Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please answer these questions asap 1.Which of the following is an example of capital expenditure? a) Paying for refurbishment as part of upgrading

can someone please answer these questions asap

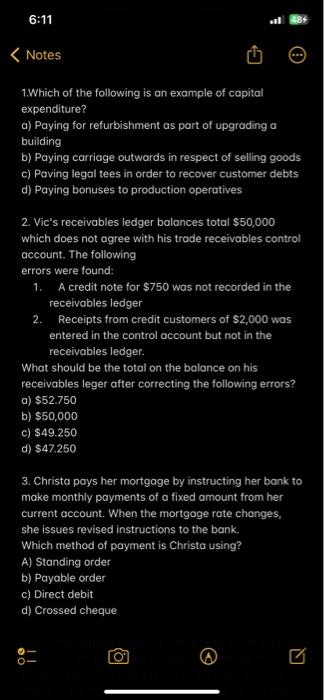

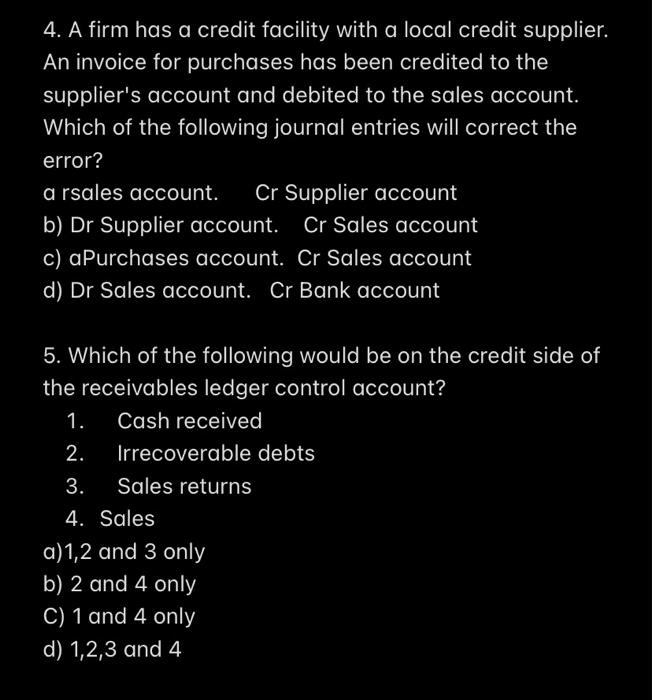

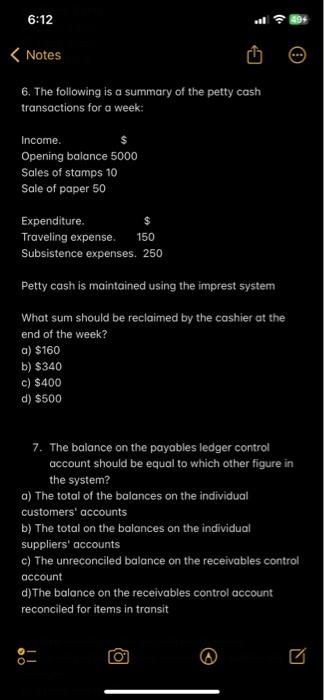

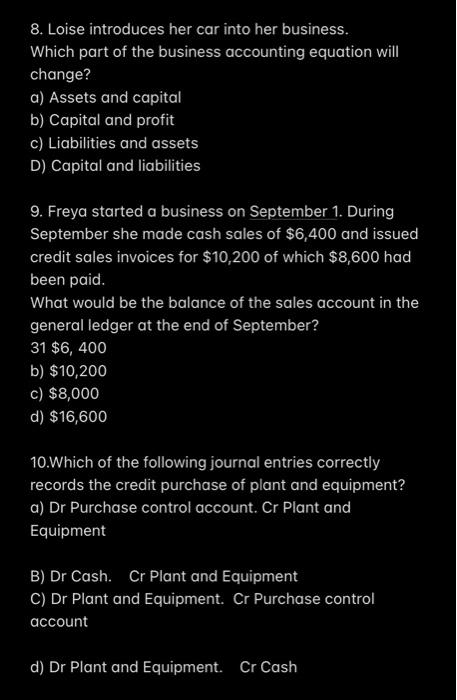

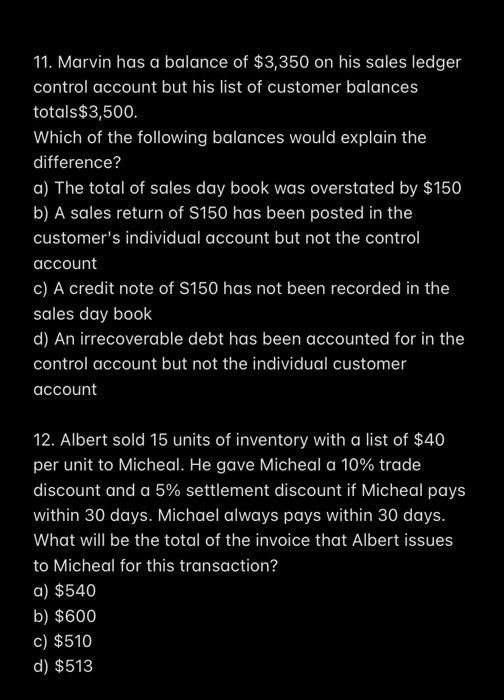

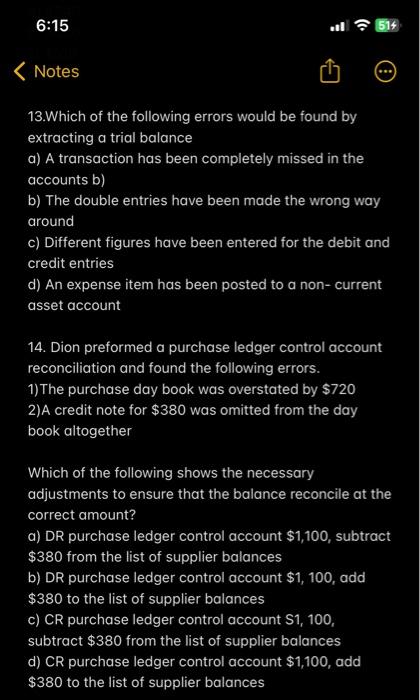

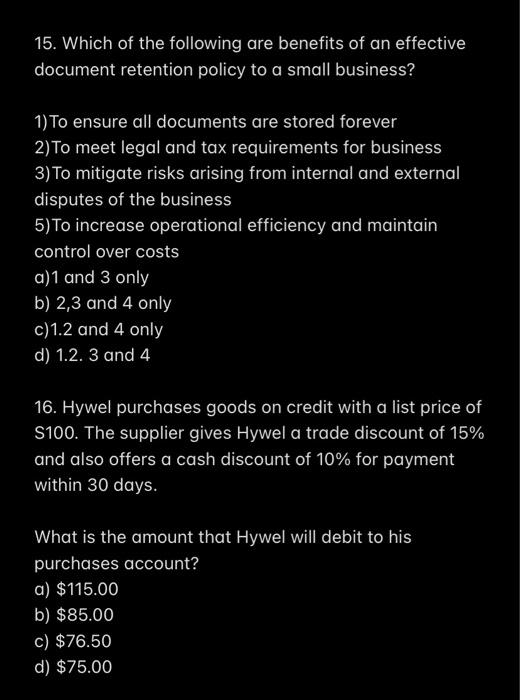

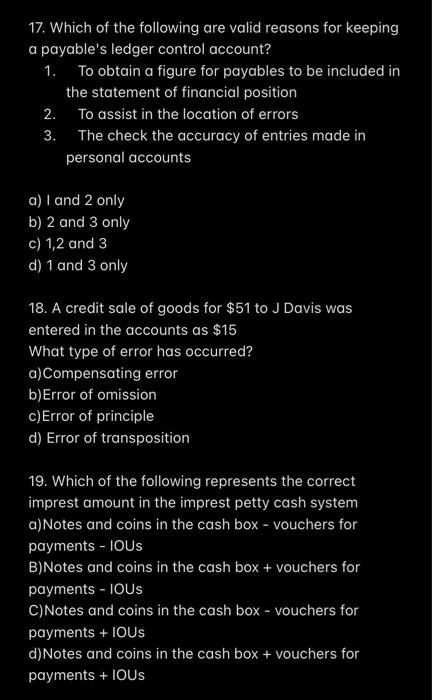

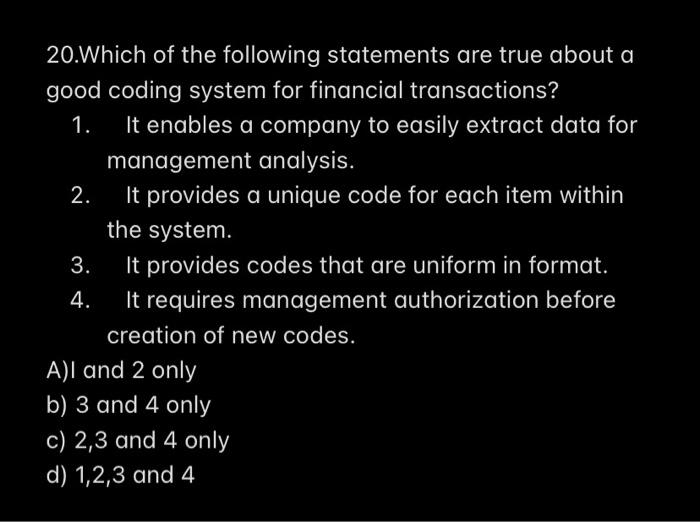

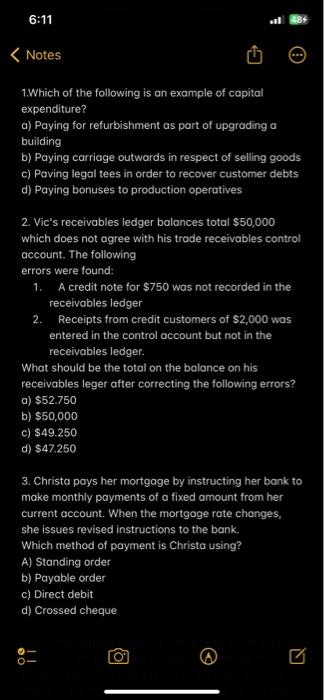

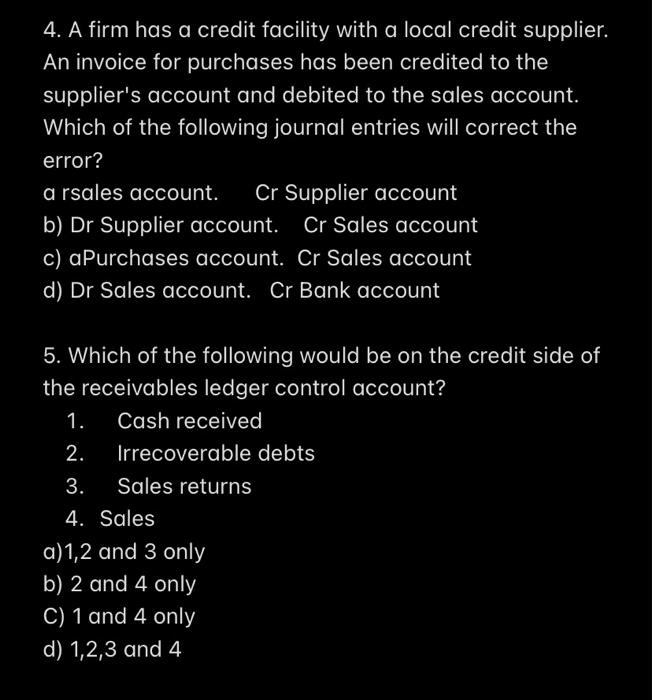

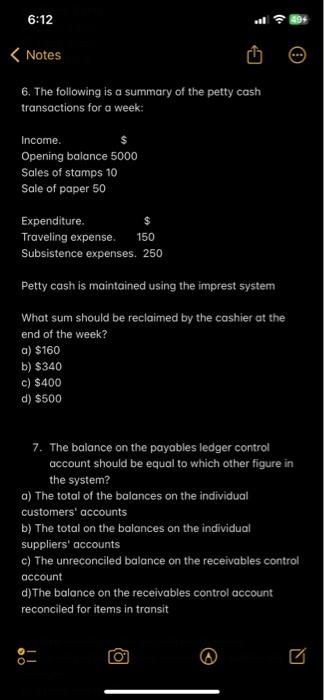

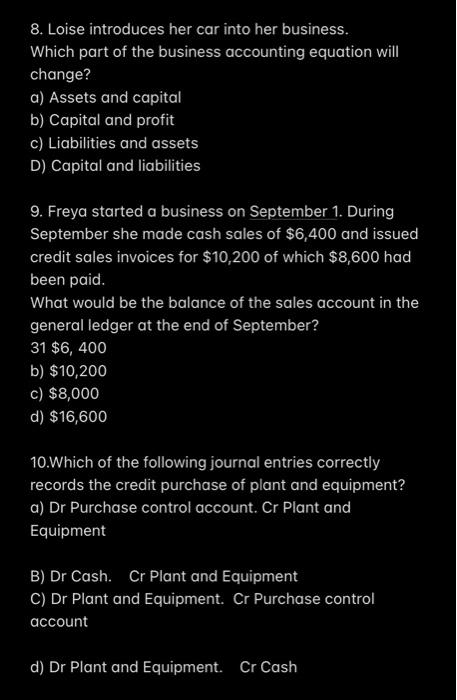

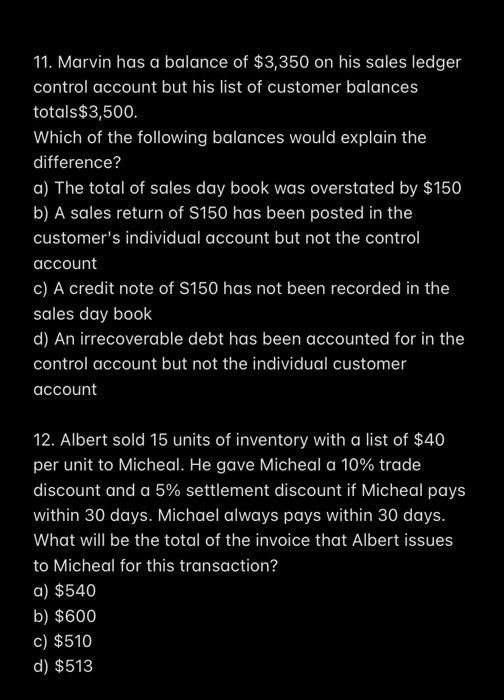

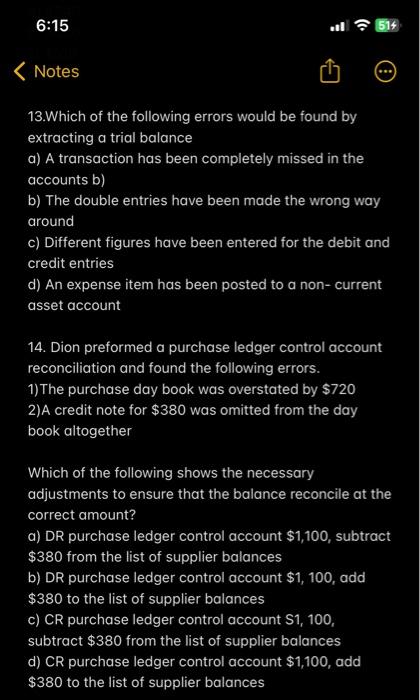

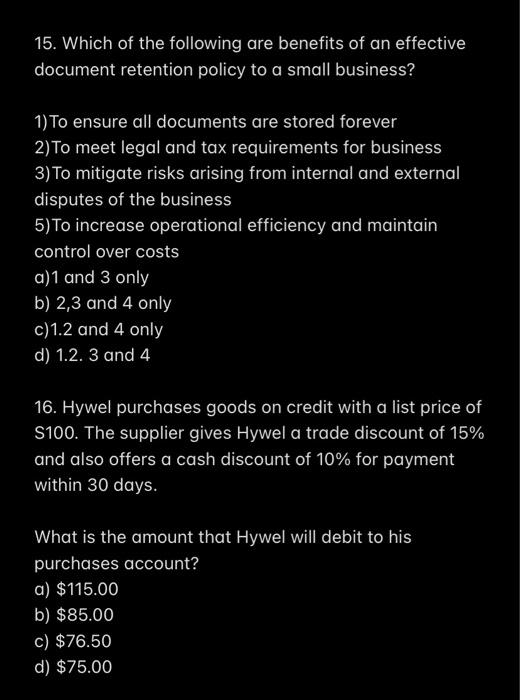

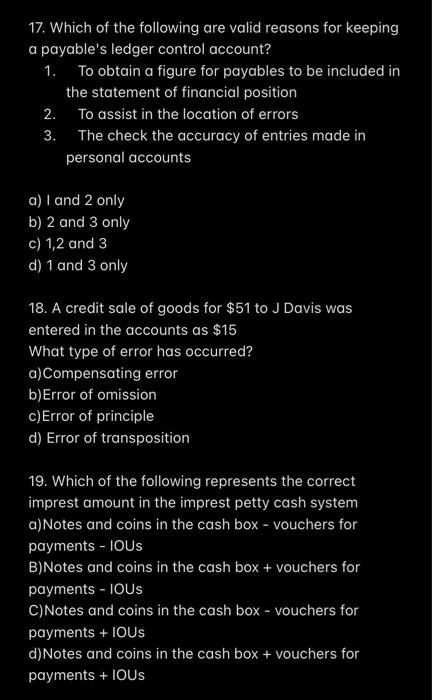

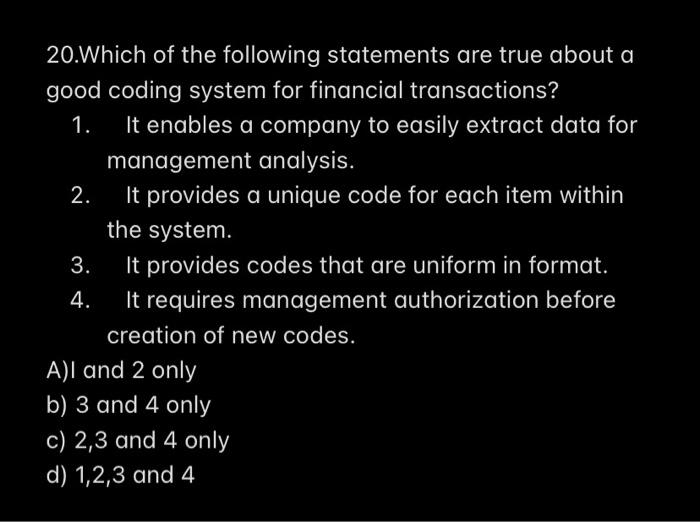

1.Which of the following is an example of capital expenditure? a) Paying for refurbishment as part of upgrading a building b) Paying carriage outwards in respect of selling goods c) Paving legal tees in order to recover customer debts d) Paying bonuses to production