Answered step by step

Verified Expert Solution

Question

1 Approved Answer

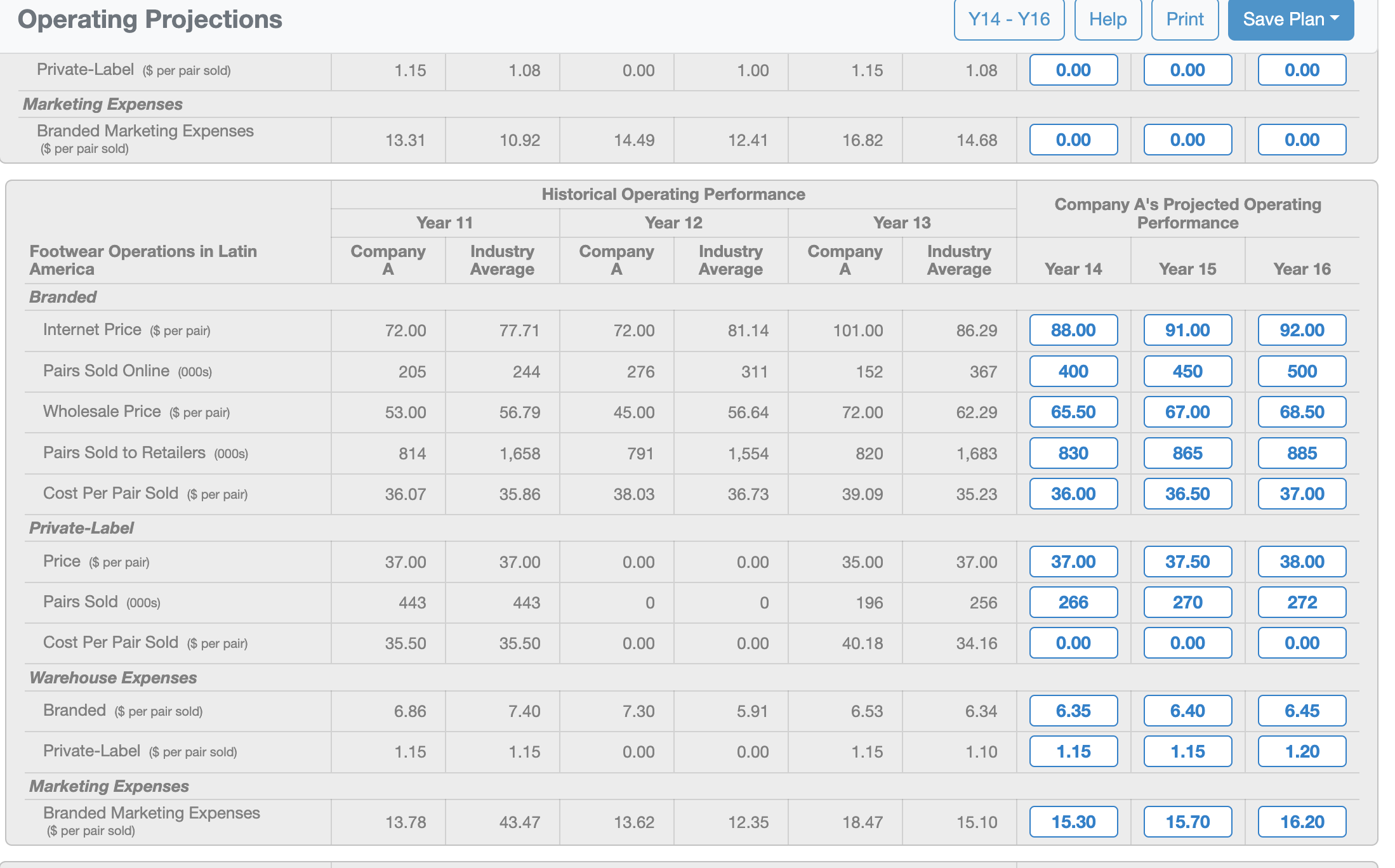

Can someone tell me the right answers here? I just plugged in these numbers that are similar but I know they are not right. Operating

Can someone tell me the right answers here? I just plugged in these numbers that are similar but I know they are not right.

