Answered step by step

Verified Expert Solution

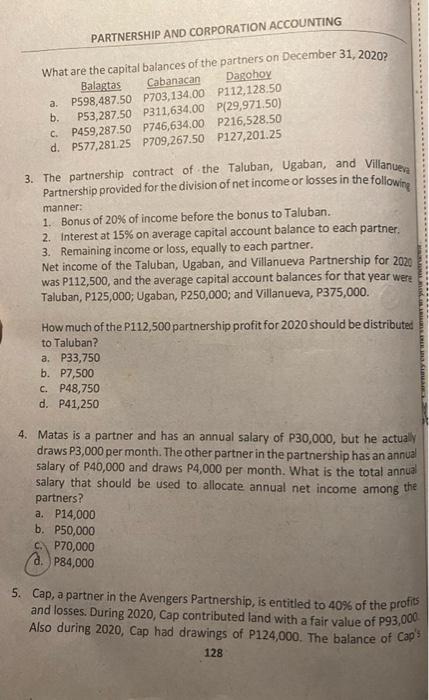

Question

1 Approved Answer

can you answer all CHAPTER 3 | PARTNERSHIP OPERATIONS CHAPTER 3 -TEST 3 PARTNERSHIP OPERATIONS Name Course and Section Date Score Instruction: Encircle the letter

