Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with this one. the 2019 is all 100% and i cant change them. my only answer boxes are 2021 and 2020

can someone help me with this one. the 2019 is all 100% and i cant change them. my only answer boxes are 2021 and 2020

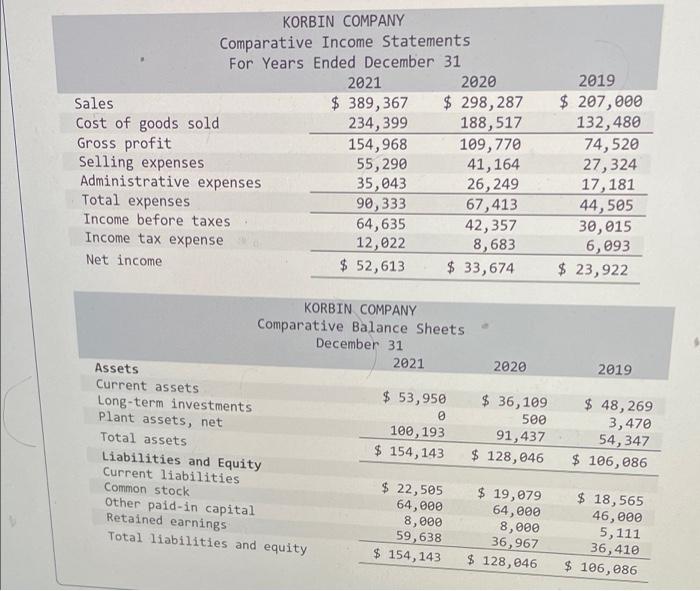

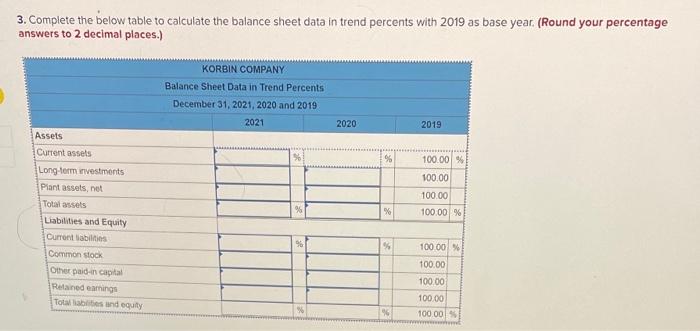

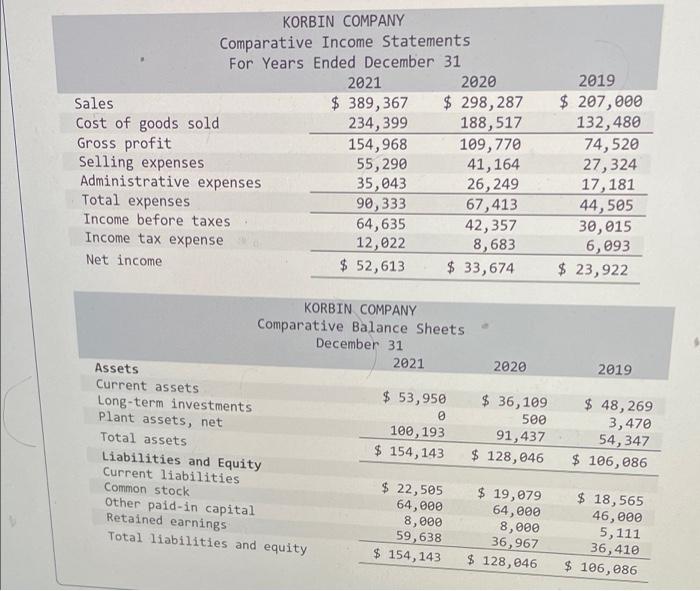

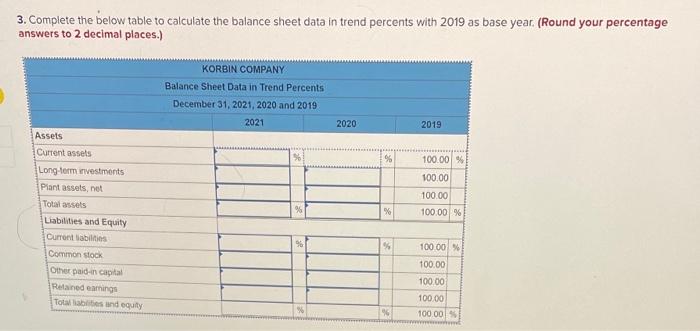

KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 Sales $ 389, 367 $ 298,287 Cost of goods sold 234,399 188,517 Gross profit 154,968 109, 770 Selling expenses 55,290 41,164 Administrative expenses 35,043 26,249 Total expenses 90,333 67,413 Income before taxes 64,635 42,357 Income tax expense 12,022 8,683 Net income $ 52,613 $ 33,674 2019 $ 207,000 132,480 74,520 27,324 17,181 44,505 30,015 6,093 $ 23,922 2020 2019 KORBIN COMPANY Comparative Balance Sheets December 31 2021 Assets Current assets $ 53,950 Long-term investments Plant assets, net 100,193 Total assets $ 154,143 Liabilities and Equity Current liabilities $ 22,505 Common stock 64,000 Other paid in capital 8,000 Retained earnings 59,638 Total liabilities and equity $ 154,143 $ 36,109 500 91,437 $ 128,046 $ 48,269 3,470 54,347 $ 106,086 $ 19,079 64,000 8,000 36,967 $ 128,046 $ 18,565 46,000 5,111 36,410 $ 106,086 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 2020 2019 % % 100.00% 100.00 100.00 100,00 % % % Assets Current assets Long-term investments Plant assets, not Total assets Liabilities and Equity Current abilities Common stock Other paid-in capital Retained earning Totale ind equity % 100.00 100.00 100.00 100.00 100.00 96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started