Can you answer all of them? Because i don't know if they depend on the others ? Please solve in excel and show formulas.. If possible. Please upload excel on dropbox so i can download it.

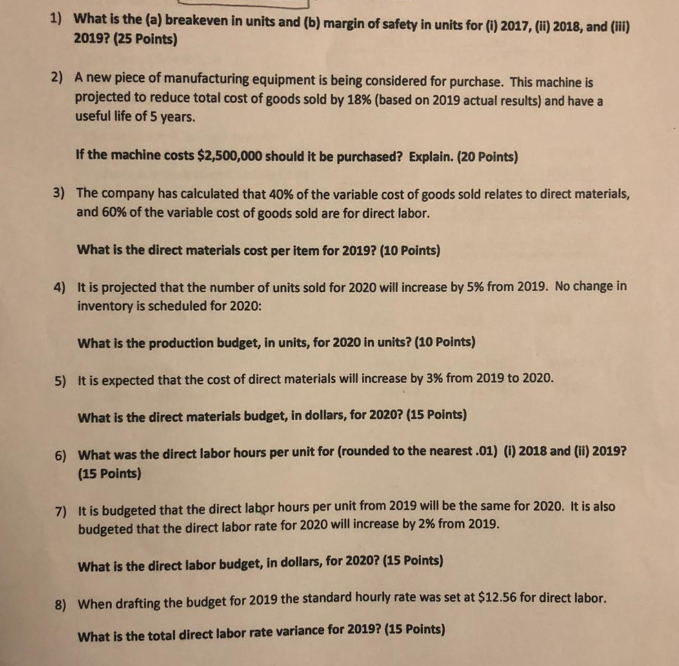

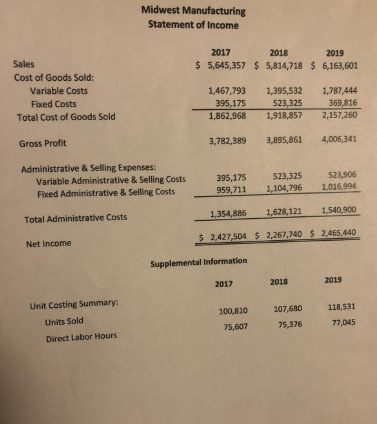

1) What is the (a) breakeven in units and (b) margin of safety in units for (1) 2017, (ii) 2018, and (iii) 2019? (25 Points) 2) A new piece of manufacturing equipment is being considered for purchase. This machine is projected to reduce total cost of goods sold by 18% (based on 2019 actual results) and have a useful life of 5 years. If the machine costs $2,500,000 should it be purchased? Explain. (20 points) 3) The company has calculated that 40% of the variable cost of goods sold relates to direct materials, and 60% of the variable cost of goods sold are for direct labor. What is the direct materials cost per item for 2019? (10 Points) 4) It is projected that the number of units sold for 2020 will increase by 5% from 2019. No change in inventory is scheduled for 2020: What is the production budget, in units, for 2020 in units? (10 Points) 5) It is expected that the cost of direct materials will increase by 3% from 2019 to 2020. What is the direct materials budget, in dollars, for 2020? (15 Points) 6) What was the direct labor hours per unit for (rounded to the nearest .01) (i) 2018 and (ii) 2019? (15 Points) 7) It is budgeted that the direct labpr hours per unit from 2019 will be the same for 2020. It is also budgeted that the direct labor rate for 2020 will increase by 2% from 2019. What is the direct labor budget, in dollars, for 2020? (15 Points) 8) When drafting the budget for 2019 the standard hourly rate was set at $12.56 for direct labor. What is the total direct labor rate variance for 2019? (15 Points) Midwest Manufacturing Statement of Income 2017 $ 5,645,357 2018 2019 $ 5,814,718 $ 6,163,601 Sales Cost of Goods Sold: Variable Costs Fixed Costs Total Cost of Goods Sold 1,467,793 395,175 1,862,968 1,395,532 523,325 1,918,857 1,787,444 369,816 2,157,260 Gross Profit 3,782,389 3,895,861 4,006,341 Administrative & Selling Expenses: Variable Administrative & Selling Costs Fixed Administrative & Selling Costs 395,175 959,711 523,325 1,104,796 523,906 1.016.994 1,354,885 1,628,121 1,540,900 Total Administrative Costs $ 2,427,504 $ 2,267,740 $ 2,465,440 Net Income Supplemental Information 2017 2018 2019 Unit Costing Summary: Units Sold Direct Labor Hours 100,810 75,607 107,680 75,376 118,531 77,045