can someone please help me with the excel formulas?!

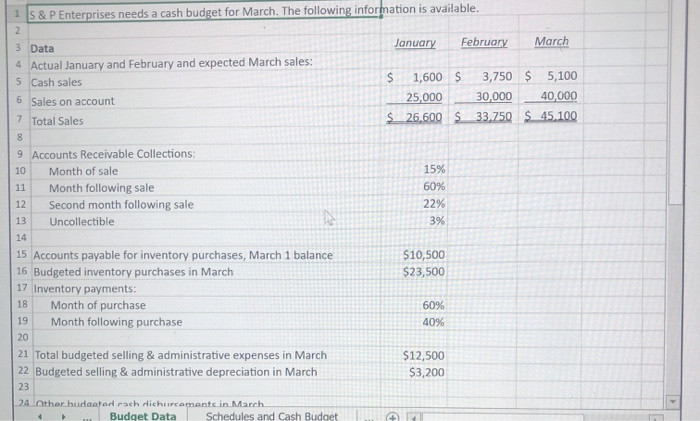

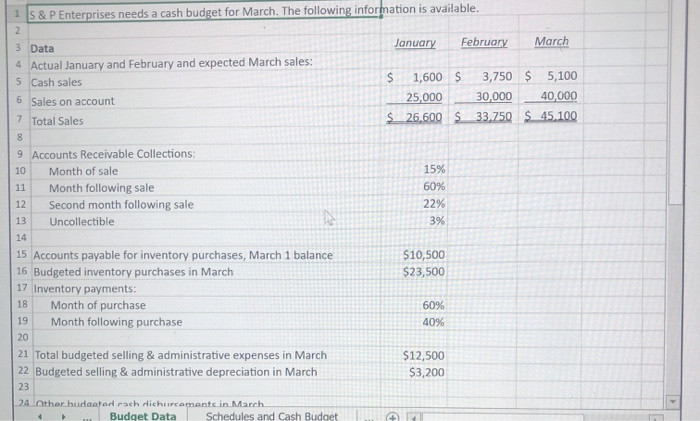

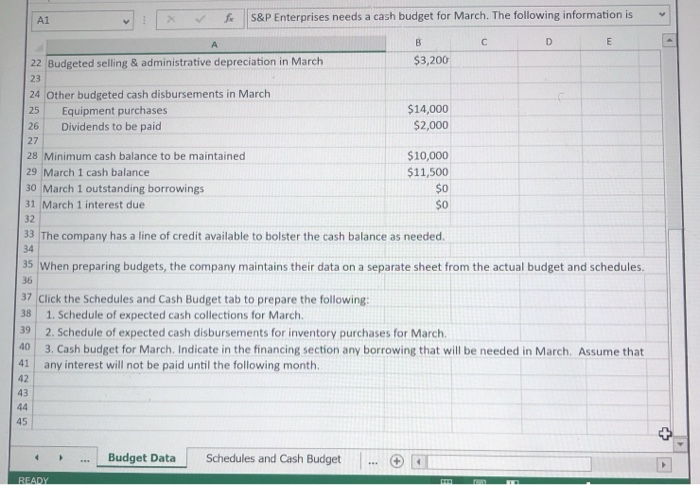

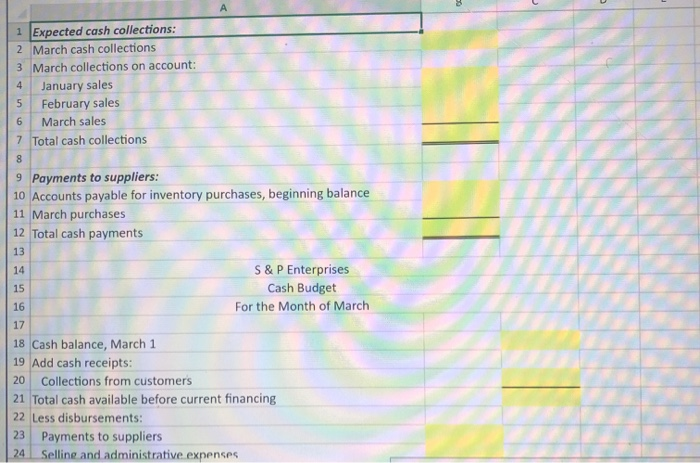

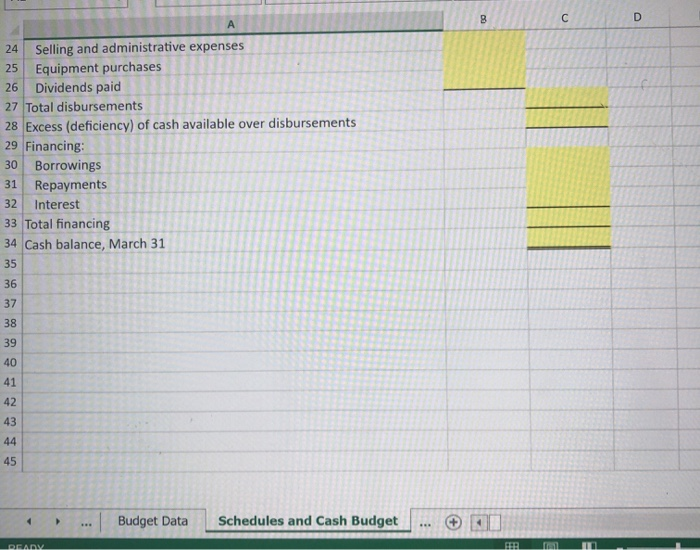

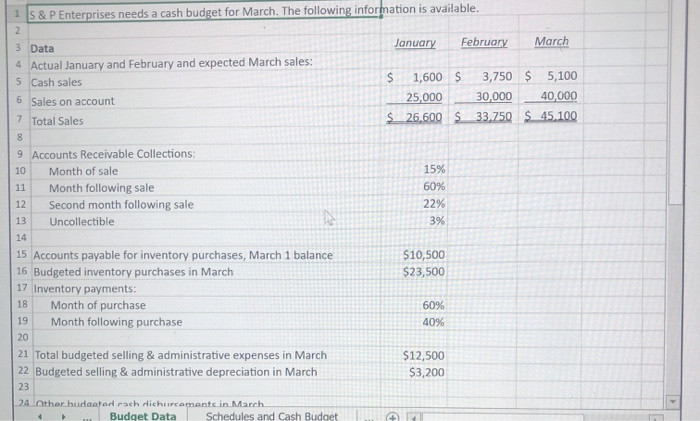

1 S & P Enterprises needs a cash budget for March. The following information is available. 2 3 Data January February March 4 Actual January and February and expected March sales: 5 Cash sales $ 1,600 $ 3,750 $ 5,100 6 Sales on account 25,000 30,000 40,000 7 Total Sales $ 26,600 S 33.750 $45.100 8 9 Accounts Receivable Collections: 10 Month of sale 15% 11 Month following sale 60% 12 Second month following sale 22% 13 Uncollectible 14 15 Accounts payable for inventory purchases, March 1 balance $10,500 16 Budgeted inventory purchases in March $23,500 17 Inventory payments: 18 Month of purchase 60% 19 Month following purchase 40% 3% 20 21 Total budgeted selling & administrative expenses in March 22 Budgeted selling & administrative depreciation in March $12,500 $3,200 23 24 Other budapter achdichureements in March 4 Budget Data Schedules and Cash Budget 1 S&P Enterprises needs a cash budget for March. The following information is v D m B 22 Budgeted selling & administrative depreciation in March $3,200 23 24 Other budgeted cash disbursements in March 25 Equipment purchases $14,000 26 Dividends to be paid $2,000 27 28 Minimum cash balance to be maintained $10,000 29 March 1 cash balance $11,500 30 March 1 outstanding borrowings $0 31 March 1 interest due $0 32 33 The company has a line of credit available to bolster the cash balance as needed. 