operatives 2. Vic's receivables ledger balances total $50,000 which does not agree with his trade receivables control account. The following errors were found: 1. A credit note for $750 was not recorded in the receivables ledger 2. Receipts from credit customers of $2,000 was entered in the control account but not in the receivables ledger. What should be the total on the balance on his receivables leger after correcting the following errors? a) $52.750 b) $50,000 c) $49.250 d) $47.250 3. Christa pays her mortgage by instructing her bank to make monthly payments of a fixed amount from her current account. When the mortgage rate changes, she issues revised instructions to the bank. Which method of payment is Christa using? A) Standing order b) Payable order c) Direct debit d) Crossed cheque 4. A firm has a credit facility with a local credit supplier. An invoice for purchases has been credited to the supplier's account and debited to the sales account. Which of the following journal entries will correct the error? a rsales account. Cr Supplier account b) Dr Supplier account. Cr Sales account c) aPurchases account. Cr Sales account d) Dr Sales account. Cr Bank account 5. Which of the following would be on the credit side of the receivables ledger control account? 1. Cash received 2. Irrecoverable debts 3. Sales returns 4. Sales a) 1,2 and 3 only b) 2 and 4 only C) 1 and 4 only d) 1,2,3 and 4 6. The following is a summary of the petty cash transactions for a week: Income. Opening balance 5000 Sales of stamps 10 Sale of paper 50 Expenditure.Travelingexpense.$150 Subsistence expenses. 250 Petty cash is maintained using the imprest system What sum should be reclaimed by the cashier at the end of the week? a) $160 b) $340 c) $400 d) $500 7. The balance on the payables ledger control account should be equal to which other figure in the system? a) The total of the balances on the individual customers' accounts b) The total on the balances on the individual suppliers' accounts c) The unreconciled balance on the receivables control account d) The balance on the receivables control account reconciled for items in transit 8. Loise introduces her car into her business. Which part of the business accounting equation will change? a) Assets and capital b) Capital and profit c) Liabilities and assets D) Capital and liabilities 9. Freya started a business on September 1. During September she made cash sales of $6,400 and issued credit sales invoices for $10,200 of which $8,600 had been paid. What would be the balance of the sales account in the general ledger at the end of September? 