can someone please help me on this?

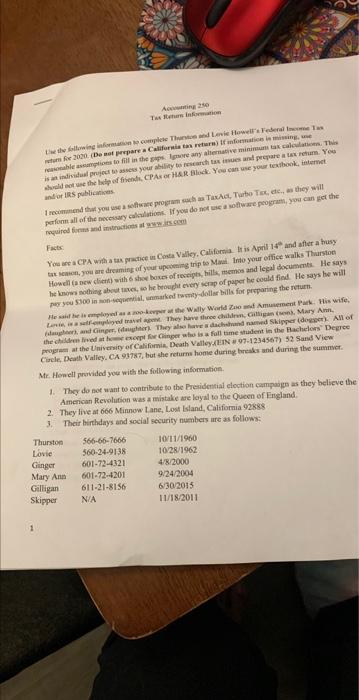

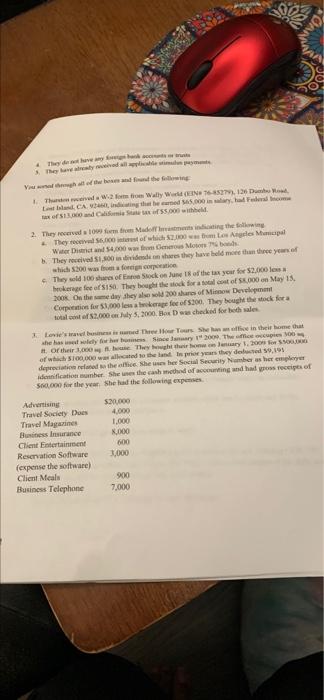

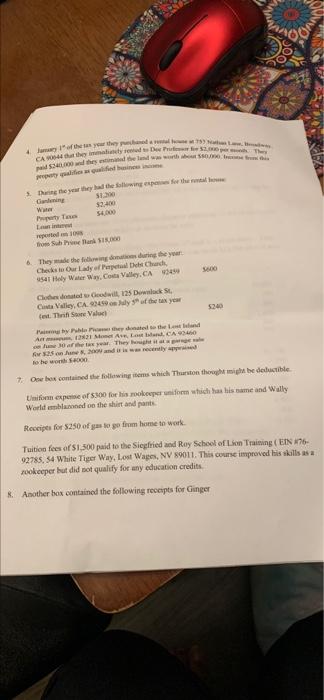

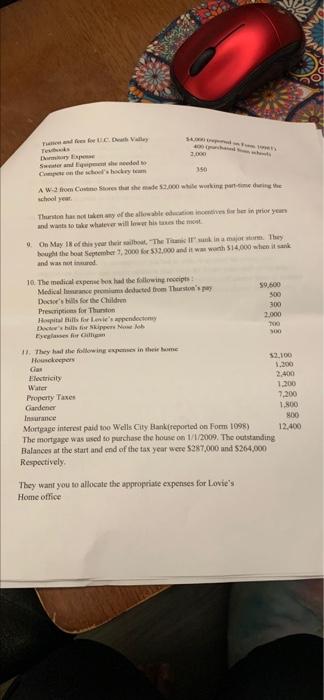

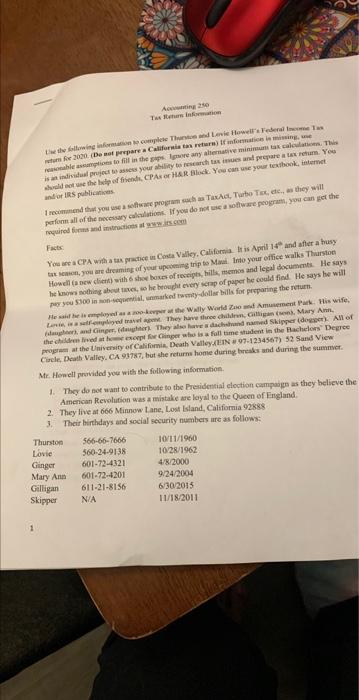

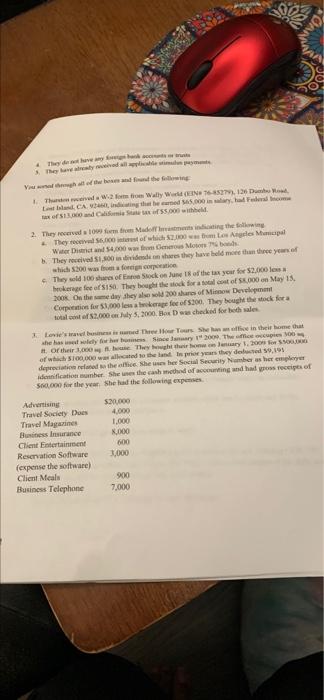

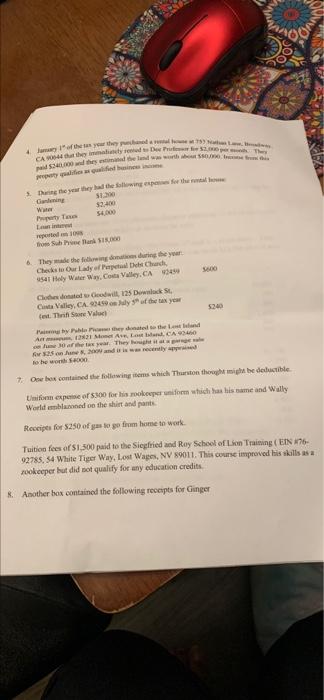

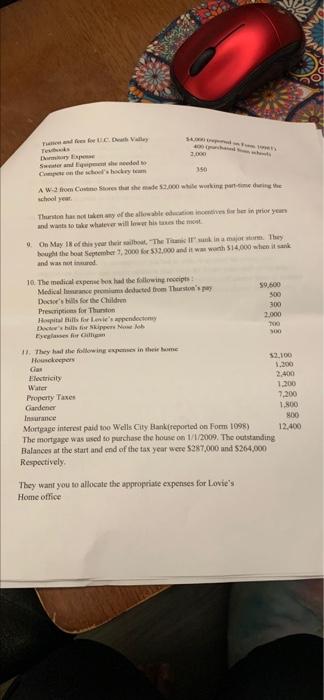

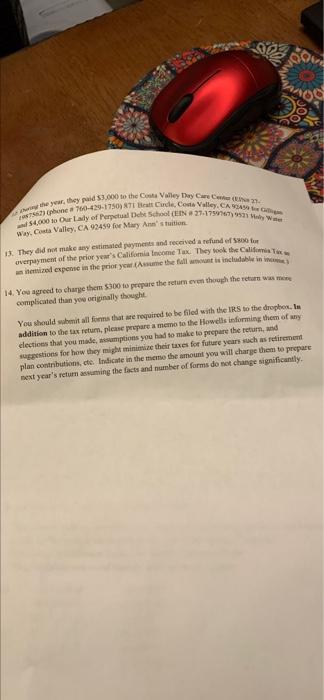

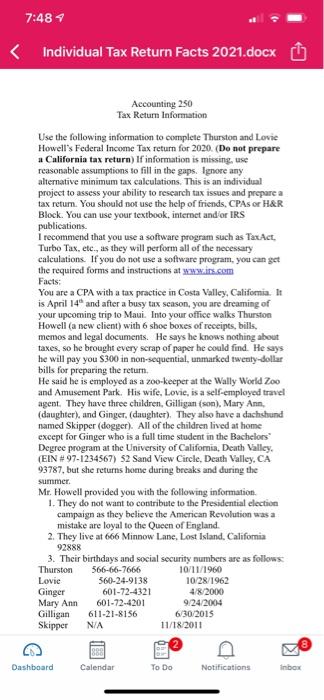

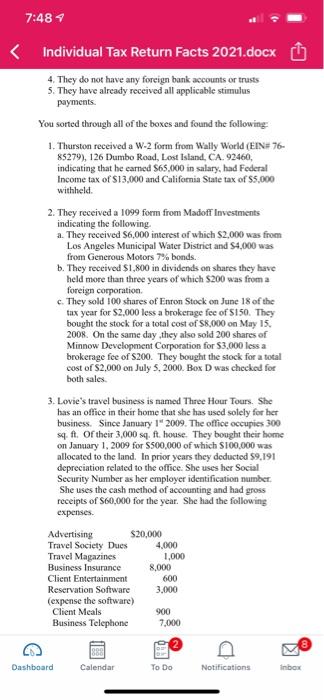

Tussion Ewing for compiere Thund Howeveral 2000 Doofpare a California trw) fois is to fill in the gaps or any hemitra. The Wil process your ty to research and prepare time. You to the offene CPARO HAR Block. You can use your textbook istemet or publicas med that you see programas Txad. Tube Teee.. they will perfon all of the necessary calice. If you do not use a software program, you can get the required forms and instructions tem Facts YCPA with a to practice Costa Valley, California Iris April 14 and after a busy tot, you are dreaming of your upcoming trip to Maui. Into your office walks Thurston Howell new clients with shoeboxes of receipts, hills, memes and legal documents. He says hemothing about me, she brought every scrap of paper he could find He she will pe you 300 ilmakety-dollar bills for preparing the He was meas kort the Willy World Zone Amment Park His wife Legal travel agent. They have three chilligan, Mary Ann grand Ginger, der. They www dachshund med Skipper ( der). All of the childred the forcinger who is a full time student in the Bachelor Degree program at the University of California Death Valley.XIN 97-1234567) 52 Sand View Circle Death Valley, CA 93787, but the returns home during trends and during the summer Mr. Howell provided you with the following information 1. They do not want to contribute to the Presidential clection campaign as they believe the American Revolution was a mistake are loyal to the Queen of England 2. They live at 666 Minnow Lane, Lost Island, California 92889 3. Their birthdays and social security numbers are as follows: Thurston 566-66-7666 10/11/1960 Lovie 560.24-9138 10/28/1962 Ginger 601-72-4321 4/8/2000 Mary Ann 601-72-4201 9/24/2004 Gilligan 611-21-8156 6/30/2015 Skipper N/A 11/18/2011 1 The death me heyvadlem Vilmowe find the ring Throwd woon Wally W (EN 76 857). 126 Dush La CAnding the same 5.000 inway, hadden of 13.00 and Com S5.000 h 2. They were 100 m. Made in the wing The 6.000 of which 2.100 mLos Mencipal Wwer District and 54,000 wa Moto They received 1.00 hores they have held more than three year which 300 was foi They sold 100 hs of Stock on June 18 of the tax your for $2.000 brokerage fee of $150 They bought the stock for a total cost of .000 on May 13 2006 Os the same day they also wol 200 shares of Minnow Development Competics for 1.000 lekerage for of 300. They bough the stock for a Best of 2,000 July 5,2000, Box was checked for both sales Love's wel bed the Tours. She has live in their home that she has soldly few hours Sinceary 2009. The cupien It or their 1.000 Thayght their own 1.200 for of which 100,000 wallected to the land is prices they deleted 9,195 depreciere so the office. She was her Social Security Number as hermeyer dedication number. She was the cash method of counting and had gross receipt of 5.000 for the year. She the following expenses 520 4,000 Advertising Travel Society Does Travel Magazines Business Insurance Client Entertainment Reservation Software expense the software) Client Meals Business Telephone 1.000 K.000 600 3,000 900 7,000 of the youth powth Sheshed with this cases the imalused Desu fied since De year they are swing expenses for the Gandeng w $2.00 5.000 La foshni SO They made the fog dom during the year Checks to Our Lady of Perpetual Debt Chardi Holy WaterWay, Costa