can someone please solve this through financial calculator?

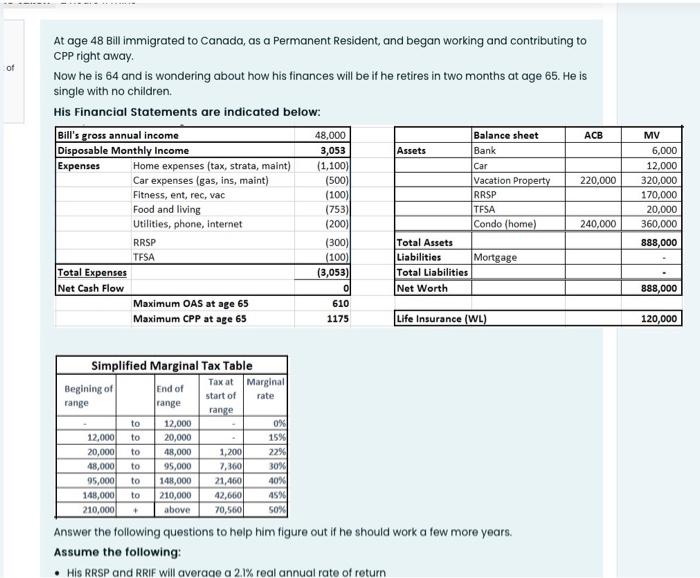

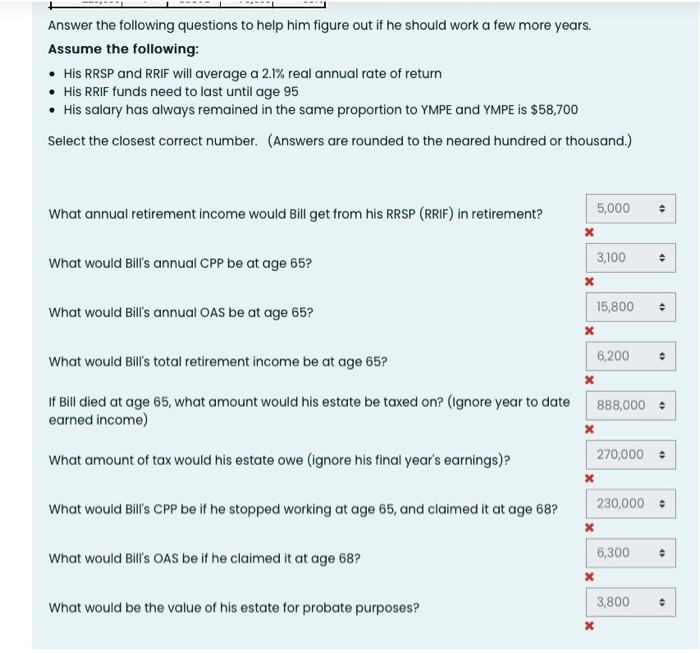

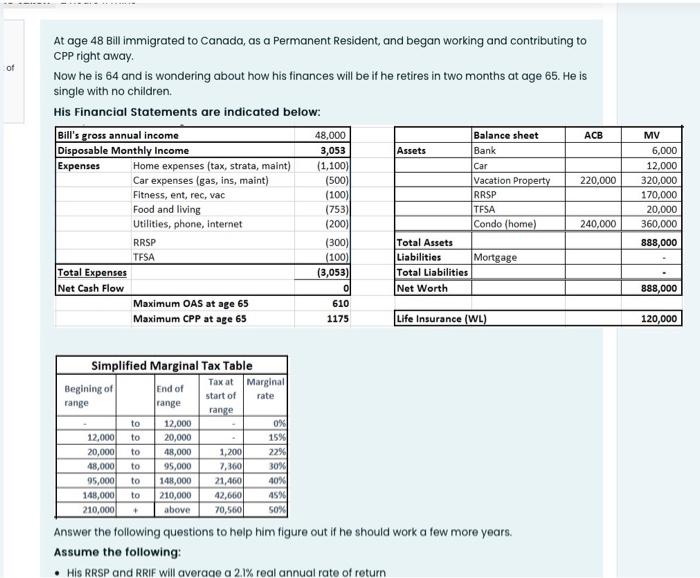

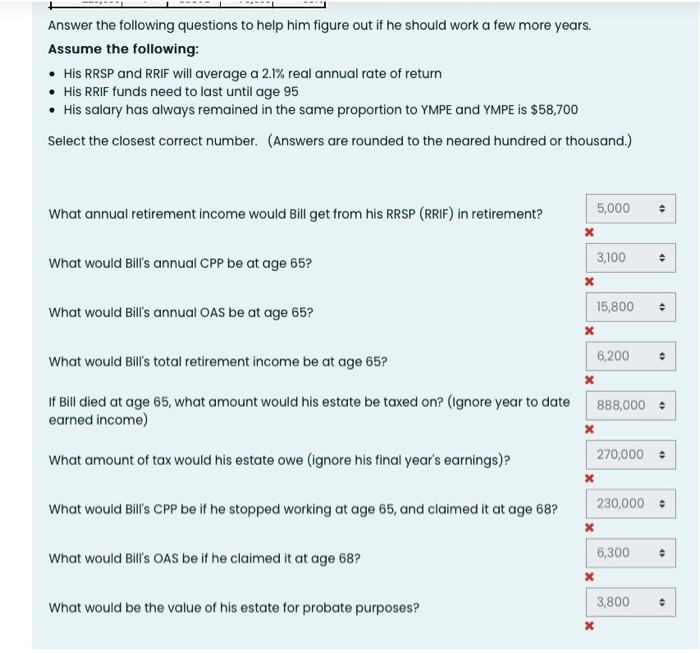

Answer the following questions to help him figure out if he should work a few more years. Assume the following: His RRSP and RRIF will average a 2.1% real annual rate of return His RRIF funds need to last until age 95 His salary has always remained in the same proportion to YMPE and YMPE is $58,700 Select the closest correct number. (Answers are rounded to the neared hundred or thousand.) What annual retirement income would Bill get from his RRSP (RRIF) in retirement? 5,000 X 3,100 What would Bill's annual CPP be at age 65? . . What would Bill's annual OAS be at age 65? 15,800 x 6,200 What would Bill's total retirement income be at age 65? . if Bill died at age 65, what amount would his estate be taxed on? (ignore year to date earned income) 888,000 + What amount of tax would his estate owe (ignore his final year's earnings)? 270,000+ What would Bill's CPP be if he stopped working at age 65, and claimed it at age 68? 230,000 X 6,300 X . What would Bill's OAS be if he claimed it at age 68? 3,800 What would be the value of his estate for probate purposes? . X Answer the following questions to help him figure out if he should work a few more years. Assume the following: His RRSP and RRIF will average a 2.1% real annual rate of return His RRIF funds need to last until age 95 His salary has always remained in the same proportion to YMPE and YMPE is $58,700 Select the closest correct number. (Answers are rounded to the neared hundred or thousand.) What annual retirement income would Bill get from his RRSP (RRIF) in retirement? 5,000 X 3,100 What would Bill's annual CPP be at age 65? . . What would Bill's annual OAS be at age 65? 15,800 x 6,200 What would Bill's total retirement income be at age 65? . if Bill died at age 65, what amount would his estate be taxed on? (ignore year to date earned income) 888,000 + What amount of tax would his estate owe (ignore his final year's earnings)? 270,000+ What would Bill's CPP be if he stopped working at age 65, and claimed it at age 68? 230,000 X 6,300 X . What would Bill's OAS be if he claimed it at age 68? 3,800 What would be the value of his estate for probate purposes? . X