Can someone please example how to complete the calculations for problem #7 parts a&b (not with excel)?

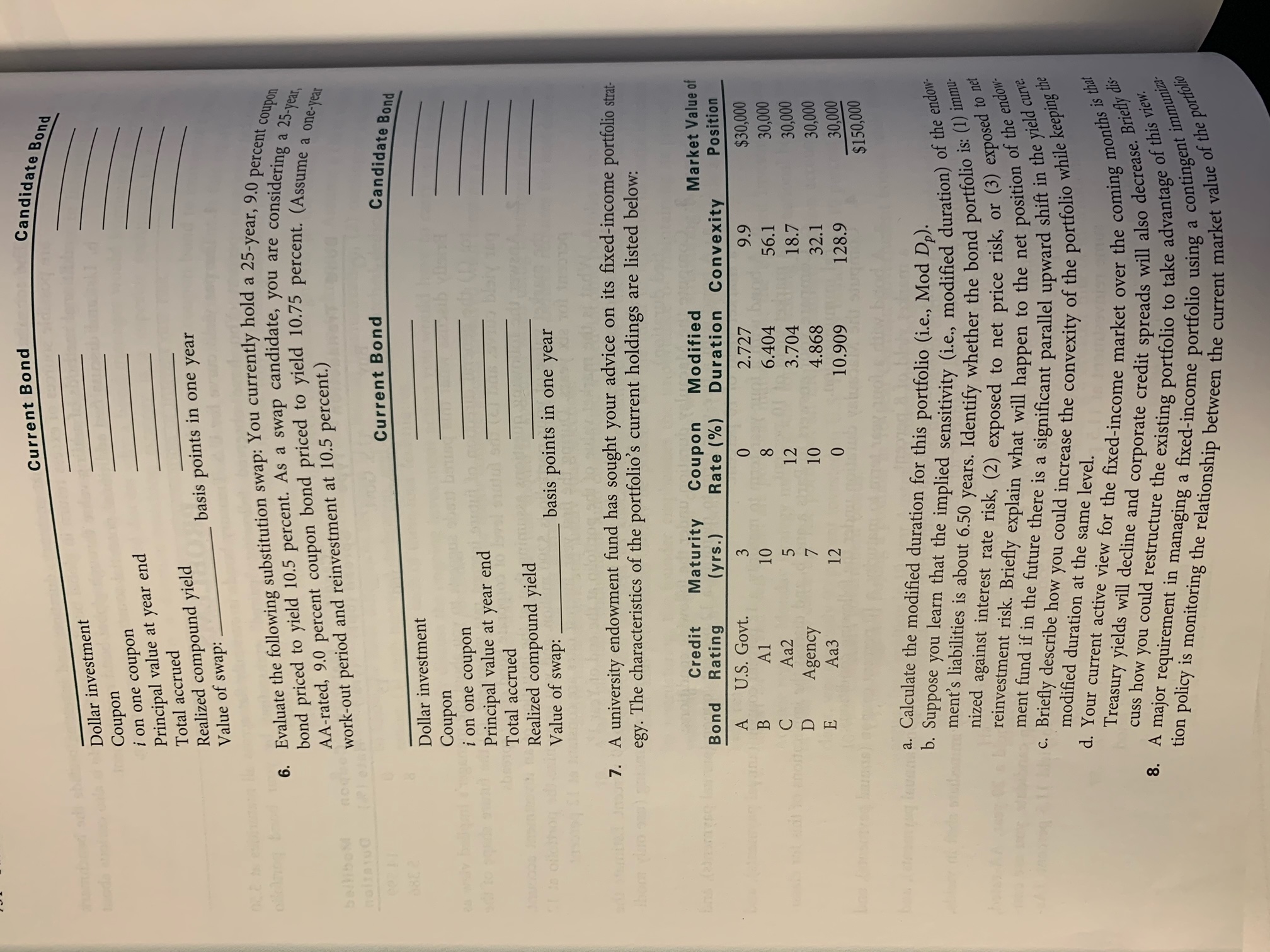

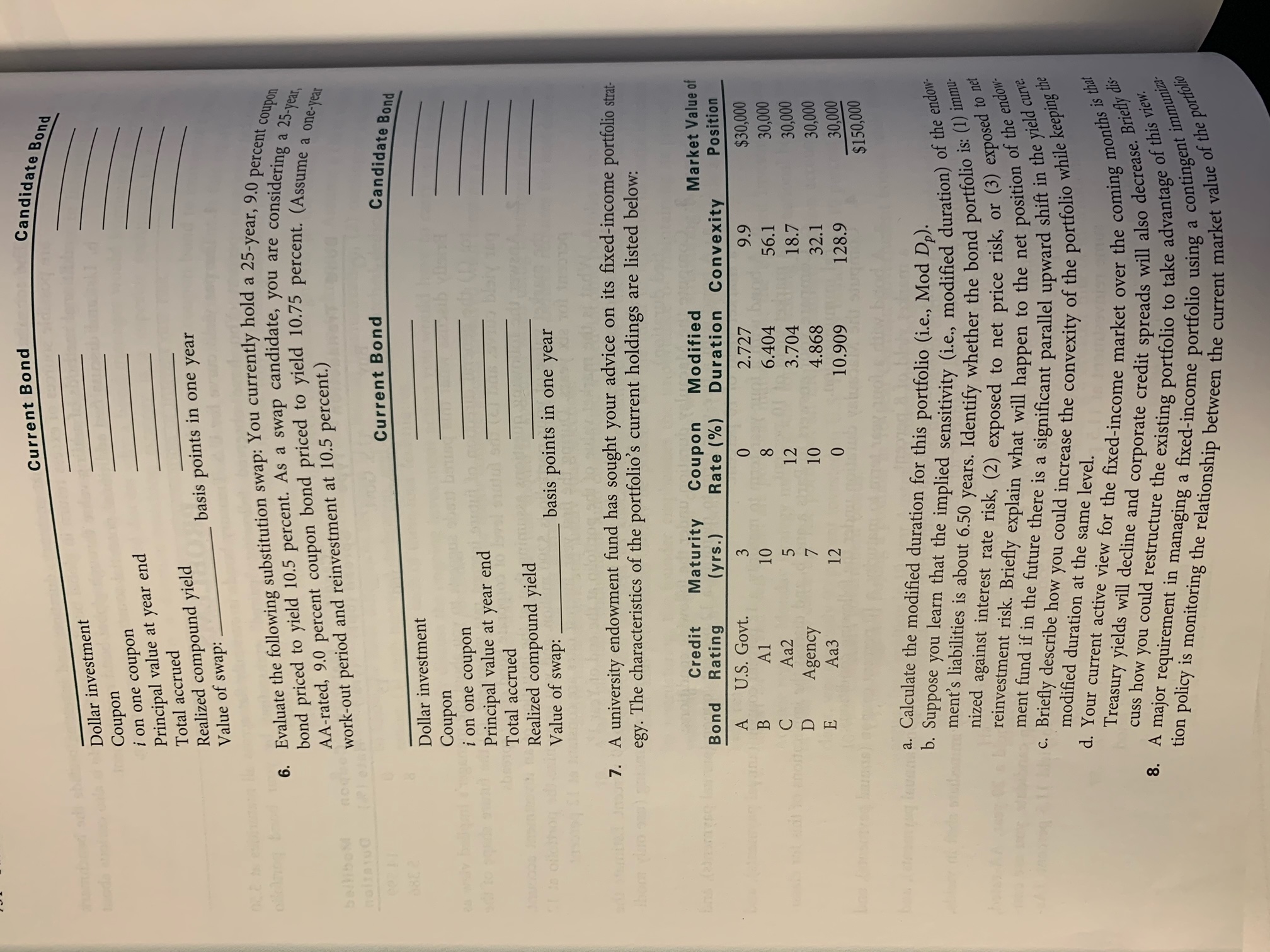

Current Bond Candidate Bond Dollar investment Coupon i on one coupon Principal value at year end Total accrued Realized compound yield Value of swap: basis points in one year bond priced to yield 10.5 percent. As a swap candidate, you are considering a 6. Evaluate the following substitution swap: You currently hold a 25-year, 9.0 percent coupon AA-rated, 9.0 percent coupon bond priced to yield 10.75 percent. (Assume a one-year 25-year, work-out period and reinvestment at 10.5 percent.) Current Bond Candidate Bond Dollar investment Coupon i on one coupon Principal value at year end Total accrued Realized compound yield Value of swap: basis points in one year 7. A university endowment fund has sought your advice on its fixed-income portfolio strat- egy. The characteristics of the portfolio's current holdings are listed below: Coupon Rate (%) Bond A 0 Credit Rating U.S. Govt. A1 Aa2 Agency Aa3 B D Maturity (yrs.) 3 10 5 7 12 Market Value of Position $30,000 30,000 30,000 Modified Duration Convexity 2.727 9.9 6.404 56.1 3.704 18.7 4.868 32.1 10.909 128.9 8 12 10 E 30,000 30,000 $150,000 a. Calculate the modified duration for this portfolio (i.e., Mod Dp). curve b. Suppose you learn that the implied sensitivity (i.e., modified duration of the endow- ment's liabilities is about 6.50 years. Identify whether the bond