Valley, CA 93459 Clothes Get 125 Deck Su CaValley, CA. 40 Buy of the year est. The Same Value May they donated to the end AM AL CA 40 cahaya They Son and recently how 7. Oor box contained the following stem which Thurston though might be deductible tonn expeme of 5300 for his rookouper uniform which has his name and Wally World laed on the shirt and pants Recipes for $250 of gas to go from home to work Tuition fees of 1.500 paid to the Siegfried and Roy School of Lion Training (EN 16- 92785, 54 White Tiger Way, Lost Wapes, NV 89011. This course improved his skills as a ookeeper but did not qualify for any education credits * Another box contained the following receipts for Ginger Tuff Death Valley 3,000 Sweated Campen the chosha tom 150 Awato Con Sie she made 5.000 we working on during the school year Thurston area of the able to be in prior your and want to take whatever willow his as the most On May 1 of this year that "The Imin a major. They bought the heat September 2000 for $2.000 and it was worth $14,000 when it sak and was not in rol 10. The medical expert box had the following receipts: Medical ce promim deducted to Thurston's 59.000 Det's for the Child 300 Press for Thurston 300 How sills for ' spenden 2,000 L'histoire TO oligai 11. They had the following in the bene Housekeeper 52100 1.300 Electricity 2.400 Water 1.200 Property Taxes 7,200 Gardener 1.800 Insurance 800 Mortgage interest paid too Wells City Hank reported on Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009. The outstanding Balances at the start and end of the tax year were 5287,000 and 264.000 Respectively They want you to allocate the appropriate expenses for Lovie's Home office ther they paid .000 to the Valley Day Care CN phone 760.09.1750) ATIB Cade. Co Valley, CASAS 54,000 10 Our Lady of Per School (N. 27.17 We Costa Valley, CA 92450 for Mary Ann's tuition 13. They did not make an estimatelyments and received a refund for overpayment of the prior year's California Income Tax They took the Californier wiemized expense in the prior your Assume the fall want is includable in 14. You agreed to charge them 530 to prepare the return even though the return was complicated than you originally thought You should hit fons that we required to be filed with the IRS to the drophos. In addition to the tax return, please prepare a memo to the Howells informing them of my clectices that you made sumptions you had to make to prepare the return, and suggestions for how they might minimize their taxes for future years such as retirement plan contributions, cte Indicate in the memo the amount you will charge them to prepare next year's retum assuming the facts and number of forms do not change significantly 7:48 Individual Tax Return Facts 2021.docx Accounting 250 Tax Return Information Use the following information to complete Thurston and Lovie Howell's Federal Income Tax return for 2020. (Do not prepare a California tax return) If information is missing, use reasonable assumptions to fill in the gaps. Ignore any alternative minimum tax calculations. This is an individual project to assess your ability to research tax issues and prepare a tax return. You should not use the help of friends, CPAs or H&R Block. You can use your textbook, internet and/or IRS publications I recommend that you use a software program such as Tax Act, Turbo Tas, etc., as they will perform all of the necessary calculations. If you do not use a software program, you can get the required forms and instructions at www.is.com Facts: You are a CPA with a tax practice in Costa Valley, California. It is April 14 and after a busy tax season, you are dreaming of your upcoming trip to Maui. Into your office walks Thurston Howell (a new client) with 6 shoe boxes of receipts, bills, memos and legal documents. He