Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please show me how to solve these? Thank you... i) What is the payback period for the following set of cash flows? ound

Can someone please show me how to solve these? Thank you...

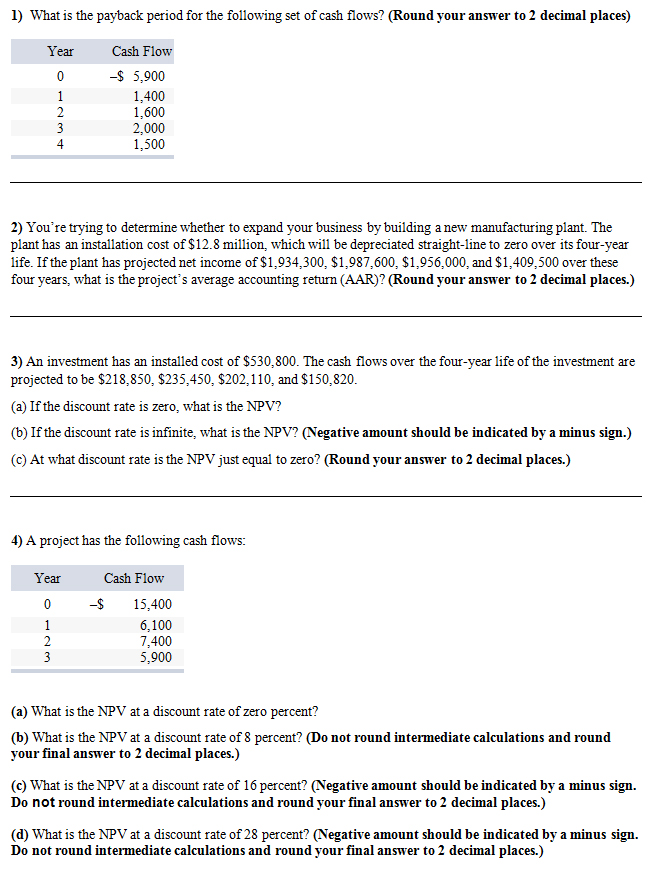

i) What is the payback period for the following set of cash flows? ound your answer to 2 decimal places Year Cash Flow 5,900 1,400 1.600 2,000 1.500 2 You're trying to determine whether to expand your business by building anew manufacturing plant. The plant has an installation cost of $12.8 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,934,300, $1,987,600, $1,956,000, and $1,409,500 over these four years, what is the project's average accounting return ound your answer to 2 decimal places 3) An investment has an installed cost of $530,800. The cash flows over the four-year life of the investment are projected to be $218,850, $235,450, $202,110, and $150,820. a) If the discount rate is zero, what is the NPV? (b) If the discount rate is infinite, what is the NPV? Negative amount should be indicated by a minus sign) (c) At what discount rate is the NPV just equal to zero? ound your answer to 2 decimal places 4 A project has the following cash flows: Year Cash Flow 15,400 6,100 7.400 5.900 (a What is the NPV at a discount rate of zero percent? (b) What is the NPV at a discount rate of 8 percent? o not round intermediate calculations and round your final answer to 2 decimal places.) (c) What is the NPV at a discount rate of 16 percent? egative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) (d) What is the NPV at a discount rate of 28 percent egative amount should be indicated by a minus sign. t? Do not round intermediate calculations and round your final answer to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started