Can someone please answer all the question and explain them.

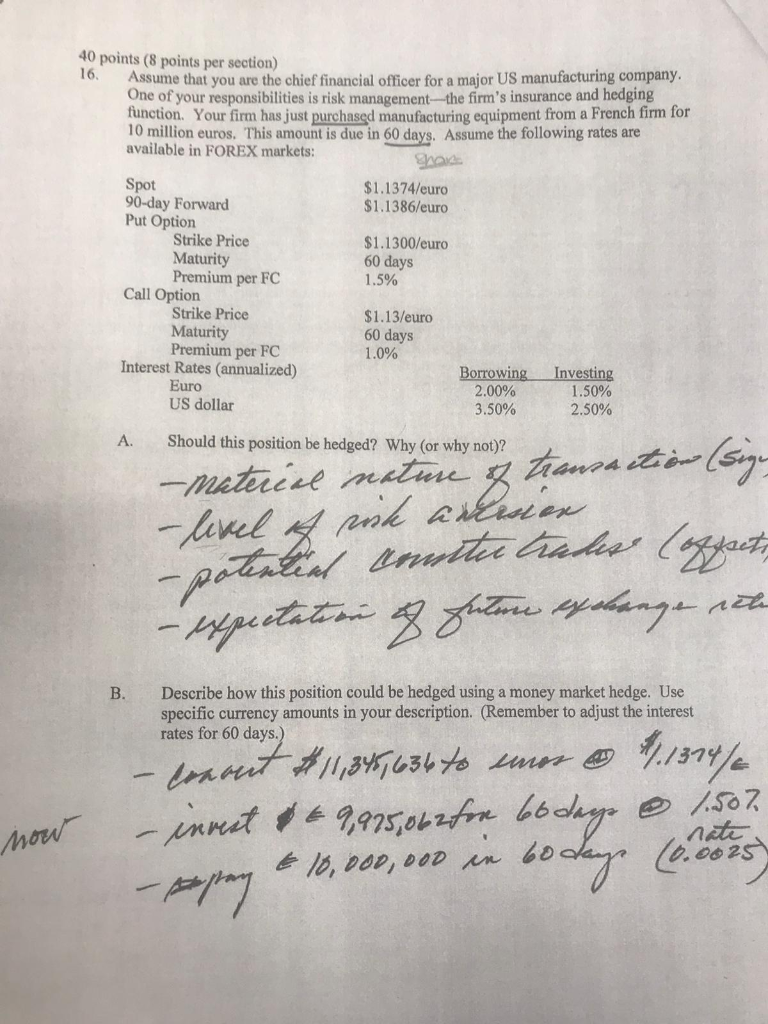

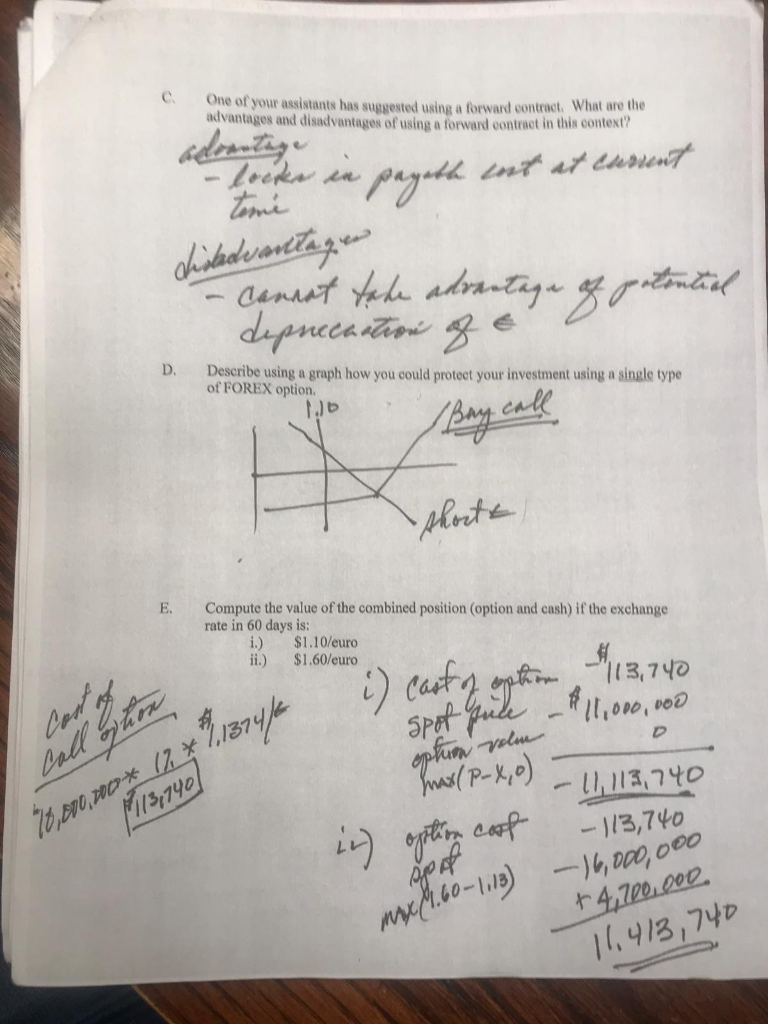

40 points (8 points per section) Assume that you are the chief financial officer for a major US manufacturing company. 16, One of your responsibilities is risk management-the firm's insurance and hedging function. Your firm has just purchased manufacturing equipment from a French firm for 10 million euros. This amount is due in 60 days. Assume the following rates are available in FOREX markets: Spot 90-day Forward Put Option $1.1374/euro $1.1386/euro Strike Price Maturity Premium per FC $1.1300/euro 60 days 1.5% Call Option Strike Price $1.13/euro 60 days 1.0% Maturity Premium per FC Interest Rates (annualized) Euro US dollar Borrowing 2.00% 3.50% Investing 1.50% 2.50% Should this position be hedged? Why (or why not)? A. tranoa -materene mtue -petalinl ta adee (t -ypitatni n Describe how this position could be hedged using a money market hedge. Use specific currency amounts in your description. (Remember to adjust the interest rates for 60 days.) . - aut 3 nite 10, DOD, DOD PIT) C. One of your assistants has suggested using a forward contract. What are the advantages and disadvantages of using a forward contract in this context adcetey Leeka n paye temi int at eusrunt hiskdk raretog depneca e D. Describe using a graph how you could protect your investment using a single type of FOREX option. Bay cade plrte E. Compute the value of the combined position (option and cash) if the exchange rate in 60 days is: i.) ii. $1.10/euro $1,60/euro Oed Dall girn Casty p s,740 5pat udell,on0, seD optinan elm Jwas P-o) -1/3,740 +4,700 000 14.413,740 40 points (8 points per section) Assume that you are the chief financial officer for a major US manufacturing company. 