Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me complete this Genereal Journal. There should be 19 Dates in toal. This is the only additional information that I can

Can someone please help me complete this Genereal Journal. There should be 19 Dates in toal.

This is the only additional information that I can provide

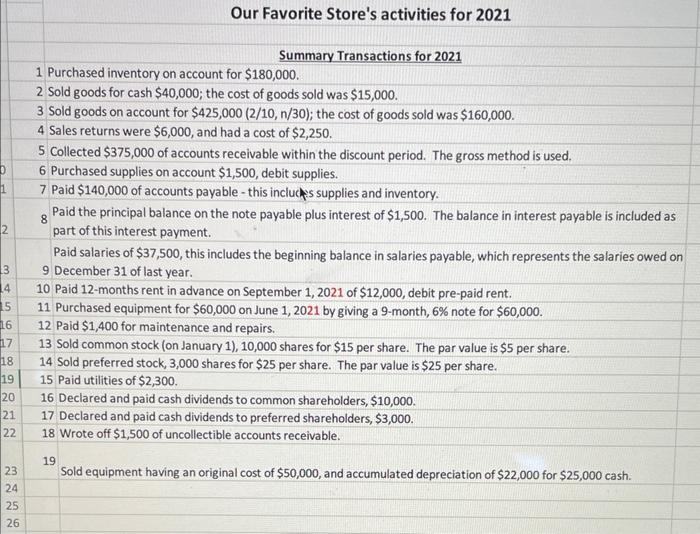

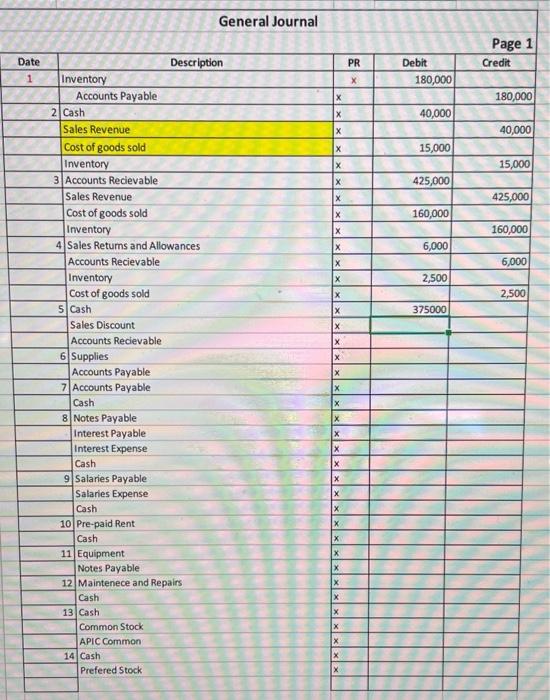

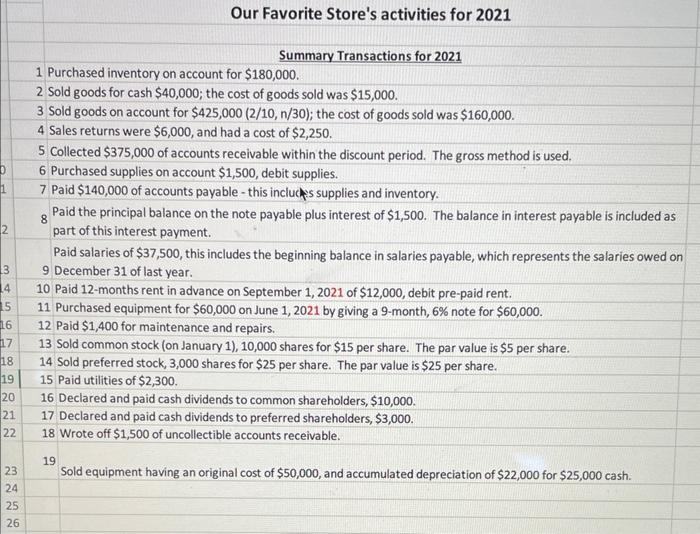

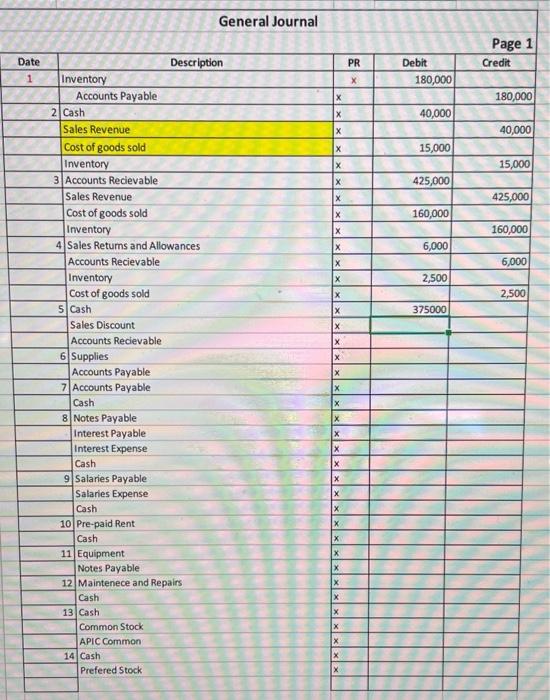

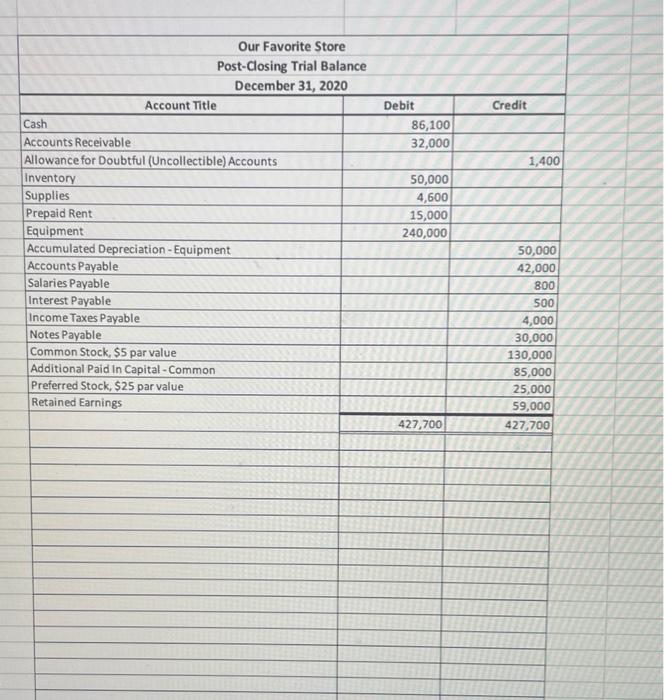

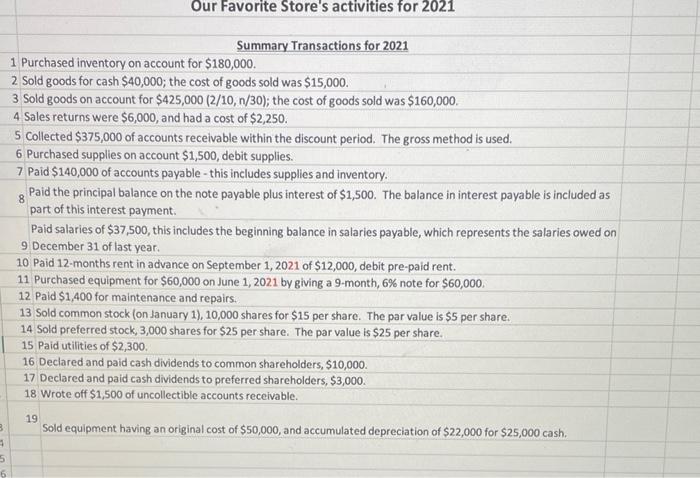

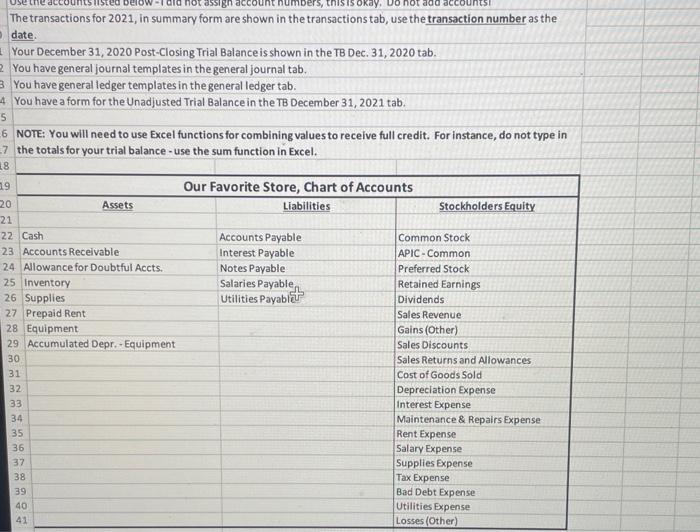

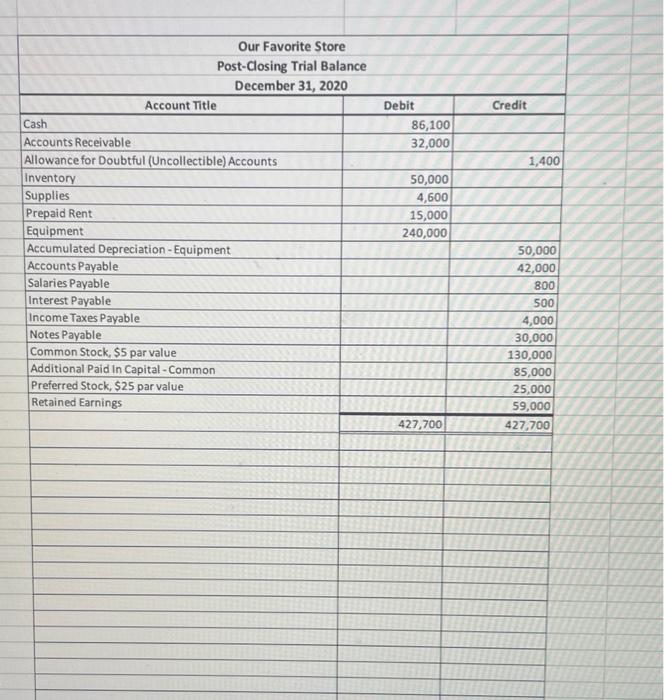

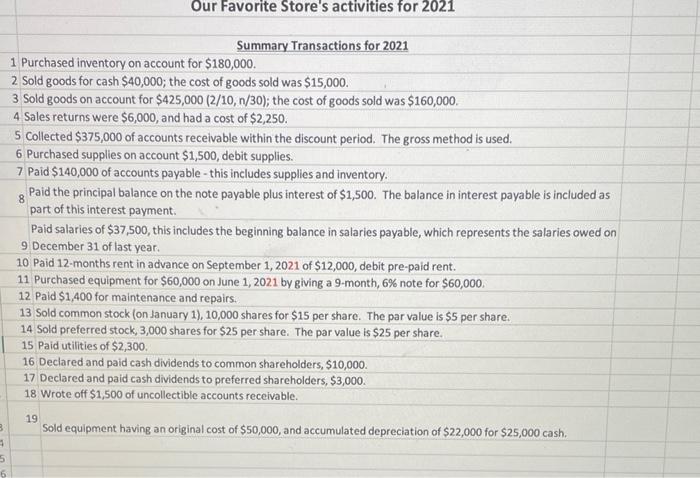

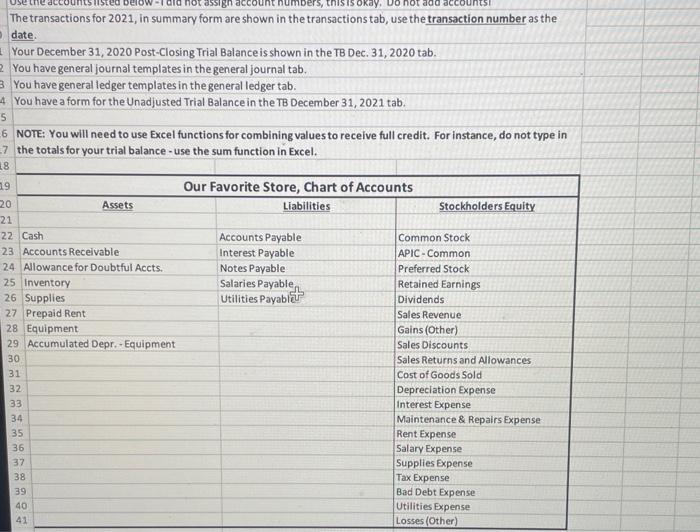

Our Favorite Store's activities for 2021 Summary Transactions for 2021 1 Purchased inventory on account for $180,000. 2 Sold goods for cash $40,000; the cost of goods sold was $15,000. 3 Sold goods on account for $425,000(2/10,n/30); the cost of goods sold was $160,000. 4 Sales returns were $6,000, and had a cost of $2,250. 5 Collected $375,000 of accounts receivable within the discount period. The gross method is used. 6 Purchased supplies on account $1,500, debit supplies. 