Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help please 24 Comprehensive Problem Directions on page 616 in textbook under the Required. Start with Required #2. skipping 1 as you are

can someone help please

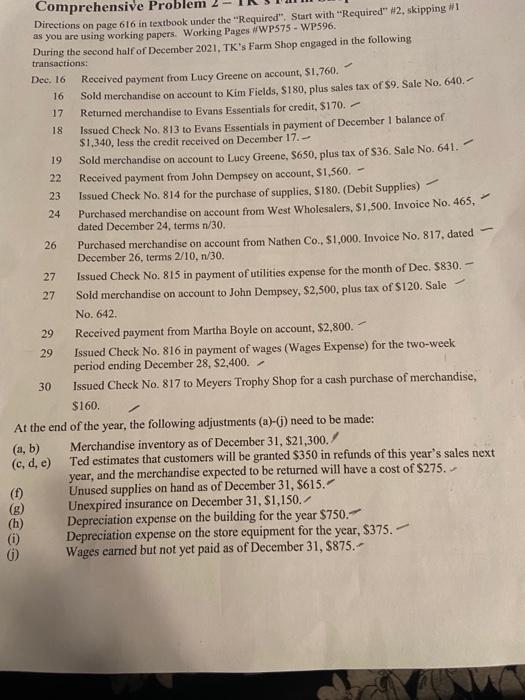

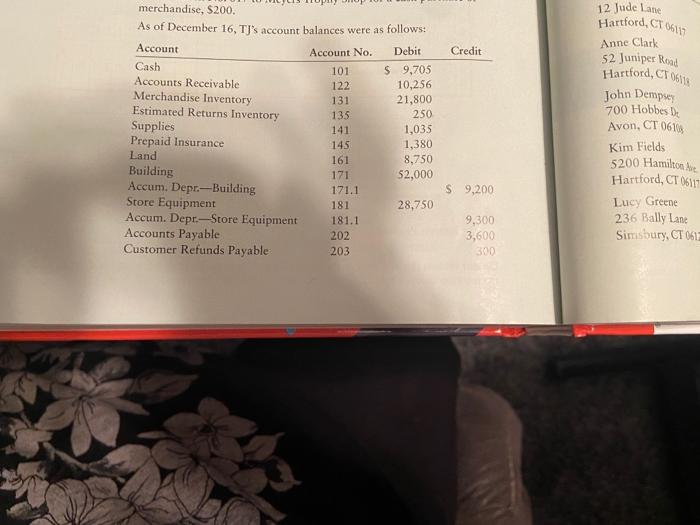

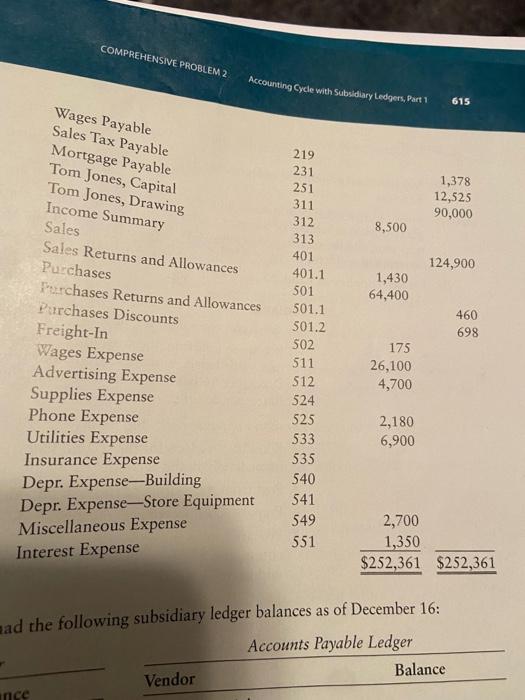

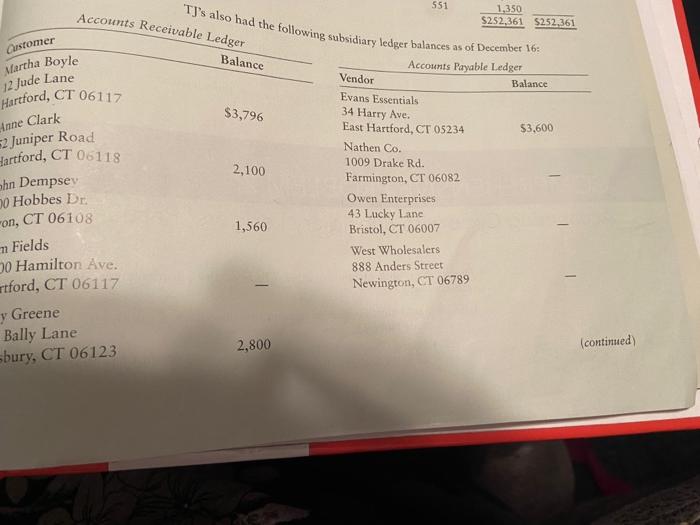

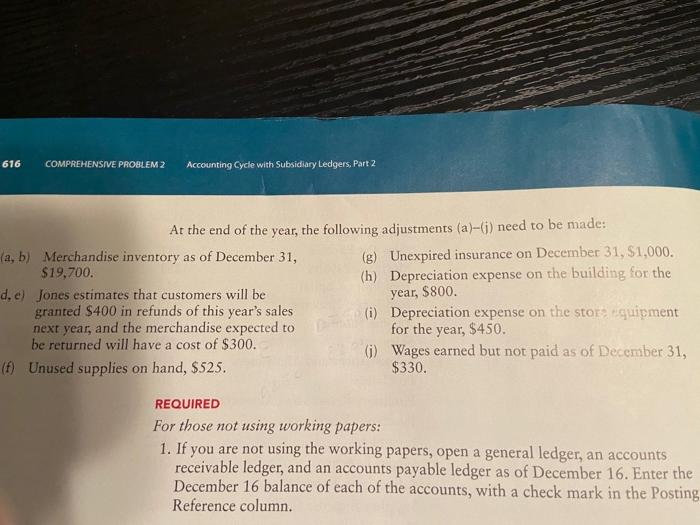

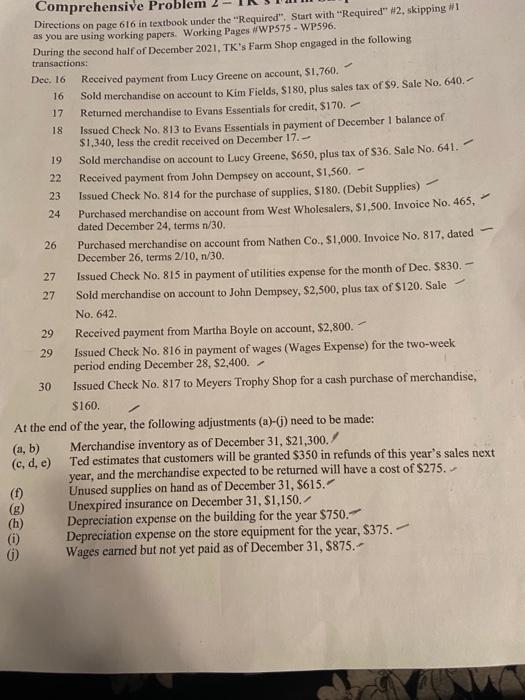

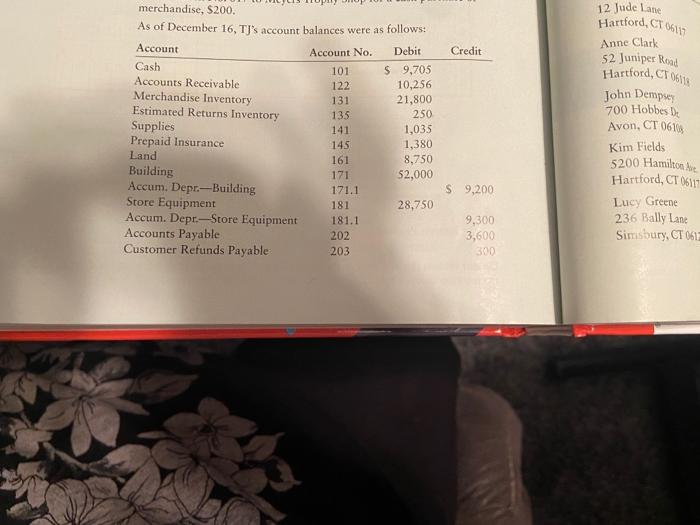

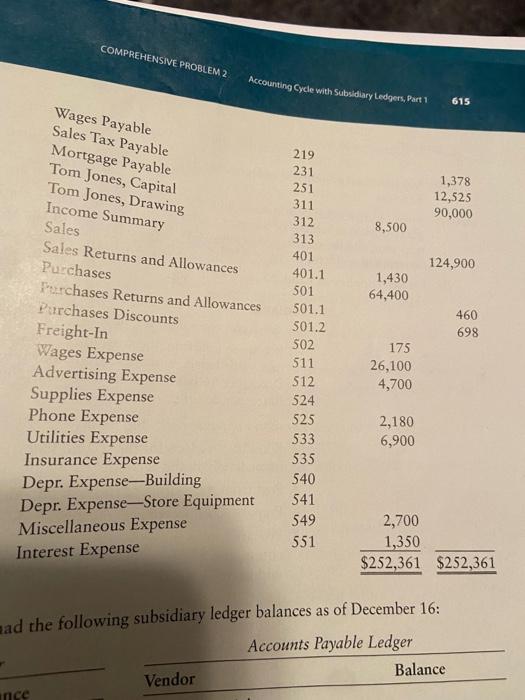

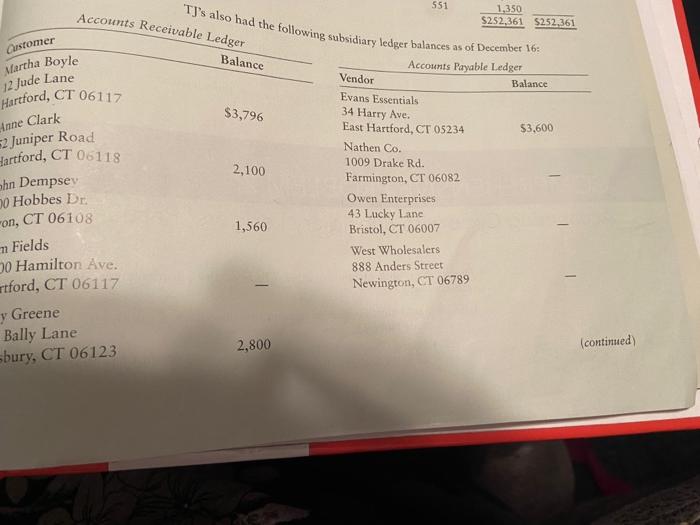

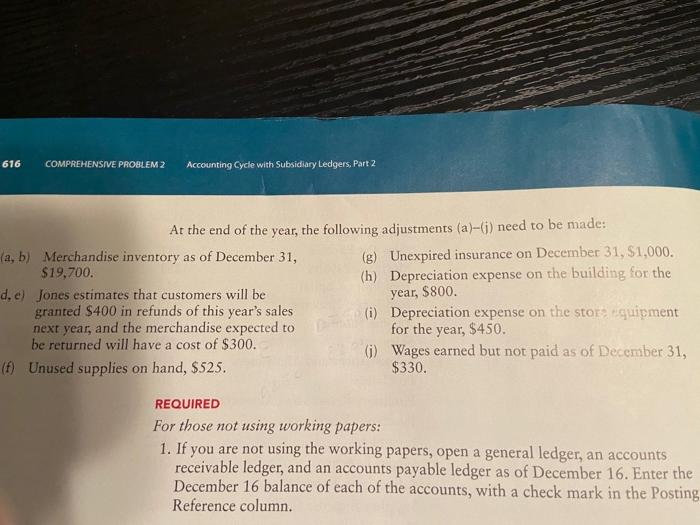

24 Comprehensive Problem Directions on page 616 in textbook under the "Required". Start with "Required" #2. skipping 1 as you are using working papers. Working Pages #WP575 - WP596. During the second half of December 2021, TK's Farm Shop engaged in the following transactions: Dec. 16 Received payment from Lucy Greene on account, $1.760. 16 Sold merchandise on account to Kim Fields, S180, plus sales tax of $9. Sale No. 640. 17 Retumed merchandise to Evans Essentials for credit, $170. 18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,340, less the credit received on December 17. - 19 Sold merchandise on account to Lucy Greene, 650plus tax of $36. Sale No. 641. 22 Received payment from John Dempsey on account, $1,560. 