can you answer all

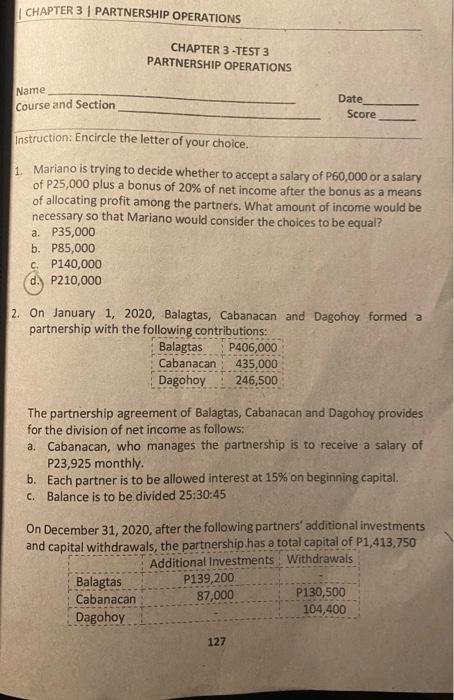

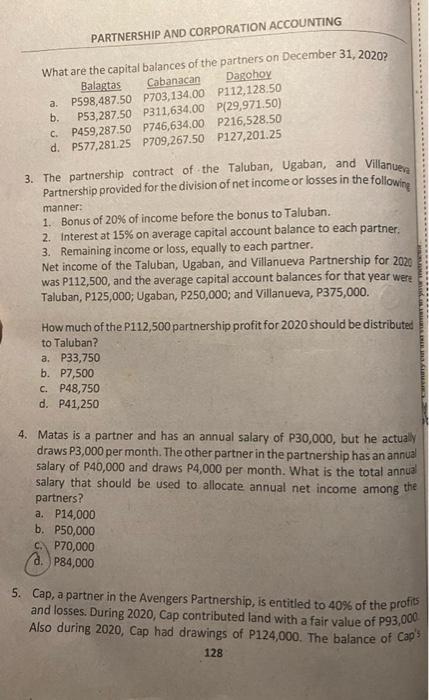

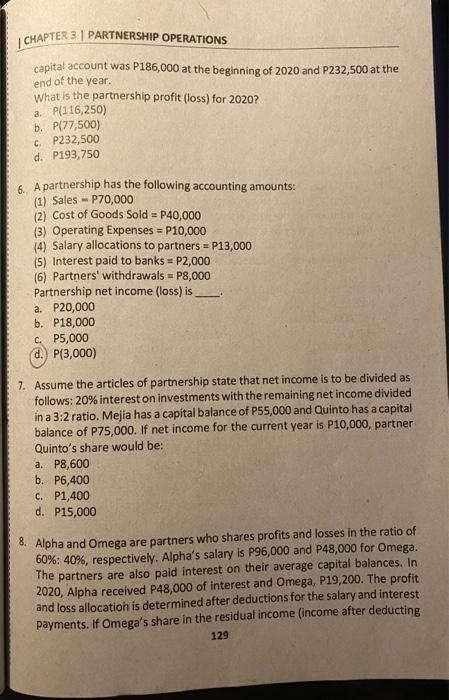

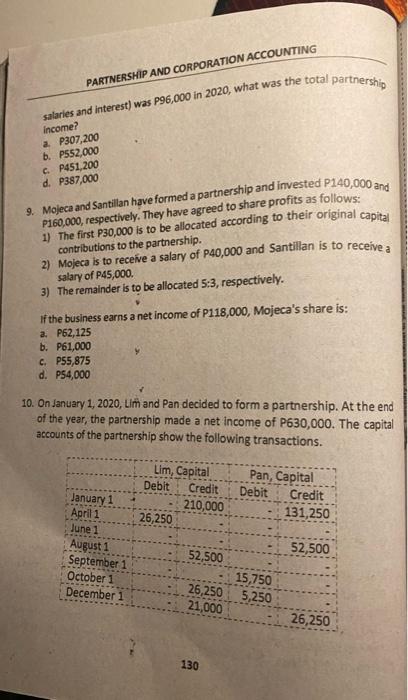

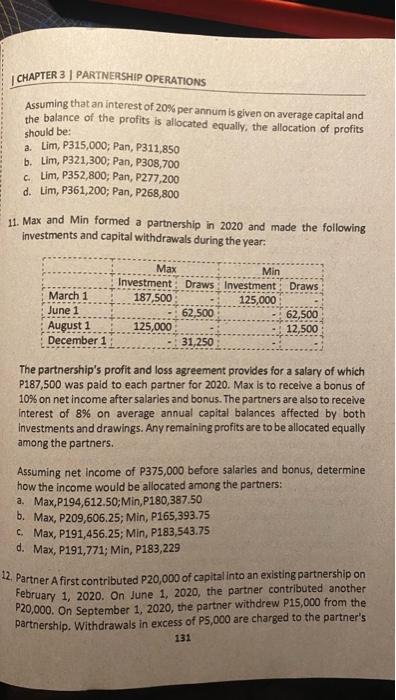

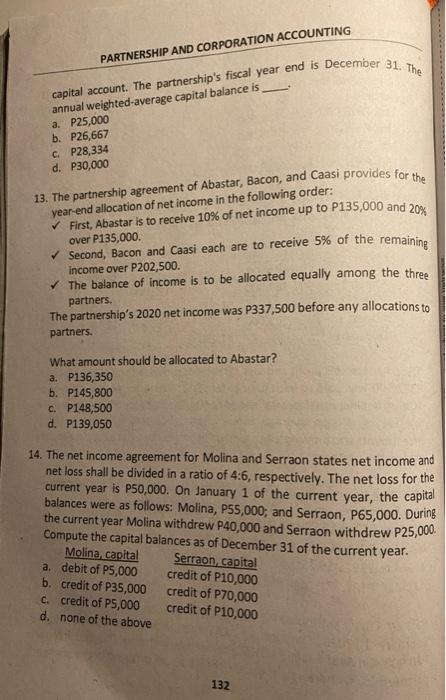

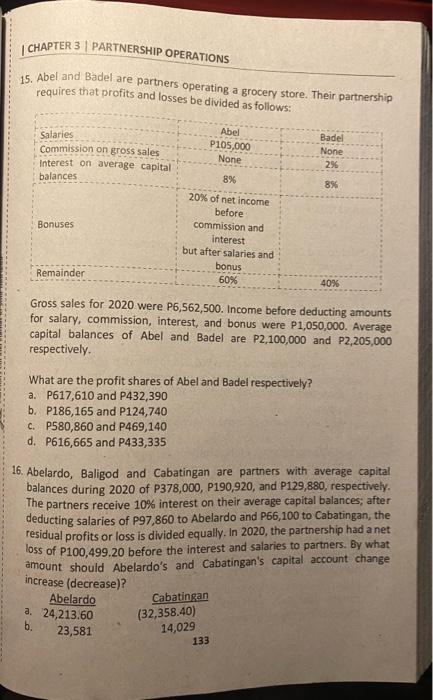

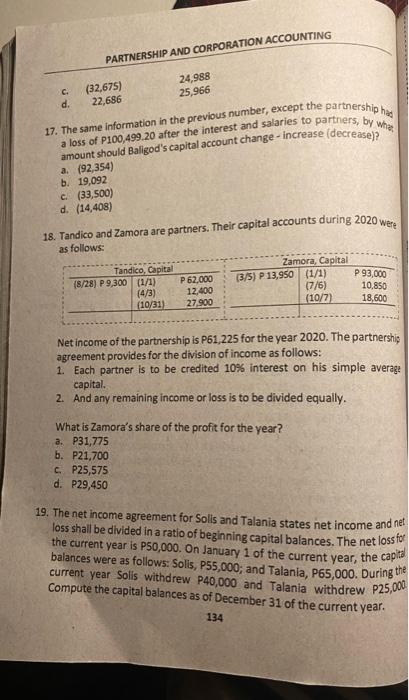

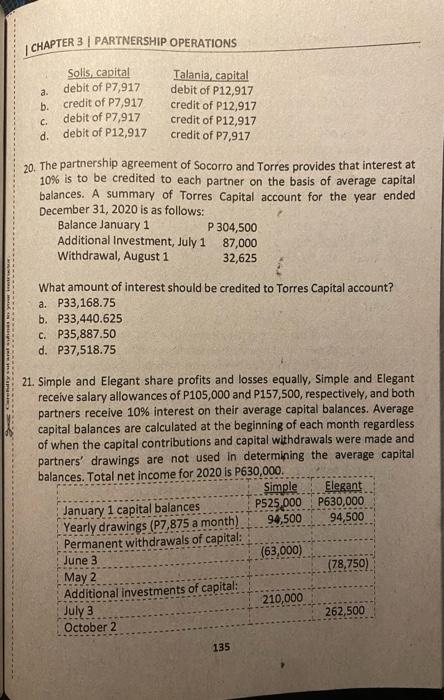

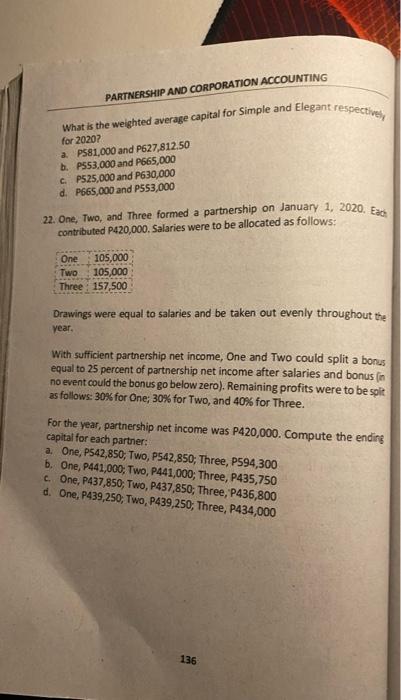

CHAPTER 3 | PARTNERSHIP OPERATIONS CHAPTER 3 -TEST 3 PARTNERSHIP OPERATIONS Name Course and Section Date Score Instruction: Encircle the letter of your choice. 1. Mariano is trying to decide whether to accept a salary of P60,000 or a salary of P25,000 plus a bonus of 20% of net income after the bonus as a means of allocating profit among the partners. What amount of income would be necessary so that Mariano would consider the choices to be equal? a. P35,000 b. P85,000 CP140,000 d. P210,000 2. On January 1, 2020, Balagtas, Cabanacan and Dagohoy formed a partnership with the following contributions: Balagtas P406,000 Cabanacan 435,000 Dagohoy 246,500 The partnership agreement of Balagtas, Cabanacan and Dagohoy provides for the division of net income as follows: a. Cabanacan, who manages the partnership is to receive a salary of P23,925 monthly b. Each partner is to be allowed interest at 15% on beginning capital. C. Balance is to be divided 25:30:45 On December 31, 2020, after the following partners' additional investments and capital withdrawals, the partnership has a total capital of P1,413,750 Additional Investments Withdrawals Balagtas P139,200 Cabanacan 87,000 P130,500 Dagohoy 104,400 127 PARTNERSHIP AND CORPORATION ACCOUNTING a. What are the capital balances of the partners on December 31, 2020? Balagtas Cabanacan Dagohoy P598,487.50 P703,134.00 P112,128.50 b. P53,287.50 P311,634.00 P(29,971.50) P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201.25 C. manner: 3. The partnership contract of the Taluban, Ugaban, and Villanueva Partnership provided for the division of net income or losses in the following 1. Bonus of 20% of income before the bonus to Taluban. 2. Interest at 15% on average capital account balance to each partner 3. Remaining income or loss, equally to each partner. Net income of the Taluban, Ugaban, and Villanueva Partnership for 2020 was P112,500, and the average capital account balances for that year were Taluban, P125,000; Ugaban, P250,000; and Villanueva, P375,000. How much of the P112,500 partnership profit for 2020 should be distributed to Taluban? a. P33,750 b. P7,500 CP48,750 d. P41,250 4. Matas is a partner and has an annual salary of P30,000, but he actually draws P3,000 per month. The other partner in the partnership has an annual salary of P40,000 and draws P4,000 per month. What is the total annua salary that should be used to allocate annual net income among the partners? a. P14,000 b. P50,000 C. P70,000 a. P84,000 5. Cap, a partner in the Avengers Partnership, is entitled to 40% of the profits and losses. During 2020, Cap contributed land with a fair value of P93,000 Also during 2020, Cap had drawings of P124,000. The balance of caps 128 | CHAPTER 3 | PARTNERSHIP OPERATIONS capital account was P186,000 at the beginning of 2020 and P232,500 at the end of the year. What is the partnership profit (loss) for 2020? a. P(116,250) b. P[77,500) c. P232,500 d. P193,750 6. A partnership has the following accounting amounts: (1) Sales - P70,000 (2) Cost of Goods Sold = P40,000 (3) Operating Expenses = P10,000 (4) Salary allocations to partners = P13,000 (5) Interest paid to banks = P2,000 (6) Partners' withdrawals = P8,000 Partnership net income (loss) is a. P20,000 b. P18,000 c. P5,000 d.) P(3,000) 7. Assume the articles of partnership state that net income is to be divided as follows: 20% interest on investments with the remaining net income divided in a 3:2 ratio. Mejia has a capital balance of P55,000 and Quinto has a capital balance of P75,000. If net income for the current year is P10,000, partner Quinto's share would be: a. P8,600 b. P6,400 c. P1,400 d. P15,000 8. Alpha and Omega are partners who shares profits and losses in the ratio of 60%: 40%, respectively. Alpha's salary is P96,000 and P48,000 for Omega. The partners are