Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with this pls i need it by today W SOC. SEC. NO WEEK ENDING GAY M OUT M T Th ..

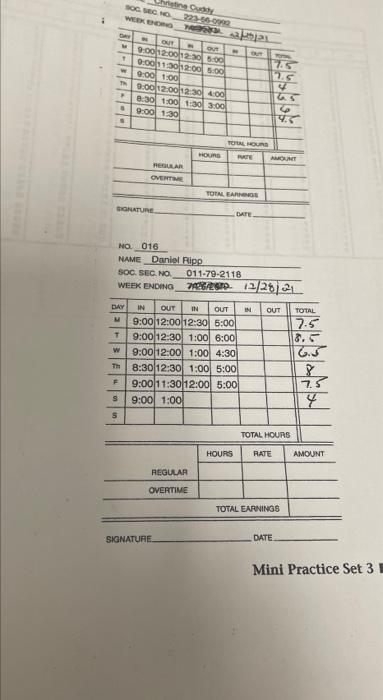

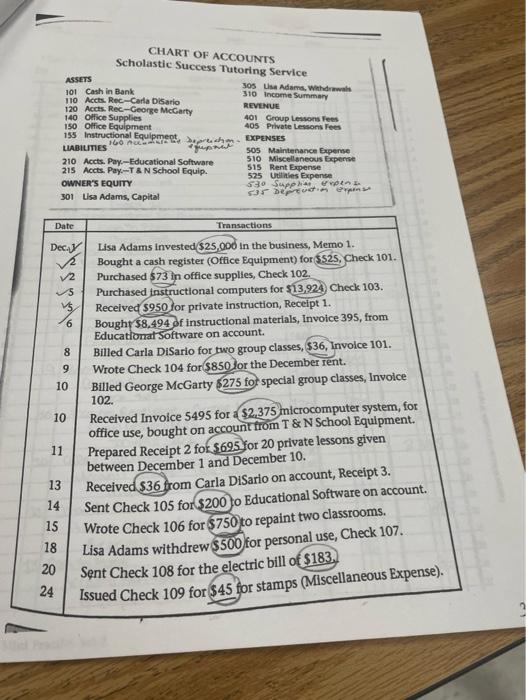

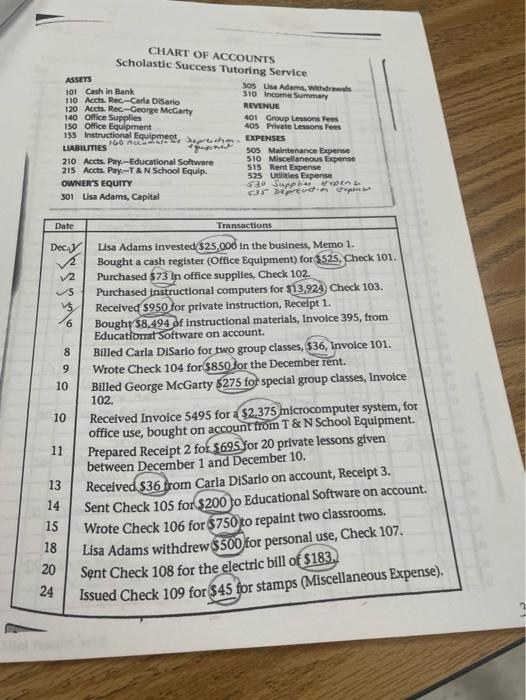

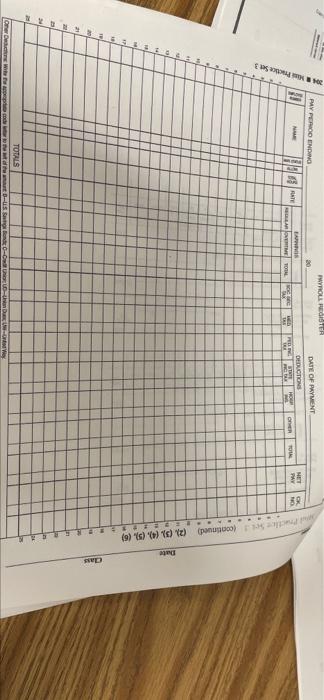

can someone help me with this pls i need it by today

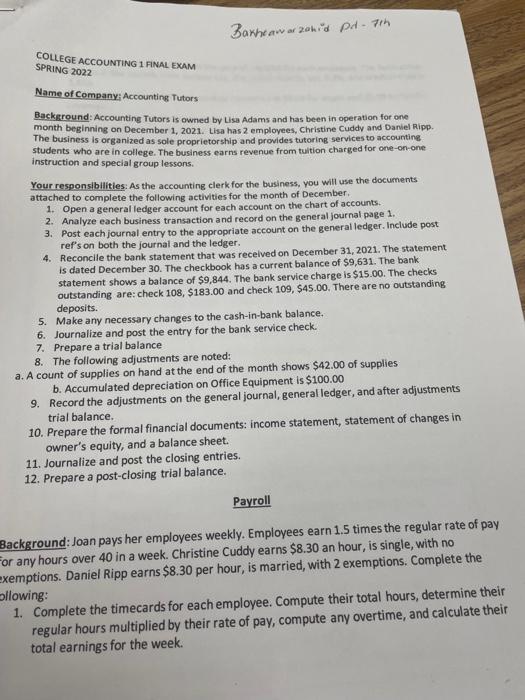

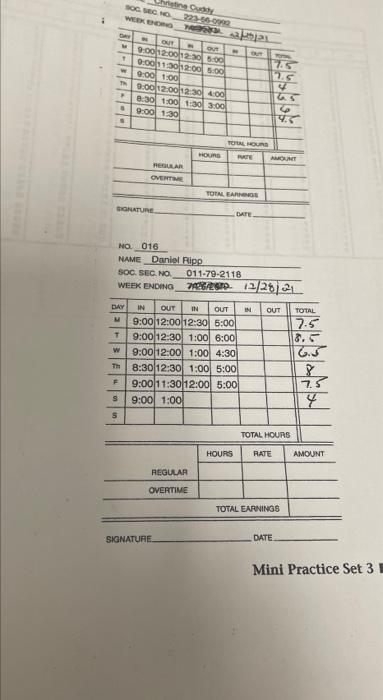

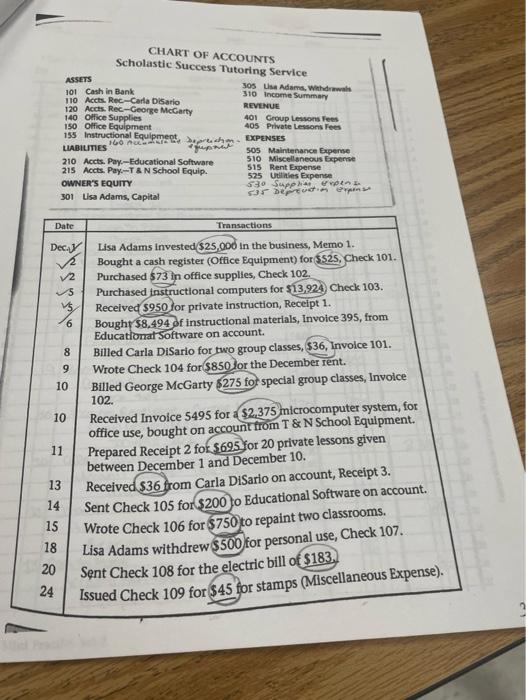

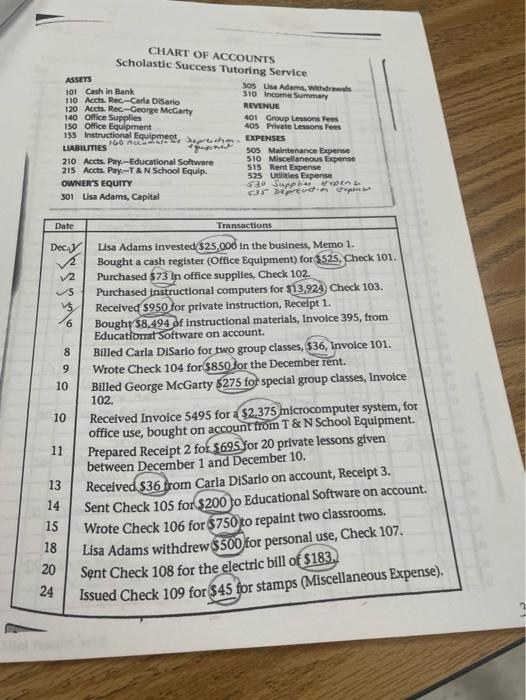

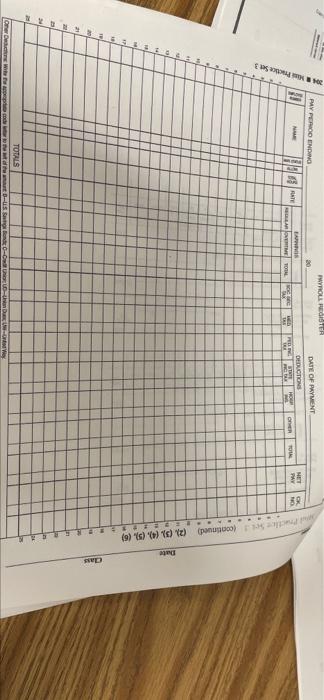

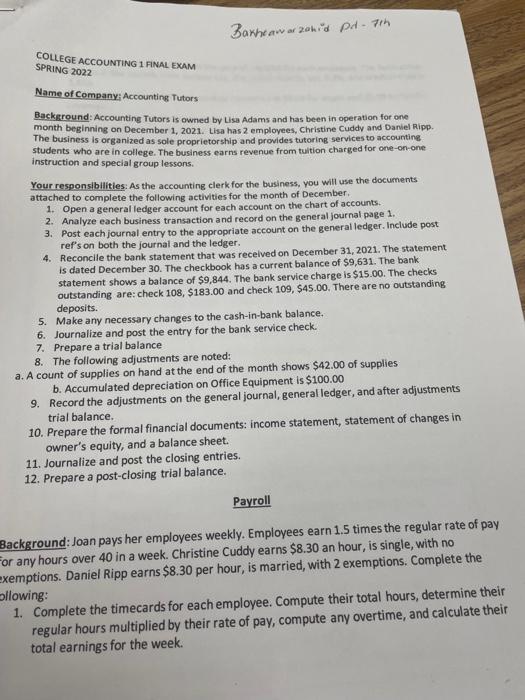

W SOC. SEC. NO WEEK ENDING GAY M OUT M T Th .. S . Christine Cuddy 223-54-9992 W OUT 9:00 12:0012:30 5:00 9:00/11:3012:00 5:00 9:00 1:00 9:00 12:00 12:30 4:00 8:30 1:00 1:30 3:00 9:00 1:30 HOURS Th F S S DAY IN M T W REGULAR OVERTIME REGULAR OVERTIME SIGNATURE DUT SIGNATURE NO. 016 NAME Daniel Ripp SOC. SEC. NO 011-79-2118 WEEK ENDING 7106/200 12/28/2 OUT IN OUT IN OUT 9:00 12:00 12:30 5:00 9:00 12:30 1:00 6:00 9:00 12:00 1:00 4:30 8:30 12:30 1:00 5:00 9:00 11:30 12:00 5:00 9:00 1:00 M 7.5 1.5 4 6.5 6 PATE AMOUNT TORAL HOURS TOTAL EARNINGS DATE TOTAL HOURS HOURS RATE TOTAL 7.5 8.5 6.5 8 7.5 4 AMOUNT TOTAL EARNINGS DATE Mini Practice Set 3 E ASSETS 101 Cash in Bank 110 Accts. Rec-Carla Diario 120 Accts. Rec-George McGarty 140 Office Supplies 150 Office Equipment 155 Instructional Equipment, h EXPENSES LIABILITIES 210 Accts. Pay-Educational Software 215 Accts. Pay-T & N School Equip. OWNER'S EQUITY 301 Lisa Adams, Capital Date CHART OF ACCOUNTS Scholastic Success Tutoring Service Dec. 305 Lise Adams, Withdrawals Income Summary 310 REVENUE 401 Group Lessons Fees 405 Private Lessons Fees 505 Maintenance Expense 510 Miscellaneous Expense 515 Rent Expense 525 Utilities Expense 530 Supplia expens 535 Deption Expense Transactions Lisa Adams invested $25,000 in the business, Memo 1. Bought a cash register (Office Equipment) for $525, Check 101. Purchased $73 in office supplies, Check 102. V2 5 Purchased instructional computers for $13,924) Check 103. Received $950 for private instruction, Receipt 1. 