says he knows nothing about taxes, so he brought every scrap of paper he could find. He says he will pay you $300 in non-sequential, unmarked twenty-dollar bills for preparing the return, He said he is employed as a zoo-keeper at the Wally World Zoo and Amusement Park. His wife, Lovie, is a self-employed travel agent. They have three children, Gilligan (son). Mary Ann. (daughter), and Ginger, (daughter). They also have a dachshund named Skipper (dogger). All of the children lived at home except for Ginger who is a full time student in the Bachelors Degree program at the University of California, Death Valley, (EIN #97-1234567) S2 Sand View Circle, Death Valley, CA 93787, but she returns home during breaks and during the summer Mr. Howell provided you with the following information. 1. They do not want to contribute to the Presidential election campaign as they believe the American Revolution was a mistake are loyal to the Queen of England. 2. They live at 666 Minnow Lane, Lost Island, California 92888 3. Their birthdays and social security numbers are as follows Thurston 566-66-7666 10/11/1960 Lovie 360-24-9138 10/28/1962 Ginger 601-72-4321 4/8/2000 Mary Ann 601-72-4201 9/24/2004 Gilligan 611-21-8156 6/30/2015 Skipper NA 11/18/2011 Dashboard Calendar To Do Notifications Inbox 7:48 Individual Tax Return Facts 2021.docx 4. They do not have any foreign bank accounts or trusts 5. They have already received all applicable stimulus payments. You sorted through all of the boxes and found the following 1. Thurston received a W-2 form from Wally World (EIN# 76- 85279), 126 Dumbo Road, Lost Island, CA. 92460, indicating that he earned $65.000 in salary, had Federal Income tax of S13,000 and California State tax of $5,000 withheld 2. They received a 1099 form from Madoff Investments indicating the following a. They received $6,000 interest of which S2,000 was from Los Angeles Municipal Water District and S4,000 was from Generous Motors 7% bonds. b. They received $1,800 in dividends on shares they have held more than three years of which S200 was from a foreign corporation c. They sold 100 shares of Enron Stock on June 18 of the tax year for $2.000 less a brokerage fee of $150. They bought the stock for a total cost of $8,000 on May 15, 2008. On the same day they also sold 200 shares of Minnow Development Corporation for $3.000 less a brokerage fee of S200. They bought the stock for a total cost of $2,000 on July 5, 2000. Box D was checked for both sales. 3. Lovie's travel business is named Three Hour Tours. She has an office in their home that she has used solely for her business. Since January 1" 2009. The office occupies 300 sq. ft. of their 3,000 sq. ft. house. They bought their home on January 1, 2009 for $500,000 of which S100,000 was allocated to the land. In prior years they deducted 9,191 depreciation related to the office. She uses her Social Security Number as her employer identification number She uses the cash method of accounting and had gross receipts of $60,000 for the year. She had the following expenses. Advertising $20,000 Travel Society Dues 4,000 Travel Magazines 1,000 Business Insurance 8,000 Client Entertainment 600 Reservation Software 3.000 (expense the software) Client Meals 900 Business Telephone 7,000 D Dashboard Calendar To Do Notifications Inbox 7:48 Individual Tax Return Facts 2021.docx 4. January 19 of the tax year they purchased a rental house at 757 Nathan Lane, Broadway, CA 90644 that they immediately rented to Dee Professor for $2,000 per month They paid $240,000 and they estimated the land was worth about $80,000. Income from this property qualifies as qualified business income 5. During the year they had the following expenses for the rental house Gardening $1,200 Water S2,400 Property Taxes S4,000 Loan interest reported