also paid interest on their average capital balances. In 2020, Alpha received P48,000 of interest and Omega, P19,200. The profit and loss allocation is determined after deductions for the salary and interest payments. If Omega's share in the residual income (income after deducting 129 PARTNERSHIP AND CORPORATION ACCOUNTING salaries and interest) was P96,000 in 2020, what was the total partnership income? a. P307,200 b. P552,000 c. P451,200 d. P387,000 9. Mojeca and Santillan have formed a partnership and invested P140,000 and P160,000, respectively. They have agreed to share profits as follows: 1) The first P30,000 is to be allocated according to their original capital contributions to the partnership. 2) Mojeca is to receive a salary of P40,000 and Santillan is to receive a salary of P45,000 3) The remainder is to be allocated 5:3, respectively. if the business earns a net income of P118,000, Mojeca's share is: a. P52, 125 b. P61,000 c. P55,875 d. P54,000 10. On January 1, 2020, Lim and Pan decided to form a partnership. At the end of the year, the partnership made a net income of P630,000. The capital accounts of the partnership show the following transactions. Lim, Capital Debit Credit 210,000 26,250 Pan, Capital Debit Credit 131,250 January 1 April 1 June 1 August 1 September 1 October 1 December 52,500 52,500 15,750 26,250 5,250 21,000 26,250 130 should be: CHAPTER 3 | PARTNERSHIP OPERATIONS Assuming that an interest of 20% per annum is given on average capital and the balance of the profits is allocated equally, the allocation of profits a. Lim, P315,000; Pan, P311,850 b. Lim, P321,300; Pan, P308,700 c. Lim, P352,800; Pan, P277,200 d. Lim, P361,200; Pan, P268,800 11. Max and Min formed a partnership in 2020 and made the following investments and capital withdrawals during the year. Max Min Investment Draws Investment Draws March 1 187,500 125,000 June 1 62,500 62,500 August 1 125,000 12,500 December 11 31 250 The partnership's profit and loss agreement provides for a salary of which P187,500 was paid to each partner for 2020. Max is to receive a bonus of 10% on net income after salaries and bonus. The partners are also to receive Interest of 8% on average annual capital balances affected by both Investments and drawings. Any remaining profits are to be allocated equally among the partners. Assuming net income of P375,000 before salaries and bonus, determine how the income would be allocated among the partners: a. Max,P194,612.50;Min, P180,387.50 b. Max, P209,606.25; Min, P165,393.75 C. Max, P191,456.25; Min, P183,543.75 d. Max, P191,771; Min, P183,229 12. Partner Afirst contributed P20,000 of capital into an existing partnership on February 1, 2020. On June 1, 2020, the partner contributed another P20,000. On September 1, 2020, the partner withdrew P15,000 from the partnership. Withdrawals in excess of P5,000 are charged to the partner's 131 PARTNERSHIP AND CORPORATION ACCOUNTING capital account. The partnership's fiscal year end is December 31. The annual weighted-average capital balance is a. P25,000 b. P26,667 c P28,334 d. P30,000 13. The partnership agreement of Abastar, Bacon, and Caasi provides for the year-end allocation of net income in the following order: First, Abastar is to receive 10% of net income up to P135,000 and 20% over P135,000. Second, Bacon and Caasi each are to receive 5% of the remaining income over P202,500. The balance of income is to be allocated equally among the three partners. The partnership's 2020 net income was P337,500 before any allocations to partners. What amount should be allocated to Abastar? a. P136,350 b. P145,800 c. P148,500 d. P139,050 14. The net income agreement for Molina and Serraon states net income and net loss shall be divided in a ratio of 4:6, respectively. The net loss for the current year is P50,000. On January 1 of the current year, the capital balances were as follows: Molina, P55,000, and Serraon, P65,000. During the current year Molina withdrew P40,000 and Serraon withdrew P25,000. Compute the capital balances as of December 31 of the current year. Molina, capital Serraon, capital a. debit of P5,000 credit of P10,000 b. credit of P35,000 credit of P70,000 C. credit of P5,000 credit of P10,000 d. none of the above 132 CHAPTER 3 