31$6,400 b) $10,200 c) $8,000 d) $16,600 10.Which of the following journal entries correctly records the credit purchase of plant and equipment? a) Dr Purchase control account. Cr Plant and Equipment B) Dr Cash. Cr Plant and Equipment C) Dr Plant and Equipment. Cr Purchase control account 12. Albert sold 15 units of inventory with a list of $40 per unit to Micheal. He gave Micheal a 10% trade discount and a 5% settlement discount if Micheal pays within 30 days. Michael always pays within 30 days. What will be the total of the invoice that Albert issues to Micheal for this transaction? a) $540 b) $600 c) $510 d) $513 13. Which of the following errors would be found by extracting a trial balance a) A transaction has been completely missed in the accounts b) b) The double entries have been made the wrong way around c) Different figures have been entered for the debit and credit entries d) An expense item has been posted to a non-current asset account 14. Dion preformed a purchase ledger control account reconciliation and found the following errors. 1) The purchase day book was overstated by $720 2)A credit note for $380 was omitted from the day book altogether Which of the following shows the necessary adjustments to ensure that the balance reconcile at the correct amount? a) DR purchase ledger control account $1,100, subtract $380 from the list of supplier balances b) DR purchase ledger control account $1,100, add $380 to the list of supplier balances c) CR purchase ledger control account S1,100, subtract $380 from the list of supplier balances d) CR purchase ledger control account $1,100, add $380 to the list of supplier balances 15. Which of the following are benefits of an effective document retention policy to a small business? 1)To ensure all documents are stored forever 2)To meet legal and tax requirements for business 3)To mitigate risks arising from internal and external disputes of the business 5) To increase operational efficiency and maintain control over costs a) 1 and 3 only b) 2,3 and 4 only c) 1.2 and 4 only d) 1.2 .3 and 4 16. Hywel purchases goods on credit with a list price of S100. The supplier gives Hywel a trade discount of 15% and also offers a cash discount of 10% for payment within 30 days. What is the amount that Hywel will debit to his purchases account? a) $115.00 b) $85.00 c) $76.50 d) $75.00 17. Which of the following are valid reasons for keeping a payable's ledger control account? 1. To obtain a figure for payables to be included in the statement of financial position 2. To assist in the location of errors 3. The check the accuracy of entries made in personal accounts a) I and 2 only b) 2 and 3 only c) 1,2 and 3 d) 1 and 3 only 18. A credit sale of goods for $51 to J Davis was entered in the accounts as $15 What type of error has occurred? a)Compensating error b) Error of omission c) Error of principle d) Error of transposition 19. Which of the following represents the correct imprest amount in the imprest petty cash system a) Notes and coins in the cash box - vouchers for payments - IOUs B)Notes and coins in the cash box + vouchers for payments - IOUs C)Notes and coins in the cash box - vouchers for payments + IOUs d) Notes and coins in the cash box + vouchers for payments + IOUs 20.Which of the following statements are true about a good coding system for financial transactions? 1. It enables a company to easily extract data for management analysis. 2. It provides a unique code for each item within the system. 3. It provides codes that are uniform in format. 4. It requires management authorization before creation of new codes. A)I and 2 only b) 3 and 4 only c) 2,3 and 4 only d) 1,2,3 and 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started