Answered step by step

Verified Expert Solution

Question

1 Approved Answer

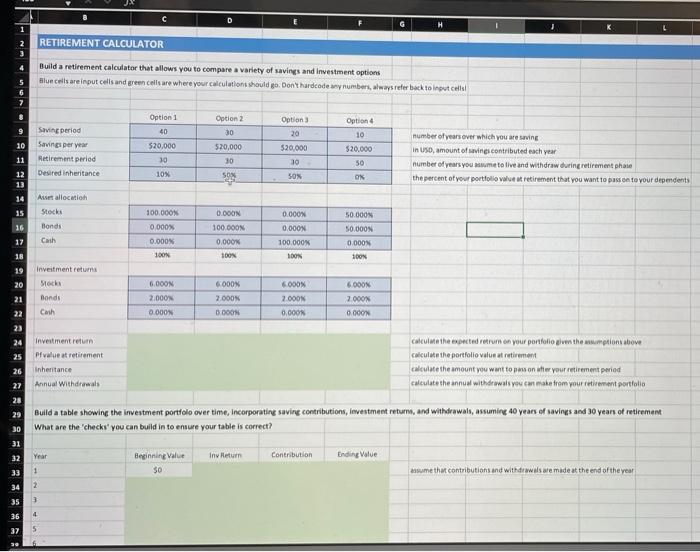

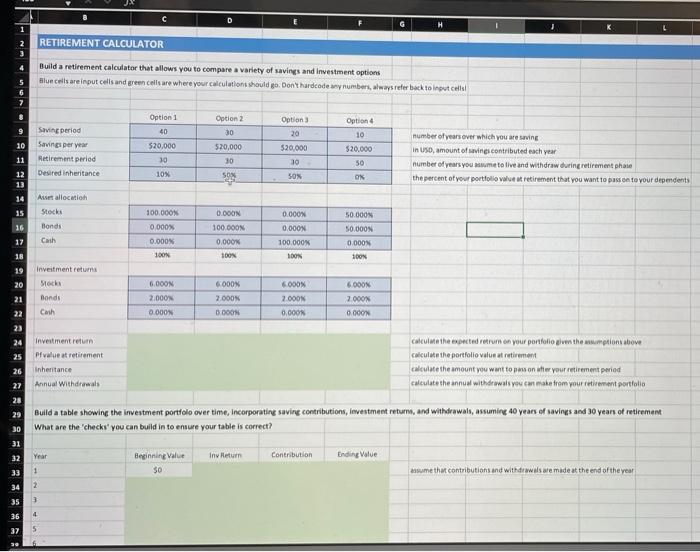

can u also post the formulas D RETIREMENT CALCULATOR Build a retirement calculator that allows you to compare a variety of savings and investment options

can u also post the formulas

D RETIREMENT CALCULATOR Build a retirement calculator that allows you to compare a variety of savings and investment options Blue cells are input cells and green cells are where your calculation should go. Don't hardcode any numbers, always refer back to not cells! Options 20 Option 4 10 Saving period Savings per year Retirement period Desired inheritance 10 11 12 13 14 Option 1 40 $20,000 30 10% Option 2 30 520,000 30 520,000 30 SON $20.000 50 OX number of years over which you are saving in USD, amount of savingscontributed each year number of years you me to live and withdraw during retirement photo the percent of your portfolio valor ut retirement that you want to pass on to your dependents SON 15 Asset allocation Stocks Bonds 0.OOON 16 17 100.000 0.000 0.000 100 0.000 0.000N 100.000 MOON 100.000 0.000 ON 50.000 50.000 0.000N SON Cash 18 19 Investment retum Stocks 20 6.000N 21 Bonds Cai 2.000 0.000 6000 2.000 0.000 6000 2.000 0.000 6.000 2.000% 0.000 22 23 24 25 Investment return Pfvaleat retirement Inheritance Annual Withdrawals Calcule the red retium on your portfoliose the umption above calculate the portfolio valeat retirement calculate the amount you want to pass on wer your retirement period calculate the annual withdrawals you can make from your retirement portfolio 26 27 28 29 30 Build a table showing the investment portfolo over time, Incorporating saving contributions, investment return, and withdrawals, assuming 40 years of savings and 30 years of retirement What are the 'checks you can build in to ensure your table is correct? 31 Year 32 Inv Retur Contribution Ending Valve Beginning Value 30 1 sume that contributions and withdrawals are made at the end of the year 34 35 3 36 4 37 D RETIREMENT CALCULATOR Build a retirement calculator that allows you to compare a variety of savings and investment options Blue cells are input cells and green cells are where your calculation should go. Don't hardcode any numbers, always refer back to not cells! Options 20 Option 4 10 Saving period Savings per year Retirement period Desired inheritance 10 11 12 13 14 Option 1 40 $20,000 30 10% Option 2 30 520,000 30 520,000 30 SON $20.000 50 OX number of years over which you are saving in USD, amount of savingscontributed each year number of years you me to live and withdraw during retirement photo the percent of your portfolio valor ut retirement that you want to pass on to your dependents SON 15 Asset allocation Stocks Bonds 0.OOON 16 17 100.000 0.000 0.000 100 0.000 0.000N 100.000 MOON 100.000 0.000 ON 50.000 50.000 0.000N SON Cash 18 19 Investment retum Stocks 20 6.000N 21 Bonds Cai 2.000 0.000 6000 2.000 0.000 6000 2.000 0.000 6.000 2.000% 0.000 22 23 24 25 Investment return Pfvaleat retirement Inheritance Annual Withdrawals Calcule the red retium on your portfoliose the umption above calculate the portfolio valeat retirement calculate the amount you want to pass on wer your retirement period calculate the annual withdrawals you can make from your retirement portfolio 26 27 28 29 30 Build a table showing the investment portfolo over time, Incorporating saving contributions, investment return, and withdrawals, assuming 40 years of savings and 30 years of retirement What are the 'checks you can build in to ensure your table is correct? 31 Year 32 Inv Retur Contribution Ending Valve Beginning Value 30 1 sume that contributions and withdrawals are made at the end of the year 34 35 3 36 4 37

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started