PARTNERSHIP OPERATIONS 15. Abel and Badel are partners operating a grocery store. Their partnership requires that profits and losses be divided as follows: Salaries Commission on gross sales Interest on average capital balances Abel P105,000 None Badel None 8% 8% Bonuses 20% of net income before commission and interest but after salaries and bonus 60% Remainder 40% Gross sales for 2020 were P6,562,500. Income before deducting amounts for salary, commission, interest, and bonus were P1,050,000. Average capital balances of Abel and Badel are P2,100,000 and P2,205,000 respectively. What are the profit shares of Abel and Badel respectively? a. P617,610 and P432,390 b. P186,165 and P124,740 C. P580,860 and P469,140 d. P616,665 and P433,335 16. Abelardo, Baligod and Cabatingan are partners with average capital balances during 2020 of P378,000, P190,920, and P129,880, respectively. The partners receive 10% interest on their average capital balances; after deducting salaries of p97,860 to Abelardo and P66,100 to Cabatingan, the residual profits or loss is divided equally. In 2020, the partnership had a net loss of P100,499.20 before the interest and salaries to partners. By what amount should Abelardo's and Cabatingan's capital account change increase (decrease)? Abelardo a. 24,213.60 23,581 Cabatingan (32,358.40) 14,029 133 PARTNERSHIP AND CORPORATION ACCOUNTING 24,988 25,966 C. d. (32,675) 22,686 17. The same information in the previous number, except the partnership has a loss of P100,499.20 after the interest and salaries to partners, by Wha, amount should Baligod's capital account change - increase (decrease) a. (92,354) b. 19,092 c. (33,500) d. (14,408) 18. Tandico and Zamora are partners. Their capital accounts during 2020 were as follows: Tandico, Capital (8/28) P9,300 (1/1) (4/3) (10/31) P 62,000 12.400 27,900 Zamora, Capital (3/5) P 13,950 (1/1) (7/6) (10/7) P 93,000 10.850 18,600 Net income of the partnership is P61,225 for the year 2020. The partnership agreement provides for the division of income as follows: 1. Each partner is to be credited 10% interest on his simple average capital. 2. And any remaining income or loss is to be divided equally. What is Zamora's share of the profit for the year? a. P31,775 b. P21,700 CP25,575 d. P29,450 19. The net income agreement for Solis and Talania states net income and net loss shall be divided in a ratio of beginning capital balances. The net loss for the current year is P50,000. On January 1 of the current year, the capita balances were as follows: Solis, P55,000; and Talania, P65,000. During the current year Solis withdrew P40,000 and Talania withdrew P25,000 Compute the capital balances as of December 31 of the current year. 134 CHAPTER 3 PARTNERSHIP OPERATIONS Solls capital a debit of P7,917 b. credit of P7,917 c. debit of P7,917 d. debit of P12,917 Talania, capital debit of P12,917 credit of P12,917 credit of P12,917 credit of P7,917 20. The partnership agreement of Socorro and Torres provides that interest at 10% is to be credited to each partner on the basis of average capital balances. A summary of Torres Capital account for the year ended December 31, 2020 is as follows: Balance January 1 P 304,500 Additional Investment, July 1 87,000 Withdrawal, August 1 32,625 What amount of interest should be credited to Torres Capital account? a. P33,168.75 b. P33,440.625 C. P35,887.50 d. P37,518.75 21. Simple and Elegant share profits and losses equally, Simple and Elegant receive salary allowances of P105,000 and P157,500, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month regardless of when the capital contributions and capital withdrawals were made and partners' drawings are not used in determining the average capital balances. Total net income for 2020 is P630,000. Simple Elegant January 1 capital balances P525.000 P630,000 Yearly drawings (P7,875 a month) 94,500 94,500 Permanent withdrawals of capital: June 3 (63,000) May 2 178,750) Additional Investments of capital: 210,000 262,500 October 2 July 3 135 PARTNERSHIP AND CORPORATION ACCOUNTING What is the weighted average capital for Simple and Elegant respectively for 2020? a P581,000 and P627,812.50 b. 553.000 and P665,000 cP525,000 and P630,000 d. P665,000 and P553,000 22. One, Two, and