6 Bought $8,494 of instructional materials, Invoice 395, from Educational Software on account. 8 Billed Carla DiSario for two group classes, $36, Invoice 101. Wrote Check 104 for $850 for the December rent. 9 Billed George McGarty $275 for special group classes, Invoice 102. 10 Received Invoice 5495 for a $2,375 microcomputer system, for office use, bought on account from T & N School Equipment. Prepared Receipt 2 for $695 for 20 private lessons given between December 1 and December 10. 11 13 14 15 Received $36 from Carla DiSario on account, Receipt 3. Sent Check 105 for $200 to Educational Software on account. Wrote Check 106 for $750 to repaint two classrooms. Lisa Adams withdrew $500 for personal use, Check 107. Sent Check 108 for the electric bill of $183 18 20 24 Issued Check 109 for $45 for stamps (Miscellaneous Expense). 10 ASSETS 101 Cash in Bank 110 Accts. Rec-Carla Diario 120 Accts. Rec-George McGarty 140 Office Supplies 150 Office Equipment 155 Instructional Equipment, h EXPENSES LIABILITIES 210 Accts. Pay-Educational Software 215 Accts. Pay-T & N School Equip. OWNER'S EQUITY 301 Lisa Adams, Capital Date CHART OF ACCOUNTS Scholastic Success Tutoring Service Dec. 305 Lise Adams, Withdrawals Income Summary 310 REVENUE 401 Group Lessons Fees 405 Private Lessons Fees 505 Maintenance Expense 510 Miscellaneous Expense 515 Rent Expense 525 Utilities Expense 530 Supplia expens 535 Deption Expense Transactions Lisa Adams invested $25,000 in the business, Memo 1. Bought a cash register (Office Equipment) for $525, Check 101. Purchased $73 in office supplies, Check 102. V2 5 Purchased instructional computers for $13,924) Check 103. Received $950 for private instruction, Receipt 1. 