on 1098 from Sub Prime Bank SI8,000 6. They made the following donations during the year Checks to Our Lady of Perpetual Debt Church, 9541 Holy Water Way, Costa Valley, CA 92459 5600 Clothes donated to Goodwill, 125 Downluck St, Costa Valley, CA. 92459 on July 5 of the tax year (est. Thrift Store Value) $240 Painting by Pablo Picasso they donated to the Lost Island Art museum, 12821 Monet Ave, Lost Island, CA 92460 on June 30 of the tax year. They bought it at a garage sale for S25 on June 8, 2009 and it is was recently appraised to be worth $4000 7. One box contained the following items which Thurston thought might be deductible. Uniform expense of $300 for his Zookeeper uniform which has his name and Wally World emblazoned on the shirt and pants Receipts for $250 of gas to go from home to work Tuition fees of $1.500 paid to the Siegfried and Roy School of Lion Training (EIN #76-92785, 54 White Tiger Way, Lost Wages, NV 89011. This course improved his skills as a zookeeper but did not qualify for any education credits 8. Another box contained the following receipts for Ginger Tuition and fees for U.C. Death Valley $4.000 (reported on Form 1098T) Textbooks 400 (purchased from school) Dashboard Calendar To Do Notifications Inbox 7:49 Individual Tax Return Facts 2021.docx Dormitory Expense 2,000 Sweater and Equipment she needed to Compete on the school's hockey team 350 A W-2 from Costmo Stores that she made $2,000 while working part-time during the school year. Thurston has not taken any of the allowable education incentives for her in prior years and wants to take whatever will lower his taxes the most 9. On May 18 of this year their sailboat. "The Titanic 11" sunk in a major storm. They bought the boat September 7, 2000 for $32,000 and it was worth $14.000 when it sank and was not insured 10. The medical expense box had the following receipts : Medical Insurance premiums deducted from Thurston's pay S9,600 Doctor's bills for the Children 300 Prescriptions for Thurston 300 Hospital Bills for Lovie's appendectomy 2,000 Doctor's bills for Skippers Nose Job 700 Eyeglasses for Gilligan 300 11. They had the following expenses in their home Housekeepers $2.100 Gas 1,200 Electricity 2.400 Water 1.200 Property Taxes 7,200 Gardener 1,800 Insurance 800 Mortgage interest paid too Wells City Bank(reported on Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009 The outstanding Balances at the start and end of the tax year were $287.000 and S264,000 Dashboard Calendar To Do Notifications Inbox 7:49 Individual Tax Return Facts 2021.docx Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009 The outstanding Balances at the start and end of the tax year were $287.000 and $264,000 Respectively. They want you to allocate the appropriate expenses for Lovie's Home office 12. During the year, they paid $3,000 to the Costa Valley Day Care Center (EIN# 27-1987562) (phone # 760-429-1750) 871 Bratt Circle, Costa Valley, CA 92459 for Gilligan and $4,000 to Our Lady of Perpetual Debt School (EIN=27- 1759767) 9521 Holy Water Way, Costa Valley, CA 92459 for Mary Ann's tuition 13. They did not make any estimated payments and received a refund of S800 for overpayment of the prior year's California Income Tax. They took the California Tax as an itemized expense in the prior yearAssume the full amount is includable in income.) 