Can someone help me with this work

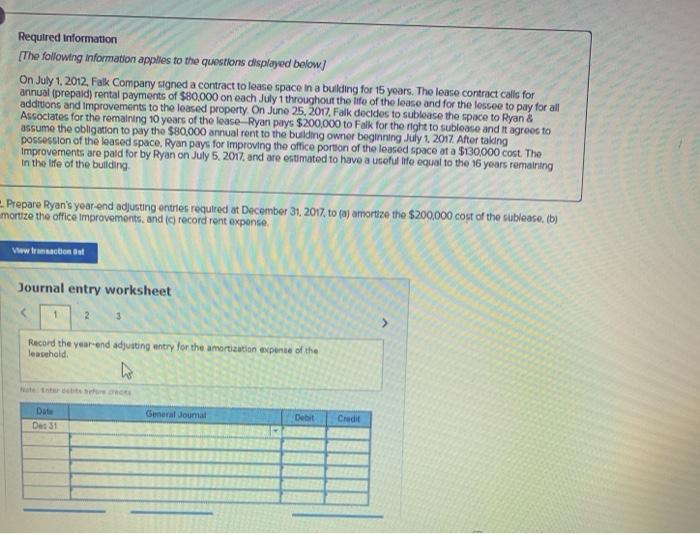

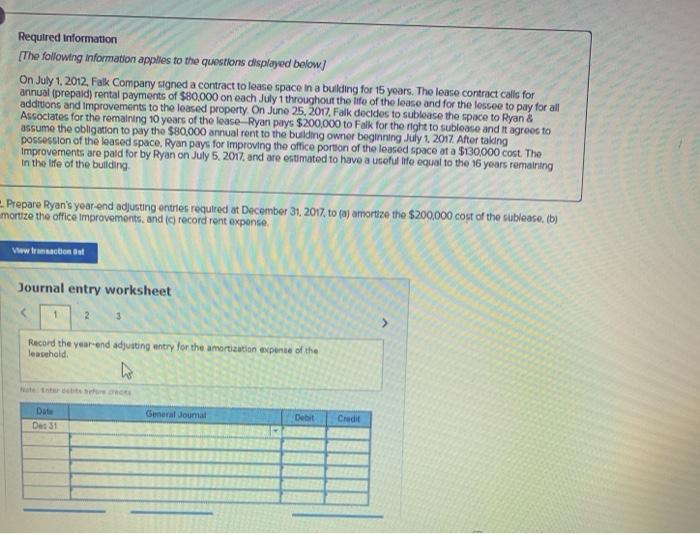

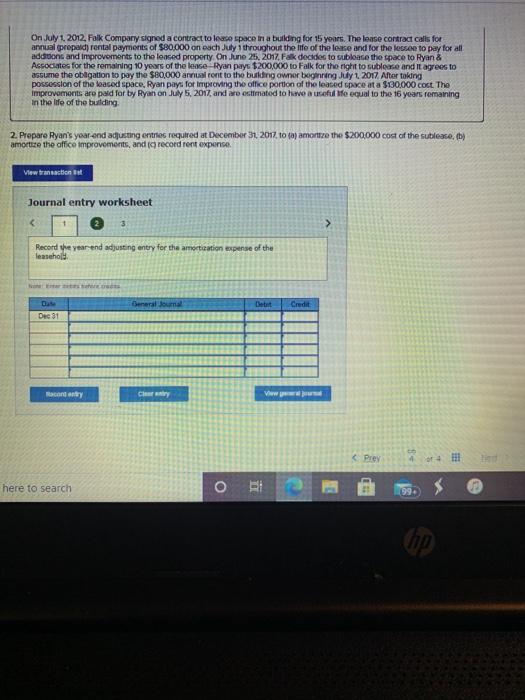

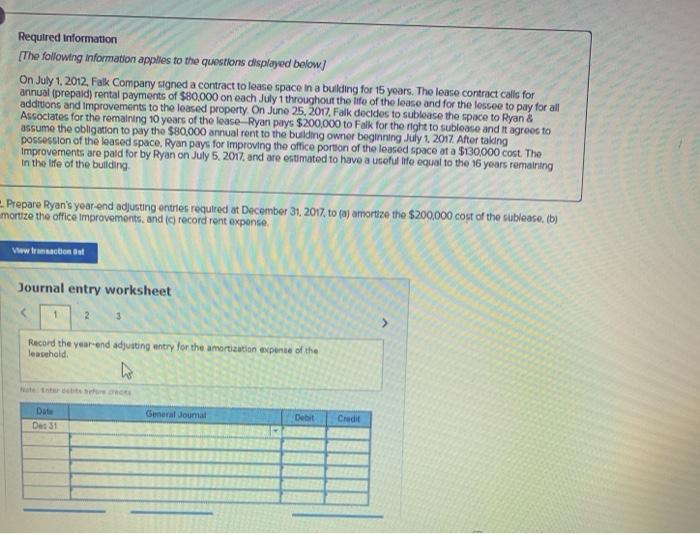

Required Information [The following information applies to the questions displayed below) On July 1, 2012. Falk Company signed a contract to lease space in a bulding for 15 years. The lease contract calls for annual (prepaid) rental payments of $80,000 on each July 1 throughout the life of the lease and for the losseo to pay for all additions and improvements to the leased property. On June 25, 2017 Falk decides to subloase the space to Ryan & Associates for the remaining 10 years of the lease Ryan pays $200,000 to Falk for the right to subleace and it agrees to assume the obligation to pay tho $80,000 annual rent to the building owner beginning July 1, 2017 After taking possession of the leased space, Ryan pays for Improving the office portion of the leased space at a $130,000 cost. The Improvements are paid for by Ryan on July 5, 2017, and are estimated to have a useful life equal to the 16 years remaining In the life of the building - Prepare Ryan's year-end adjusting entries required at December 31, 2017, to (a) amortize the $200.000 cost of the sublato. (b) mortize the office Improvements, and (c) record rent expense, View transaction et Journal entry worksheet 1 2 3 Record the year-end adjusting entry for the amortization expense of the Jeasehold General Journal Date Des 31 Debit Credit On July 1, 2012. Falk Company signed a contract to leto space in a building for 15 years. The lease contract calls for annual prepaid) rental payments of $80.000 on each July throughout the life of the lease and for the lessee to pay for all additions and improvements to the leased property. On June 25, 2017 Falk decides to subloare the space to Ryan & Associates for the remaining 10 years of the lease Ryan pays $200,000 to Falk for the right to sublere and it agrees to assume the obligation to pay the $80,000 annual ront to the buting owner boring July 2017 After taking possession of the leased space, Ryan pays for improving the office portion of the leased space at a $130,000 cost. The improvements aro paid for by Ryan on July 5, 2017, and are esterated to have a useful fe equal to the 16 years remaining in the life of the building 2. Preparo Ryan's yoar and adjusting entries required at December 31, 2017 to taj amortize the $200,000 cost of the sublate. (b) amortere the office improvements, and record rent expense View transaction Journal entry worksheet Record the year end adjusting entry for the amortization expense of the leasehold General Journal Det Credit Dec 31 Macony