23 Issued Check No. 814 for the purchase of supplies, S180. (Debit Supplies) Purchased merchandise on account from West Wholesalers, $1.500. Invoice No. 465, dated December 24, terms n/30. 26 Purchased merchandise on account from Nathen Co., $1,000. Invoice No. 817, dated December 26, terms 2/10, n/30. 27 Issued Check No. 815 in payment of utilities expense for the month of Dec. $830. 27 Sold merchandise on account to John Dempsey, $2,500, plus tax of $120. Sale No. 642 29 Received payment from Martha Boyle on account, $2,800. 29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $2,400.- 30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $160. At the end of the year, the following adjustments (a)-() need to be made: (a, b) Merchandise inventory as of December 31, $21,300. (c,d,e) Ted estimates that customers will be granted $350 in refunds of this year's sales next year, and the merchandise expected to be returned will have a cost of $275. Unused supplies on hand as of December 31, $615. Unexpired insurance on December 31, $1,150. (h) Depreciation expense on the building for the year $750.- (0) Depreciation expense on the store equipment for the year, $375. ) Wages earned but not yet paid as of December 31, $875. 12 Jude Lane Hartford, CT 06 Credit Merchandise Inventory merchandise, $200. As of December 16, TJ's account balances were as follows: Account Account No. Debit Cash 101 S 9,705 Accounts Receivable 122 10,256 131 21,800 Estimated Returns Inventory 135 250 Supplies 141 1,035 Prepaid Insurance 145 1,380 Land 161 8,750 Building 171 52,000 Accum. Depr.