Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with this question please? Problem 5: Bank Reconciliation (16 POINTS) Information below is for Maverick Company on March 31, 2020 The

can someone help me with this question please?

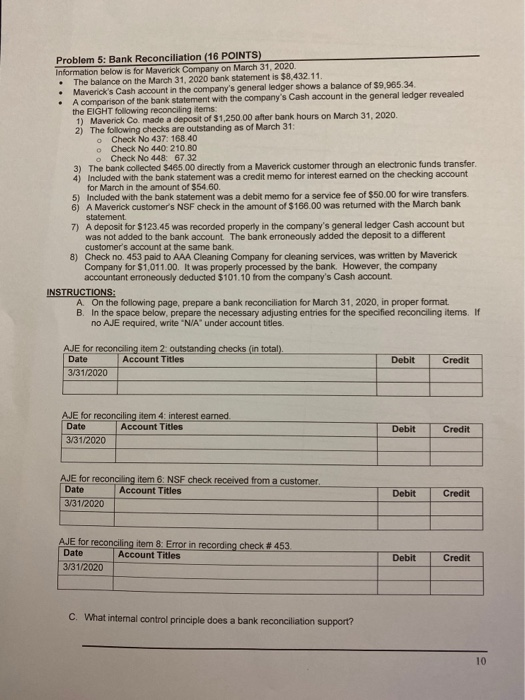

Problem 5: Bank Reconciliation (16 POINTS) Information below is for Maverick Company on March 31, 2020 The balance on the March 31, 2020 bank statement is $8.432.11. Maverick's Cash account in the company's general ledger shows a balance of $9,965.34 A comparison of the bank statement with the company's Cash account in the general ledger revealed the EIGHT following reconciling items: 1) Maverick Co. made a deposit of $1,250.00 after bank hours on March 31, 2020. 2) The following checks are outstanding as of March 31: Check No 437: 168.40 Check No 440: 210.80 Check No 448 67.32 3) The bank collected $465.00 directly from a Maverick customer through an electronic funds transfer 4) Included with the bank statement was a credit memo for interest earned on the checking account for March in the amount of $54.60 5) Included with the bank statement was a debit memo for a service fee of $50.00 for wire transfers 6) A Maverick customer's NSF check in the amount of $166.00 was returned with the March bank statement 7) A deposit for $123.45 was recorded properly in the company's general ledger Cash account but was not added to the bank account. The bank erroneously added the deposit to a different customer's account at the same bank 8) Check no. 453 paid to AAA Cleaning Company for cleaning services, was written by Maverick Company for $1,011.00. It was properly processed by the bank. However, the company accountant erroneously deducted $101.10 from the company's Cash account. INSTRUCTIONS: A. On the following page, prepare a bank reconciliation for March 31, 2020, in proper format. B. In the space below, prepare the necessary adjusting entries for the specified reconciling items. If no AJE required, write "N/A under account titles. AJE for reconciling item 2: outstanding checks (in total) Date Account Titles 3/31/2020 Debit Credit AJE for reconciling item 4: interest earned Date Account Titles 3/31/2020 Debit Credit AJE for reconciling item 6: NSF check received from a customer. Date Account Titles 3/31/2020 Debit Credit AJE for reconciling item 8: Error in recording check # 453 Date Account Titles 3/31/2020 Debit Credit C. What intemal control principle does a bank reconciliation support Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started