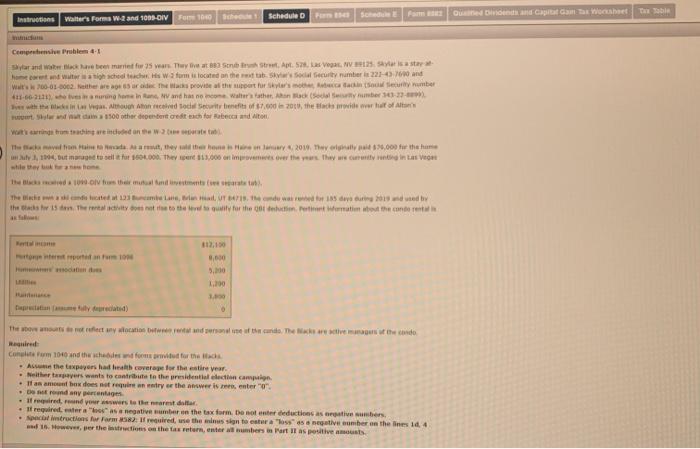

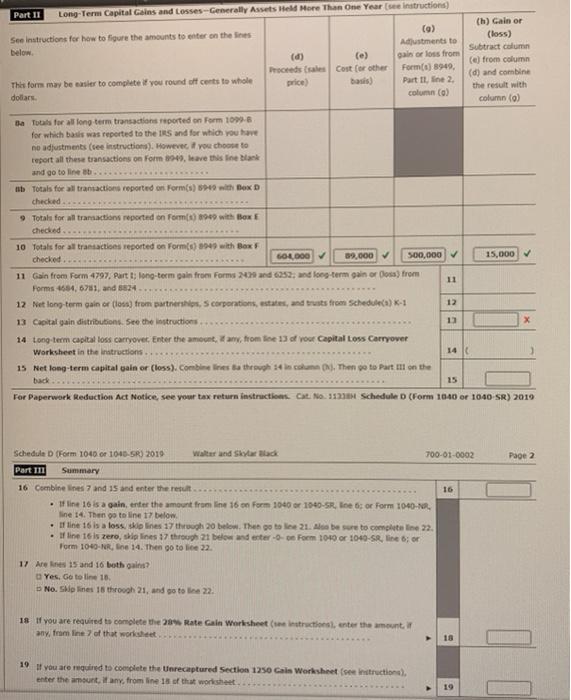

Can someone please help me with this comprehensive problem in my Tax class. I need help with Schedule D, specifically line 13 is what I keep getting wrong. I entered the $6,540.34 which wasn't it and I could use some help, thank you.

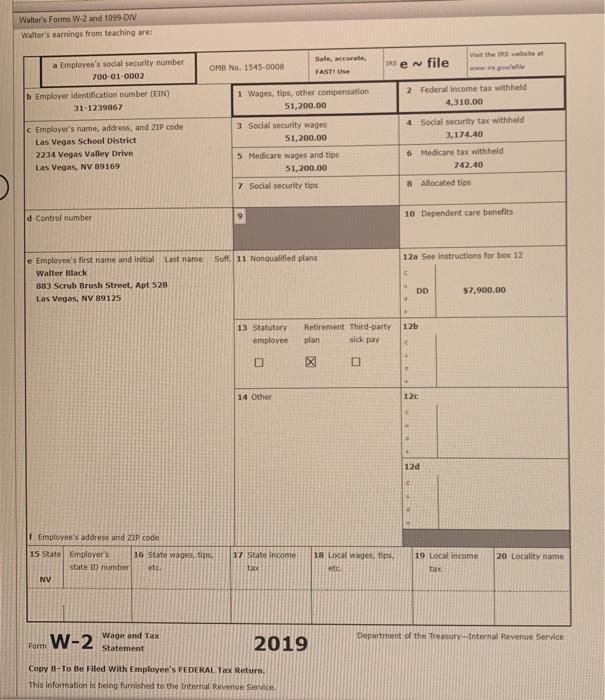

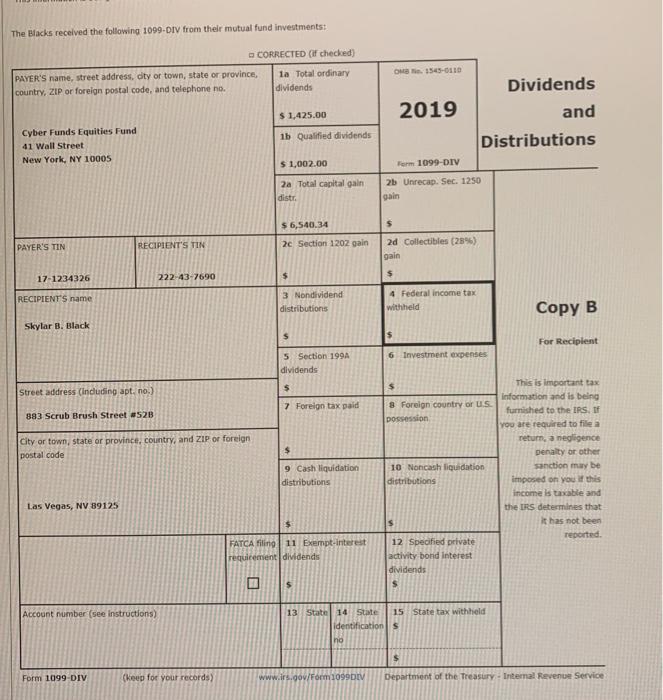

Schedule Que and Gap Gama Woh Tao Instructions Waters Forma W. and 1099-OIV Form 101 Case Priblem 4 Skylar and we can be marefu 5 ans. They eat 883 Sant Ants VNV 1 Statissa home and weigh schools wom stocated in the Social Security number is 22H45 and Wit's 7001-2002, Mieres ride the provides the other style's cube 418-66-vein Rano, NV and has no one whether and be with this once tole Security benefit of 7.000 2001, the act wide wall of tista 1500 other depender creditch for becando www., 109,but merupeetusellatur 1504.000. The 313.00 improve the years. They we currently once in Las Vegas I wote mtandao The candeletta, MUT713, and was to decided by the baditor is the core to the for the other Wormation the content on 10 3,60 1,200 The best wy location of the candle. There is the condo Conform 1046 and the che fonts wild for the As the taxpayers had health coverage for the entire year Neither ever wants to contribute to the residential election campaign If an ambos os not require an entry or the answer is, entero Orom any antages If required and your swers to the nearest If required to as a negative number on the tax form. De monter deductions as ative sumber Spectructions Form52: Frequired, use the mission to enter a los negative number on the line 14 16. However, per the wins on the tax return, enter lumbers in Part It Spositive amount Walter's Forms W-2 and 1099-DIV Walter's earnings from teaching are: OMB No 1545-0008 Sat, accurate, FASTI U en file a Employee's social security number 700-01-0002 D Employer identification number (EIN) 31-1239867 1 Wages, tips, other compensation 51,200.00 2 Federal income tax withheld 4,310.00 C Employer's name, address, and ZIP code Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 3 Social security wages 51,200.00 5 Medicare wages and tips 51,200.00 7 Social security tips 4 Social Security tax withheld 3,174.40 6 Medicare tax withheld 742.40 8 Allocated tips d Control number 10 Dependent care benefits Suff. 11 Nonqualified plans 12a See Instructions for box 12 e Employee's first name and initial Last name Walter Black 383 Scrub Brush Street, Apt 528 Las Vegas, NV 89125 DD $7.900,00 125 13 Statutory employee Retirement Third-party plan sick pay 14 Other 120 12d Employee's address and ZIP code 15 State Employer's 16 State Wages, tips, state ID number etc. NV 17 State income 18 Local wages, tips 20 Locality name 19 Local income tax tax Department of the Treasury Internal Revenue Service Fm W-2 Wage and Tax Statement 2019 Copy - To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service The Blacks received the following 1099-DIV from their mutual fund investments: CORRECTED (if checked) PAYER'S name, street address, dty or town, state or province, la Total ordinary country, ZIP or foreign postal code, and telephone no. dividends OM 1545-0110 $ 1.425.00 2019 Dividends and Distributions 1b Qualified dividends Cyber Funds Equities Fund 41 Wall Street New York, NY 10005 $ 