird. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.15. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 5/1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 6 Sales Revenue S (To record the lease) 5/1/20 Cash 19656.69 Date Account Titles and Explanation Debit Credit /1/20 Lease Receivable 93000 Cost of Goods Sold 65000 inventory 65000 .. Sales Revenue 93000 (To record the lease) 1/20 Cash 19656.69 Lease Receivable 19656.69 (To record lease payment) /31/20 Lease Receivable 2933.73 Interest Revenue 2933.73 1/21 Cash 19656.69Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started