can someone help me with this question?

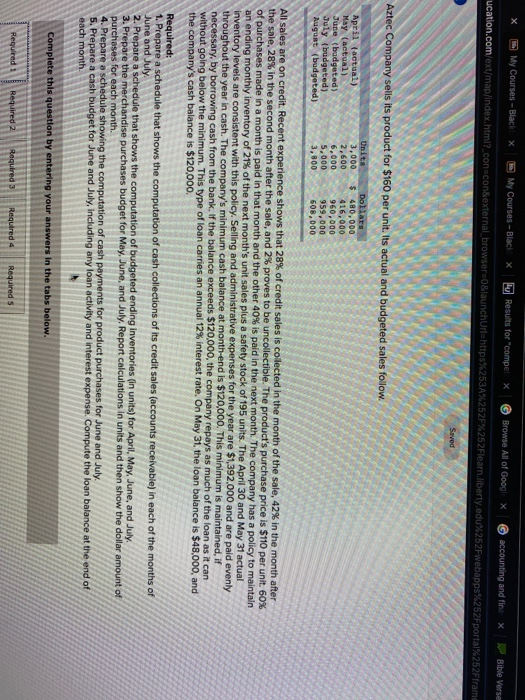

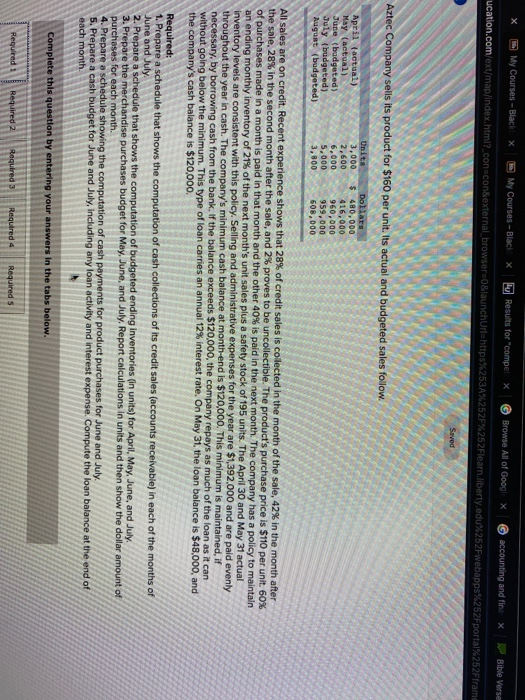

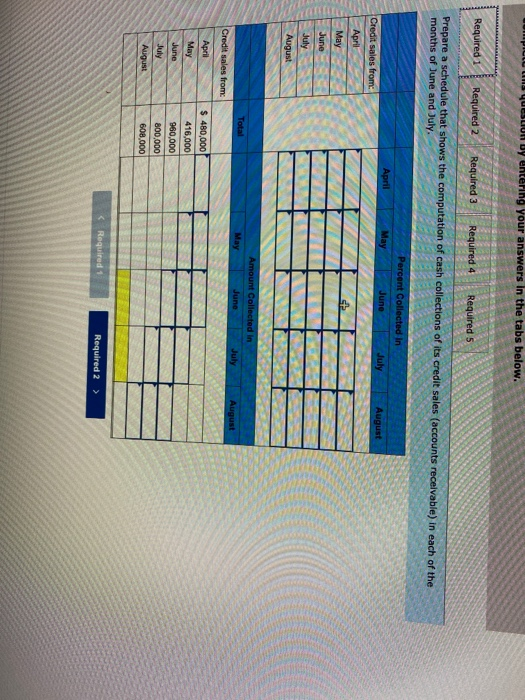

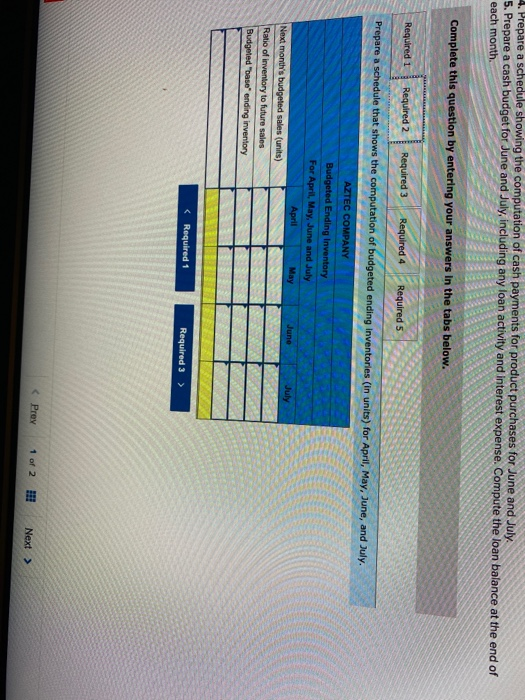

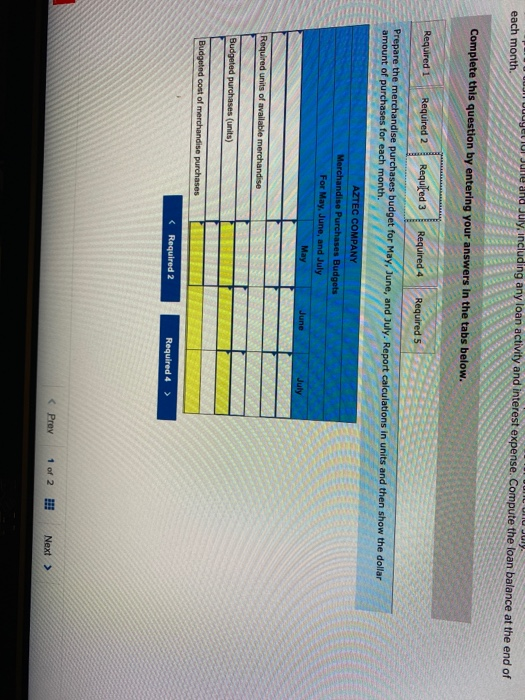

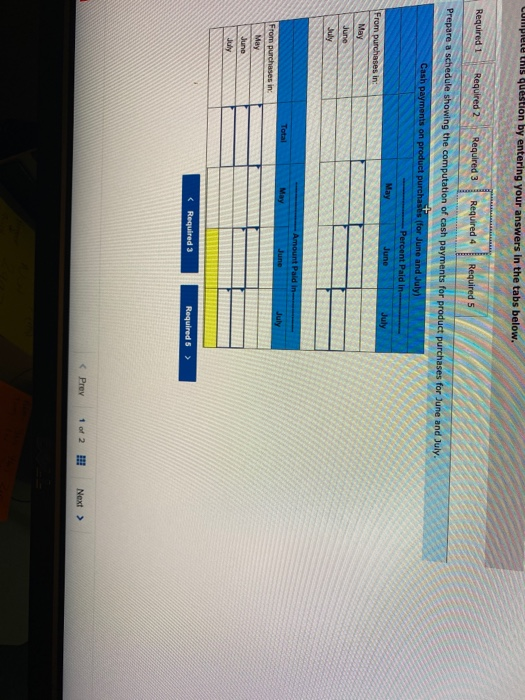

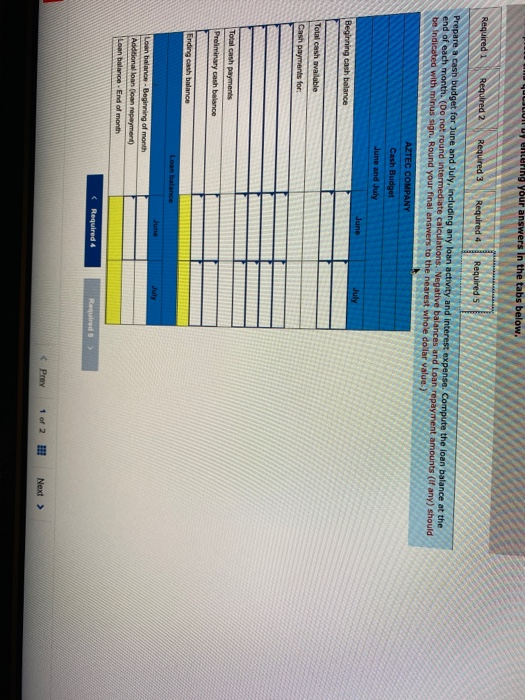

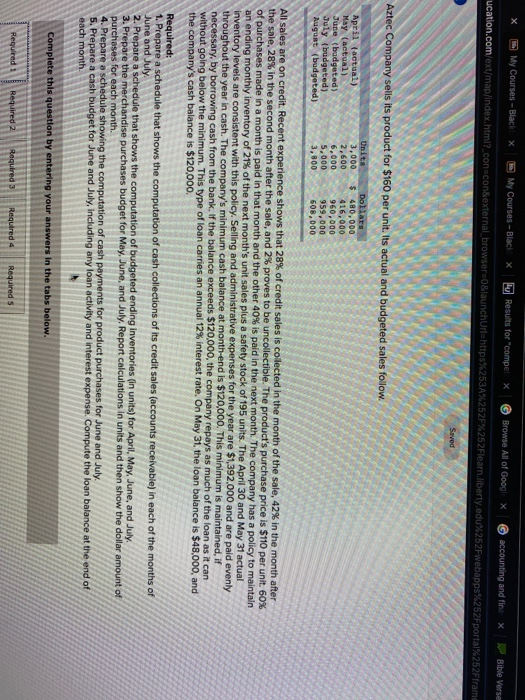

X My Courses - Black My Courses - Black x Results for "compe @ Browse All of Good accounting and fix Bible Verse ucation.com/ext/map/index.html?_con-con&external_browser=0&launchurl=https%253A%252F%252Flearn.liberty.edu%252Fwebapps%252Fportal%252Fframe X Saved Aztec Company sells its product for $160 per unit. Its actual and budgeted sales follow April (actual) May (actual) June (budgeted) July (budgeted) August (budgeted) Units 3,000 2,600 6,000 5,000 3,800 Dollars $ 480,000 416,000 960,000 959,000 608,000 All sales are on credit. Recent experience shows that 28% of credit sales is collected in the month of the sale, 42% in the month after the sale, 28% in the second month after the sale, and 2% proves to be uncollectible. The product's purchase price is $110 per unit. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. The company has a policy to maintain an ending monthly inventory of 21% of the next month's unit sales plus a safety stock of 195 units. The April 30 and May 31 actual inventory levels are consistent with this policy. Selling and administrative expenses for the year are $1,392,000 and are paid evenly throughout the year in cash. The company's minimum cash balance at month-end is $120,000. This minimum is maintained, if necessary, by borrowing cash from the bank. If the balance exceeds $120.000, the company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 12% interest rate. On May 31, the loan balance is $48,000, and the company's cash balance is $120,000. Required: 1. Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of June and July 2. Prepare a schedule that shows the computation of budgeted ending inventories (in units) for April, May, June, and July. 3. Prepare the merchandise purchases budget for May, June, and July. Report calculations in units and then show the dollar amount of purchases for each month. 4. Prepare a schedule showing the computation of cash payments for product purchases for June and July. 5. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required s un YULILIUA DY Untering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of June and July. Percent Collected in June April May July August Credit sales from: April May June July August Amount Collected in Total May June July August Credit sales from April May June July August $ 480,000 416,000 960,000 800,000 608,000 4. Prepare a schedule showing the computation of cash payments for product purchases for June and July 5. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule that shows the computation of budgeted ending Inventories (in units) for April, May, June, and July. AZTEC COMPANY Budgeted Ending Inventory For April May June and July April May Next month's budgeted sales (units) Ratio of inventory to future sales Budgeted "base" ending inventory June July Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule showing the computation of cash payments for product purchases for June and July. Cash payments on product purchases (for June and July) Percent Pald in May June July From purchases in: May June July Total May Amount Paid in June July From purchases in May June July uy cering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month. (Do not round intermediate calculations. Negative balances and Loan repayment amounts (if any) should be Indicated with minus sign. Round your final answers to the nearest whole dollar value.) AZTEC COMPANY Cash Budget June and July June July Beginning cash balance Total cash available Cash payments for Total cash payments Preliminary cash balance Ending cash balance Loan balance July Loen balance - Beginning of month Additional loan luan repayment) Loan balance - End of month X My Courses - Black My Courses - Black x Results for "compe @ Browse All of Good accounting and fix Bible Verse ucation.com/ext/map/index.html?_con-con&external_browser=0&launchurl=https%253A%252F%252Flearn.liberty.edu%252Fwebapps%252Fportal%252Fframe X Saved Aztec Company sells its product for $160 per unit. Its actual and budgeted sales follow April (actual) May (actual) June (budgeted) July (budgeted) August (budgeted) Units 3,000 2,600 6,000 5,000 3,800 Dollars $ 480,000 416,000 960,000 959,000 608,000 All sales are on credit. Recent experience shows that 28% of credit sales is collected in the month of the sale, 42% in the month after the sale, 28% in the second month after the sale, and 2% proves to be uncollectible. The product's purchase price is $110 per unit. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. The company has a policy to maintain an ending monthly inventory of 21% of the next month's unit sales plus a safety stock of 195 units. The April 30 and May 31 actual inventory levels are consistent with this policy. Selling and administrative expenses for the year are $1,392,000 and are paid evenly throughout the year in cash. The company's minimum cash balance at month-end is $120,000. This minimum is maintained, if necessary, by borrowing cash from the bank. If the balance exceeds $120.000, the company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 12% interest rate. On May 31, the loan balance is $48,000, and the company's cash balance is $120,000. Required: 1. Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of June and July 2. Prepare a schedule that shows the computation of budgeted ending inventories (in units) for April, May, June, and July. 3. Prepare the merchandise purchases budget for May, June, and July. Report calculations in units and then show the dollar amount of purchases for each month. 4. Prepare a schedule showing the computation of cash payments for product purchases for June and July. 5. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required s un YULILIUA DY Untering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of June and July. Percent Collected in June April May July August Credit sales from: April May June July August Amount Collected in Total May June July August Credit sales from April May June July August $ 480,000 416,000 960,000 800,000 608,000 4. Prepare a schedule showing the computation of cash payments for product purchases for June and July 5. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule that shows the computation of budgeted ending Inventories (in units) for April, May, June, and July. AZTEC COMPANY Budgeted Ending Inventory For April May June and July April May Next month's budgeted sales (units) Ratio of inventory to future sales Budgeted "base" ending inventory June July Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a schedule showing the computation of cash payments for product purchases for June and July. Cash payments on product purchases (for June and July) Percent Pald in May June July From purchases in: May June July Total May Amount Paid in June July From purchases in May June July uy cering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month. (Do not round intermediate calculations. Negative balances and Loan repayment amounts (if any) should be Indicated with minus sign. Round your final answers to the nearest whole dollar value.) AZTEC COMPANY Cash Budget June and July June July Beginning cash balance Total cash available Cash payments for Total cash payments Preliminary cash balance Ending cash balance Loan balance July Loen balance - Beginning of month Additional loan luan repayment) Loan balance - End of month