Three formed a partnership on January 1, 2020. Eac contributed P420,000. Salaries were to be allocated as follows: One 105,000 TWO 105,000 Three: 157,500 Drawings were equal to salaries and be taken out evenly throughout the year. with sufficient partnership net income, One and Two could split a bonus equal to 25 percent of partnership net income after salaries and bonus in no event could the bonus go below zero). Remaining profits were to be split as follows: 30% for One; 30% for Two, and 40% for Three. For the year, partnership net income was P420,000. Compute the ending capital for each partner: a. One, PS42,850, Two, P542,850, Three, P594,300 b. One, P441,000, Two, P441,000; Three, P435,750 c. One, P437,850, Two, P437,850; Three, P436,800 d. One, P439,250, Two, P439,250, Three, P434,000 136 PARTNERSHIP AND CORPORATION ACCOUNTING What are the capital balances of the partners on December 31, 2020? Balagtas Cabanacan Dagohoy a. P598,487.50 P703,134.00 P112,128.50 b. P53,287.50 P311,634.00 P(29,971.50) C. P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201.25 3. The partnership contract of the Taluban, Ugaban, and Villanueva Partnership provided for the division of net income or losses in the following manner: 1. Bonus of 20% of income before the bonus to Taluban. 2. Interest at 15% on average capital account balance to each partner 3. Remaining income or loss, equally to each partner. Net income of the Taluban, Ugaban, and Villanueva Partnership for 2020 was P112,500, and the average capital account balances for that year were Taluban, P125,000; Ugaban, P250,000; and Villanueva, P375,000. How much of the P112,500 partnership profit for 2020 should be distributed to Taluban? a. P33,750 b. P7,500 C. P48,750 d. P41,250 4. Matas is a partner and has an annual salary of P30,000, but he actually draws P3,000 per month. The other partner in the partnership has an annual salary of P40,000 and draws P4,000 per month. What is the total annual salary that should be used to allocate annual net income among the partners? a. P14,000 b. P50,000 C. P70,000 a. P84,000 5. Cap, a partner in the Avengers Partnership, is entitled to 40% of the profits and losses. During 2020, Cap contributed land with a fair value of P93,000 Also during 2020, Cap had drawings of P124,000. The balance of Cap 128 CHAPTER 3 | PARTNERSHIP OPERATIONS CHAPTER 3 -TEST 3 PARTNERSHIP OPERATIONS Name Course and Section Date Score Instruction: Encircle the letter of your choice. 1. Mariano is trying to decide whether to accept a salary of P60,000 or a salary of P25,000 plus a bonus of 20% of net income after the bonus as a means of allocating profit among the partners. What amount of income would be necessary so that Mariano would consider the choices to be equal? a. P35,000 b. P85,000 CP140,000 d. P210,000 2. On January 1, 2020, Balagtas, Cabanacan and Dagohoy formed a partnership with the following contributions: Balagtas P406,000 Cabanacan 435,000 Dagohoy 246,500 The partnership agreement of Balagtas, Cabanacan and Dagohoy provides for the division of net income as follows: a. Cabanacan, who manages the partnership is to receive a salary of P23,925 monthly b. Each partner is to be allowed interest at 15% on beginning capital. C. Balance is to be divided 25:30:45 On December 31, 2020, after the following partners' additional investments and capital withdrawals, the partnership has a total capital of P1,413,750 Additional Investments Withdrawals Balagtas P139,200 Cabanacan 87,000 P130,500 Dagohoy 104,400 127 PARTNERSHIP AND CORPORATION ACCOUNTING a. What are the capital balances of the partners on December 31, 2020? Balagtas Cabanacan Dagohoy P598,487.50 P703,134.00 P112,128.50 b. P53,287.50 P311,634.00 P(29,971.50) P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201.25 C. manner: 3. The partnership contract of the Taluban, Ugaban, and Villanueva Partnership provided for the division of net income or losses in the following 1. Bonus of 20% of income before the bonus to Taluban. 