14. You agreed to charge them $300 to prepare the return even though the return was more complicated than you originally thought. You should submit all forms that are required to be filed with the IRS to the dropbox. In addition to the tax return please prepare a memo to the Howells informing them of any elections that you made, assumptions you had to make to prepare the return, and suggestions for how they might minimize their taxes for future years such as retirement plan contributions, etc. Indicate in the memo the amount you will charge them to prepare next year's return assuming the facts and number of forms do not change significantly G 1888 Dashboard Calendar To Do Notifications Inbox Tussion Ewing for compiere Thund Howeveral 2000 Doofpare a California trw) fois is to fill in the gaps or any hemitra. The Wil process your ty to research and prepare time. You to the offene CPARO HAR Block. You can use your textbook istemet or publicas med that you see programas Txad. Tube Teee.. they will perfon all of the necessary calice. If you do not use a software program, you can get the required forms and instructions tem Facts YCPA with a to practice Costa Valley, California Iris April 14 and after a busy tot, you are dreaming of your upcoming trip to Maui. Into your office walks Thurston Howell new clients with shoeboxes of receipts, hills, memes and legal documents. He says hemothing about me, she brought every scrap of paper he could find He she will pe you 300 ilmakety-dollar bills for preparing the He was meas kort the Willy World Zone Amment Park His wife Legal travel agent. They have three chilligan, Mary Ann grand Ginger, der. They www dachshund med Skipper ( der). All of the childred the forcinger who is a full time student in the Bachelor Degree program at the University of California Death Valley.XIN 97-1234567) 52 Sand View Circle Death Valley, CA 93787, but the returns home during trends and during the summer Mr. Howell provided you with the following information 1. They do not want to contribute to the Presidential clection campaign as they believe the American Revolution was a mistake are loyal to the Queen of England 2. They live at 666 Minnow Lane, Lost Island, California 92889 3. Their birthdays and social security numbers are as follows: Thurston 566-66-7666 10/11/1960 Lovie 560.24-9138 10/28/1962 Ginger 601-72-4321 4/8/2000 Mary Ann 601-72-4201 9/24/2004 Gilligan 611-21-8156 6/30/2015 Skipper N/A 11/18/2011 1 The death me heyvadlem Vilmowe find the ring Throwd woon Wally W (EN 76 857). 126 Dush La CAnding the same 5.000 inway, hadden of 13.00 and Com S5.000 h 2. They were 100 m. Made in the wing The 6.000 of which 2.100 mLos Mencipal Wwer District and 54,000 wa Moto They received 1.00 hores they have held more than three year which 300 was foi They sold 100 hs of Stock on June 18 of the tax your for $2.000 brokerage fee of $150 They bought the stock for a total cost of .000 on May 13 2006 Os the same day they also wol 200 shares of Minnow Development Competics for 1.000 lekerage for of 300. They bough the stock for a Best of 2,000 July 5,2000, Box was checked for both sales Love's wel bed the Tours. She has live in their home that she has soldly few hours Sinceary 2009. The cupien It or their 1.000 Thayght their own 1.200 for of which 100,000 wallected to the land is prices they deleted 9,195 depreciere so the office. She was her Social Security Number as hermeyer dedication number. She was the cash method of counting and had gross receipt of 5.000 for the year. She the following expenses 520 4,000 Advertising Travel Society Does Travel Magazines Business Insurance Client Entertainment Reservation Software expense the software) Client Meals Business Telephone 1.000 K.000 600 3,000 900 7,000 of the youth powth Sheshed with this cases the imalused Desu fied since De year they are swing expenses for the Gandeng w $2.00 5.000 La foshni SO They made the fog dom during the year Checks to Our Lady of Perpetual Debt Chardi Holy WaterWay, Costa Valley, CA 93459 Clothes Get 125 Deck Su CaValley, CA. 40 Buy of the year est. The Same Value May they donated to the end AM AL CA 40 cahaya They Son and recently how 7. Oor box contained the following stem which Thurston though might be deductible