Answered step by step

Verified Expert Solution

Question

1 Approved Answer

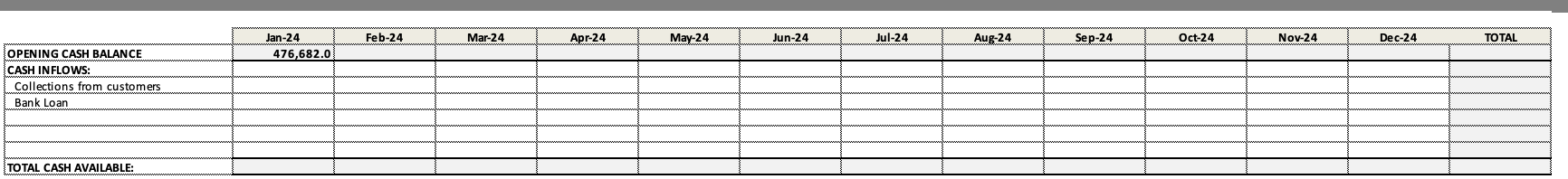

Can someone please work out the opening cash balance and collections from customers with working out. FactSheet - Data on 2022 Financial Year Sales Volume

Can someone please work out the opening cash balance and collections from customers with working out.

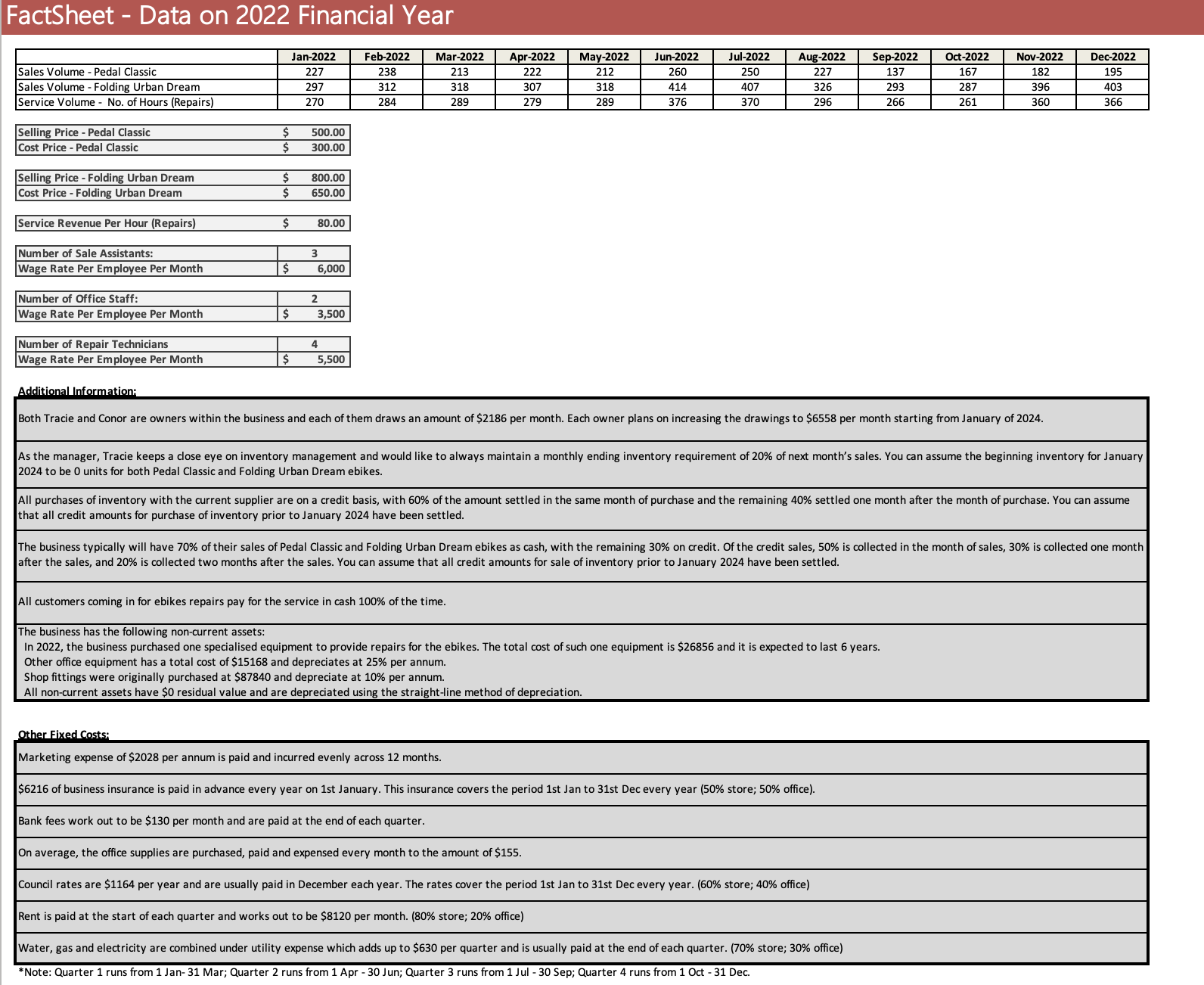

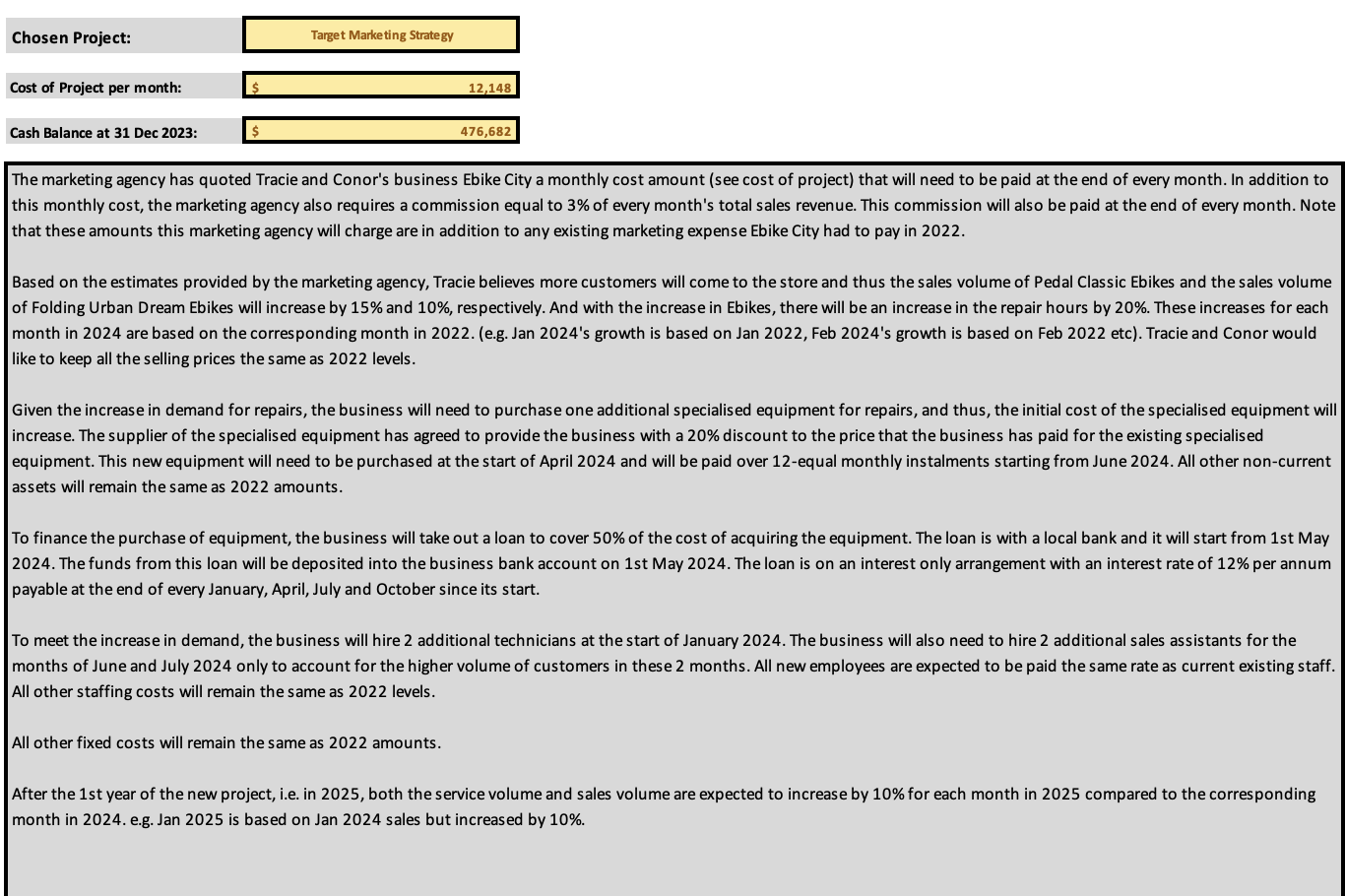

FactSheet - Data on 2022 Financial Year Sales Volume - Pedal Classic Sales Volume - Folding Urban Dream Service Volume - No. of Hours (Repairs) Selling Price - Pedal Classic Jan-2022 Feb-2022 Mar-2022 Apr-2022 May-2022 Jun-2022 Jul-2022 Aug-2022 Sep-2022 Oct-2022 Nov-2022 Dec-2022 227 238 213 222 212 260 250 227 137 167 182 195 297 312 318 307 318 414 407 326 293 287 396 403 270 284 289 279 289 376 370 296 266 261 360 366 $ 500.00 Cost Price - Pedal Classic $ 300.00 Selling Price - Folding Urban Dream $ 800.00 Cost Price - Folding Urban Dream $ 650.00 Service Revenue Per Hour (Repairs) $ 80.00 Number of Sale Assistants: 3 Wage Rate Per Employee Per Month $ 6,000 Number of Office Staff: 2 Wage Rate Per Employee Per Month $ 3,500 Number of Repair Technicians 4 Wage Rate Per Employee Per Month $ 5,500 Additional Information: Both Tracie and Conor are owners within the business and each of them draws an amount of $2186 