-Building 171.1 Store Equipment 181 28,750 Accum. Depr.-Store Equipment 181.1 Accounts Payable 202 Customer Refunds Payable 203 Anne Clark 52 Juniper Road Hartford, CT 06118 John Dempsey 700 Hobbes De Avon, CT 0610 Kim Fields 5200 Hamilton Hartford, CT 06111 Lucy Greene 236 Bally Lane Simsbury, CT 06 S 9,200 9,300 3,600 300 COMPREHENSIVE PROBLEM 2 Accounting Cycle with Subsidiary Ledgers, Part 1 615 Wages Payable Sales Tax Payable Mortgage Payable Tom Jones, Capital Tom Jones, Drawing Income Summary 219 231 251 311 1,378 12,525 90,000 8,500 124,900 Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight-In Wages Expense Advertising Expense 1,430 64,400 460 698 312 313 401 401.1 501 501.1 501.2 502 511 512 524 525 533 535 540 541 549 551 175 26,100 4,700 2,180 6,900 Supplies Expense Phone Expense Utilities Expense Insurance Expense Depr. Expense-Building Depr. Expense-Store Equipment Miscellaneous Expense Interest Expense 2,700 1,350 $252,361 $252,361 nad the following subsidiary ledger balances as of December 16: Accounts Payable Ledger Vendor Balance ince Accounts Receivable Ledger Balance Customer Martha Boyle 12 Jude Lane 551 1.350 $252,361 5252,361 Ty's also had the following subsidiary ledger balances as of December 16 Accounts Payable Ledger Vendor Balance Evans Essentials 