Can someone please help with me Answer B and create a balance sheet? Answer was not complete the first time

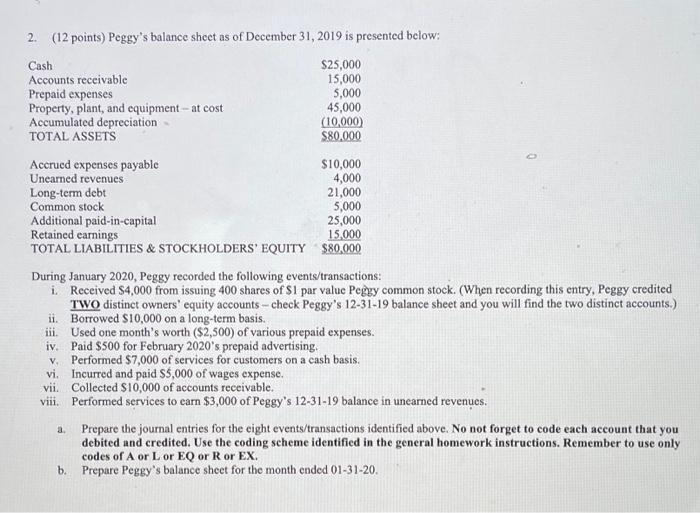

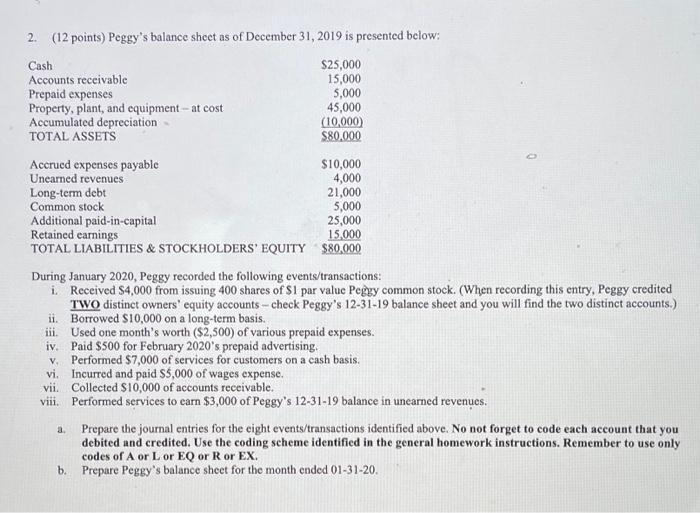

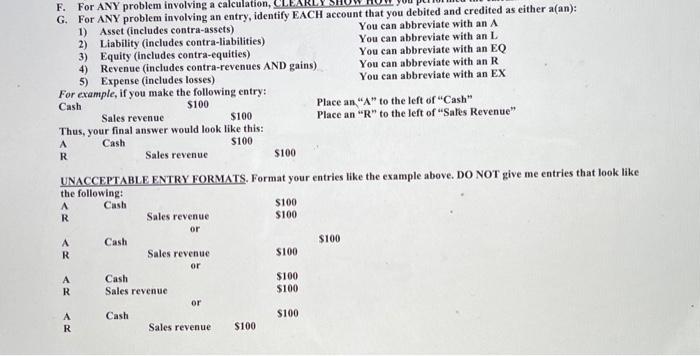

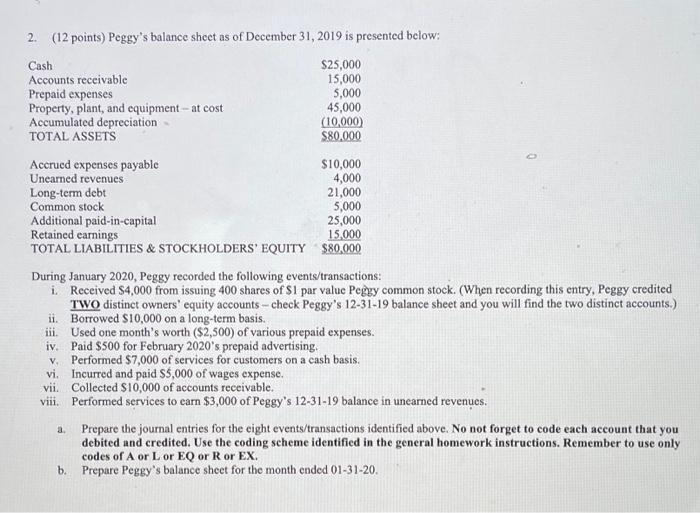

2. (12 points) Peggy's balance sheet as of December 31, 2019 is presented below: Cash $25,000 Accounts receivable 15,000 Prepaid expenses 5,000 Property, plant, and equipment - at cost 45,000 Accumulated depreciation (10,000) TOTAL ASSETS $80.000 Accrued expenses payable $10,000 Unearned revenues 4,000 Long-term debt 21,000 Common stock 5,000 Additional paid-in-capital 25,000 Retained earnings 15,000 TOTAL LIABILITIES & STOCKHOLDERS' EQUITY $80,000 During January 2020, Peggy recorded the following events/transactions: i Received $4,000 from issuing 400 shares of S1 par value Peggy common stock. (When recording this entry, Peggy credited TWO distinct owners' equity accounts -check Peggy's 12-31-19 balance sheet and you will find the two distinct accounts.) ii. Borrowed $10,000 on a long-term basis. iii. Used one month's worth ($2,500) of various prepaid expenses. iv. Paid $500 for February 2020's prepaid advertising. v Performed $7,000 of services for customers on a cash basis. vi. Incurred and paid $5,000 of wages expense. vii. Collected $10,000 of accounts receivable. viii. Performed services to earn $3,000 of Peggy's 12-31-19 balance in unearned revenues. Prepare the journal entries for the eight events/transactions identified above. No not forget to code each account that you debited and credited. Use the coding scheme identified in the general homework instructions. Remember to use only codes of A or Lor EQ or R or EX. Prepare Peggy's balance sheet for the month ended 01-31-20 a. b. 6:324 Outlook ul 5G Answer 1 