2. Interest at 15% on average capital account balance to each partner 3. Remaining income or loss, equally to each partner. Net income of the Taluban, Ugaban, and Villanueva Partnership for 2020 was P112,500, and the average capital account balances for that year were Taluban, P125,000; Ugaban, P250,000; and Villanueva, P375,000. How much of the P112,500 partnership profit for 2020 should be distributed to Taluban? a. P33,750 b. P7,500 CP48,750 d. P41,250 4. Matas is a partner and has an annual salary of P30,000, but he actually draws P3,000 per month. The other partner in the partnership has an annual salary of P40,000 and draws P4,000 per month. What is the total annua salary that should be used to allocate annual net income among the partners? a. P14,000 b. P50,000 C. P70,000 a. P84,000 5. Cap, a partner in the Avengers Partnership, is entitled to 40% of the profits and losses. During 2020, Cap contributed land with a fair value of P93,000 Also during 2020, Cap had drawings of P124,000. The balance of caps 128 | CHAPTER 3 | PARTNERSHIP OPERATIONS capital account was P186,000 at the beginning of 2020 and P232,500 at the end of the year. What is the partnership profit (loss) for 2020? a. P(116,250) b. P[77,500) c. P232,500 d. P193,750 6. A partnership has the following accounting amounts: (1) Sales - P70,000 (2) Cost of Goods Sold = P40,000 (3) Operating Expenses = P10,000 (4) Salary allocations to partners = P13,000 (5) Interest paid to banks = P2,000 (6) Partners' withdrawals = P8,000 Partnership net income (loss) is a. P20,000 b. P18,000 c. P5,000 d.) P(3,000) 7. Assume the articles of partnership state that net income is to be divided as follows: 20% interest on investments with the remaining net income divided in a 3:2 ratio. Mejia has a capital balance of P55,000 and Quinto has a capital balance of P75,000. If net income for the current year is P10,000, partner Quinto's share would be: a. P8,600 b. P6,400 c. P1,400 d. P15,000 8. Alpha and Omega are partners who shares profits and losses in the ratio of 60%: 40%, respectively. Alpha's salary is P96,000 and P48,000 for Omega. The partners are also paid interest on their average capital balances. In 2020, Alpha received P48,000 of interest and Omega, P19,200. The profit and loss allocation is determined after deductions for the salary and interest payments. If Omega's share in the residual income (income after deducting 129 PARTNERSHIP AND CORPORATION ACCOUNTING salaries and interest) was P96,000 in 2020, what was the total partnership income? a. P307,200 b. P552,000 c. P451,200 d. P387,000 9. Mojeca and Santillan have formed a partnership and invested P140,000 and P160,000, respectively. They have agreed to share profits as follows: 1) The first P30,000 is to be allocated according to their original capital contributions to the partnership. 2) Mojeca is to receive a salary of P40,000 and Santillan is to receive a salary of P45,000 3) The remainder is to be allocated 5:3, respectively. if the business earns a net income of P118,000, Mojeca's share is: a. P52, 125 b. P61,000 c. P55,875 d. P54,000 10. On January 1, 2020, Lim and Pan decided to form a partnership. At the end of the year, the partnership made a net income of P630,000. The capital accounts of the partnership show the following transactions. Lim, Capital Debit Credit 210,000 26,250 Pan, Capital Debit Credit 131,250 January 1 April 1 June 1 August 1 September 1 October 1 December 52,500 52,500 15,750 26,250 5,250 21,000 26,250 130 should be: CHAPTER 3 | PARTNERSHIP OPERATIONS Assuming that an interest of 20% per annum is given on average capital and the balance of the profits is allocated equally, the allocation of profits a. Lim, P315,000; Pan, P311,850 b. Lim, P321,300; Pan, P308,700 c. Lim, P352,800; Pan, P277,200 d. Lim, P361,200; Pan, P268,800 11. Max and Min formed a partnership in 2020 and made the following investments and capital withdrawals during the year. Max Min Investment Draws Investment Draws March 1 187,500 125,000 June 1 62,500 62,500 August 1 125,000 12,500 December 11 31 250 The partnership's profit and loss agreement provides for a salary of which P187,500 was paid to each partner for 2020. Max is to receive a bonus of 10% on net income after salaries and bonus. The partners are also to receive Interest of 8% on average annual capital balances affected by both Investments and drawings. Any remaining profits are to be allocated equally among the partners. Assuming net income of P375,000 before salaries