tonn expeme of 5300 for his rookouper uniform which has his name and Wally World laed on the shirt and pants Recipes for $250 of gas to go from home to work Tuition fees of 1.500 paid to the Siegfried and Roy School of Lion Training (EN 16- 92785, 54 White Tiger Way, Lost Wapes, NV 89011. This course improved his skills as a ookeeper but did not qualify for any education credits * Another box contained the following receipts for Ginger Tuff Death Valley 3,000 Sweated Campen the chosha tom 150 Awato Con Sie she made 5.000 we working on during the school year Thurston area of the able to be in prior your and want to take whatever willow his as the most On May 1 of this year that "The Imin a major. They bought the heat September 2000 for $2.000 and it was worth $14,000 when it sak and was not in rol 10. The medical expert box had the following receipts: Medical ce promim deducted to Thurston's 59.000 Det's for the Child 300 Press for Thurston 300 How sills for ' spenden 2,000 L'histoire TO oligai 11. They had the following in the bene Housekeeper 52100 1.300 Electricity 2.400 Water 1.200 Property Taxes 7,200 Gardener 1.800 Insurance 800 Mortgage interest paid too Wells City Hank reported on Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009. The outstanding Balances at the start and end of the tax year were 5287,000 and 264.000 Respectively They want you to allocate the appropriate expenses for Lovie's Home office ther they paid .000 to the Valley Day Care CN phone 760.09.1750) ATIB Cade. Co Valley, CASAS 54,000 10 Our Lady of Per School (N. 27.17 We Costa Valley, CA 92450 for Mary Ann's tuition 13. They did not make an estimatelyments and received a refund for overpayment of the prior year's California Income Tax They took the Californier wiemized expense in the prior your Assume the fall want is includable in 14. You agreed to charge them 530 to prepare the return even though the return was complicated than you originally thought You should hit fons that we required to be filed with the IRS to the drophos. In addition to the tax return, please prepare a memo to the Howells informing them of my clectices that you made sumptions you had to make to prepare the return, and suggestions for how they might minimize their taxes for future years such as retirement plan contributions, cte Indicate in the memo the amount you will charge them to prepare next year's retum assuming the facts and number of forms do not change significantly 7:48 Individual Tax Return Facts 2021.docx Accounting 250 Tax Return Information Use the following information to complete Thurston and Lovie Howell's Federal Income Tax return for 2020. (Do not prepare a California tax return) If information is missing, use reasonable assumptions to fill in the gaps. Ignore any alternative minimum tax calculations. This is an individual project to assess your ability to research tax issues and prepare a tax return. You should not use the help of friends, CPAs or H&R Block. You can use your textbook, internet and/or IRS publications I recommend that you use a software program such as Tax Act, Turbo Tas, etc., as they will perform all of the necessary calculations. If you do not use a software program, you can get the required forms and instructions at www.is.com Facts: You are a CPA with a tax practice in Costa Valley, California. It is April 14 and after a busy tax season, you are dreaming of your upcoming trip to Maui. Into your office walks Thurston Howell (a new client) with 6 shoe boxes of receipts, bills, memos and legal documents. He says he knows nothing about taxes, so he brought every scrap of paper he could find. He says he will pay you $300 in non-sequential, unmarked twenty-dollar bills for preparing the return, He said he is employed as a zoo-keeper at the Wally World Zoo and Amusement Park. His wife, Lovie, is a self-employed travel agent. They have three children, Gilligan (son). Mary Ann. (daughter), and Ginger, (daughter). They also have a dachshund named Skipper (dogger). All of the children lived at home except for Ginger who is a full time student in the Bachelors Degree program at the University of California, Death Valley, (EIN #97-1234567) S2 Sand View Circle, Death Valley, CA 93787, but she returns home during breaks and during the summer Mr. Howell provided you with the following information. 