1.002.00 Form 1099-DIV 2a Total capital gain distr 2b Unrecap Sec. 1250 gain $ 6,540.34 PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain 17-1234326 222-43-7690 $ RECIPIENTS name 3 Nondividend distributions 4 Federal income tax withheld Copy B Skylar B. Black $ For Recipient 6 Investment expenses 5 Section 199A dividends $ $ Street address (including apt, no.) 7 Foreign tax paid 883 Scrub Brush Street #52B 8 Foreign country or US possession City or town, state or province, country, and ZIP or foreign postal code $ This is important tax Information and is being furnished to the IRS. If you are required to file a return, negligence penalty or other sanction may be imposed on you of this income is taxable and the IRS determines that it has not been reported. 9 Cash liquidation distributions 10 Noncash liquidation distributions Las Vegas, NV 89125 s FATCA filino 11 Exempt interest requirement dividends 12 Specified private activity bond Interest dividends ] $ S Account number (see Instructions) 13 State 14 State 15 State tax withheld identifications ho $ Form 1099-DIV (keup for your records) www.irs.gov/Form 1099DTV Department of the Treasury - Internal Revenue Service (a) Part 11 Long-Term Capital Gains and Losses-Generally Assets More Than One Year(see instructions) (h) Gain or See Instructions for how to figure the amounts to enter on the les (loss) Adjustments to below Subtract column (d) (e) gain or loss from (e) from column Proceeds sales Cost (or other Form(s) 8949, (d) and combine This form may be easier to complete if you round off cents to whole price) basis) Part It, Iine 2 the result with dollars column (0) column (0) Ba Tuals for a long term transactions reported on Form 108 for which bod was reported to the IRS and for which you have no adjustments (see instructions). However if you choose to report all these transactions on Form 1949, leave this in Black and go to line ab Totals for all transaction reported on Form(s) 0949 with ex D checked. Totals for all transaction reported on Form 99 with Box checked. 10 Totals for all transactions reported on Form) 949 with Box checked. GOLDOG 2.000 500,000 15,000 11 Gain from Form 4797, Part : long-term gain from Forms 20 and 6952, and long-term gain or oss) from 11 Forms-654.6781, and 1824 12 Net long term gain or loss) from partnerships, corporations, states, and trusts from Schedule(a) K-1 12 13 Capital gain distributions. See the instructions 13 14 tongterm capital loss carryover Enter the amount any from toe 13 of your capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combines through 4 column. Then go to Part on the back For Paperwork Reduction Act Notice see your tax return instruction Cat. No 1121 Schedule (Form 1040 or 1040 SR) 2019 Page 2 Schedule D (Form 1040 1040-5R) 2019 Walter and Skylara 700-01-0002 Part II Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Form 1040 1040-5R, les or Form 104-1 line 14. Then go to line 17 below If line 16 is a loss, skielines 17 through 20 below. Then go to 21. Al be sure to completene 22 If line 16 is zero, ship lines 17 through 21 below and enter -- Form 1010 or 1040-SR, line 6; or Form 104-NR, Bne 14. Then go to lice 22 17 Arenes 15 and 16 both gain? Yes, Go to line 18. No. Skip lines 18 through 21, and go to le 22. 