and bonus, determine how the income would be allocated among the partners: a. Max,P194,612.50;Min, P180,387.50 b. Max, P209,606.25; Min, P165,393.75 C. Max, P191,456.25; Min, P183,543.75 d. Max, P191,771; Min, P183,229 12. Partner Afirst contributed P20,000 of capital into an existing partnership on February 1, 2020. On June 1, 2020, the partner contributed another P20,000. On September 1, 2020, the partner withdrew P15,000 from the partnership. Withdrawals in excess of P5,000 are charged to the partner's 131 PARTNERSHIP AND CORPORATION ACCOUNTING capital account. The partnership's fiscal year end is December 31. The annual weighted-average capital balance is a. P25,000 b. P26,667 c P28,334 d. P30,000 13. The partnership agreement of Abastar, Bacon, and Caasi provides for the year-end allocation of net income in the following order: First, Abastar is to receive 10% of net income up to P135,000 and 20% over P135,000. Second, Bacon and Caasi each are to receive 5% of the remaining income over P202,500. The balance of income is to be allocated equally among the three partners. The partnership's 2020 net income was P337,500 before any allocations to partners. What amount should be allocated to Abastar? a. P136,350 b. P145,800 c. P148,500 d. P139,050 14. The net income agreement for Molina and Serraon states net income and net loss shall be divided in a ratio of 4:6, respectively. The net loss for the current year is P50,000. On January 1 of the current year, the capital balances were as follows: Molina, P55,000, and Serraon, P65,000. During the current year Molina withdrew P40,000 and Serraon withdrew P25,000. Compute the capital balances as of December 31 of the current year. Molina, capital Serraon, capital a. debit of P5,000 credit of P10,000 b. credit of P35,000 credit of P70,000 C. credit of P5,000 credit of P10,000 d. none of the above 132 CHAPTER 3 PARTNERSHIP OPERATIONS 15. Abel and Badel are partners operating a grocery store. Their partnership requires that profits and losses be divided as follows: Salaries Commission on gross sales Interest on average capital balances Abel P105,000 None Badel None 8% 8% Bonuses 20% of net income before commission and interest but after salaries and bonus 60% Remainder 40% Gross sales for 2020 were P6,562,500. Income before deducting amounts for salary, commission, interest, and bonus were P1,050,000. Average capital balances of Abel and Badel are P2,100,000 and P2,205,000 respectively. What are the profit shares of Abel and Badel respectively? a. P617,610 and P432,390 b. P186,165 and P124,740 C. P580,860 and P469,140 d. P616,665 and P433,335 16. Abelardo, Baligod and Cabatingan are partners with average capital balances during 2020 of P378,000, P190,920, and P129,880, respectively. The partners receive 10% interest on their average capital balances; after deducting salaries of p97,860 to Abelardo and P66,100 to Cabatingan, the residual profits or loss is divided equally. In 2020, the partnership had a net loss of P100,499.20 before the interest and salaries to partners. By what amount should Abelardo's and Cabatingan's capital account change increase (decrease)? Abelardo a. 24,213.60 23,581 Cabatingan (32,358.40) 14,029 133 PARTNERSHIP AND CORPORATION ACCOUNTING 24,988 25,966 C. d. (32,675) 22,686 17. The same information in the previous number, except the partnership has a loss of P100,499.20 after the interest and salaries to partners, by Wha, amount should Baligod's capital account change - increase (decrease) a. (92,354) b. 19,092 c. (33,500) d. (14,408) 18. Tandico and Zamora are partners. Their capital accounts during 2020 were as follows: Tandico, Capital (8/28) P9,300 (1/1) (4/3) (10/31) P 62,000 12.400 27,900 Zamora, Capital (3/5) P 13,950 (1/1) (7/6) (10/7) P 93,000 10.850 18,600 Net income of the partnership is P61,225 for the year 2020. The partnership agreement provides for the division of income as follows: 1. Each partner is to be credited 10% interest on his simple average capital. 