Question: 2.2. In the Fairyland country, the return on the market portfolio is 15,45%, and standard deviation of market return is 12,1% and the risk

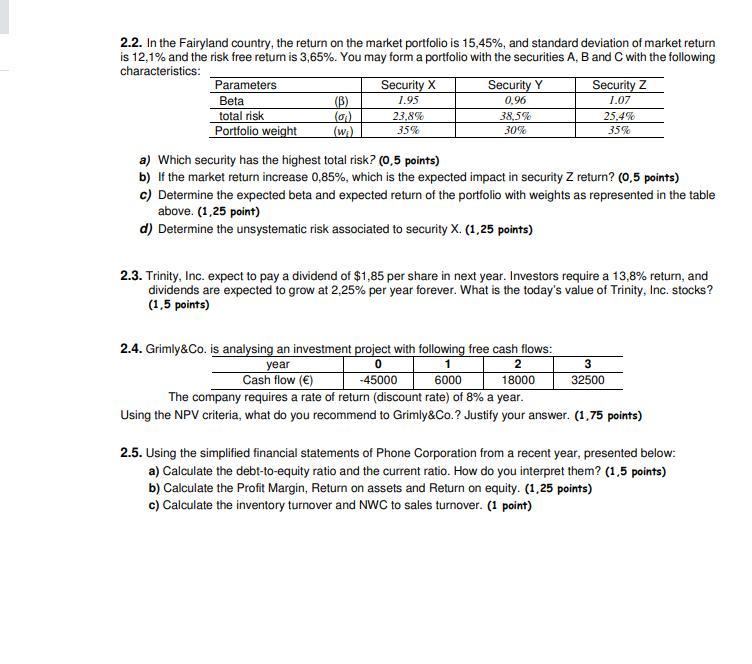

2.2. In the Fairyland country, the return on the market portfolio is 15,45%, and standard deviation of market return is 12,1% and the risk free retum is 3,65%. You may form a portfolio with the securities A, B and C with the following characteristics: Parameters Beta total risk Portfolio weight Security X Security Y Security Z (B) 1.95 0,96 1.07 23.8% 38,5% 25,4% 35% (wi) 35% 30% a) Which security has the highest total risk? (0,5 points) b) If the market return increase 0,85%, which is the expected impact in security Z return? (0,5 points) c) Determine the expected beta and expected return of the portfolio with weights as represented in the table above. (1,25 point) d) Determine the unsystematic risk associated to security X. (1,25 points) 2.3. Trinity, Inc. expect to pay a dividend of $1,85 per share in next year. Investors require a 13,8% return, and dividends are expected to grow at 2,25% per year forever. What is the today's value of Trinity, Inc. stocks? (1,5 points) 2.4. Grimly&Co. is analysing an investment project with following free cash flows: 1 2 3 year Cash flow () -45000 6000 18000 32500 The company requires a rate of return (discount rate) of 8% a year. Using the NPV criteria, what do you recommend to Grimly&Co.? Justify your answer. (1,75 points) 2.5. Using the simplified financial statements of Phone Corporation from a recent year, presented below: a) Calculate the debt-to-equity ratio and the current ratio. How do you interpret them? (1,5 points) b) Calculate the Profit Margin, Return on assets and Return on equity. (1,25 points) c) Calculate the inventory turnover and NWC to sales turnover. (1 point)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Lets work through each part of the question step by step 22 Portfolio and Securities a Which security has the highest total risk 05 points Total risk ... View full answer

Get step-by-step solutions from verified subject matter experts