Operating Projections Y14-Y16 ][ Help ][ Print ] Save Plan \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline Private-Label ( $ per pair sold) & 1.15 & 1.08 & 0.00 & 1.00 & 1.15 & 1.08 & 0.00 & 0.00 & 0.00 \\ \hline \multicolumn{10}{|l|}{ Marketing Expenses } \\ \hline \begin{tabular}{l} Branded Marketing Expenses \\ ( $ per pair sold) \end{tabular} & 13.31 & 10.92 & 14.49 & 12.41 & 16.82 & 14.68 & 0.00 & 0.00 & 0.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{3}{*}{\begin{tabular}{l} Footwear Operations in Latin \\ America \end{tabular}} & \multicolumn{6}{|c|}{ Historical Operating Performance } & \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{c} Company A's Projected Operating \\ Performance \end{tabular}}} \\ \hline & \multicolumn{2}{|c|}{ Year 11} & \multicolumn{2}{|c|}{ Year 12} & \multicolumn{2}{|c|}{ Year 13} & & & \\ \hline & ACompany & \begin{tabular}{l} Industry \\ Average \end{tabular} & ACompany & \begin{tabular}{l} Industry \\ Average \end{tabular} & ACompany & \begin{tabular}{l} Industry \\ Average \end{tabular} & Year 14 & Year 15 & Year 16 \\ \hline \multicolumn{10}{|l|}{ Branded } \\ \hline Internet Price ( $ per pair) & 72.00 & 77.71 & 72.00 & 81.14 & 101.00 & 86.29 & 88.00 & 91.00 & 92.00 \\ \hline Pairs Sold Online (000s) & 205 & 244 & 276 & 311 & 152 & 367 & 400 & 450 & 500 \\ \hline Wholesale Price ( $ per pair) & 53.00 & 56.79 & 45.00 & 56.64 & 72.00 & 62.29 & 65.50 & 67.00 & 68.50 \\ \hline Pairs Sold to Retailers (000s) & 814 & 1,658 & 791 & 1,554 & 820 & 1,683 & 830 & 865 & 885 \\ \hline Cost Per Pair Sold (\$ per pair) & 36.07 & 35.86 & 38.03 & 36.73 & 39.09 & 35.23 & 36.00 & 36.50 & 37.00 \\ \hline \multicolumn{10}{|l|}{ Private-Label } \\ \hline Price ( $ per pair) & 37.00 & 37.00 & 0.00 & 0.00 & 35.00 & 37.00 & 37.00 & 37.50 & 38.00 \\ \hline Pairs Sold (000s) & 443 & 443 & 0 & 0 & 196 & 256 & 266 & 270 & 272 \\ \hline Cost Per Pair Sold ( $ per pair) & 35.50 & 35.50 & 0.00 & 0.00 & 40.18 & 34.16 & 0.00 & 0.00 & 0.00 \\ \hline \multicolumn{10}{|l|}{ Warehouse Expenses } \\ \hline Branded ( $ per pair sold) & 6.86 & 7.40 & 7.30 & 5.91 & 6.53 & 6.34 & 6.35 & 6.40 & 6.45 \\ \hline Private-Label ($ per pair sold) & 1.15 & 1.15 & 0.00 & 0.00 & 1.15 & 1.10 & 1.15 & 1.15 & 1.20 \\ \hline \multicolumn{10}{|l|}{ Marketing Expenses } \\ \hline \begin{tabular}{l} Branded Marketing Expenses \\ ( $ per pair sold) \end{tabular} & 13.78 & 43.47 & 13.62 & 12.35 & 18.47 & 15.10 & 15.30 & 15.70 & 16.20 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started