Answered step by step

Verified Expert Solution

Question

1 Approved Answer

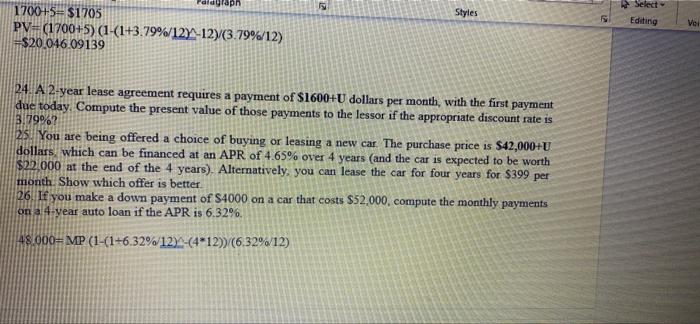

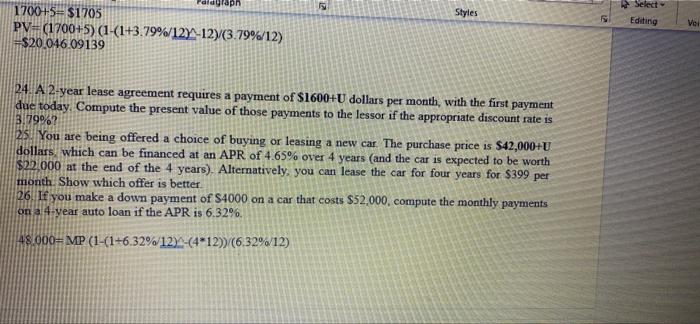

can u please do 24,25 im confused U=5 apn Styles Select Editing 1700+5=$1705 PV=(1700+5) (1-(1+3.79%/127-12y(3.79%/12) $20.046 09139 Vol 24. A 2-year lease agreement requires a

can u please do 24,25 im confused U=5

apn Styles Select Editing 1700+5=$1705 PV=(1700+5) (1-(1+3.79%/127-12y(3.79%/12) $20.046 09139 Vol 24. A 2-year lease agreement requires a payment of S1600+U dollars per month, with the first payment due today. Compute the present value of those payments to the lessor if the appropriate discount rate is 3.79962 25. You are being offered a choice of buying or leasing a new car. The purchase price is $42,000+U dollars, which can be financed at an APR of 4.65% over 4 years and the car is expected to be worth $22.000 at the end of the 4 years). Alternatively, you can lease the car for four years for $399 per month. Show which offer is better 26. If you make a down payment of S4000 on a car that costs $52,000, compute the monthly payments on a 4-year auto loan if the APR is 6.32%. 48.000= MP (1-(1+6.32%/12)-(4-12))/(6.329/12)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started