portfolio is: (1) immu- reinvestment risk. Briefly explain what will happen to the net position of the endow- nized against interest rate risk, (2) exposed to net price risk, or (3) exposed to net ment fund if in the future there is a significant parallel upward shift in the yield C. Briefly describe how you could increase the convexity of the portfolio while keeping the Treasury yields will decline and corporate credit spreads will also decrease. Briefly dis- d. Your current active view for the fixed-income market over the coming months is that cuss how you could restructure the existing portfolio to take advantage of this view. tion policy is monitoring the relationship between the current market value of the portfolio modified duration at the same level. immuniza contingent 8. A major requirement in managing a fixed-income portfolio using a Current Bond Candidate Bond Dollar investment Coupon i on one coupon Principal value at year end Total accrued Realized compound yield Value of swap: basis points in one year bond priced to yield 10.5 percent. As a swap candidate, you are considering a 6. Evaluate the following substitution swap: You currently hold a 25-year, 9.0 percent coupon AA-rated, 9.0 percent coupon bond priced to yield 10.75 percent. (Assume a one-year 25-year, work-out period and reinvestment at 10.5 percent.) Current Bond Candidate Bond Dollar investment Coupon i on one coupon Principal value at year end Total accrued Realized compound yield Value of swap: basis points in one year 7. A university endowment fund has sought your advice on its fixed-income portfolio strat- egy. The characteristics of the portfolio's current holdings are listed below: Coupon Rate (%) Bond A 0 Credit Rating U.S. Govt. A1 Aa2 Agency Aa3 B D Maturity (yrs.) 3 10 5 7 12 Market Value of Position $30,000 30,000 30,000 Modified Duration Convexity 2.727 9.9 6.404 56.1 3.704 18.7 4.868 32.1 10.909 128.9 8 12 10 E 30,000 30,000 $150,000 a. Calculate the modified duration for this portfolio (i.e., Mod Dp). curve b. Suppose you learn that the implied sensitivity (i.e., modified duration of the endow- ment's liabilities is about 6.50 years. Identify whether the bond portfolio is: (1) immu- reinvestment risk. Briefly explain what will happen to the net position of the endow- nized against interest rate risk, (2) exposed to net price risk, or (3) exposed to net ment fund if in the future there is a significant parallel upward shift in the yield C. Briefly describe how you could increase the convexity of the portfolio while keeping the Treasury yields will decline and corporate credit spreads will also decrease. Briefly dis- d. Your current active view for the fixed-income market over the coming months is that cuss how you could restructure the existing portfolio to take advantage of this view. tion policy is monitoring the relationship between the current market value of the portfolio modified duration at the same level. immuniza contingent 8. A major requirement in managing a fixed-income portfolio using a