6 Bought $8,494 of instructional materials, Invoice 395, from Educational Software on account. 8 Billed Carla DiSario for two group classes, $36, Invoice 101. Wrote Check 104 for $850 for the December rent. 9 Billed George McGarty $275 for special group classes, Invoice 102. 10 Received Invoice 5495 for a $2,375 microcomputer system, for office use, bought on account from T & N School Equipment. Prepared Receipt 2 for $695 for 20 private lessons given between December 1 and December 10. 11 13 14 15 Received $36 from Carla DiSario on account, Receipt 3. Sent Check 105 for $200 to Educational Software on account. Wrote Check 106 for $750 to repaint two classrooms. Lisa Adams withdrew $500 for personal use, Check 107. Sent Check 108 for the electric bill of $183 18 20 24 Issued Check 109 for $45 for stamps (Miscellaneous Expense). 10 IF 20 204 Mini Practice Set 3 H g %% ch ol PAY PERIOD ENDING NAME 41 TOTALS 31.08 20 PWYROLL REGISTER OCULT EAS OVERTIME TOTAL DATE OF PAYMENT DEDUCTIONS DAY HO PILING OTHER TOTA 89 Practice Set 1 (continued) (2), (3), (4), (5), (6) Date Class Banheawar zahid Pd - 7th COLLEGE ACCOUNTING 1 FINAL EXAM SPRING 2022 Name of Company; Accounting Tutors Background: Accounting Tutors is owned by Lisa Adams and has been in operation for one month beginning on December 1, 2021. Lisa has 2 employees, Christine Cuddy and Daniel Ripp. The business is organized as sole proprietorship and provides tutoring services to accounting students who are in college. The business earns revenue from tuition charged for one-on-one instruction and special group lessons. Your responsibilities: As the accounting clerk for the business, you will use the documents attached to complete the following activities for the month of December. 