Answered step by step

Verified Expert Solution

Question

1 Approved Answer

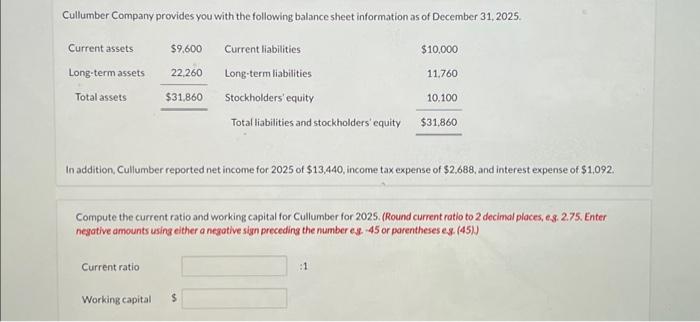

Can someone olease help with all the steps im this please im just a bit confused, thank you. Cullumber Company provides you with the following

Can someone olease help with all the steps im this please im just a bit confused, thank you.

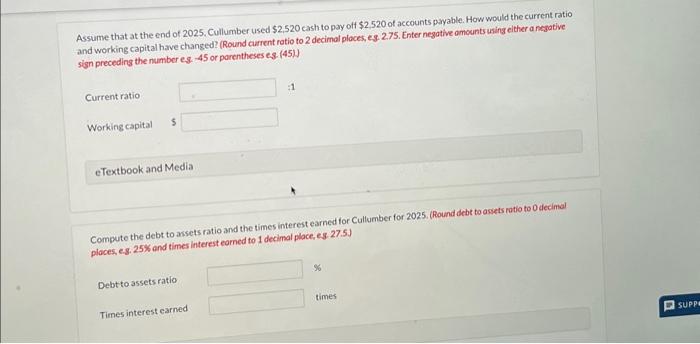

Cullumber Company provides you with the following balance sheet information as of December 31, 2025. Current assets Long-term assets Total assets $9,600 Current ratio 22,260 Working capital $31,860 Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $ $10,000 In addition, Cullumber reported net income for 2025 of $13,440, income tax expense of $2,688, and interest expense of $1,092. 11,760 Compute the current ratio and working capital for Cullumber for 2025. (Round current ratio to 2 decimal places, e.g. 2.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) :1 10,100 $31,860

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started