34 35 When preparing budgets, the company maintains their data on a separate sheet from the actual budget and schedules. 36 38 39 37 Click the Schedules and Cash Budget tab to prepare the following: 1. Schedule of expected cash collections for March. 2. Schedule of expected cash disbursements for inventory purchases for March 3. Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that any interest will not be paid until the following month. 40 41 42 43 44 45 - 4 Budget Data Schedules and Cash Budget + READY 1 Expected cash collections: 2 March cash collections 3 March collections on account: January sales 5 February sales 6 March sales 7 Total cash collections 4 8 9 Payments to suppliers: 10 Accounts payable for inventory purchases, beginning balance 11 March purchases 12 Total cash payments 13 14 S&P Enterprises 15 Cash Budget 16 For the Month of March 17 18 Cash balance, March 1 19 Add cash receipts: 20 Collections from customers 21 Total cash available before current financing 22 Less disbursements: 23 Payments to suppliers 24 Selline and administrative expenses B D A 24 Selling and administrative expenses 25 Equipment purchases 26 Dividends paid 27 Total disbursements 28 Excess (deficiency) of cash available over disbursements 29 Financing 30 Borrowings Repayments 32 Interest 33 Total financing 34 Cash balance, March 31 35 31 36 37 38 39 40 41 42 43 44 45 Budget Data Schedules and Cash Budget + mall