2. And any remaining income or loss is to be divided equally. What is Zamora's share of the profit for the year? a. P31,775 b. P21,700 CP25,575 d. P29,450 19. The net income agreement for Solis and Talania states net income and net loss shall be divided in a ratio of beginning capital balances. The net loss for the current year is P50,000. On January 1 of the current year, the capita balances were as follows: Solis, P55,000; and Talania, P65,000. During the current year Solis withdrew P40,000 and Talania withdrew P25,000 Compute the capital balances as of December 31 of the current year. 134 CHAPTER 3 PARTNERSHIP OPERATIONS Solls capital a debit of P7,917 b. credit of P7,917 c. debit of P7,917 d. debit of P12,917 Talania, capital debit of P12,917 credit of P12,917 credit of P12,917 credit of P7,917 20. The partnership agreement of Socorro and Torres provides that interest at 10% is to be credited to each partner on the basis of average capital balances. A summary of Torres Capital account for the year ended December 31, 2020 is as follows: Balance January 1 P 304,500 Additional Investment, July 1 87,000 Withdrawal, August 1 32,625 What amount of interest should be credited to Torres Capital account? a. P33,168.75 b. P33,440.625 C. P35,887.50 d. P37,518.75 21. Simple and Elegant share profits and losses equally, Simple and Elegant receive salary allowances of P105,000 and P157,500, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month regardless of when the capital contributions and capital withdrawals were made and partners' drawings are not used in determining the average capital balances. Total net income for 2020 is P630,000. Simple Elegant January 1 capital balances P525.000 P630,000 Yearly drawings (P7,875 a month) 94,500 94,500 Permanent withdrawals of capital: June 3 (63,000) May 2 178,750) Additional Investments of capital: 210,000 262,500 October 2 July 3 135 PARTNERSHIP AND CORPORATION ACCOUNTING What is the weighted average capital for Simple and Elegant respectively for 2020? a P581,000 and P627,812.50 b. 553.000 and P665,000 cP525,000 and P630,000 d. P665,000 and P553,000 22. One, Two, and Three formed a partnership on January 1, 2020. Eac contributed P420,000. Salaries were to be allocated as follows: One 105,000 TWO 105,000 Three: 157,500 Drawings were equal to salaries and be taken out evenly throughout the year. with sufficient partnership net income, One and Two could split a bonus equal to 25 percent of partnership net income after salaries and bonus in no event could the bonus go below zero). Remaining profits were to be split as follows: 30% for One; 30% for Two, and 40% for Three. For the year, partnership net income was P420,000. Compute the ending capital for each partner: a. One, PS42,850, Two, P542,850, Three, P594,300 b. One, P441,000, Two, P441,000; Three, P435,750 c. One, P437,850, Two, P437,850; Three, P436,800 d. One, P439,250, Two, P439,250, Three, P434,000 136 PARTNERSHIP AND CORPORATION ACCOUNTING What are the capital balances of the partners on December 31, 2020? Balagtas Cabanacan Dagohoy a. P598,487.50 P703,134.00 P112,128.50 b. P53,287.50 P311,634.00 P(29,971.50) C. P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201.25 3. The partnership contract of the Taluban, Ugaban, and Villanueva Partnership provided for the division of net income or losses in the following manner: 1. Bonus of 20% of income before the bonus to Taluban. 2. Interest at 15% on average capital account balance to each partner 3. Remaining income or loss, equally to each partner. Net income of the Taluban, Ugaban, and Villanueva Partnership for 2020 was P112,500, and the average capital account balances for that year were Taluban, P125,000; Ugaban, P250,000; and Villanueva, P375,000. How much of the P112,500 partnership profit for 2020 should be distributed to Taluban? a. P33,750 b. P7,500 C. P48,750 d. P41,250 4. Matas is a partner and has an annual salary of P30,000, but he actually draws P3,000 per month. The other partner in the partnership has an annual salary of P40,000 and draws P4,000 per month. What is the total annual salary that should be used to allocate annual net income among the partners? a. P14,000 b. P50,000 C. P70,000 a. P84,000 5. Cap, a partner in the Avengers Partnership, is entitled to 40% of the profits and losses. During 2020, Cap contributed land with a fair value of P93,000 Also during 2020, Cap had drawings of P124,000. The balance of Cap 128 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started