1. They do not want to contribute to the Presidential election campaign as they believe the American Revolution was a mistake are loyal to the Queen of England. 2. They live at 666 Minnow Lane, Lost Island, California 92888 3. Their birthdays and social security numbers are as follows Thurston 566-66-7666 10/11/1960 Lovie 360-24-9138 10/28/1962 Ginger 601-72-4321 4/8/2000 Mary Ann 601-72-4201 9/24/2004 Gilligan 611-21-8156 6/30/2015 Skipper NA 11/18/2011 Dashboard Calendar To Do Notifications Inbox 7:48 Individual Tax Return Facts 2021.docx 4. They do not have any foreign bank accounts or trusts 5. They have already received all applicable stimulus payments. You sorted through all of the boxes and found the following 1. Thurston received a W-2 form from Wally World (EIN# 76- 85279), 126 Dumbo Road, Lost Island, CA. 92460, indicating that he earned $65.000 in salary, had Federal Income tax of S13,000 and California State tax of $5,000 withheld 2. They received a 1099 form from Madoff Investments indicating the following a. They received $6,000 interest of which S2,000 was from Los Angeles Municipal Water District and S4,000 was from Generous Motors 7% bonds. b. They received $1,800 in dividends on shares they have held more than three years of which S200 was from a foreign corporation c. They sold 100 shares of Enron Stock on June 18 of the tax year for $2.000 less a brokerage fee of $150. They bought the stock for a total cost of $8,000 on May 15, 2008. On the same day they also sold 200 shares of Minnow Development Corporation for $3.000 less a brokerage fee of S200. They bought the stock for a total cost of $2,000 on July 5, 2000. Box D was checked for both sales. 3. Lovie's travel business is named Three Hour Tours. She has an office in their home that she has used solely for her business. Since January 1" 2009. The office occupies 300 sq. ft. of their 3,000 sq. ft. house. They bought their home on January 1, 2009 for $500,000 of which S100,000 was allocated to the land. In prior years they deducted 9,191 depreciation related to the office. She uses her Social Security Number as her employer identification number She uses the cash method of accounting and had gross receipts of $60,000 for the year. She had the following expenses. Advertising $20,000 Travel Society Dues 4,000 Travel Magazines 1,000 Business Insurance 8,000 Client Entertainment 600 Reservation Software 3.000 (expense the software) Client Meals 900 Business Telephone 7,000 D Dashboard Calendar To Do Notifications Inbox 7:48 Individual Tax Return Facts 2021.docx 4. January 19 of the tax year they purchased a rental house at 757 Nathan Lane, Broadway, CA 90644 that they immediately rented to Dee Professor for $2,000 per month They paid $240,000 and they estimated the land was worth about $80,000. Income from this property qualifies as qualified business income 5. During the year they had the following expenses for the rental house Gardening $1,200 Water S2,400 Property Taxes S4,000 Loan interest reported on 1098 from Sub Prime Bank SI8,000 6. They made the following donations during the year Checks to Our Lady of Perpetual Debt Church, 9541 Holy Water Way, Costa Valley, CA 92459 5600 Clothes donated to Goodwill, 125 Downluck St, Costa Valley, CA. 92459 on