7 Paid $140,000 of accounts payable - this incluchs supplies and inventory. 8 Paid the principal balance on the note payable plus interest of $1,500. The balance in interest payable is included as part of this interest payment. Paid salaries of $37,500, this includes the beginning balance in salaries payable, which represents the salaries owed on 9 December 31 of last year. 10 Paid 12-months rent in advance on September 1,2021 of $12,000, debit pre-paid rent. 11 Purchased equipment for $60,000 on June 1,2021 by giving a 9 -month, 6% note for $60,000. 12 Paid $1,400 for maintenance and repairs. 13 Sold common stock (on January 1), 10,000 shares for $15 per share. The par value is $5 per share. 14 Sold preferred stock, 3,000 shares for $25 per share. The par value is $25 per share. 15 Paid utilities of $2,300. 16 Declared and paid cash dividends to common shareholders, $10,000. 17 Declared and paid cash dividends to preferred shareholders, $3,000. 18 Wrote off $1,500 of uncollectible accounts receivable. 19 Sold equipment having an original cost of $50,000, and accumulated depreciation of $22,000 for $25,000 cash. Our Favorite Store Our Favorite Store's activities for 2021 1 Purchased inventory on account for $180,000. 2 Sold goods for cash $40,000; the cost of goods sold was $15,000. 3 Sold goods on account for $425,000(2/10,n/30); the cost of goods sold was $160,000. 4 Sales returns were $6,000, and had a cost of $2,250. 5 Collected $375,000 of accounts receivable within the discount period. The gross method is used. 6 Purchased supplies on account \$1,500, debit supplies. 7 Paid $140,000 of accounts payable - this includes supplies and inventory. 8 Paid the principal balance on the note payable plus interest of $1,500. The balance in interest payable is included as part of this interest payment. Paid salaries of $37,500, this includes the beginning balance in salaries payable, which represents the salaries owed on 9 December 31 of last year. 10 Paid 12 -months rent in advance on September 1, 2021 of $12,000, debit pre-paid rent. 11 Purchased equipment for $60,000 on June 1,2021 by giving a 9-month, 6% note for $60,000. 12 Paid $1,400 for maintenance and repairs. 13 Sold common stock (on January 1), 10,000 shares for $15 per share. The par value is $5 per share. 14 Sold preferred stock, 3,000 shares for $25 per share. The par value is $25 per share. 15 Paid utilities of $2,300. 16 Declared and paid cash dividends to common shareholders, $10,000. 17 Declared and paid cash dividends to preferred shareholders, $3,000. 18 Wrote off $1,500 of uncollectible accounts receivable. 19 Sold equipment having an original cost of $50,000, and accumulated depreciation of $22,000 for $25,000 cash. The transactions for 2021 , in summary form are shown in the transactions tab, use the transaction number as the date. Your December 31,2020 Post-Closing Trial Balance is shown in the TB Dec. 31, 2020 tab. You have general journal templates in the general journal tab. You have general ledger templates in the general ledger tab. You have a form for the Unadjusted Trial Balance in the TB December 31, 2021 tab. NOTE: You will need to use Excel functions for combining values to receive full credit. For instance, do not type in the totals for your trial balance - use the sum function in Excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started