Can someone please help with this question? If so, can you show exactly how to do it, not just the answer. Thank you!

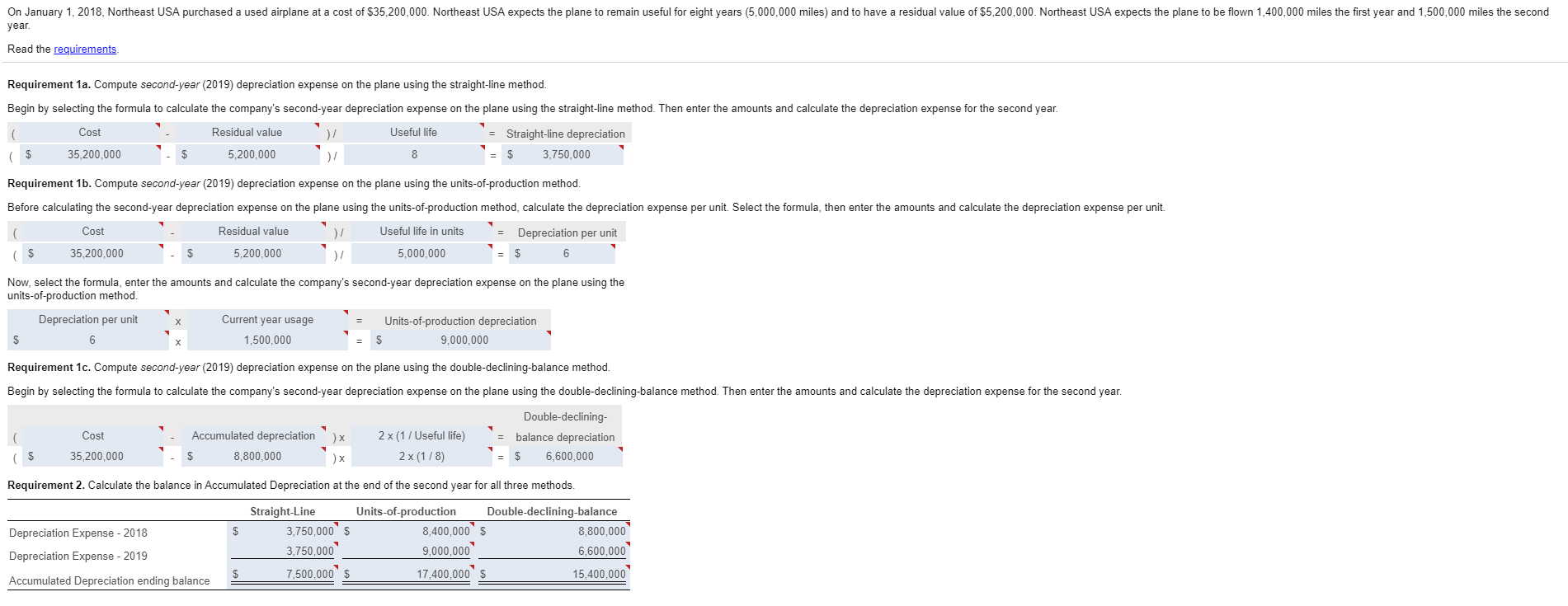

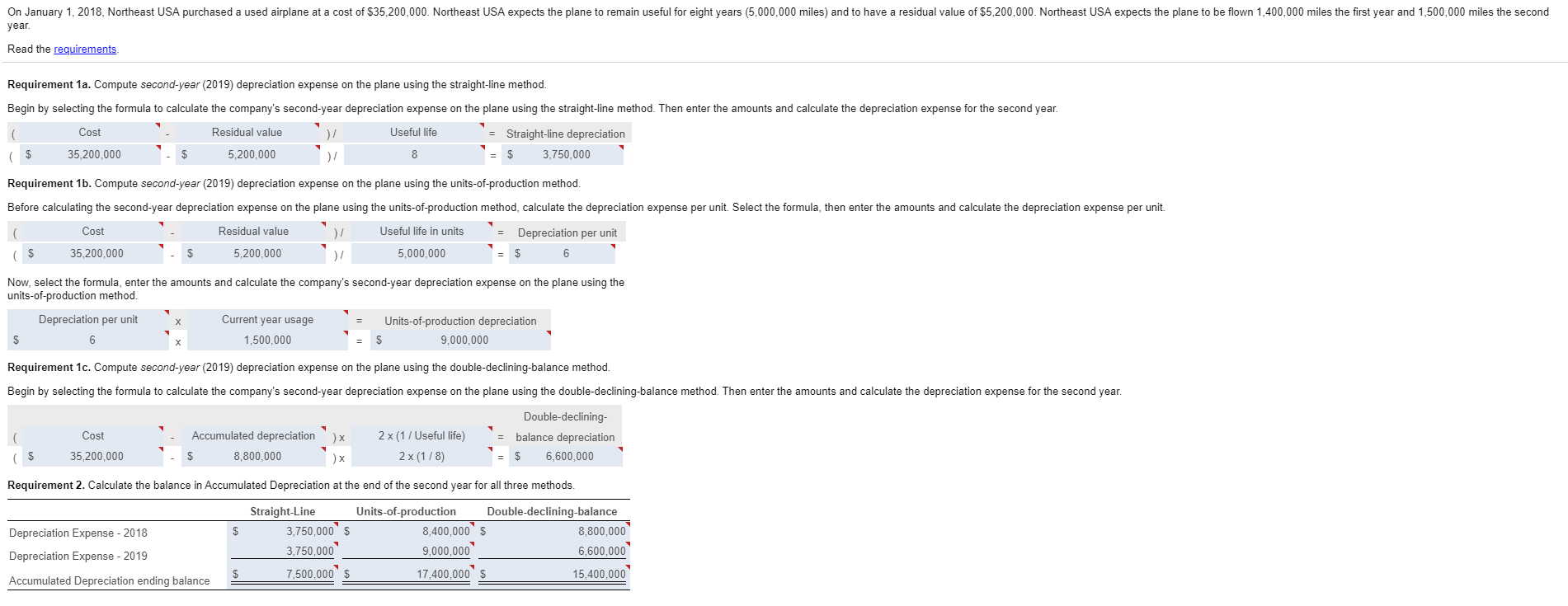

On January 1, 2018, Northeast USA purchased a used airplane at a cost of $35,200,000. Northeast USA expects the plane to remain useful for eight years (5,000,000 miles) and to have a residual value of $5,200,000. Northeast USA expects the plane to be flown 1,400,000 miles the first year and 1,500,000 miles the second year. Read the requirements Requirement 1a. Compute second-year (2019) depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation expense for the second year. Cost Residual value )4 Useful life = Straight-line depreciation ( $ 35,200,000 5,200,000 8 3,750,000 Requirement 1b. Compute second-year (2019) depreciation expense on the plane using the units-of-production method. Before calculating the second-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation expense per unit. Cost Residual value ) Useful life in units Depreciation per unit 35,200,000 $ 5,200,000 5,000,000 6 Now, select the formula, enter the amounts and calculate the company's second-year depreciation expense on the plane using the units-of-production method. Depreciation per unit Current year usage Units-of-production depreciation $ 1,500,000 9,000,000 Requirement 1c. Compute second-year (2019) depreciation expense on the plane using the double-declining-balance method. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the second year. Cost ) x Accumulated depreciation 8,800,000 2 x (1 / Useful life) 2 x (1/8) Double-declining- balance depreciation 6,600,000 ($ 35,200,000 ) x Requirement 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods Depreciation Expense - 2018 $ Straight-Line 3,750,000 $ 3,750,000 7,500,000 $ Units-of-production Double-declining-balance 8,400,000 $ 8,800,000 9,000,000 6,600,000 Depreciation Expense - 2019 $ 17,400,000 $ 15,400,000 Accumulated Depreciation ending balance