Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone solve this for me please? Question 3 The statement of financial position of Builder plc (a manufacturing firm) at 31 December 20X0 includes

Can someone solve this for me please?

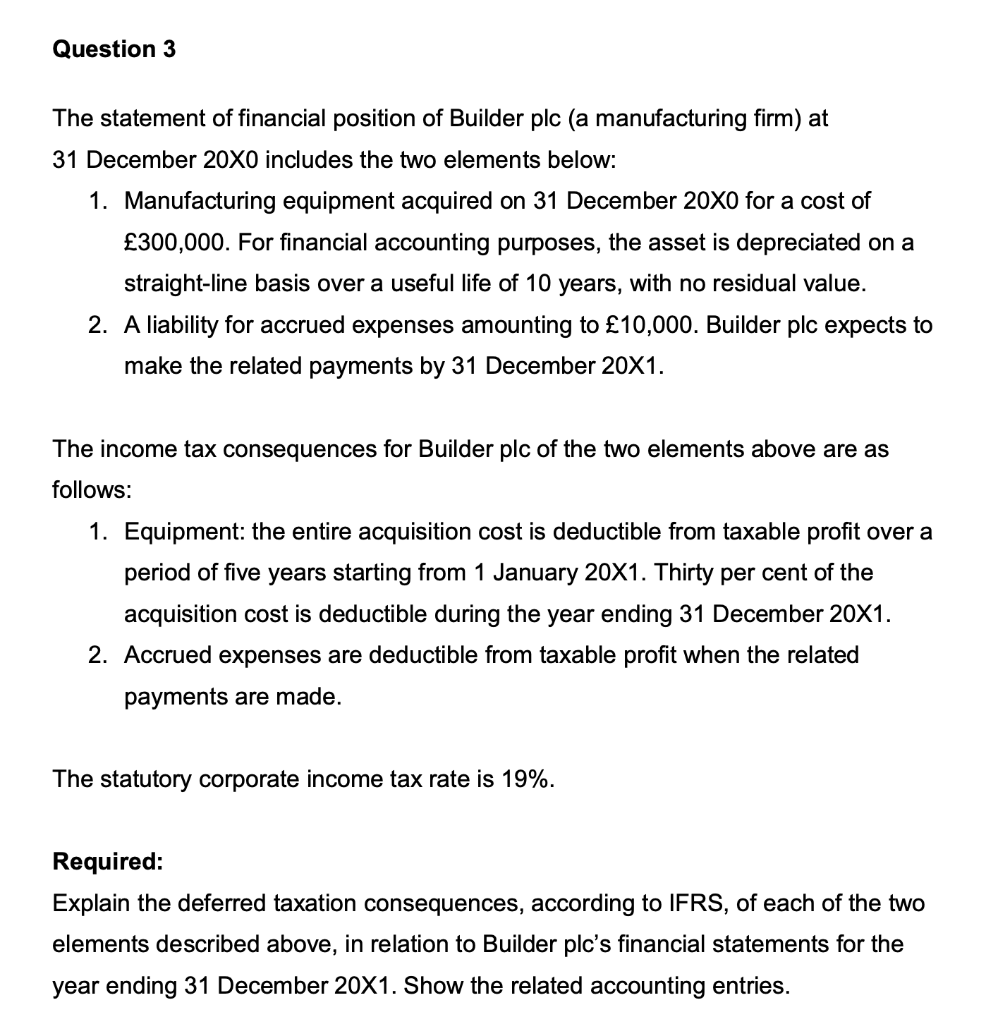

Question 3 The statement of financial position of Builder plc (a manufacturing firm) at 31 December 20X0 includes the two elements below: 1. Manufacturing equipment acquired on 31 December 20XO for a cost of 300,000. For financial accounting purposes, the asset is depreciated on a straight-line basis over a useful life of 10 years, with no residual value. 2. A liability for accrued expenses amounting to 10,000. Builder plc expects to make the related payments by 31 December 20X1. The income tax consequences for Builder plc of the two elements above are as follows: 1. Equipment: the entire acquisition cost is deductible from taxable profit over a period of five years starting from 1 January 20X1. Thirty per cent of the acquisition cost is deductible during the year ending 31 December 20X1. 2. Accrued expenses are deductible from taxable profit when the related payments are made. The statutory corporate income tax rate is 19%. Required: Explain the deferred taxation consequences, according to IFRS, of each of the two elements described above, in relation to Builder plc's financial statements for the year ending 31 December 20X1. Show the related accounting entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started