18 If you are required to complete the 28 Rate Gain Worksheet (instructionsenter the amount any, from line of that worksheet 18 19 If you are required to complete the Unrecaptured Section 1250 Cais Worksheet (see Instruction) enter the amount any, from ine 18 of that worksheet A Schedule Que and Gap Gama Woh Tao Instructions Waters Forma W. and 1099-OIV Form 101 Case Priblem 4 Skylar and we can be marefu 5 ans. They eat 883 Sant Ants VNV 1 Statissa home and weigh schools wom stocated in the Social Security number is 22H45 and Wit's 7001-2002, Mieres ride the provides the other style's cube 418-66-vein Rano, NV and has no one whether and be with this once tole Security benefit of 7.000 2001, the act wide wall of tista 1500 other depender creditch for becando www., 109,but merupeetusellatur 1504.000. The 313.00 improve the years. They we currently once in Las Vegas I wote mtandao The candeletta, MUT713, and was to decided by the baditor is the core to the for the other Wormation the content on 10 3,60 1,200 The best wy location of the candle. There is the condo Conform 1046 and the che fonts wild for the As the taxpayers had health coverage for the entire year Neither ever wants to contribute to the residential election campaign If an ambos os not require an entry or the answer is, entero Orom any antages If required and your swers to the nearest If required to as a negative number on the tax form. De monter deductions as ative sumber Spectructions Form52: Frequired, use the mission to enter a los negative number on the line 14 16. However, per the wins on the tax return, enter lumbers in Part It Spositive amount Walter's Forms W-2 and 1099-DIV Walter's earnings from teaching are: OMB No 1545-0008 Sat, accurate, FASTI U en file a Employee's social security number 700-01-0002 D Employer identification number (EIN) 31-1239867 1 Wages, tips, other compensation 51,200.00 2 Federal income tax withheld 4,310.00 C Employer's name, address, and ZIP code Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 3 Social security wages 51,200.00 5 Medicare wages and tips 51,200.00 7 Social security tips 4 Social Security tax withheld 3,174.40 6 Medicare tax withheld 742.40 8 Allocated tips d Control number 10 Dependent care benefits Suff. 11 Nonqualified plans 12a See Instructions for box 12 e Employee's first name and initial Last name Walter Black 383 Scrub Brush Street, Apt 528 Las Vegas, NV 89125 DD $7.900,00 125 13 Statutory employee Retirement Third-party plan sick pay 14 Other 120 12d Employee's address and ZIP code 15 State Employer's 16 State Wages, tips, state ID number etc. NV 17 State income 18 Local wages, tips 20 Locality name 19 Local income tax tax Department of the Treasury Internal Revenue Service Fm W-2 Wage and Tax Statement 2019 Copy - To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service The Blacks received the following 1099-DIV from their mutual fund investments: CORRECTED (if checked) PAYER'S name, street address, dty or town, state or province, la Total ordinary country, ZIP or foreign postal code, and telephone no. dividends OM 1545-0110 $ 1.425.00 2019 Dividends and Distributions 1b Qualified dividends Cyber Funds Equities Fund 41 Wall Street New York, NY 10005 $ 1.002.00 Form 1099-DIV 2a Total capital gain distr 2b Unrecap Sec. 1250 gain $ 6,540.34 PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain 17-1234326 222-43-7690 $ RECIPIENTS name 3 Nondividend