Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this problem? I attached an example to help. Question 2 1 pts An insurance company owns a 1000 par value

Can someone help me with this problem? I attached an example to help.

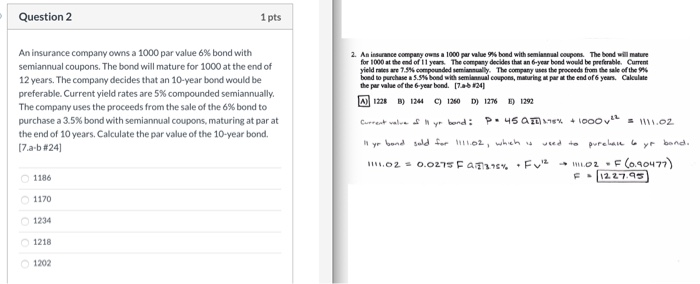

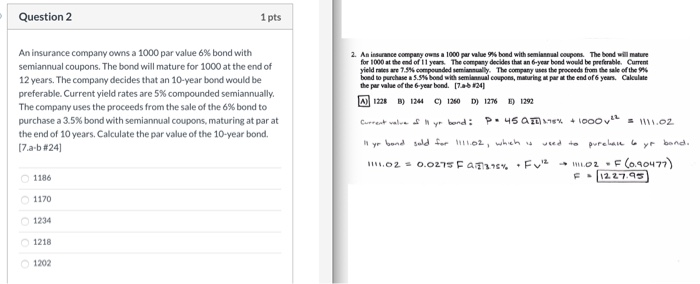

Question 2 1 pts An insurance company owns a 1000 par value 6% bond with semiannual coupons. The bond will mature for 1000 at the end of 12 years. The company decides that an 10-year bond would be preferable. Current yield rates are 5% compounded semiannually, The company uses the proceeds from the sale of the 6% bond to purchase a 3.5% bond with semiannual coupons, maturing at par at the end of 10 years. Calculate the par value of the 10-year bond. 17.a-b#24] 2. A y a 1000 ve and with m oss The bedre for 1000 at the end of years. The company decides than your bod would be preferable. Current yield as we 7.5compounded mi l y. The company was the proceeds from the sale of the bond to purchase a 3.5% bond with m u lcowpo, maturing the end of 6 years. Calculate the per value of the year bond 17 4 A) 1226 ) 124 C) 1260 D) 1276 ) 1292 y band : PMS AT8 % +100OV O Z Current value 1 yr band sold for 1111.02, which is veed to O2 = 0.0275 Fan F M F purchase o yr band. 2 -F (0.40477) 12 27.95 1186 1170 1234 1218 1202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started