Answered step by step

Verified Expert Solution

Question

1 Approved Answer

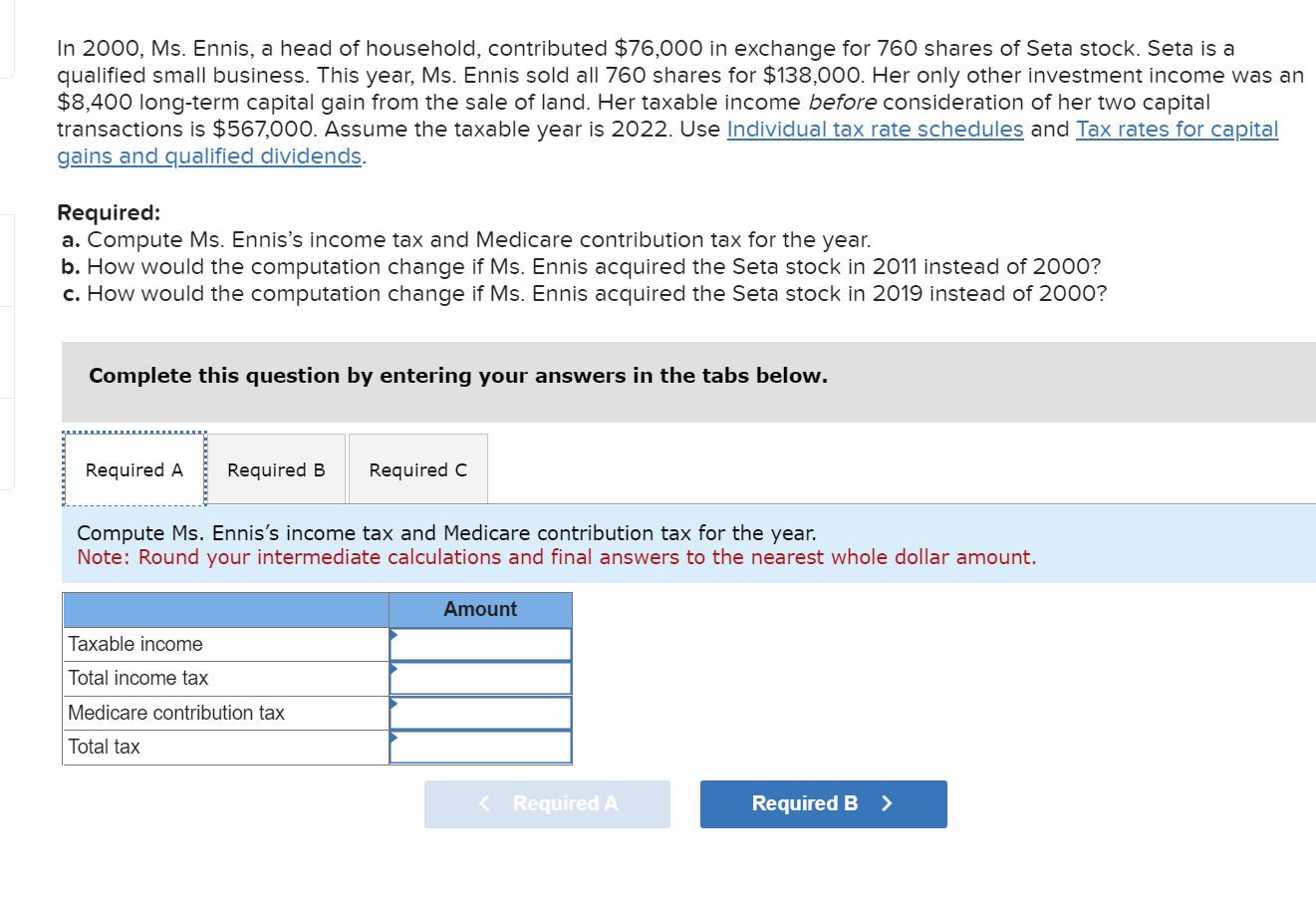

can you answer A, B, and C? In 2000, Ms. Ennis, a head of household, contributed $76,000 in exchange for 760 shares of Seta stock.

can you answer A, B, and C?

In 2000, Ms. Ennis, a head of household, contributed $76,000 in exchange for 760 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 760 shares for $138,000. Her only other investment income was an $8,400 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $567,000. Assume the taxable year is 2022 . Use Individualtaxrateschedulesand gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started