Answered step by step

Verified Expert Solution

Question

1 Approved Answer

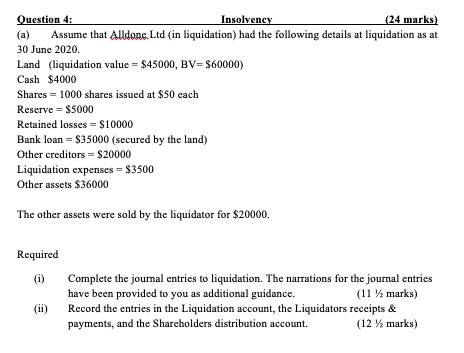

Can someone help with this please Question 4: Insolvency (24 marks) (a) Assume that Alldone Ltd (in liquidation) had the following details at liquidation as

Can someone help with this please

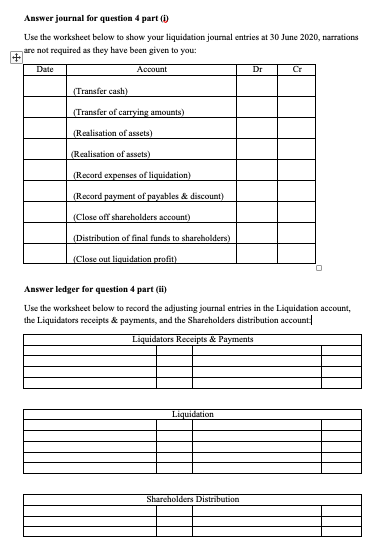

Question 4: Insolvency (24 marks) (a) Assume that Alldone Ltd (in liquidation) had the following details at liquidation as at 30 June 2020. Land (liquidation value =$45000,BV=$60000 ) Cash $4000 Shares =1000 shares issued at $50 each Reserve =$5000 Retained losses =$10000 Bank loan =$35000 (secured by the land) Other creditors =$20000 Liquidation expenses =$3500 Other assets $36000 The other assets were sold by the liquidator for $20000. Required (i) Complete the journal entries to liquidation. The narrations for the journal entries have been provided to you as additional guidance. (11 1/2 marks) (ii) Record the entries in the Liquidation account, the Liquidators receipts \& payments, and the Shareholders distribution account. (12 1/2 marks) Answer journal for question 4 part (i) Use the worksheet below to show your liquidation journal entries at 30 June 2020 , narrations are not required as they have been given to you: Answer ledger for question 4 part (ii) Use the worksheet below to record the adjusting journal entries in the Liquidation account, the Liquidators receipts \& payments, and the Shareholders distribution account Question 4: Insolvency (24 marks) (a) Assume that Alldone Ltd (in liquidation) had the following details at liquidation as at 30 June 2020. Land (liquidation value =$45000,BV=$60000 ) Cash $4000 Shares =1000 shares issued at $50 each Reserve =$5000 Retained losses =$10000 Bank loan =$35000 (secured by the land) Other creditors =$20000 Liquidation expenses =$3500 Other assets $36000 The other assets were sold by the liquidator for $20000. Required (i) Complete the journal entries to liquidation. The narrations for the journal entries have been provided to you as additional guidance. (11 1/2 marks) (ii) Record the entries in the Liquidation account, the Liquidators receipts \& payments, and the Shareholders distribution account. (12 1/2 marks) Answer journal for question 4 part (i) Use the worksheet below to show your liquidation journal entries at 30 June 2020 , narrations are not required as they have been given to you: Answer ledger for question 4 part (ii) Use the worksheet below to record the adjusting journal entries in the Liquidation account, the Liquidators receipts \& payments, and the Shareholders distribution accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started