Answered step by step

Verified Expert Solution

Question

1 Approved Answer

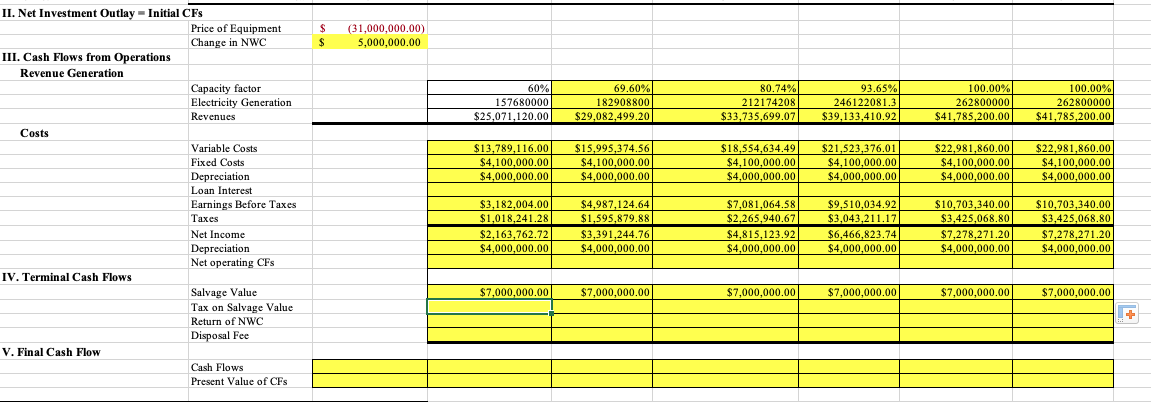

Can someone tell me if I am doing this right? I am most concerned about the depreciation in the cost section and the salvage value.

Can someone tell me if I am doing this right? I am most concerned about the depreciation in the cost section and the salvage value. Would the salvage value go down by the depreciation cost until it hit 7k or would it just be 7k a year?

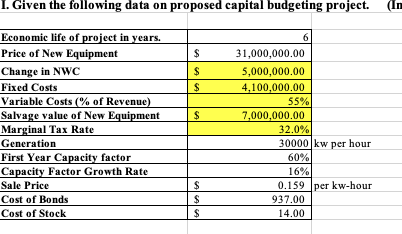

I. Given the following data on proposed capital budgeting project. (In $ $ $ $ Economic life of project in years. Price of New Equipment Change in NWC Fixed Costs Variable Costs (% of Revenue) Salvage value of New Equipment Marginal Tax Rate Generation First Year Capacity factor Capacity Factor Growth Rate Sale Price Cost of Bonds Cost of Stock 31,000,000.00 5,000,000.00 4,100,000.00 55% 7,000,000.00 32.0% 30000 lkw per hour 60% 16% 0.159 per kw-hour 937.00 14.00 $ $ $ $ S (31,000,000.00) 5,000,000.00 60%) 157680000 $25,071,120.00 69.60% 182908800 $29,082,499.20 80.74% 2121742081 $33,735,699.07 93.65% 246122081.3 $39,133,410.92 100.00% 262800000 $41,785,200.00 100.00% 262800000 $41,785,200.00 $13,789,116.00 $4,100,000.00 $4,000,000.00 $15,995,374.56 $4,100,000.00 $4,000,000.00 $18,554,634.49 $4,100,000.00 $4,000,000.00 $21,523,376.01 $4,100,000.00 $4,000,000.00 $22,981,860.00 $4,100,000.00 $4,000,000.00 $22,981,860.00 $4,100,000.00 $4,000,000.00 II. Net Investment Outlay Initial CFs Price of Equipment Change in NWC III. Cash Flows from Operations Revenue Generation Capacity factor Electricity Generation Revenues Costs Variable Costs Fixed Costs Depreciation Loan Interest Earnings Before Taxes Taxes Net Income Depreciation Net operating CFS IV. Terminal Cash Flows Salvage Value Tax on Salvage Value Return of NWC Disposal Fee V. Final Cash Flow Cash Flows Present Value of CFS $3,182,004.00 $1,018,241.28 $2,163,762.72 $4,000,000.00 $4,987,124.64 $1,595,879.88 $3,391,244.76 $4,000,000.00 $7,081,064.58 $2,265,940.67 $4,815,123.92 $4,000,000.00 $9,510,034.92 $3,043,211.17 $6,466,823.74 $4,000,000.00 $10,703,340.00 $3,425,068.80 $7,278,271.20 $4,000,000.00 $10,703,340.00 $3,425,068.80 $7,278,271.20 $4,000,000.00 $7,000,000.00 $7,000,000.00 $7,000,000.00 $7,000,000.00 $7,000,000.00 $7,000,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started