1. Open a general ledger account for each account on the chart of accounts. 2. Analyze each business transaction and record on the general journal page 1. 3. Post each journal entry to the appropriate account on the general ledger. Include post ref's on both the journal and the ledger. 4. Reconcile the bank statement that was received on December 31, 2021. The statement is dated December 30. The checkbook has a current balance of $9,631. The bank statement shows a balance of $9,844. The bank service charge is $15.00. The checks outstanding are: check 108, $183.00 and check 109, $45.00. There are no outstanding deposits. 5. Make any necessary changes to the cash-in-bank balance. 6. Journalize and post the entry for the bank service check. 7. Prepare a trial balance 8. The following adjustments are noted: a. A count of supplies on hand at the end of the month shows $42.00 of supplies b. Accumulated depreciation on Office Equipment is $100.00 9. Record the adjustments on the general journal, general ledger, and after adjustments trial balance. 10. Prepare the formal financial documents: income statement, statement of changes in owner's equity, and a balance sheet. 11. Journalize and post the closing entries. 12. Prepare a post-closing trial balance. Payroll Background: Joan pays her employees weekly. Employees earn 1.5 times the regular rate of pay For any hours over 40 in a week. Christine Cuddy earns $8.30 an hour, is single, with no exemptions. Daniel Ripp earns $8.30 per hour, is married, with 2 exemptions. Complete the ollowing: 1. Complete the timecards for each employee. Compute their total hours, determine their regular hours multiplied by their rate of pay, compute any overtime, and calculate their total earnings for the week

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started