per month. Each owner plans on increasing the drawings to $6558 per month starting from January of 2024. As the manager, Tracie keeps a close eye on inventory management and would like to always maintain a monthly ending inventory requirement of 20% of next month's sales. You can assume the beginning inventory for January 2024 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. All purchases of inventory with the current supplier are on a credit basis, with 60% of the amount settled in the same month of purchase and the remaining 40% settled one month after the month of purchase. You can assume that all credit amounts for purchase of inventory prior to January 2024 have been settled. The business typically will have 70% of their sales of Pedal Classic and Folding Urban Dream ebikes as cash, with the remaining 30% on credit. Of the credit sales, 50% is collected in the month of sales, 30% is collected one month after the sales, and 20% is collected two months after the sales. You can assume that all credit amounts for sale of inventory prior to January 2024 have been settled. All customers coming in for ebikes repairs pay for the service in cash 100% of the time. The business has the following non-current assets: In 2022, the business purchased one specialised equipment to provide repairs for the ebikes. The total cost of such one equipment is $26856 and it is expected to last 6 years. Other office equipment has a total cost of $15168 and depreciates at 25% per annum. Shop fittings were originally purchased at $87840 and depreciate at 10% per annum. All non-current assets have $0 residual value and are depreciated using the straight-line method of depreciation. Other Fixed Costs: Marketing expense of $2028 per annum is paid and incurred evenly across 12 months. $6216 of business insurance is paid in advance every year on 1st January. This insurance covers the period 1st Jan to 31st Dec every year (50% store; 50% office). Bank fees work out to be $130 per month and are paid at the end of each quarter. On average, the office supplies are purchased, paid and expensed every month to the amount of $155. Council rates are $1164 per year and are usually paid in December each year. The rates cover the period 1st Jan to 31st Dec every year. (60% store; 40% office) Rent is paid at the start of each quarter and works out to be $8120 per month. (80% store; 20% office) Water, gas and electricity are combined under utility expense which adds up to $630 per quarter and is usually paid at the end of each quarter. (70% store; 30% office) *Note: Quarter 1 runs from 1 Jan- 31 Mar; Quarter 2 runs from 1 Apr - 30 Jun; Quarter 3 runs from 1 Jul - 30 Sep; Quarter 4 runs from 1 Oct - 31 Dec.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started