Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone pls help me with this finance question A university student painter is considering the purchase of a new air compressor and paint gun

Can someone pls help me with this finance question

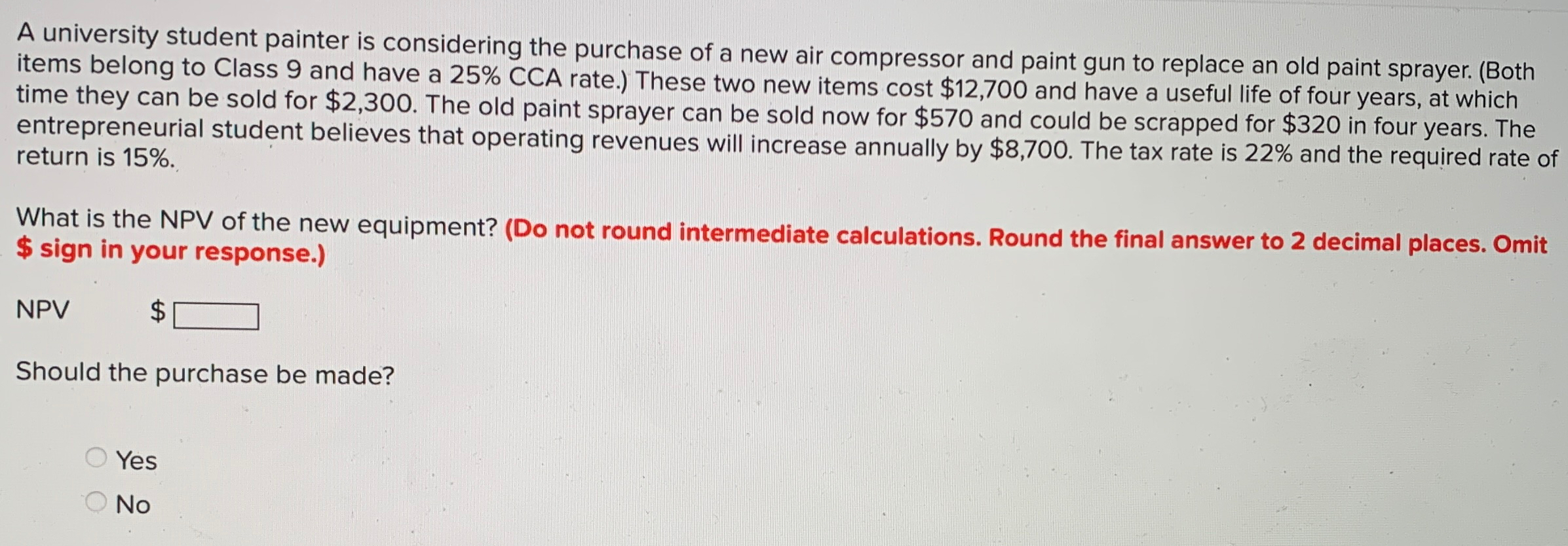

A university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer. Both items belong to Class and have a CCA rate. These two new items cost $ and have a useful life of four years, at which time they can be sold for $ The old paint sprayer can be sold now for $ and could be scrapped for $ in four years. The entrepreneurial student believes that operating revenues will increase annually by $ The tax rate is and the required rate of return is

What is the NPV of the new equipment? Do not round intermediate calculations. Round the final answer to decimal places. Omit $ sign in your response.

NPV

$

Should the purchase be made?

Yes

No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started