Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me work out this problem? Attached below is an example to help. John took out a 2,560,000 construction loan, disbursed to

Can someone please help me work out this problem? Attached below is an example to help.

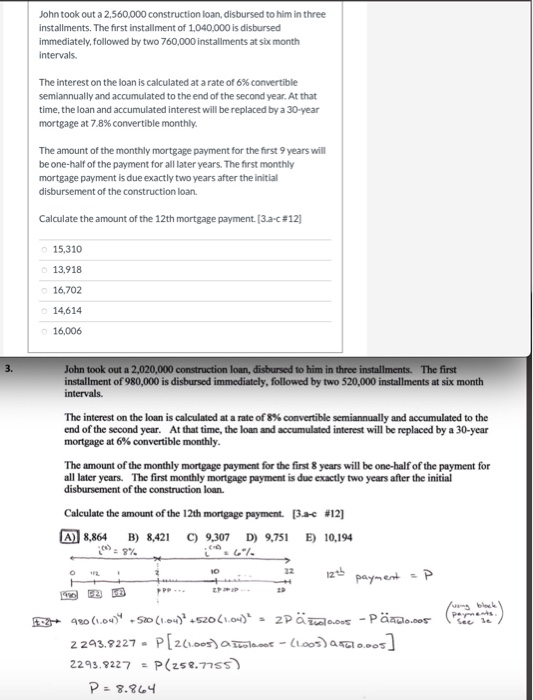

John took out a 2,560,000 construction loan, disbursed to him in three installments. The first installment of 1,040,000 is disbursed immediately, followed by two 760,000 installments at six month intervals. The interest on the loan is calculated at a rate of 6% convertible semiannually and accumulated to the end of the second year. At that time, the loan and accumulated interest will be replaced by a 30-year mortgage at 7.8% convertible monthly. The amount of the monthly mortgage payment for the first 9 years will be one-half of the payment for all later years. The first monthly mortgage payment is due exactly two years after the initial disbursement of the construction loan. Calculate the amount of the 12th mortgage payment. (3.a-c #121 15,310 13,918 16,702 14,614 16,006 John took out a 2,020,000 construction loan, disbursed to him in three installments. The first installment of 980,000 is disbursed immediately, followed by two 520,000 installments at six month intervals. The interest on the loan is calculated at a rate of 8% convertible semiannually and accumulated to the end of the second year. At that time, the loan and accumulated interest will be replaced by a 30-year mortgage at 6% convertible monthly. The amount of the monthly mortgage payment for the first 8 years will be one-half of the payment for all later years. The first monthly mortgage payment is due exactly two years after the initial disbursement of the construction loan. Calculate the amount of the 12th mortgage payment. 3. #12] A) 8,864 B) 8,421 C) 9,307 D) 9,751 E) 10.194 = 8% 6. 125 payment EP 82 4R (100) 4520 (1.04) 25201) 2P .05 - Paadio.P 2 243.9227 P[261.003) a izola.cos - (1.005) a=610.005] 2293.8227 = P(258.7755) P = 8.864

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started