distributions 4 Federal income tax withheld Copy B Skylar B. Black $ For Recipient 6 Investment expenses 5 Section 199A dividends $ $ Street address (including apt, no.) 7 Foreign tax paid 883 Scrub Brush Street #52B 8 Foreign country or US possession City or town, state or province, country, and ZIP or foreign postal code $ This is important tax Information and is being furnished to the IRS. If you are required to file a return, negligence penalty or other sanction may be imposed on you of this income is taxable and the IRS determines that it has not been reported. 9 Cash liquidation distributions 10 Noncash liquidation distributions Las Vegas, NV 89125 s FATCA filino 11 Exempt interest requirement dividends 12 Specified private activity bond Interest dividends ] $ S Account number (see Instructions) 13 State 14 State 15 State tax withheld identifications ho $ Form 1099-DIV (keup for your records) www.irs.gov/Form 1099DTV Department of the Treasury - Internal Revenue Service (a) Part 11 Long-Term Capital Gains and Losses-Generally Assets More Than One Year(see instructions) (h) Gain or See Instructions for how to figure the amounts to enter on the les (loss) Adjustments to below Subtract column (d) (e) gain or loss from (e) from column Proceeds sales Cost (or other Form(s) 8949, (d) and combine This form may be easier to complete if you round off cents to whole price) basis) Part It, Iine 2 the result with dollars column (0) column (0) Ba Tuals for a long term transactions reported on Form 108 for which bod was reported to the IRS and for which you have no adjustments (see instructions). However if you choose to report all these transactions on Form 1949, leave this in Black and go to line ab Totals for all transaction reported on Form(s) 0949 with ex D checked. Totals for all transaction reported on Form 99 with Box checked. 10 Totals for all transactions reported on Form) 949 with Box checked. GOLDOG 2.000 500,000 15,000 11 Gain from Form 4797, Part : long-term gain from Forms 20 and 6952, and long-term gain or oss) from 11 Forms-654.6781, and 1824 12 Net long term gain or loss) from partnerships, corporations, states, and trusts from Schedule(a) K-1 12 13 Capital gain distributions. See the instructions 13 14 tongterm capital loss carryover Enter the amount any from toe 13 of your capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combines through 4 column. Then go to Part on the back For Paperwork Reduction Act Notice see your tax return instruction Cat. No 1121 Schedule (Form 1040 or 1040 SR) 2019 Page 2 Schedule D (Form 1040 1040-5R) 2019 Walter and Skylara 700-01-0002 Part II Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Form 1040 1040-5R, les or Form 104-1 line 14. Then go to line 17 below If line 16 is a loss, skielines 17 through 20 below. Then go to 21. Al be sure to completene 22 If line 16 is zero, ship lines 17 through 21 below and enter -- Form 1010 or 1040-SR, line 6; or Form 104-NR, Bne 14. Then go to lice 22 17 Arenes 15 and 16 both gain? Yes, Go to line 18. No. Skip lines 18 through 21, and go to le 22. 18 If you are required to complete the 28 Rate Gain Worksheet (instructionsenter the amount any, from line of that worksheet 18 19 If you are required to complete the Unrecaptured Section 1250 Cais Worksheet (see Instruction) enter the amount any, from ine 18 of that worksheet A