16, One of your responsibilities is risk management-the firm's insurance and hedging function. Your firm has just purchased manufacturing equipment from a French firm for 10 million euros. This amount is due in 60 days. Assume the following rates are available in FOREX markets: Spot 90-day Forward Put Option $1.1374/euro $1.1386/euro Strike Price Maturity Premium per FC $1.1300/euro 60 days 1.5% Call Option Strike Price $1.13/euro 60 days 1.0% Maturity Premium per FC Interest Rates (annualized) Euro US dollar Borrowing 2.00% 3.50% Investing 1.50% 2.50% Should this position be hedged? Why (or why not)? A. tranoa -materene mtue -petalinl ta adee (t -ypitatni n Describe how this position could be hedged using a money market hedge. Use specific currency amounts in your description. (Remember to adjust the interest rates for 60 days.) . - aut 3 nite 10, DOD, DOD PIT) C. One of your assistants has suggested using a forward contract. What are the advantages and disadvantages of using a forward contract in this context adcetey Leeka n paye temi int at eusrunt hiskdk raretog depneca e D. Describe using a graph how you could protect your investment using a single type of FOREX option. Bay cade plrte E. Compute the value of the combined position (option and cash) if the exchange rate in 60 days is: i.) ii. $1.10/euro $1,60/euro Oed Dall girn Casty p s,740 5pat udell,on0, seD optinan elm Jwas P-o) -1/3,740 +4,700 000 14.413,740