Can someone please help me with this.

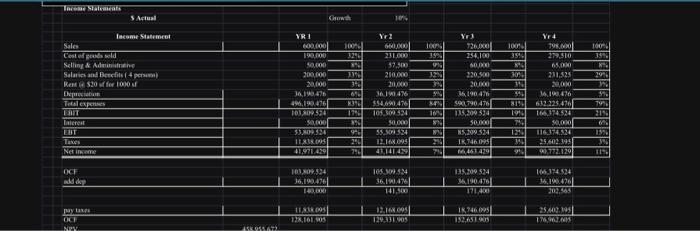

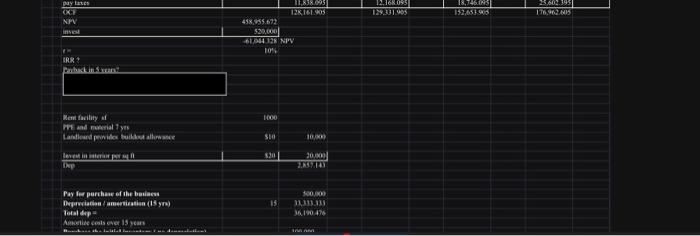

Mark commissioned a marketing study at the cost of $20k to learn about the local business conditions and location. That study suggested that there was great surfing in the area; a lot of surf shops in the larger towns, but only one in Laie, and that it is indeed for sale. Mark visited the site and looked at the existing financials. They are similar to the financials for Sunsets Boards; this is a comparable size business. Working with the consultant and with Slick, Mark put together a proforma business plan and financials going out four years. He developed a rough plan on how to finance the purchase of the business and set up the initial inventory. The location for the facility, a 1000 square foot store front, is for rent now, with an option to buy after five years. The rent seems reasonable based on local conditions. The landlord will provide a $10 per square foot build out allowance to help with the relocation. Additional funds will be needed from Mark. With the concurrence of the other shareholders, three other cousins, Mark plans to use $200K from retained earnings and then borrow the remainder. Mark estimates that the cost of the business is about $500K and the cost of the purchasing the initial inventory from the owner is about $100K. With the landlord providing a build out allowance, an additional $20K is needed for the build out. This will be sparse, but functional and adaptable. Initial capital needed is $520K. After Mark ran the numbers he was disappointed to see that the NPV came out negative. He had done a four year analysis, even though he thought he could recover the investment in five years. He used a 10% discount rate as that is the interest rate on the loan too. He has come to you and asked you to review the calculations and numbers. He wants you to confirm the numbers and analysis. Then he wants you to make recommendations as to what can improve the outcome and chances of success in starting the business. He has come to you and asked you to review the calculations and numbers. He wants you to confirm the numbers and analysis. Then he wants you to make recommendations as to what can improve the outcome and chances of success in starting the business. Here is the requirement: 1. Using the numbers, data, and analysis on the spreadsheet, confirm the analysis so far. 2. Analyze the case and suggest what can be done to improve the case; a. Look at the sales numbers - reasonable? b. Costs - reasonable? Any opportunity for reductions? c. Mark wants to break even in five years (Payback) but he did only a four year analysis. Would another year of data and analysis help? If so, show this? d. Develop a course of action and recommendation for Mark to implement to be successful. 3. Prepare the analysis, case write up and recommendations to Mark in a memorandum of about 250 to 400 words. Be specific in the recommendations a. Support this with the spreadsheet if necessary property annotated b. In considering your courses of action consider these and comment as needed: (1.) Abandon the idea - too much risk and loss. (2.) Go ahead as planned with these numbers, maybe with a fifth year of analysis and "hope for the best." (3.) Make some specific adjustments in the plan and the numbers that will improve the NPV and chances. Explain the ideas. Show the numbers. Mark commissioned a marketing study at the cost of $20k to learn about the local business conditions and location. That study suggested that there was great surfing in the area; a lot of surf shops in the larger towns, but only one in Laie, and that it is indeed for sale. Mark visited the site and looked at the existing financials. They are similar to the financials for Sunsets Boards; this is a comparable size business. Working with the consultant and with Slick, Mark put together a proforma business plan and financials going out four years. He developed a rough plan on how to finance the purchase of the business and set up the initial inventory. The location for the facility, a 1000 square foot store front, is for rent now, with an option to buy after five years. The rent seems reasonable based on local conditions. The landlord will provide a $10 per square foot build out allowance to help with the relocation. Additional funds will be needed from Mark. With the concurrence of the other shareholders, three other cousins, Mark plans to use $200K from retained earnings and then borrow the remainder. Mark estimates that the cost of the business is about $500K and the cost of the purchasing the initial inventory from the owner is about $100K. With the landlord providing a build out allowance, an additional $20K is needed for the build out. This will be sparse, but functional and adaptable. Initial capital needed is $520K. After Mark ran the numbers he was disappointed to see that the NPV came out negative. He had done a four year analysis, even though he thought he could recover the investment in five years. He used a 10% discount rate as that is the interest rate on the loan too. He has come to you and asked you to review the calculations and numbers. He wants you to confirm the numbers and analysis. Then he wants you to make recommendations as to what can improve the outcome and chances of success in starting the business. He has come to you and asked you to review the calculations and numbers. He wants you to confirm the numbers and analysis. Then he wants you to make recommendations as to what can improve the outcome and chances of success in starting the business. Here is the requirement: 1. Using the numbers, data, and analysis on the spreadsheet, confirm the analysis so far. 2. Analyze the case and suggest what can be done to improve the case; a. Look at the sales numbers - reasonable? b. Costs - reasonable? Any opportunity for reductions? c. Mark wants to break even in five years (Payback) but he did only a four year analysis. Would another year of data and analysis help? If so, show this? d. Develop a course of action and recommendation for Mark to implement to be successful. 3. Prepare the analysis, case write up and recommendations to Mark in a memorandum of about 250 to 400 words. Be specific in the recommendations a. Support this with the spreadsheet if necessary property annotated b. In considering your courses of action consider these and comment as needed: (1.) Abandon the idea - too much risk and loss. (2.) Go ahead as planned with these numbers, maybe with a fifth year of analysis and "hope for the best." (3.) Make some specific adjustments in the plan and the numbers that will improve the NPV and chances. Explain the ideas. Show the numbers