of 1 Done Solution- S.no Code LO ILO Account Title and Explanation (For Reference) Den Credit Cash 5400000 Common Stock $ 40000 Additional Pain Capital 5 3.60000 To Record issue of common stock at $10 above its par 31 . A $1000000 S 1000000 Cash Long terme To Record the borrowing Expenses Prepaid Expenses to Record Expired portion of Prepaid Expenses) EX 5 2.500.00 $ 2.500.00 S Prepad Expenses Cash (To Record Prepaid expenses) 50000 550000 A IR $ 750000 5 750000 Sales Revenge To Record income from Service) M EX A $ 5.000.00 S 5.000 Je IA A 5 1000000 5 1000000 wages Expenes Cash (To Record Wages Paid Cash Account Receivable To Record Collection of Account Receivable Unearned Revenue Sales Revenue To Record performance of service in Balance est S 300000 $ 3.000.00 Note- Explanation is included in journal entries for reference E. For ANY problem involving a calculation, G. For ANY problem involving an entry, identify EACH account that you debited and credited as either a(an): 1) Asset (includes contra-assets) You can abbreviate with an A 2) Liability (includes contra-liabilities) You can abbreviate with an L 3) Equity (Includes contra-equities) You can abbreviate with an EQ 4) Revenue (includes contra-revenues AND gains) You can abbreviate with an R 5) Expense (includes losses) You can abbreviate with an EX For example, if you make the following entry: Cash $100 Place an "A" to the left of "Cash" Sales revenue S100 Place an "R" to the left of "Sales Revenue" Thus, your final answer would look like this: Cash $100 R Sales revenue $100 UNACCEPTABLE ENTRY FORMATS. Format your entries like the example above. DO NOT give me entries that look like the following: A Cash $100 R Sales revenue $100 or A Cash $100 R Sales revenue S100 or Cash $100 Sales revenue $100 A R or Cash S100 R Sales revenue $100