Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me with what im doing wrong? For years 4 & 5 you cannot adjust the depreciation rate it is a locked

Can someone please help me with what im doing wrong? For years 4 & 5 you cannot adjust the depreciation rate it is a locked cell

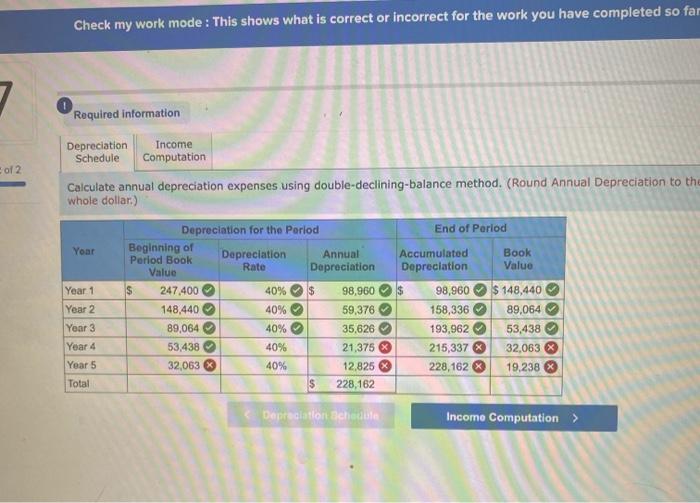

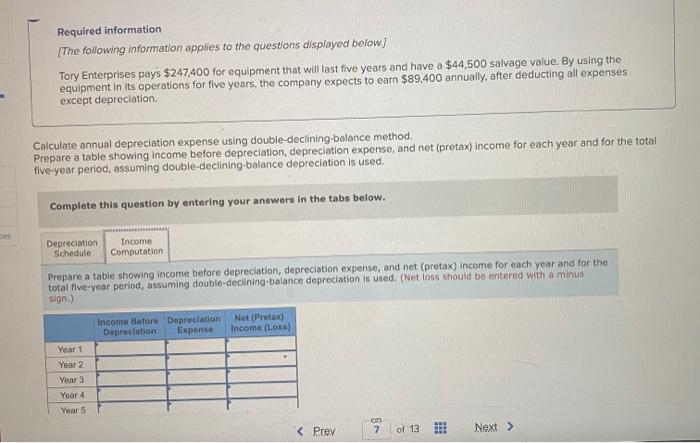

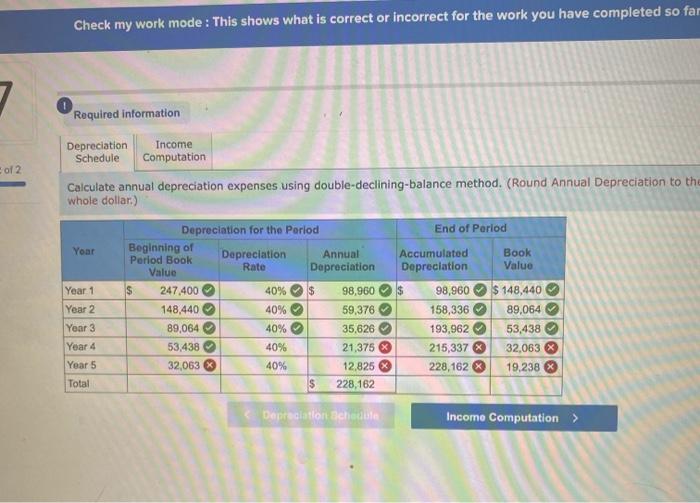

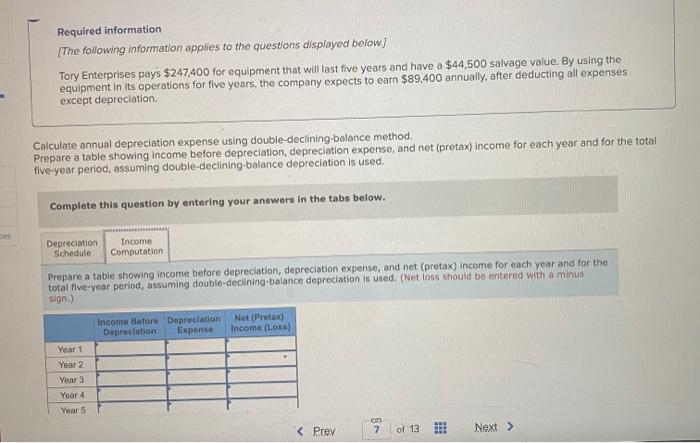

Check my work mode : This shows what is correct or incorrect for the work you have completed so far Required information of 2 Depreciation Income Schedule Computation Calculate annual depreciation expenses using double-declining-balance method. (Round Annual Depreciation to the whole dollar) Yoar Year 1 Year 2 Year 3 Year 4 Year 5 Depreciation for the Period End of Period Beginning of Depreciation Annual Accumulated Period Book Book Rate Depreciation Value Depreciation Value $ 247,400 40% $ 98,960 $ 98,960 $ 148,440 148,440 40% 59,376 158,336 89,064 89,064 40% 35,626 193,962 53,438 53,438 40% 21,375 X 215,337 32,063 32,063 40% 12,825 228,162 19.238 $ 228,162 Total Depreciation Echebe Incomo Computation > Required information [The following information applies to the questions displayed below) Tory Enterprises pays $247.400 for equipment that will last five years and have a $44,500 salvage value. By using the equipment in its operations for five years, the company expects to earn $89,400 annually, after deducting all expenses except depreciation. Calculate annual depreciation expense using double-declining balance method. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining balance depreciation is used. Complete this question by entering your answers in the tabs below. Depreciation Schedule Income Computation Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining balance depreciation is used. (Net loss should be entered with a minus sign) Income Before Depreciation Depreciation Expense Net (Prota Income (Loss) Year 1 Year 2 Year 3 Your 4 Year 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started