Answered step by step

Verified Expert Solution

Question

1 Approved Answer

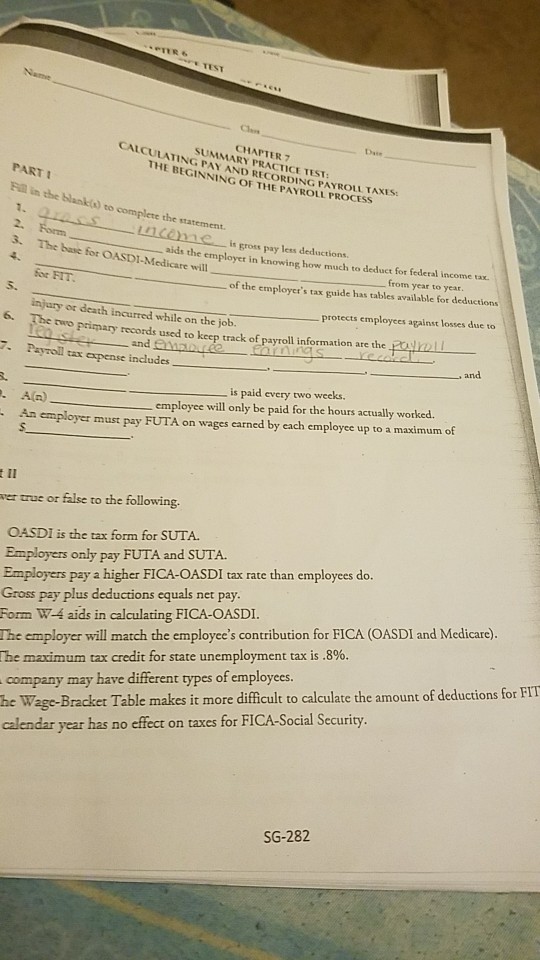

can someone please help me with these CHAPTER 7 SUMMARY PRACTICE TEST CALCULATING PAY AND RECORDING PAYROLL TAXES THE BEGINNING OF THE PAYROLL PROCESS PART

can someone please help me with these

CHAPTER 7 SUMMARY PRACTICE TEST CALCULATING PAY AND RECORDING PAYROLL TAXES THE BEGINNING OF THE PAYROLL PROCESS PART I Fill in the blanko) to complete the statement 2. Form 3. The base for OASDI-Medicare will is gross pay less deductions. aids the employet in knowing how much to deduct for federal income tax. from year to year for FIT of the employer's tax guide has tables available fot deductions injury or death incurred while on the job. protects employees against losses due to 6 The two primary records used to keep track of payroll information are the 7 Payroll and tax expense includes is paid every two weeks. employee will only be paid for the hours actually worked. An employer must pay FUTA on wages earned by each employee up to a maximum of iI ver true or false to the following. OASDI is the tax form for SUTA Employers ony Employers pay a higher FICA-OASDI tax rate than employees do. Gross pay plus deductions equals net pay. Form W-4 aids in calculating FICA-OASDI. The employer will match the employee's contribution for FICA (OASDI and Medicare). the maximum tax credit for state unemployment tax is .8%. company may have different types of employees. he Wage-Bracket Table makes it more difficult to calculate the amount of deductions for FIT calendar year has no effect on taxes for FICA-Social Security pay FUTA and SUTA. SG-282 CHAPTER 7 SUMMARY PRACTICE TEST CALCULATING PAY AND RECORDING PAYROLL TAXES THE BEGINNING OF THE PAYROLL PROCESS PART I Fill in the blanko) to complete the statement 2. Form 3. The base for OASDI-Medicare will is gross pay less deductions. aids the employet in knowing how much to deduct for federal income tax. from year to year for FIT of the employer's tax guide has tables available fot deductions injury or death incurred while on the job. protects employees against losses due to 6 The two primary records used to keep track of payroll information are the 7 Payroll and tax expense includes is paid every two weeks. employee will only be paid for the hours actually worked. An employer must pay FUTA on wages earned by each employee up to a maximum of iI ver true or false to the following. OASDI is the tax form for SUTA Employers ony Employers pay a higher FICA-OASDI tax rate than employees do. Gross pay plus deductions equals net pay. Form W-4 aids in calculating FICA-OASDI. The employer will match the employee's contribution for FICA (OASDI and Medicare). the maximum tax credit for state unemployment tax is .8%. company may have different types of employees. he Wage-Bracket Table makes it more difficult to calculate the amount of deductions for FIT calendar year has no effect on taxes for FICA-Social Security pay FUTA and SUTA. SG-282

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started