July 5 of the tax year (est. Thrift Store Value) $240 Painting by Pablo Picasso they donated to the Lost Island Art museum, 12821 Monet Ave, Lost Island, CA 92460 on June 30 of the tax year. They bought it at a garage sale for S25 on June 8, 2009 and it is was recently appraised to be worth $4000 7. One box contained the following items which Thurston thought might be deductible. Uniform expense of $300 for his Zookeeper uniform which has his name and Wally World emblazoned on the shirt and pants Receipts for $250 of gas to go from home to work Tuition fees of $1.500 paid to the Siegfried and Roy School of Lion Training (EIN #76-92785, 54 White Tiger Way, Lost Wages, NV 89011. This course improved his skills as a zookeeper but did not qualify for any education credits 8. Another box contained the following receipts for Ginger Tuition and fees for U.C. Death Valley $4.000 (reported on Form 1098T) Textbooks 400 (purchased from school) Dashboard Calendar To Do Notifications Inbox 7:49 Individual Tax Return Facts 2021.docx Dormitory Expense 2,000 Sweater and Equipment she needed to Compete on the school's hockey team 350 A W-2 from Costmo Stores that she made $2,000 while working part-time during the school year. Thurston has not taken any of the allowable education incentives for her in prior years and wants to take whatever will lower his taxes the most 9. On May 18 of this year their sailboat. "The Titanic 11" sunk in a major storm. They bought the boat September 7, 2000 for $32,000 and it was worth $14.000 when it sank and was not insured 10. The medical expense box had the following receipts : Medical Insurance premiums deducted from Thurston's pay S9,600 Doctor's bills for the Children 300 Prescriptions for Thurston 300 Hospital Bills for Lovie's appendectomy 2,000 Doctor's bills for Skippers Nose Job 700 Eyeglasses for Gilligan 300 11. They had the following expenses in their home Housekeepers $2.100 Gas 1,200 Electricity 2.400 Water 1.200 Property Taxes 7,200 Gardener 1,800 Insurance 800 Mortgage interest paid too Wells City Bank(reported on Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009 The outstanding Balances at the start and end of the tax year were $287.000 and S264,000 Dashboard Calendar To Do Notifications Inbox 7:49 Individual Tax Return Facts 2021.docx Form 1098) 12,400 The mortgage was used to purchase the house on 1/1/2009 The outstanding Balances at the start and end of the tax year were $287.000 and $264,000 Respectively. They want you to allocate the appropriate expenses for Lovie's Home office 12. During the year, they paid $3,000 to the Costa Valley Day Care Center (EIN# 27-1987562) (phone # 760-429-1750) 871 Bratt Circle, Costa Valley, CA 92459 for Gilligan and $4,000 to Our Lady of Perpetual Debt School (EIN=27- 1759767) 9521 Holy Water Way, Costa Valley, CA 92459 for Mary Ann's tuition 13. They did not make any estimated payments and received a refund of S800 for overpayment of the prior year's California Income Tax. They took the California Tax as an itemized expense in the prior yearAssume the full amount is includable in income.) 14. You agreed to charge them $300 to prepare the return even though the return was more complicated than you originally thought. You should submit all forms that are required to be filed with the IRS to the dropbox. In addition to the tax return please prepare a memo to the Howells informing them of any elections that you made, assumptions you had to make to prepare the return, and suggestions for how they might minimize their taxes for future years such as retirement plan contributions, etc. Indicate in the memo the amount you will charge them to prepare next year's return assuming the facts and number of forms do not change significantly G 1888 Dashboard Calendar To Do Notifications Inbox