34 Harry Ave. East Hartford, CT 05234 Nathen Co. 1009 Drake Rd. 2,100 Hartford, CT 06117 $3,796 Anne Clark 53,600 2 Juniper Road Hartford, CT 06118 ohn Dempsey 50 Hobbes Dr. mon, CT 06108 1,560 Farmington, CT 06082 Owen Enterprises 43 Lucky Lane Bristol, CT 06007 West Wholesalers 888 Anders Street Newington, CT 06789 m Fields 0 Hamilton Ave. utford, CT 06117 y Greene Bally Lane sbury, CT 06123 2,800 continued 616 COMPREHENSIVE PROBLEM 2 Accounting Cycle with Subsidiary Ledgers, Part 2 At the end of the year, the following adjustments (a)-(i) need to be made: (a, b) Merchandise inventory as of December 31, (g) Unexpired insurance on December 31, $1,000. $19.700. (h) Depreciation expense on the building for the d. e) Jones estimates that customers will be granted $400 in refunds of this year's sales (i) Depreciation expense on the store equipment next year, and the merchandise expected to for the year, $450. be returned will have a cost of $300. 6) Wages earned but not paid as of December 31, ( Unused supplies on hand, $525. $330. year, $800. REQUIRED For those not using working papers: 1. If you are not using the working papers, open a general ledger, an accounts receivable ledger, and an accounts payable ledger as of December 16. Enter the December 16 balance of each of the accounts, with a check mark in the Posting Reference column. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started